The gold market is a dynamic and complex landscape influenced by a multitude of factors, making it a fascinating area for investors and market enthusiasts alike. Gold, a precious metal with a rich history, has long been regarded as a safe haven asset, a hedge against inflation, and a potential source of portfolio diversification. Understanding the current trends, driving forces, and investment outlook of the gold market is crucial for navigating its intricacies and making informed decisions.

This comprehensive analysis delves into the heart of the gold market, exploring the key factors that shape its trajectory. We will examine the latest price trends, delve into the economic and geopolitical forces that influence demand and supply, and assess the investment outlook for gold in the coming months and years. Whether you are a seasoned investor or just starting to explore the world of precious metals, this article provides valuable insights to help you understand the nuances of the gold market and its potential impact on your portfolio.

Historical Performance of Gold

Gold has long been considered a safe-haven asset, a store of value, and a hedge against inflation. Its historical performance reflects this, showing periods of strong gains and periods of stagnation or even losses.

Over the long term, gold has generally outpaced inflation. Since 1971, when the US dollar was decoupled from the gold standard, gold has averaged an annual return of around 8%, while inflation has averaged about 3%. This means that gold has held its value and even grown in purchasing power over time.

Gold’s performance has also been volatile. In the short term, its price can fluctuate significantly, driven by factors such as economic uncertainty, interest rates, and geopolitical events. For example, during times of economic crisis, investors tend to flock to gold as a safe-haven asset, driving its price up.

Here are some key historical periods that demonstrate gold’s performance:

- The 1970s: The price of gold soared in the 1970s, reaching a record high in 1980 due to the oil crisis, inflation, and the end of the gold standard.

- The 1980s and 1990s: Gold prices declined during these periods, as inflation subsided and the US economy grew.

- The 2000s and 2010s: Gold prices experienced a resurgence in the 2000s and 2010s, fueled by factors such as the financial crisis of 2008, quantitative easing, and global economic uncertainty.

Understanding gold’s historical performance is crucial for investors. It provides insights into its potential as a hedge against inflation and a safe-haven asset. However, it’s important to remember that past performance is not necessarily indicative of future results, and gold’s price can fluctuate significantly.

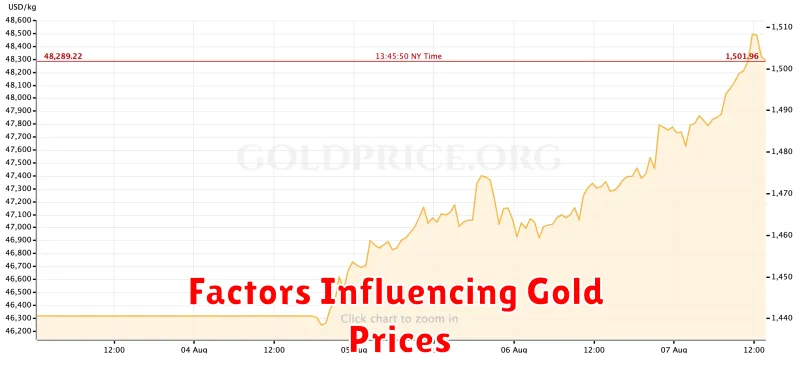

Factors Influencing Gold Prices

Gold, a precious metal that has captivated humanity for millennia, is renowned for its inherent value, beauty, and versatility. It has historically served as a store of value, a hedge against inflation, and a safe haven asset during economic uncertainty. The price of gold fluctuates constantly, influenced by a complex interplay of factors that can be categorized into two broad groups: fundamental factors and technical factors.

Fundamental Factors

Fundamental factors are economic and geopolitical events that directly impact the supply and demand dynamics of gold. These include:

- Interest Rates: Rising interest rates generally lead to a decrease in gold prices. This is because higher rates make holding non-interest-bearing assets like gold less attractive, as investors can earn a better return on their investment in bonds and other fixed-income securities.

- Inflation: Gold has historically been a hedge against inflation, as its value tends to rise during periods of high inflation. This is because gold is a tangible asset whose value is not tied to a specific currency, making it a good store of wealth during times of economic uncertainty.

