Are you seeking to maximize your trading potential and generate profits in the short term? Day trading, with its fast-paced action and ability to capitalize on fleeting market fluctuations, can be an exhilarating and lucrative strategy. But without the right knowledge and strategies, it can also be a risky endeavor. This comprehensive guide will equip you with the essential insights and techniques to master day trading and unlock the potential for consistent profitability.

We’ll delve into the best day trading strategies, covering everything from technical analysis and market indicators to risk management and emotional discipline. From understanding the nuances of chart patterns to mastering the art of order execution, we’ll provide you with a framework for making informed decisions and navigating the dynamic world of day trading. Whether you’re a seasoned trader or just starting out, this article will empower you with the knowledge and tools to take your day trading to the next level.

What is Day Trading? Understanding the Basics

Day trading is a high-risk, high-reward strategy in the financial markets where traders aim to profit from short-term price fluctuations of financial instruments like stocks, forex, or futures. Unlike long-term investors who hold assets for months or years, day traders execute multiple trades within a single trading day, typically closing all positions before the market closes.

The core concept of day trading is to capitalize on small price movements by buying low and selling high, or vice versa. This requires a deep understanding of technical analysis, market trends, and risk management. Day traders rely heavily on charts, indicators, and real-time market data to identify trading opportunities.

Key features of day trading:

- Short-term focus: Trades are executed and closed within a single trading day.

- High frequency: Multiple trades are conducted throughout the day.

- Technical analysis: Day traders use technical indicators and chart patterns to identify trading opportunities.

- Risk management: Strict stop-loss orders and position sizing are crucial to control potential losses.

- Volatility: Day traders seek out volatile markets to maximize potential profits.

Choosing the Right Securities: Liquidity and Volatility

Day trading thrives on quick, decisive moves, demanding a deep understanding of the market’s ebb and flow. One crucial aspect of this understanding lies in the liquidity and volatility of the securities you choose to trade. These two factors are intrinsically linked and determine the ease of entry and exit from positions, influencing your potential profits and losses.

Liquidity refers to how easily a security can be bought or sold without significantly affecting its price. High-liquidity securities, such as those traded on major exchanges with substantial trading volume, allow for quick and efficient execution of trades. This is vital for day traders who need to enter and exit positions promptly to capitalize on short-term price fluctuations.

Volatility, on the other hand, measures how much the price of a security fluctuates over time. High-volatility securities experience frequent and significant price swings, presenting opportunities for rapid gains but also exposing traders to greater risk. Day traders typically favor volatile securities, as they offer the potential for quick profits. However, it’s crucial to balance this with the need for liquidity to ensure smooth exits and minimize losses.

The ideal scenario for day trading involves securities that exhibit both high liquidity and moderate to high volatility. This combination allows for swift execution of trades while still offering ample opportunities for profit. Remember, the key is to find a balance that aligns with your trading style, risk tolerance, and overall strategy. Understanding the interplay of liquidity and volatility empowers you to select the right securities and enhance your chances of success in the dynamic world of day trading.

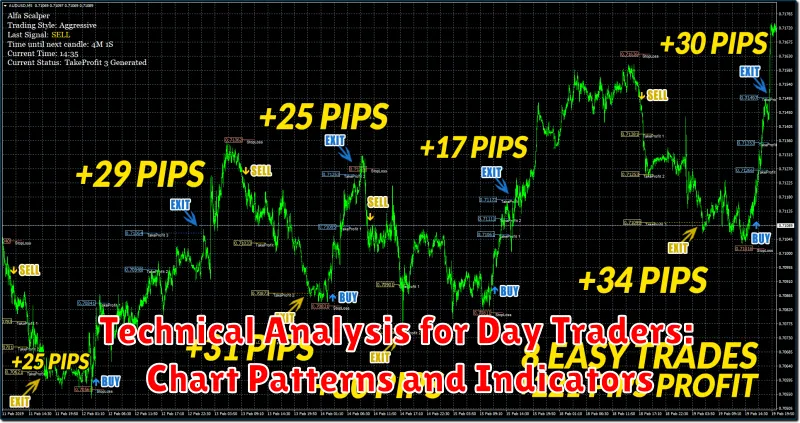

Technical Analysis for Day Traders: Chart Patterns and Indicators

Technical analysis is a crucial tool for day traders who aim to capitalize on short-term price fluctuations. It involves studying historical price charts, volume data, and other market indicators to identify potential trading opportunities. Day traders rely heavily on chart patterns and technical indicators to gain insights into market sentiment and make informed trading decisions.

Chart patterns are recurring formations on price charts that suggest potential future price movements. Common chart patterns include:

- Head and Shoulders: This pattern indicates a potential reversal of an uptrend, suggesting that the price is likely to decline.

- Double Top/Bottom: These patterns signal a potential reversal of a trend. A double top suggests a decline after an uptrend, while a double bottom suggests an upswing after a downtrend.

