Looking to take control of your finances and grow your wealth? The world of investing is no longer restricted to traditional brokerages and stock markets. In today’s digital age, investment apps have revolutionized how individuals manage their money. These mobile applications offer a user-friendly platform for anyone to explore different investment options, from stocks and bonds to cryptocurrencies and real estate, all from the convenience of their smartphone. But with so many apps to choose from, how do you know which one is right for you?

This comprehensive guide will delve into the best investment apps available, providing insights into their features, benefits, and target audience. Whether you’re a seasoned investor or just starting, we’ll break down the key considerations to help you find the perfect app for your investing journey. Get ready to unlock the potential of your money and achieve your financial goals with the power of mobile investing.

Choosing the Right Investment App for Your Needs

In today’s digital world, managing your finances and growing your wealth has become increasingly convenient thanks to the rise of investment apps. These apps offer a wide range of features, from investing in stocks and ETFs to managing your portfolio and tracking your progress. However, with so many options available, choosing the right investment app for your needs can feel overwhelming. Here’s a guide to help you navigate the choices and find the perfect app to meet your investment goals.

1. Consider Your Investment Goals and Risk Tolerance: Before diving into the app landscape, define your investment objectives. Are you looking for long-term growth, short-term gains, or a mix of both? Your risk tolerance is also crucial. Some apps cater to conservative investors with low-risk options, while others focus on growth and higher-risk investments.

2. Research the Features and Fees: Investment apps offer various features, including research tools, educational resources, and personalized recommendations. Compare the available features and ensure they align with your needs. Also, pay attention to fees. Some apps charge commission fees on trades, while others have monthly subscriptions or a combination of both.

3. Evaluate User Experience and Security: The user interface and overall experience are essential. A user-friendly app with intuitive navigation makes managing your investments effortless. Security is paramount. Choose an app with robust security measures to protect your personal and financial information.

4. Read Reviews and Compare Apps: Reviews provide valuable insights from other users. Read reviews to get a sense of an app’s strengths and weaknesses. Additionally, compare several apps side by side to understand their key differences and determine which best meets your criteria.

5. Consider Your Investment Experience: If you’re new to investing, look for apps that offer beginner-friendly resources, tutorials, and guidance. Experienced investors might prefer apps with advanced features, such as options trading or portfolio optimization tools.

Choosing the right investment app is a critical step in managing your money and building wealth. By carefully considering your needs, researching features, and evaluating user experience and security, you can find an app that empowers you to achieve your financial goals.

Robo-Advisors: Automated Investing for Beginners

In the world of finance, investing can seem like a daunting task, especially for beginners. Navigating the complexities of stock markets, choosing the right investments, and managing your portfolio can feel overwhelming. However, with the rise of robo-advisors, investing has become more accessible and convenient than ever before.

Robo-advisors are essentially automated investment platforms that use algorithms to create and manage investment portfolios tailored to your individual needs. They’re designed to be user-friendly, taking the guesswork out of investing by simplifying the process for busy individuals who might not have the time or expertise to manage their finances themselves.

Here are some key benefits of using robo-advisors for beginners:

- Low minimum investments: Robo-advisors often have low or no minimum investment requirements, making them an attractive option for those starting with limited capital.

- Low fees: Compared to traditional investment advisors, robo-advisors typically have lower fees, making them cost-effective for investors of all income levels.

- Personalized portfolios: Robo-advisors use sophisticated algorithms to create diversified portfolios based on your risk tolerance, investment goals, and financial situation.

- Convenient and accessible: With mobile-friendly platforms, you can access your portfolio, monitor investments, and make changes anytime, anywhere.

- Automatic rebalancing: Robo-advisors continuously monitor your portfolio and automatically rebalance it to ensure your investments remain aligned with your risk profile.

While robo-advisors offer numerous benefits, it’s essential to consider your individual needs and preferences. Not all robo-advisors are created equal, and some may be better suited for certain investment goals or risk levels. Research different platforms, compare their features, fees, and investment strategies to find the best fit for you.