- Economic Growth: Economic growth can also influence gold prices. Strong economic growth often leads to higher demand for gold, as investors seek to protect their wealth and diversify their portfolios. Conversely, weak economic growth can lead to a decline in gold prices as investors move out of safe haven assets and into riskier assets.

- Geopolitical Events: Geopolitical events such as wars, political instability, and global conflicts can significantly impact gold prices. These events create uncertainty and volatility in the financial markets, leading investors to seek safe-haven assets like gold.

- Supply and Demand: The supply and demand for gold also play a major role in determining its price. Factors such as mining production, central bank purchases, and jewelry demand all influence the market balance.

Technical Factors

Technical factors refer to the analysis of market trends, charts, and indicators to predict future price movements. These factors include:

- Chart Patterns: Technical analysts study chart patterns to identify potential price trends and reversals. Patterns like head and shoulders, double tops, and triangles can provide insights into future price movements.

- Moving Averages: Moving averages are calculated by averaging the closing prices of an asset over a specific period. They can help identify support and resistance levels and indicate potential trend changes.

- Technical Indicators: Various technical indicators, such as the Relative Strength Index (RSI) and the MACD, provide signals based on price and volume data. These indicators can help traders identify overbought or oversold conditions and potential trend reversals.

- Sentiment Analysis: Sentiment analysis involves gauging the overall market sentiment towards gold. Factors like media coverage, investor surveys, and social media chatter can provide insights into the market’s prevailing mood and potential price movements.

Understanding the factors influencing gold prices is crucial for investors seeking to make informed decisions about their investment strategies. By carefully considering both fundamental and technical factors, investors can gain a better understanding of the dynamics driving the gold market and make more informed investment choices.

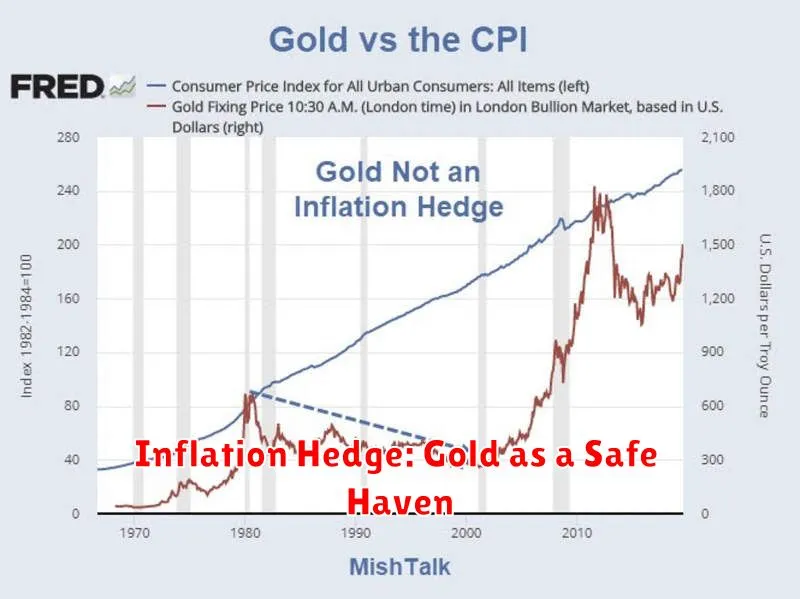

Inflation Hedge: Gold as a Safe Haven

Gold has long been considered a safe haven asset, particularly during periods of economic uncertainty and inflation. This is because gold is a tangible asset with inherent value, and its price tends to rise when other assets, like stocks and bonds, are declining. Gold’s historical track record suggests that it can preserve wealth during times of inflation. As the purchasing power of currencies erodes, the value of gold, a finite resource, tends to hold its value or even appreciate.

The relationship between gold and inflation can be explained by several factors. Firstly, gold is a natural hedge against currency devaluation. When inflation rises, the value of fiat currencies declines, and investors seek assets that can preserve their wealth. Gold, as a non-fiat asset, is seen as a reliable store of value. Secondly, gold is a limited resource, with a finite supply. As demand for gold increases, its price tends to rise, further protecting investors from inflation.

In conclusion, gold’s role as an inflation hedge is deeply rooted in its historical performance and intrinsic value. While other assets may be more volatile during inflationary periods, gold has consistently demonstrated its ability to maintain purchasing power. Investors seeking to protect their portfolios from inflation often consider gold as a crucial component of their investment strategy.

