Are you ready to take control of your financial future and start investing in the stock market? The idea of buying stocks online might seem daunting, but it doesn’t have to be. With the right knowledge and strategy, you can confidently navigate the world of online stock trading and potentially grow your wealth over time. This step-by-step guide will equip you with the essential information you need to get started, from choosing the right brokerage account to understanding investment basics and making your first trade.

Investing in stocks can be a powerful tool for building long-term wealth. However, it’s crucial to approach it with a safe and confident mindset. This guide will walk you through the entire process, breaking down complex concepts into easy-to-understand steps. You’ll learn how to research stocks, identify promising investment opportunities, manage your risk, and avoid common pitfalls.

Opening a Brokerage Account: Choosing the Right Platform

Before you can start investing in stocks, you need to open a brokerage account. This is where you’ll buy and sell your stocks. But with so many different platforms available, choosing the right one can feel overwhelming. Here’s a breakdown of key factors to consider when selecting a brokerage platform:

Fees and Commissions: Some brokers charge commissions on every trade, while others offer commission-free trading. Look for platforms with low fees and transparent pricing structures. Consider if you’ll be trading frequently or just occasionally, as commission-free platforms might be more cost-effective for frequent traders.

Investment Options: Different platforms offer various investment options. Some specialize in stocks, while others provide access to ETFs, mutual funds, options, and even cryptocurrencies. Make sure the platform offers the specific investment options that align with your investment goals.

Research Tools and Resources: Investing involves making informed decisions. A good brokerage platform will offer research tools, market data, and educational resources to help you make informed choices. Some platforms provide real-time market updates, analyst ratings, and company financials to support your investment research.

User Interface and Experience: A user-friendly platform makes navigating and placing trades a seamless experience. Look for platforms with intuitive interfaces, clear dashboards, and mobile apps that make managing your investments convenient. Consider trying out different platforms using their free demo accounts or researching online reviews to get a sense of their user experience.

Security and Reliability: Investing your money requires a platform you trust. Ensure the platform has robust security measures like encryption and two-factor authentication to safeguard your personal information and financial assets. Check for the broker’s regulatory licenses and certifications for added assurance.

Customer Support: When you have questions or need assistance, responsive customer support is crucial. Look for platforms offering multiple ways to reach out, such as phone, email, and live chat. Research their customer service reviews to gauge the quality of their support.

Opening a brokerage account is a vital step in your investment journey. Taking the time to compare different platforms and choose one that aligns with your needs and preferences will set you up for success in the stock market.

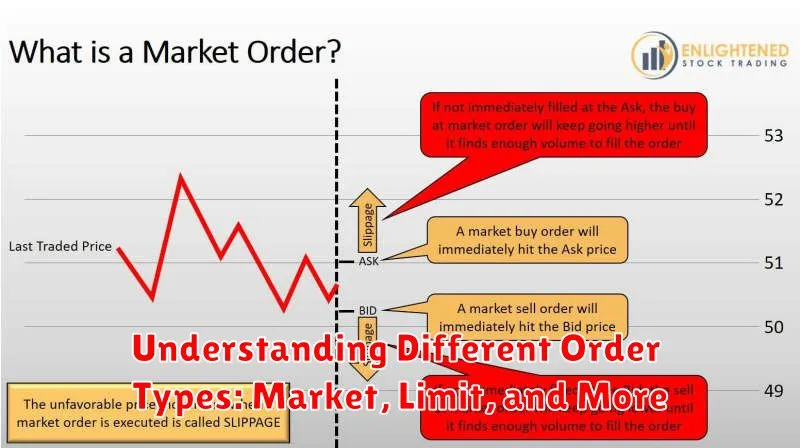

Understanding Different Order Types: Market, Limit, and More

When you’re buying stocks online, understanding different order types is crucial for executing trades effectively and confidently. These order types allow you to specify how you want your trade to be filled, influencing the price and execution speed. Here’s a breakdown of common order types:

Market Orders

A market order is the simplest type. It instructs your broker to execute your trade immediately at the best available price in the market. This is great for speed, as it ensures your order is filled quickly. However, you may not get the best price, especially during volatile market conditions. If the price is rapidly moving, you could end up paying more than expected.