- Triangles: Triangles represent periods of consolidation and can indicate either a breakout or breakdown.

Technical indicators are mathematical formulas that analyze price data and provide insights into market momentum, volatility, and trend strength. Some popular technical indicators used by day traders include:

- Moving Averages (MA): MAs smooth out price fluctuations and help identify trends. Simple Moving Average (SMA) and Exponential Moving Average (EMA) are commonly used.

- Relative Strength Index (RSI): This indicator measures the magnitude of recent price changes to evaluate overbought or oversold conditions.

- Bollinger Bands: These bands provide a measure of price volatility and can help identify potential breakouts or breakdowns.

- MACD (Moving Average Convergence Divergence): This indicator compares two moving averages to identify trend changes and momentum shifts.

Day traders use a combination of chart patterns and technical indicators to identify entry and exit points for their trades. It’s important to note that technical analysis is not foolproof and should be used in conjunction with other forms of market analysis. Additionally, understanding the underlying fundamentals of the asset being traded can enhance trading decisions.

Scalping: Profiting from Small Price Movements

Scalping is a day trading strategy that involves taking advantage of small price movements in a market. Scalpers typically open and close trades very quickly, often within seconds or minutes, aiming to make a small profit on each trade. This strategy requires lightning-fast reflexes and a deep understanding of market dynamics. While it can be highly lucrative, it’s also a high-risk strategy that’s not suitable for all traders.

To succeed at scalping, you need a reliable and fast trading platform, a strong understanding of technical analysis, and the ability to make quick decisions under pressure. You also need to be comfortable with the fact that you’ll likely be making a lot of small profits, and that you’ll also experience some losses along the way.

Scalping is a strategy that requires a high level of skill and discipline. If you’re not comfortable with the risks involved, it’s best to avoid this strategy.

News Trading: Capitalizing on Market-Moving Events

News trading involves leveraging the impact of significant economic events on market movements. These events, such as interest rate decisions, inflation reports, or political pronouncements, can cause substantial price fluctuations. Capitalizing on these fluctuations requires a keen understanding of how news affects different asset classes and developing a robust trading strategy.

Key Elements of News Trading:

- Economic Calendar: Stay informed about upcoming economic releases and their potential impact on markets.

- Market Sentiment: Gauge market expectations and how they align with the news release. This can help anticipate price reactions.

- Technical Analysis: Combine news analysis with technical indicators to identify entry and exit points, reinforcing trading decisions.

- Risk Management: Employ stop-loss orders and position sizing to mitigate potential losses from unexpected market reactions.

Strategies for Capitalizing on News Events:

- News-Driven Breakout: Identify assets that are likely to break out after a news release. This involves assessing market sentiment and technical indicators.

- News-Driven Reversal: Anticipate price reversals after a significant news release, utilizing technical indicators and market sentiment analysis.

- News-Driven Volatility Trading: Profit from increased volatility around news releases by employing short-term trading strategies, such as scalping.

Important Considerations:

- Volatility: News trading involves high volatility, requiring precise execution and risk management.

- Market Impact: The impact of news events varies, necessitating careful assessment of its potential influence on specific assets.

- Market Psychology: Understanding how market sentiment influences price reactions is crucial for successful news trading.

News trading can be a lucrative strategy for experienced traders. By mastering the art of analyzing economic events and incorporating technical analysis, traders can capitalize on market-moving news and potentially generate substantial profits.

Momentum Trading: Riding the Waves of Price Trends

Momentum trading is a popular day trading strategy that capitalizes on the speed and direction of price movements. By identifying and riding the waves of strong price trends, traders aim to profit from short-term market fluctuations.

The core principle of momentum trading is to buy when an asset’s price is rising rapidly and sell when it starts to slow down. This approach focuses on the velocity of price changes, rather than fundamental analysis or long-term market projections.

To successfully employ momentum trading, traders typically rely on technical indicators, such as:

- Moving averages: Identifying the direction and strength of trends.

- Relative strength index (RSI): Gauging the momentum of price movements.

- MACD (Moving Average Convergence Divergence): Detecting bullish and bearish signals by comparing moving averages.

Momentum trading can be a lucrative strategy, but it’s crucial to understand the risks involved. The fast-paced nature of this style requires discipline, swift execution, and tight stop-loss orders to minimize potential losses.

Here are some key considerations for momentum trading:

- Identifying the trend: Recognizing strong uptrends and downtrends is crucial for successful entry and exit points.

- Entry and exit points: Choosing the right time to buy and sell based on technical indicators and price action.

- Risk management: Implementing stop-loss orders to limit potential losses and protect profits.

Momentum trading can be a dynamic and rewarding approach for day traders who are comfortable with the inherent risks and volatility. By understanding the fundamentals and developing a solid trading plan, traders can effectively ride the waves of price trends and capture short-term profits.

