The oil market is a complex and dynamic system, constantly affected by a multitude of factors, including geopolitical events, global demand, and technological advancements. Understanding these factors and their impact on oil prices is crucial for businesses and individuals alike. From driving fuel costs to influencing inflation and economic growth, the oil market plays a significant role in our daily lives.

This article delves into the intricacies of the oil market, providing insights into the current price forecast, key trends shaping the industry, and the potential impact on the global economy. We will explore the forces driving oil price volatility, examine the role of major oil producers, and analyze the implications of the transition towards renewable energy sources. Join us as we navigate this essential market and uncover the factors influencing its future trajectory.

The Fundamentals of Oil Supply and Demand

The oil market is a complex and dynamic system driven by the interplay of supply and demand. Understanding these fundamental forces is crucial for navigating the market and forecasting future price trends.

Supply refers to the amount of oil that producers are willing and able to bring to the market at a given price. Oil production is influenced by factors such as:

- Exploration and discovery of new reserves

- Technological advancements in extraction and production

- Political stability in oil-producing countries

- Investment decisions by oil companies

- Production costs, including labor, materials, and transportation

Demand refers to the amount of oil that consumers are willing and able to purchase at a given price. Oil consumption is influenced by factors such as:

- Economic growth and industrial activity

- Population growth and urbanization

- Transportation patterns, including the use of vehicles and air travel

- Government policies, such as fuel efficiency standards and taxes

- Alternative energy sources, such as solar and wind power

The relationship between supply and demand determines the equilibrium price of oil. When supply exceeds demand, prices tend to fall. Conversely, when demand exceeds supply, prices tend to rise. This dynamic interaction is constantly at play, shaping the oil market and influencing global economic activity.

Geopolitical Factors Influencing Oil Prices

Oil prices are influenced by a complex interplay of factors, with geopolitical events playing a crucial role. These events can significantly impact supply, demand, and investor sentiment, resulting in price fluctuations. Here are some of the key geopolitical factors that influence oil prices:

Political Instability and Conflicts

Political unrest, conflicts, and wars in major oil-producing regions can disrupt production and transportation, leading to supply shortages and price increases. For example, the ongoing conflict in the Middle East has significantly impacted oil prices due to its potential to disrupt production and exports from the region, which is a major oil supplier.

Sanctions and Embargoes

Imposing sanctions or embargoes on oil-producing countries can limit their ability to export oil, thereby reducing global supply and driving up prices. The recent sanctions imposed on Russia, a significant oil exporter, have already impacted global oil markets.

Strategic Reserves

Governments often maintain strategic oil reserves as a buffer against supply disruptions. The release of oil from these reserves can help moderate price spikes during periods of crisis. However, the timing and scale of such releases can also impact oil prices.

Government Policies

Government policies related to oil production, exploration, and taxation can influence oil prices. For example, policies promoting renewable energy sources can reduce demand for oil, potentially lowering prices.

Geopolitical Alliances

Alliances between oil-producing and consuming nations can influence oil prices. For example, the Organization of the Petroleum Exporting Countries (OPEC) has significant control over global oil production and can influence prices through coordinated production quotas.

Understanding the geopolitical factors influencing oil prices is crucial for navigating the oil market. These events can create significant volatility and present both opportunities and risks for investors, businesses, and consumers alike.

OPEC’s Role in the Global Oil Market

The Organization of the Petroleum Exporting Countries (OPEC) plays a pivotal role in the global oil market, wielding significant influence over oil prices and production levels. OPEC is a cartel comprising 13 member countries, responsible for producing a substantial portion of the world’s oil supply. Its primary objective is to coordinate and unify petroleum policies among member countries, with the aim of ensuring stable oil prices and a steady supply for both producers and consumers.

One of OPEC’s most potent tools is the ability to adjust production quotas. By collectively reducing or increasing production, OPEC can directly impact the supply of oil in the market. This, in turn, affects oil prices, as supply and demand dictate market dynamics. When OPEC reduces output, it typically leads to higher oil prices, while increasing production can lower prices.

OPEC’s decisions and actions can have far-reaching consequences for the global economy. Higher oil prices can increase inflation, impact consumer spending, and affect the profitability of businesses reliant on oil. Conversely, lower oil prices can provide relief to consumers and businesses, boosting economic activity.

The dynamics of the global oil market are complex and constantly evolving. OPEC’s role remains crucial in shaping the market landscape. Its decisions continue to have a profound impact on energy security, global economic stability, and the livelihoods of individuals worldwide. Understanding OPEC’s role is essential for comprehending the intricate workings of the oil market and its impact on the global economy.