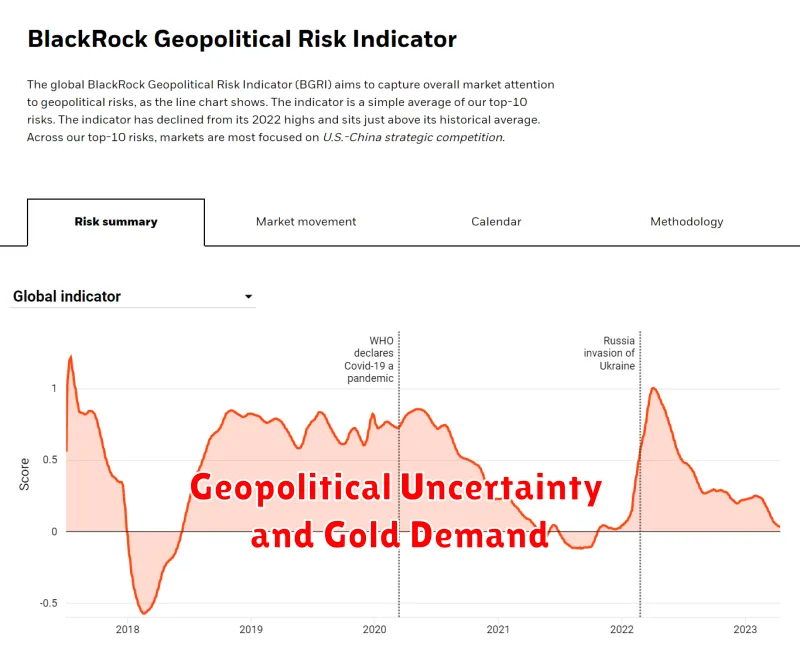

Geopolitical Uncertainty and Gold Demand

Gold has historically been considered a safe-haven asset, and its demand tends to rise during times of geopolitical uncertainty. This is because investors see gold as a store of value that can preserve wealth during periods of economic instability.

In recent years, the world has witnessed a surge in geopolitical tensions, including the ongoing conflict in Ukraine, rising tensions between the US and China, and escalating global inflation. These events have contributed to increased demand for gold as investors seek to hedge against potential risks.

When geopolitical uncertainty is high, investors may be hesitant to invest in traditional assets such as stocks and bonds. This is because these assets are more susceptible to market volatility and economic downturns. Gold, on the other hand, is seen as a more stable investment that can provide protection against market risks.

Furthermore, gold’s lack of correlation with other asset classes makes it a valuable diversification tool. When stock markets decline, gold often rises in value, providing investors with a hedge against portfolio losses.

In conclusion, geopolitical uncertainty is a significant driver of gold demand. As global tensions escalate, investors are increasingly turning to gold as a safe-haven asset and a hedge against economic risks. The demand for gold is likely to remain strong as long as geopolitical uncertainty persists.

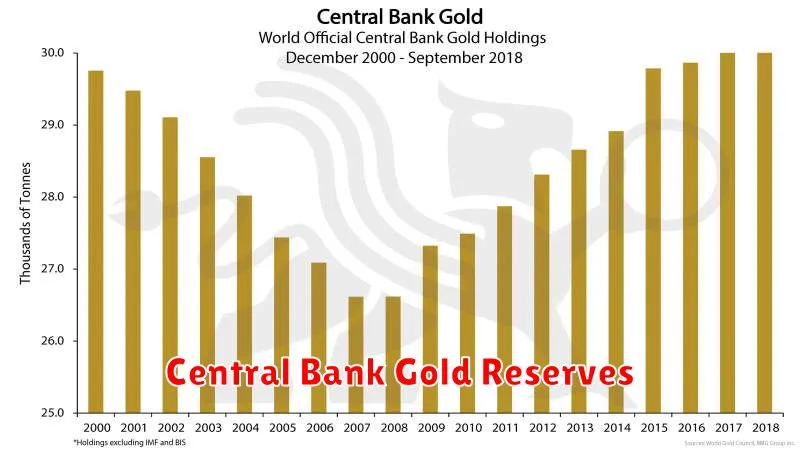

Central Bank Gold Reserves

Central banks around the world are actively increasing their gold reserves, a trend that has been gaining momentum in recent years. This strategic shift reflects a growing interest in gold as a safe-haven asset and a hedge against inflation, currency devaluation, and geopolitical risks.