Limit Orders

A limit order lets you set a maximum price you’re willing to pay (for a buy order) or a minimum price you’re willing to sell (for a sell order). This gives you more control over the price, preventing you from paying too much or selling too low. While it provides price protection, it doesn’t guarantee execution. If the market price never reaches your limit, your order may not be filled.

Stop Orders

A stop order is used to limit your potential losses. It’s triggered when the stock price reaches a specified level, automatically placing a market order to sell (for a stop-loss order) or buy (for a stop-buy order). This can be valuable for managing risk during volatile market swings. However, be cautious with stop-loss orders as they can be triggered by temporary fluctuations, leading to unwanted sell-offs.

Other Order Types

Besides these common types, you may also encounter other order variations like stop-limit orders, which combine features of stop and limit orders, and fill-or-kill orders, requiring the entire order to be filled immediately or canceled. Each order type has its own set of advantages and disadvantages. It’s important to understand your trading goals and risk tolerance when choosing the right order type.

Choosing the Right Order Type

The best order type depends on your specific needs and trading style. If speed is paramount, a market order is suitable. If price control is a priority, a limit order is recommended. For managing risk, a stop-loss order can be helpful. Always consult your broker’s documentation or contact their customer support to understand the full implications of each order type before using them.

Researching Stocks: Fundamental and Technical Analysis

Before you dive into the exciting world of stock investing, understanding how to research stocks is crucial. This step-by-step guide will walk you through two essential methods: fundamental analysis and technical analysis.

Fundamental Analysis: Digging Deep into the Company

Fundamental analysis focuses on a company’s underlying financial health and future prospects. It delves into data like:

- Financial statements: Income statements, balance sheets, and cash flow statements provide insights into the company’s profitability, assets, and cash management.

- Industry trends: Understanding the industry the company operates in helps assess its competitive landscape and growth potential.

- Management team: Evaluating the leadership and their track record can indicate the company’s direction and effectiveness.

- Competitive landscape: Assessing the company’s position relative to its rivals can reveal its strengths and weaknesses.

By carefully analyzing these factors, you can form a well-informed opinion about a company’s long-term value.

Technical Analysis: Charting the Stock’s Behavior

Technical analysis focuses on the stock’s price and volume patterns, using charts and indicators to identify trends and potential trading opportunities. Key elements include:

- Price action: Analyzing stock price movements over time can help identify support and resistance levels, potential trend reversals, and buying or selling signals.

- Volume: Monitoring trading volume can provide insights into market sentiment and the strength of price movements.

- Technical indicators: These are mathematical calculations based on historical price and volume data that can help identify trends, overbought or oversold conditions, and other market signals.

Technical analysis can be particularly useful for short-term trading decisions and identifying potential entry and exit points.

Integrating Both Approaches for Informed Decisions

While fundamental and technical analysis provide distinct perspectives, they can be effectively combined for comprehensive stock research. Fundamental analysis helps you understand the company’s inherent value, while technical analysis assists in navigating market trends and timing your investments.

Remember, thorough research is the foundation of confident stock investing. By diligently applying both fundamental and technical analysis, you can make informed investment decisions and navigate the stock market with greater assurance.

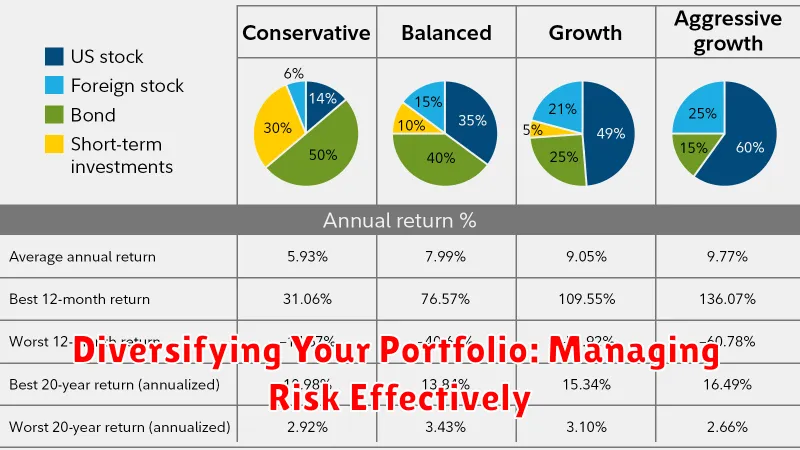

Diversifying Your Portfolio: Managing Risk Effectively

Diversification is a key strategy for managing risk in any investment portfolio, particularly when it comes to buying stocks online. It’s all about spreading your investments across different asset classes, industries, and geographic locations. This helps to mitigate the impact of any single investment performing poorly and reduces the overall volatility of your portfolio.