Analyzing Historical Oil Price Trends

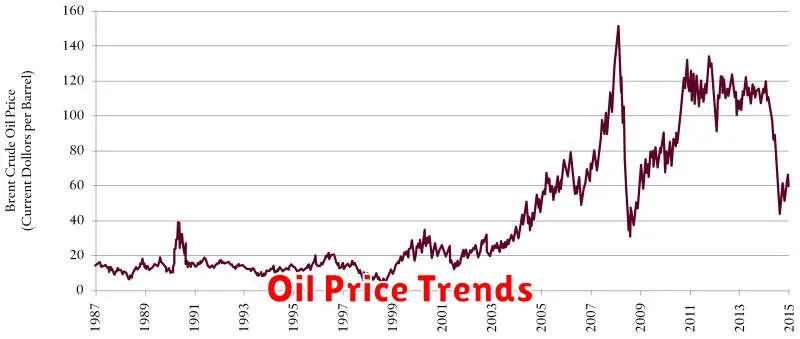

The price of oil has fluctuated dramatically over the past century, influenced by a complex interplay of factors including global demand, supply disruptions, geopolitical events, and technological advancements. Understanding these historical trends is crucial for navigating the oil market and anticipating future price movements.

In the early 20th century, oil prices remained relatively stable, largely due to the dominance of American oil production. However, the OPEC (Organization of the Petroleum Exporting Countries) emerged in the 1960s, gaining significant control over global oil supply and wielding considerable influence over prices.

The 1970s witnessed two major oil crises: the 1973 oil crisis, triggered by the Arab oil embargo, and the 1979 oil crisis, sparked by the Iranian Revolution. These events resulted in sharp price increases and global economic instability.

During the 1980s, oil prices declined due to increased production and a global economic slowdown. The 1990s saw a period of relative stability, with prices hovering around $20 per barrel. However, the Gulf War in 1991 and the subsequent sanctions against Iraq caused temporary price spikes.

The early 21st century witnessed a sustained rise in oil prices, driven by rapid economic growth in China and other emerging markets. The price of crude oil reached an all-time high of over $140 per barrel in 2008. The global financial crisis and subsequent recession led to a sharp decline in prices, which continued to fall during the 2014-2016 oil price crash.

Since then, oil prices have shown signs of recovery, but remain vulnerable to various factors, including global economic conditions, technological advancements in renewable energy, and geopolitical tensions. Analyzing these historical trends provides valuable insights into the dynamics of the oil market and helps us better understand the factors influencing future price fluctuations.

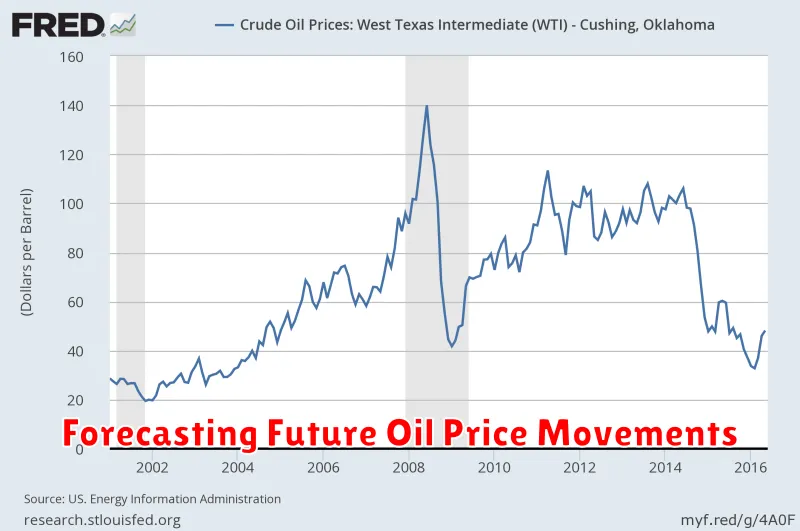

Forecasting Future Oil Price Movements

Predicting future oil price movements is a complex task, influenced by numerous factors that can be difficult to predict. However, understanding the key drivers can offer valuable insights. Global supply and demand dynamics are at the heart of the equation. Increased production from major players like OPEC+ and the US can lead to lower prices, while growing global energy demand, driven by factors like population growth and economic development, can push prices higher.

Geopolitical events play a significant role. Conflicts, political instability, and sanctions can disrupt supply chains and create price volatility. The ongoing war in Ukraine, for example, has significantly impacted global energy markets. Technological advancements, such as the development of renewable energy sources and advancements in energy efficiency, can influence long-term oil demand and pricing trends.