Key Drivers Behind Central Bank Gold Accumulation:

- Diversification: Gold provides diversification benefits to central bank portfolios, reducing overall risk by adding an asset class that is uncorrelated with other investments.

- Safe Haven Demand: During periods of economic uncertainty and market volatility, gold serves as a traditional safe-haven asset, offering a potential refuge for investors.

- Inflation Hedge: Gold is often seen as an effective hedge against inflation, as its value tends to rise during periods of high inflation.

- Geopolitical Concerns: Geopolitical tensions and sanctions can lead to increased demand for gold, as it is perceived as a store of value that is less vulnerable to geopolitical risks.

Impact on the Gold Market:

The increased demand for gold from central banks has a significant impact on the gold market. It helps to support gold prices and reinforces its role as a safe-haven asset.

Investment Outlook:

The trend of central bank gold accumulation is likely to continue in the near future, as central banks remain focused on safeguarding their financial reserves and mitigating risks. This continued demand could further support gold prices and enhance its investment appeal.

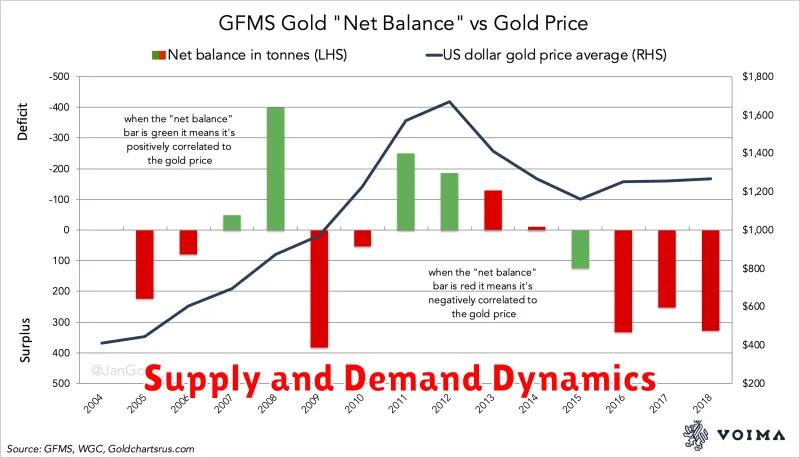

Supply and Demand Dynamics

The gold market is fundamentally driven by the interplay of supply and demand. Understanding these dynamics is crucial for investors seeking to navigate the intricacies of this precious metal.

Supply is influenced by factors such as mining output, recycling rates, and central bank sales. Mining production is often subject to geopolitical risks, environmental regulations, and technological advancements. Recycling plays a significant role in supplying the market with gold, particularly in developed economies with established recycling infrastructure. Central banks, particularly in emerging markets, may choose to sell gold reserves as part of their monetary policy strategies.

Demand for gold originates from various sources, including jewelry, investment, and industrial applications. Jewelry accounts for a significant portion of gold demand, particularly in emerging markets with strong cultural preferences for gold ornaments. Gold’s appeal as a safe-haven asset during periods of economic uncertainty fuels investment demand. Industrial applications, such as electronics and dentistry, contribute to a steady and relatively predictable demand for gold.

The dynamics between supply and demand shape the price of gold. When demand exceeds supply, prices tend to rise. Conversely, when supply outweighs demand, prices may fall. Market sentiment, economic conditions, and geopolitical events can influence both supply and demand, contributing to gold’s price fluctuations.

In the current market, factors such as global economic uncertainty, inflationary pressures, and central bank policies are influencing gold’s supply and demand dynamics. The ongoing geopolitical tensions and potential economic downturns are contributing to safe-haven demand for gold. However, rising interest rates and strong economic growth could potentially limit investment demand for gold.

Technical Analysis of Gold Charts

Technical analysis is a valuable tool for understanding gold price trends and predicting future movements. By studying historical price data, traders can identify patterns, support and resistance levels, and other indicators that provide insights into market sentiment and potential price action.