When diversifying your portfolio, consider these key areas:

- Asset Allocation: Don’t put all your eggs in one basket. Allocate your investments across different asset classes like stocks, bonds, real estate, and commodities. The ideal allocation will depend on your risk tolerance, investment goals, and time horizon.

- Industry Diversification: Investing in various industries helps to mitigate sector-specific risks. A diversified portfolio will include companies from different sectors, like technology, healthcare, energy, and consumer goods.

- Geographic Diversification: Investing in companies located in different regions around the world can help reduce exposure to localized economic or political risks. Consider investing in international stocks and emerging markets.

- Size Diversification: Include companies of various market capitalizations in your portfolio. This can help you capitalize on the growth potential of smaller companies while benefiting from the stability of larger, established businesses.

By diligently diversifying your portfolio, you can effectively manage risk and increase the likelihood of achieving your long-term investment goals.

Investing for the Long Term: Patience and Consistency

The stock market can be a volatile place, but that doesn’t mean you should shy away from it. In fact, investing in stocks for the long term is one of the best ways to build wealth.

When you invest for the long term, you’re essentially taking a bet on the future of the companies you’re investing in. You’re betting that these companies will continue to grow and become more profitable over time.

The key to successful long-term investing is patience and consistency. You need to be patient enough to ride out the inevitable ups and downs of the market. And you need to be consistent with your investing habits, making regular contributions to your portfolio even when the market is down.

Here are a few tips for investing for the long term:

- Start early: The earlier you start investing, the more time your money has to grow. Even if you can only afford to invest a small amount each month, it will add up over time.

- Invest regularly: Make investing a habit. Set up automatic contributions to your brokerage account so you don’t have to think about it.

- Diversify your portfolio: Don’t put all your eggs in one basket. Invest in a variety of different asset classes, such as stocks, bonds, and real estate.

- Rebalance your portfolio regularly: As your portfolio grows, you’ll need to rebalance it to make sure you’re still diversified. This means selling some of your holdings in asset classes that have performed well and buying more of asset classes that have underperformed.

- Don’t panic sell: The stock market is cyclical. There will be times when the market goes down. But it will always recover eventually. Don’t let short-term fluctuations in the market scare you into selling your investments.

Investing for the long term is a marathon, not a sprint. It’s about building wealth gradually over time. By following these tips, you can increase your chances of achieving your financial goals.

Dollar-Cost Averaging: A Strategy for All Market Conditions

Dollar-cost averaging is an investment strategy that involves investing a fixed amount of money at regular intervals, regardless of the current market price. This strategy can help to reduce the impact of market volatility and can be a valuable tool for investors of all experience levels. In this article, we’ll explain how dollar-cost averaging works and why it’s a smart approach to investing in stocks.

Here’s how dollar-cost averaging works. Let’s say you want to invest $1,000 per month in a particular stock. If the stock price is $50 per share, you’d buy 20 shares. But if the stock price drops to $40 per share, you’d buy 25 shares. By investing a fixed amount each month, you’re buying more shares when prices are low and fewer shares when prices are high. This helps to smooth out your average cost per share and reduces the impact of market fluctuations.

Here are some of the benefits of dollar-cost averaging:

- Reduces the risk of market timing: By investing regularly, you’re less likely to be caught in a market downturn or miss out on a bull market. You won’t have to worry about guessing the market peaks and troughs.

- Helps to buy low and sell high: By buying more shares when prices are low and fewer shares when prices are high, you’re essentially buying low and selling high over the long term.

- Provides discipline and consistency: This strategy can help you stay focused and consistent with your investment goals. You’ll be more likely to stick to your investment plan, even when the market is volatile.

Dollar-cost averaging isn’t a get-rich-quick scheme. It’s a long-term strategy that can help you build wealth over time. Remember, it’s important to do your research and choose stocks that you believe will perform well over the long term. Dollar-cost averaging can help you weather the ups and downs of the market and potentially achieve your financial goals.