Risk Management for Day Traders: Setting Stop-Loss Orders

Day trading can be a thrilling and potentially lucrative endeavor, but it also comes with inherent risks. Mastering risk management is crucial for any successful day trader. One of the most effective tools for mitigating risk is setting stop-loss orders. Stop-loss orders are automatic instructions to your broker to sell a position when it reaches a predetermined price, limiting potential losses.

Stop-loss orders serve as a safety net, helping you avoid substantial losses due to market volatility or unexpected price swings. They can be set at a specific price level, a percentage below your entry price, or even a combination of both. The key is to determine a stop-loss level that aligns with your risk tolerance and trading strategy.

When setting stop-loss orders, consider the following:

- Entry Point: Your initial entry point should influence the placement of your stop-loss. A higher entry point might warrant a wider stop-loss, while a lower entry point could allow for a tighter stop.

- Volatility of the Asset: Highly volatile assets require wider stop-loss orders to account for sharp price movements. Conversely, less volatile assets may allow for tighter stops.

- Trading Strategy: Different trading strategies have varying risk profiles. For example, scalping strategies might employ tighter stops, while trend-following strategies might use wider stops.

It’s important to remember that stop-loss orders are not foolproof. Market gaps or sudden price crashes can trigger stop-loss orders even if the underlying fundamentals haven’t changed significantly. Nevertheless, stop-loss orders remain a vital risk management tool for day traders, providing a disciplined approach to managing potential losses and preserving capital.

The Importance of Discipline and Emotional Control

Day trading, the art of buying and selling assets within the same trading day, demands a unique skill set. While technical analysis and market knowledge are crucial, discipline and emotional control are the cornerstones of success. The fast-paced nature of day trading can easily lead to impulsive decisions driven by fear and greed. These emotions can cloud judgment, leading to costly mistakes and ultimately, financial losses.

Discipline allows you to stick to your trading plan, even when the market seems volatile or tempting. It prevents you from chasing profits or cutting losses too early. A disciplined trader enters and exits trades based on predefined criteria, avoiding emotional biases.

Emotional control is equally important. Fear can cause you to sell assets too soon, missing out on potential profits. Greed can lead to overtrading, exposing you to unnecessary risk. Mastering your emotions means staying calm under pressure, recognizing your own biases, and acting rationally despite market fluctuations.

Developing discipline and emotional control requires conscious effort. This includes:

- Setting realistic goals: Don’t expect to get rich quickly. Focus on consistent, sustainable gains.

- Creating a detailed trading plan: This should outline your entry and exit points, risk management strategies, and profit targets.

- Using stop-loss orders: These automatically exit your position if the price moves against you, limiting potential losses.

- Managing your risk: Never risk more than you can afford to lose.

- Learning to control your emotions: Practice mindfulness techniques, journal your trades, and analyze your emotional responses.

The journey to becoming a successful day trader is not easy, but it is attainable. By prioritizing discipline and emotional control, you can lay a strong foundation for consistent profits.

Day Trading Tools and Software: Enhancing Your Performance

Day trading, the art of buying and selling assets within the same trading day, demands precision, speed, and informed decisions. While strategy and market knowledge play crucial roles, the right day trading tools and software can empower you to navigate the fast-paced world of short-term trading with increased efficiency and accuracy.

Trading Platforms: The cornerstone of day trading is a reliable trading platform that provides real-time market data, charting tools, order execution, and account management features. Look for platforms with intuitive interfaces, advanced charting capabilities, and customizable watchlists to monitor your chosen assets.

Technical Analysis Tools: Identifying trends and patterns is essential for day trading. Technical analysis tools, such as moving averages, oscillators, and trendlines, help you interpret price action and generate trading signals. Some platforms offer built-in technical indicators, while others allow you to download and customize your own.

Real-Time Market Data: Access to real-time, accurate market data is critical for making informed decisions. Day trading tools provide live price quotes, news feeds, and economic indicators that keep you abreast of market movements. Consider platforms that offer data feeds from reputable sources.

Order Execution Tools: Speed is of the essence in day trading. Look for platforms that offer fast order execution, ensuring your trades are placed and filled promptly. Advanced order types, such as stop-loss and limit orders, can help manage your risk and maximize profits.

Backtesting and Simulation: Before applying your trading strategies in real-time, it’s wise to backtest them using historical data. Many platforms offer backtesting features that allow you to simulate your strategies and assess their performance. This can help you refine your approach and reduce potential losses.

Risk Management Tools: Day trading carries inherent risks, and proper risk management is paramount. Utilize tools that help you set stop-loss orders, define position sizes, and monitor your overall risk exposure. This can help you protect your capital and avoid significant losses.

Choosing the right day trading tools and software can significantly impact your success. By leveraging these tools, you can gain a competitive edge, improve your trading decisions, and enhance your overall performance in the dynamic world of day trading.