Ultimately, robo-advisors can be a valuable tool for beginners, offering a simple, cost-effective, and convenient way to start building wealth. As technology continues to evolve, we can expect even more sophisticated and personalized investment solutions to emerge, making investing more accessible and empowering for everyone.

Micro-Investing Apps: Investing Spare Change

Micro-investing apps have become increasingly popular as a way for people to invest small amounts of money, often referred to as “spare change.” These apps automate the investment process, making it easy and accessible for everyone. With micro-investing, you can set up recurring investments, round up your purchases to the nearest dollar, and invest the difference.

One of the main advantages of micro-investing apps is that they make investing accessible to people who may not have a large amount of money to invest. By investing small amounts regularly, you can build a portfolio over time. Micro-investing apps often offer a variety of investment options, such as exchange-traded funds (ETFs) and index funds, allowing you to diversify your portfolio.

Another benefit of micro-investing is that it can help you develop good financial habits. By investing regularly, you can start to think about your financial future and make smart decisions about your money. Micro-investing apps can also provide educational resources and insights to help you learn more about investing.

Some popular micro-investing apps include Acorns, Stash, and Robinhood. These apps offer different features and benefits, so it’s important to compare them and choose the one that best fits your needs. Some apps allow you to invest in specific stocks, while others focus on diversified ETFs.

Before using any micro-investing app, it’s important to understand the fees and charges associated with the app. Some apps may charge a monthly fee or a commission on each trade. You should also research the investment options available and make sure they align with your investment goals and risk tolerance.

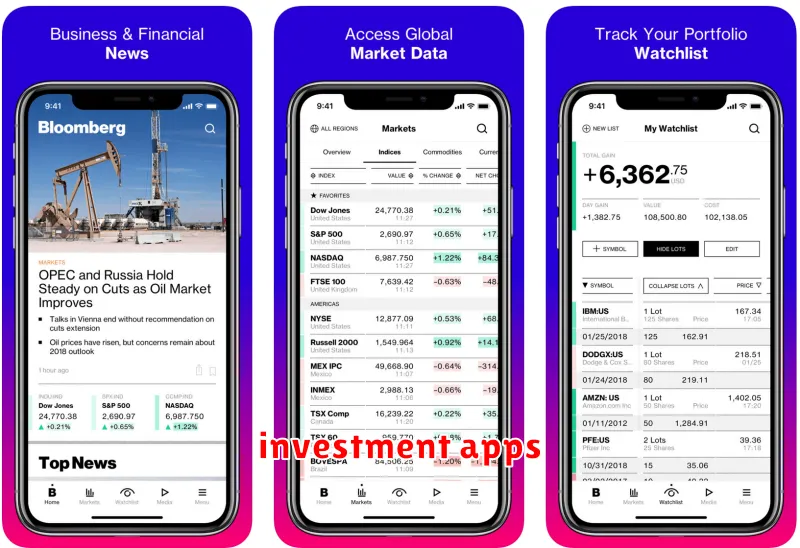

Stock Trading Apps: Commission-Free Trading and Real-Time Quotes

In the modern era of finance, stock trading apps have revolutionized how investors manage their portfolios. These mobile applications offer a seamless and convenient way to buy, sell, and track investments on the go. One of the most significant advancements in this space has been the emergence of commission-free trading, eliminating the traditional brokerage fees that used to deter many from participating in the market.

Furthermore, these apps provide real-time quotes, giving users access to the latest market data, including stock prices, charts, and news feeds. This real-time information is crucial for making informed investment decisions and staying ahead of the curve. With the ability to track your investments and receive instant notifications about market fluctuations, you can react quickly to opportunities and manage your portfolio efficiently.