Moving Averages are widely used in technical analysis to smooth out price fluctuations and identify trends. The 50-day and 200-day moving averages are particularly significant. When the price of gold crosses above the 50-day moving average, it suggests a short-term bullish trend. Crossing above the 200-day moving average indicates a longer-term bullish sentiment. Conversely, crossing below these moving averages suggests bearish signals.

Relative Strength Index (RSI) is a momentum indicator that measures the magnitude of recent price changes to evaluate overbought or oversold conditions in the market. A reading above 70 indicates an overbought market, while a reading below 30 suggests an oversold market. These levels can signal potential reversals in price trends.

Support and Resistance Levels are crucial for identifying price boundaries and potential turning points. Support levels are price levels where buying pressure is expected to emerge, preventing further price declines. Resistance levels represent price levels where selling pressure is expected to increase, potentially capping further price gains.

Chart Patterns provide valuable insights into potential price movements. Common patterns include head and shoulders, double tops and bottoms, and triangles. These patterns can indicate potential reversals or continuations of trends, depending on their specific configuration.

It’s important to remember that technical analysis is just one piece of the puzzle in gold market analysis. Fundamental factors like interest rates, inflation, and geopolitical events also play a significant role in influencing gold prices. Combining technical and fundamental analysis provides a more comprehensive perspective and helps traders make informed investment decisions.

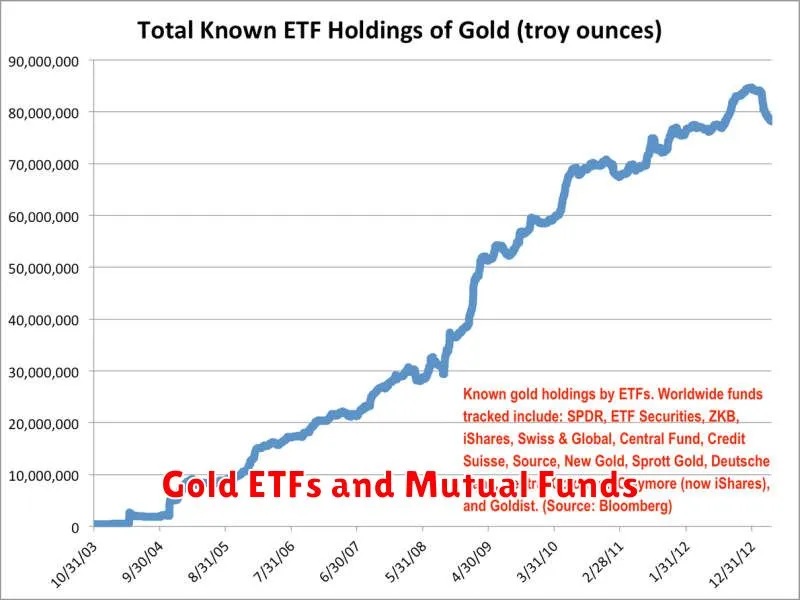

Gold ETFs and Mutual Funds

Gold exchange-traded funds (ETFs) and mutual funds offer investors a convenient and cost-effective way to gain exposure to the gold market. These funds typically track the price of gold, allowing investors to participate in its potential price appreciation without having to physically buy and store the metal. Gold ETFs are traded on stock exchanges like any other stock, providing investors with real-time price transparency and liquidity. Gold mutual funds, on the other hand, are actively managed funds that invest in a portfolio of gold-related assets.

One of the key advantages of investing in gold ETFs and mutual funds is their diversification benefits. By investing in these funds, investors can spread their risk across a wider range of assets, reducing their overall portfolio volatility. Additionally, these funds offer accessibility and affordability, allowing investors with limited capital to participate in the gold market.

However, it’s important to note that both gold ETFs and mutual funds come with their own set of fees and expenses. Investors should carefully consider the expense ratios and trading costs associated with these funds before making an investment decision. Furthermore, the performance of gold ETFs and mutual funds can be influenced by factors such as market sentiment, interest rates, and global economic conditions.

Overall, gold ETFs and mutual funds provide investors with a valuable tool for accessing the gold market. Whether you are looking to diversify your portfolio, hedge against inflation, or simply gain exposure to a precious metal, these funds offer a convenient and flexible investment option.