Economic conditions also play a role. Economic growth and inflation rates can impact energy demand and, consequently, oil prices. Central bank policies and interest rate changes can influence investment in oil production and consumption patterns. Market sentiment and speculation can contribute to short-term price fluctuations. Investor expectations and market perceptions about future supply and demand can drive rapid price movements.

Accurately forecasting future oil prices requires a comprehensive analysis of these factors and their potential interactions. By carefully considering the impact of global supply and demand, geopolitical events, technological advancements, economic conditions, and market sentiment, it’s possible to gain a better understanding of the forces driving oil price movements and potentially make more informed investment decisions.

The Impact of Renewable Energy on Oil Demand

The rise of renewable energy sources like solar and wind power is significantly impacting the global oil market. As these technologies become more cost-effective and widespread, they are displacing traditional fossil fuels, leading to a decline in oil demand. This shift has far-reaching implications for oil prices, energy security, and the global economy.

The impact of renewable energy on oil demand is multifaceted. One key factor is the increasing energy efficiency of electric vehicles (EVs). As EV adoption accelerates, the demand for gasoline and diesel fuel decreases, putting pressure on oil prices. Additionally, the growth of renewable energy sources like solar and wind power is directly reducing the reliance on oil for electricity generation.

However, the transition to a renewable energy future is not without its challenges. The intermittency of renewable energy sources, meaning their dependence on weather conditions, poses a significant hurdle. This requires the development of effective energy storage solutions and grid management systems to ensure a reliable and consistent energy supply. Furthermore, the global infrastructure for renewable energy production and distribution still needs to be expanded and optimized.

Despite these challenges, the long-term outlook for renewable energy is positive. Governments around the world are implementing policies to incentivize renewable energy investments and reduce carbon emissions. As technology continues to advance and costs decrease, renewable energy is poised to play an increasingly dominant role in the global energy mix, further impacting oil demand and shaping the future of the oil market.

Understanding Oil Futures and Options

Oil futures and options are financial instruments that allow investors to speculate on or hedge against the price of crude oil. While they might sound complex, understanding their fundamentals can give you an edge in navigating the volatile oil market. This guide will delve into the core concepts of oil futures and options, highlighting their key features and applications.

What are Oil Futures?

An oil future is a contract that obligates the buyer to purchase, and the seller to sell, a specific quantity of crude oil at a predetermined price on a future date. This contract is standardized, meaning the terms are predefined and publicly available. The price of oil futures contracts fluctuates based on market forces, including supply and demand, economic factors, geopolitical events, and speculation.

Understanding Oil Options

An oil option is a contract that gives the buyer the right, but not the obligation, to buy (call option) or sell (put option) a certain quantity of crude oil at a specific price within a defined period. Unlike futures, options allow for flexibility, providing the holder the right to exercise the contract depending on the market conditions.

Key Applications of Oil Futures and Options

These instruments serve various purposes within the oil market:

- Price Speculation: Investors can profit from price fluctuations by buying or selling futures and options based on their market outlook.

- Price Hedging: Producers and consumers can use futures and options to mitigate price risk by locking in a future price for their oil purchases or sales.

- Market Research: Futures and options market data can provide valuable insights into market sentiment, anticipated supply and demand dynamics, and potential price movements.

Navigating the World of Oil Futures and Options

It is crucial to understand the risks associated with these instruments. Price fluctuations can lead to significant losses, and there are complexities involved in understanding and interpreting market signals. Seeking expert advice, conducting thorough research, and employing a sound risk management strategy are essential for navigating the oil futures and options market effectively.