The rise of commission-free trading and real-time quotes has democratized investing, making it more accessible to a wider range of individuals. Whether you’re a seasoned trader or a beginner investor, these apps provide the tools and resources you need to navigate the complexities of the stock market. From researching investment options to executing trades, these apps empower you to take control of your financial future.

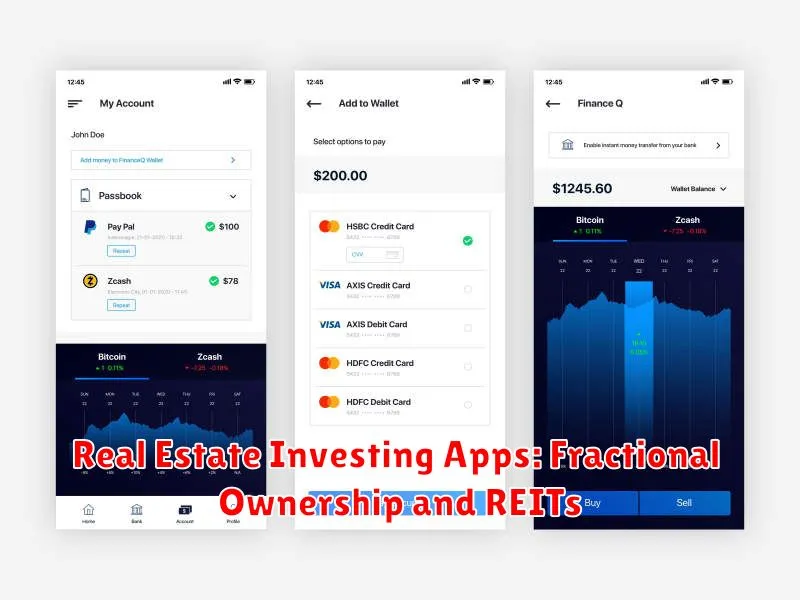

Real Estate Investing Apps: Fractional Ownership and REITs

The world of real estate investing has become increasingly accessible thanks to investment apps that allow you to invest in fractional ownership and REITs. These apps provide a user-friendly platform for diversifying your portfolio and gaining exposure to the real estate market without the traditional barriers of high entry costs.

Fractional Ownership apps allow you to invest in small portions of properties, making it possible to own a piece of valuable real estate without having to purchase the entire property. This opens up opportunities for investors with smaller budgets to gain exposure to the lucrative real estate market. These apps often handle the complexities of property management, making it a hassle-free way to invest in real estate.

REITs (Real Estate Investment Trusts), on the other hand, are companies that own and operate income-producing real estate. Investing in REITs through apps allows you to invest in a diversified portfolio of properties like apartments, malls, and office buildings. REITs offer a steady stream of income through dividends, providing a potential source of passive income. These apps simplify the process of investing in REITs, allowing you to purchase shares in a matter of minutes.

Both fractional ownership and REITs present unique advantages and disadvantages. While fractional ownership offers direct ownership in a specific property, REITs provide diversification and passive income through dividends. Choosing the right approach depends on your individual investment goals and risk tolerance. Before investing in any real estate app, it is crucial to research and understand the platform’s fees, investment options, and risk factors.

Personal Finance Apps: Budgeting, Saving, and Investing

In today’s digital age, managing your finances has become increasingly convenient thanks to the proliferation of powerful personal finance apps. These apps empower you to take control of your money, from budgeting and saving to investing and tracking your progress. With a wide range of features and functionalities, these apps offer a comprehensive solution for managing your financial well-being.

Budgeting apps help you create a detailed spending plan, track your expenses, and identify areas where you can cut back. They typically allow you to categorize your transactions, set budgets for different categories, and monitor your progress towards your financial goals. Some popular budgeting apps include Mint, YNAB (You Need a Budget), and Personal Capital.

Saving apps make it easier to set aside money regularly and reach your savings goals. They often offer features like round-up transactions, where your spare change from purchases is automatically saved, or automated transfers to your savings account. Some notable saving apps include Acorns, Qapital, and Digit.