Investing in Physical Gold

Investing in physical gold has always been a popular choice for investors seeking to diversify their portfolios and hedge against inflation. Gold, a precious metal, has a long history of being a store of value, and its price tends to rise during periods of economic uncertainty or geopolitical turmoil.

Owning physical gold can offer several benefits:

- Tangible asset: Unlike stocks or bonds, gold is a tangible asset you can physically hold. This can provide a sense of security and control over your investment.

- Hedge against inflation: Gold’s price tends to rise during periods of high inflation, making it a good hedge against purchasing power erosion.

- Safe haven asset: In times of economic instability, investors often flock to gold as a safe haven asset, as its value tends to remain relatively stable.

- Diversification: Gold can diversify your portfolio by adding a non-correlated asset to your investment mix.

However, there are also some downsides to consider:

- No yield: Gold does not provide regular income like stocks or bonds.

- Storage costs: You need to find a safe and secure place to store your physical gold.

- Price volatility: Gold prices can fluctuate significantly in the short term.

When investing in physical gold, you have several options:

- Gold bullion: These are bars or coins of pure gold, available in various weights.

- Gold coins: These are legal tender coins, often minted by governments.

- Gold ETFs: Exchange-traded funds that track the price of gold, offering a convenient way to invest.

It is essential to research and understand the risks and potential benefits of investing in physical gold before making any decisions. Consult with a financial advisor to determine if it’s the right investment for you.

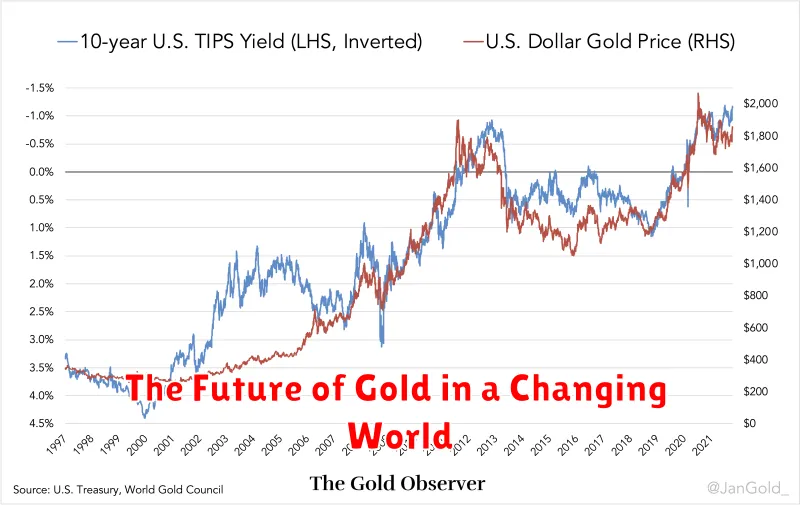

The Future of Gold in a Changing World

Gold has long been considered a safe haven asset, a store of value that can protect investors during times of economic uncertainty. But with the world changing rapidly, what does the future hold for gold? This article will explore the key trends, drivers, and investment outlook for gold in a rapidly evolving global landscape.

One of the biggest factors influencing the future of gold is the growing global debt. Governments and corporations around the world are saddled with record levels of debt, making them increasingly vulnerable to economic shocks. In this environment, gold is likely to remain an attractive safe haven asset.

Another important driver is inflation. As central banks around the world print more money, the value of fiat currencies is likely to decline. Gold, which has a limited supply, is seen as a hedge against inflation.

The rise of central bank digital currencies (CBDCs) could also have a significant impact on the gold market. If CBDCs become widely adopted, they could reduce the demand for physical gold as a store of value. However, it’s also possible that CBDCs could increase demand for gold as a hedge against government overreach and financial instability.

The geopolitical landscape is also evolving, with increasing tensions between major powers. Gold could benefit from this uncertainty as investors seek safe haven assets.

The growing demand for gold from emerging markets, particularly in Asia, is another positive factor. As economies in these regions continue to grow, their citizens are likely to increase their demand for gold as a wealth preservation tool.

Overall, the future of gold in a changing world is likely to be influenced by a complex interplay of factors. However, with growing global debt, inflation, and geopolitical uncertainty, gold is likely to remain a valuable asset for investors seeking to protect their wealth. While the rise of CBDCs presents some challenges, it’s also possible that it could drive up demand for gold.