Managing Your Investment Portfolio: Tracking and Adjusting

Once you’ve built a portfolio, it’s crucial to stay on top of its performance. Regular tracking and adjusting are key to maximizing returns and minimizing risk.

Tracking your portfolio involves monitoring the performance of your individual investments. This includes tracking their current value, growth, and any dividends or distributions they may be paying. There are many online tools and platforms that can help you track your portfolio, such as:

- Brokerage accounts

- Investment apps

- Spreadsheet programs like Excel

- Portfolio tracking websites

Adjusting your portfolio involves making changes to your investment mix based on your financial goals, risk tolerance, and market conditions. This can involve buying and selling securities, rebalancing your portfolio to maintain your desired asset allocation, or adjusting your investment strategy.

Here are some key factors to consider when adjusting your portfolio:

- Your investment goals: What are you investing for? Retirement, a down payment on a house, or something else? Your goals will help determine your investment timeline and risk tolerance.

- Your risk tolerance: How much risk are you comfortable taking with your investments? This will affect your asset allocation and your choice of investments.

- Market conditions: The stock market is constantly changing. You may need to adjust your portfolio based on economic conditions, interest rates, and other market factors.

- Your personal situation: Life changes, such as getting married, having a child, or changing jobs, can also impact your investment strategy.

It’s important to remember that investing involves risk. There’s no guarantee of returns, and you could lose money. However, by tracking and adjusting your portfolio regularly, you can make informed decisions that help you achieve your financial goals.

Tax Implications of Stock Trading: What You Need to Know

Investing in the stock market can be a rewarding experience, but it’s crucial to understand the tax implications of your trading activities. Whether you’re a seasoned investor or just starting out, navigating the tax landscape is essential to maximize your returns and avoid any unpleasant surprises.

Here’s a breakdown of the key tax considerations for stock trading:

Capital Gains Tax

The primary tax you’ll encounter on stock trading is capital gains tax. This tax applies to profits earned from selling stocks or other assets you’ve held for longer than a year. Capital gains are classified as either short-term (held for less than a year) or long-term (held for a year or more). The tax rates vary based on your income level and the holding period.

Tax Loss Harvesting

While you’ll pay taxes on capital gains, you can also potentially offset those gains with tax loss harvesting. This strategy involves selling losing investments to realize a capital loss, which you can then use to reduce your tax liability on any capital gains. It’s important to consult a tax professional to ensure you’re utilizing tax loss harvesting effectively.

Wash Sale Rule

A critical rule to be aware of is the wash sale rule. This rule prevents you from deducting a loss on a security if you repurchase the same or substantially similar security within 30 days before or after the sale. Understanding the wash sale rule is essential for minimizing your tax burden.

Reporting Your Stock Trading

You’ll need to report your stock trading activities on your tax return. The IRS Form 8949, “Sales and Other Dispositions of Capital Assets,” is used to report your capital gains and losses. Depending on the complexity of your trading, you might also need to complete Schedule D, “Capital Gains and Losses.”

Seek Professional Advice

The tax implications of stock trading can be complex. It’s always a good idea to consult with a qualified tax professional to ensure you’re properly understanding and managing your tax obligations. They can provide personalized guidance tailored to your specific investment strategy.

By understanding the tax implications of stock trading, you can invest with confidence, knowing that you’re minimizing your tax burden and maximizing your returns.

Staying Informed: Market News and Economic Indicators

In the dynamic world of online stock trading, staying informed about market news and economic indicators is crucial for making sound investment decisions. This information provides valuable insights into the overall health of the economy and its impact on individual companies and industries. By keeping abreast of these key factors, you can navigate the market with greater confidence and make informed choices about your investment portfolio.

Market News encompasses a wide range of information, including company earnings reports, industry trends, regulatory changes, and global events. By following reputable financial news sources, you can stay updated on developments that could affect your investments.

Economic Indicators provide valuable insights into the overall health of the economy. Key indicators to watch include:

- Gross Domestic Product (GDP): Measures the total value of goods and services produced in a country.

- Inflation Rate: Tracks the rate at which prices for goods and services are rising.

- Unemployment Rate: Indicates the percentage of the labor force that is unemployed.

- Interest Rates: Influence borrowing costs for businesses and consumers, impacting economic activity.

Understanding how these indicators are trending can help you anticipate potential market shifts and adjust your investment strategy accordingly.