Investing apps provide a user-friendly platform for investing in stocks, bonds, ETFs, and other investment vehicles. They often offer fractional shares, allowing you to invest in expensive stocks with a smaller amount of money. Many investment apps also offer robo-advisors, which provide automated portfolio management based on your risk tolerance and financial goals. Popular investment apps include Robinhood, Acorns, and Betterment.

By using personal finance apps, you can gain valuable insights into your spending habits, streamline your savings efforts, and make informed investment decisions. These apps provide a convenient and accessible way to manage your money effectively and grow your wealth over time.

Key Features to Look for in an Investment App

Investing is an important part of building wealth and achieving your financial goals. Fortunately, there are now many great investment apps available that make it easier than ever to start investing, even if you’re a beginner. But with so many options to choose from, how do you know which one is right for you? Here are some key features to look for in an investment app:

Ease of Use

An investment app should be easy to use, even if you’re not familiar with investing. Look for an app with a simple and intuitive interface, clear explanations of investment options, and helpful tutorials. It should be easy to set up an account, deposit funds, and make trades.

Investment Options

The best investment apps offer a wide range of investment options, such as stocks, bonds, ETFs, mutual funds, and even cryptocurrency. You should also be able to choose from different investment strategies, such as dollar-cost averaging or robo-advisors.

Research Tools

An investment app should provide you with the tools you need to make informed investment decisions. Look for features like stock charts, company news, and analyst ratings. You should also be able to track your portfolio performance and see how your investments are doing.

Security

Security is paramount when it comes to your finances. Make sure the investment app you choose has strong security features, such as two-factor authentication and encryption. You should also check the app’s reputation and read reviews from other users.

Fees and Costs

Most investment apps charge fees for certain services, such as trading commissions or account maintenance fees. Compare the fees charged by different apps and choose one that fits your budget. Some apps offer free trading for certain types of investments or for accounts with a certain balance.

Customer Support

It’s important to have access to customer support in case you have any questions or problems. Look for an app with a responsive customer service team that’s available via phone, email, or chat.

By considering these features, you can find an investment app that meets your needs and helps you reach your financial goals.

Security and Reliability: Protecting Your Investments

When choosing an investment app, security and reliability are paramount. You’re entrusting your hard-earned money to this platform, so it’s crucial to ensure your investments are protected. Look for apps with robust security measures, including:

- Encryption: Data should be encrypted both in transit and at rest to prevent unauthorized access.

- Two-factor authentication (2FA): This adds an extra layer of security by requiring a code from your phone in addition to your password.

- Regular security updates: The app should be regularly updated to patch any vulnerabilities.

- Strong customer support: Reliable customer support can help you resolve any issues or concerns you may have.

It’s also essential to consider the app’s track record. Look for established platforms with a history of security and reliability. Read reviews from other users and research any potential risks before investing.

Remember, your financial security is paramount. Choose an investment app that prioritizes these key aspects to safeguard your investments and peace of mind.

User Experience: Intuitive Design and Easy Navigation

In the realm of investment apps, a seamless and intuitive user experience is paramount. The best investment apps prioritize easy navigation and a user-friendly design, making it effortless for users to manage their finances and grow their wealth on the go.

A well-designed app should have a clear and logical layout, with essential features readily accessible. Users should be able to easily find what they need, whether it’s tracking their portfolio, making trades, or accessing customer support. The app’s interface should be visually appealing and uncluttered, with a consistent design language throughout.

Intuitive navigation is crucial for a positive user experience. The app should use clear and concise language, with intuitive icons and gestures. A well-structured menu and navigation system ensures users can move seamlessly between different sections of the app without feeling lost or frustrated.

By prioritizing intuitive design and easy navigation, investment apps empower users to confidently manage their finances and achieve their financial goals. A smooth and enjoyable user experience fosters trust and encourages continued engagement with the platform.