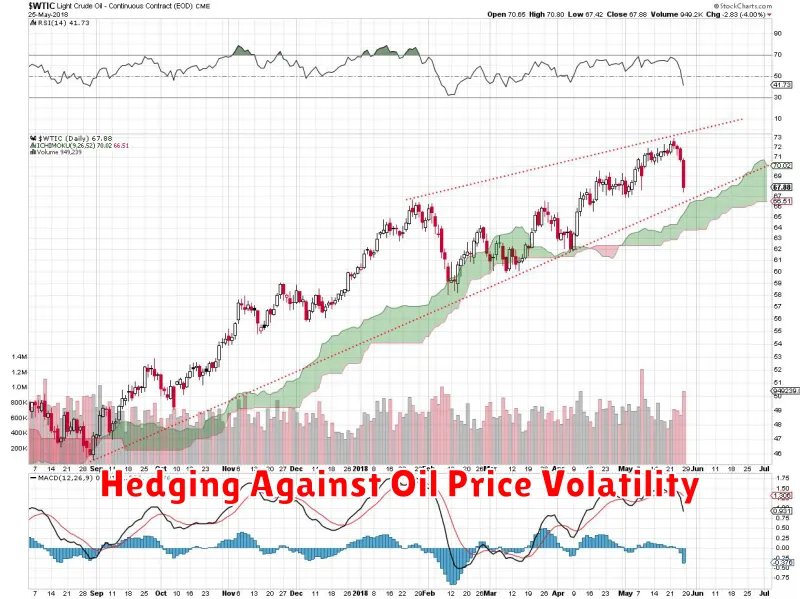

Hedging Against Oil Price Volatility

The price of oil is a notoriously volatile commodity. It is influenced by a wide range of factors, including global demand, supply disruptions, geopolitical events, and government policies. This volatility can create significant risks for businesses and investors who rely on oil. Hedging is a risk management strategy that can be used to mitigate these risks.

There are a variety of hedging strategies that can be used to protect against oil price volatility. One common strategy is to use futures contracts. A futures contract is an agreement to buy or sell a specific quantity of oil at a predetermined price on a future date. By entering into a futures contract, businesses can lock in a price for their oil purchases or sales, regardless of what happens to the spot price of oil in the meantime.

Another common hedging strategy is to use options. An option gives the holder the right, but not the obligation, to buy or sell oil at a predetermined price on a future date. This can be a useful strategy for businesses that are unsure about their future oil needs or for investors who want to speculate on the direction of oil prices.

Hedging is not a foolproof strategy, and there are risks associated with it. However, it can be a valuable tool for businesses and investors who are looking to manage the risk of oil price volatility. It is important to carefully consider the risks and benefits of hedging before making any decisions.

When choosing a hedging strategy, it is important to consider the following factors:

- The time horizon of your hedge

- The amount of risk you are willing to accept

- The cost of hedging

- The liquidity of the hedging instrument

It is also important to work with a reputable financial advisor or broker to develop a hedging strategy that is right for your specific needs.

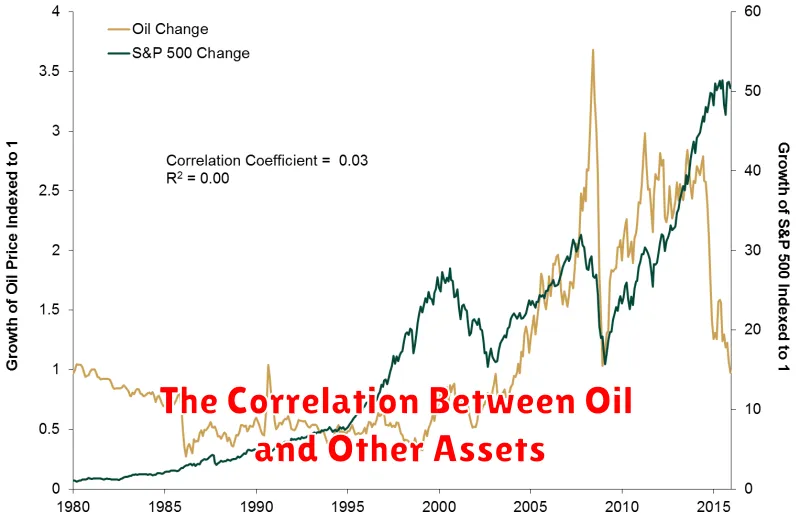

The Correlation Between Oil and Other Assets

The oil market is a complex and dynamic system that is influenced by a wide range of factors, including global economic growth, geopolitical events, and technological advancements. One important aspect of understanding the oil market is its correlation with other assets. This correlation can have significant implications for investors and policymakers alike.

Oil and Stock Markets: Historically, oil prices have shown a strong correlation with stock markets. When oil prices rise, it can lead to increased inflation, which can dampen economic growth and reduce corporate profits. This can negatively impact stock prices. Conversely, a decline in oil prices can boost economic activity and corporate profits, leading to higher stock prices.

Oil and Commodities: Oil is also closely correlated with other commodities, such as gold and copper. Gold is often seen as a safe haven asset during times of economic uncertainty, and its price can rise when investors are concerned about inflation. Copper is used in a wide range of industrial applications, and its price is sensitive to global economic growth. When oil prices rise, it can indicate strong economic growth, which can boost demand for copper.

Oil and Currencies: The correlation between oil and currencies can be complex and depends on various factors, such as the currency’s role in the global oil market. For example, the US dollar is the dominant currency in the global oil market, and a strong dollar can make oil imports more expensive for countries with weaker currencies, leading to lower demand for oil.

Understanding the Correlation: Understanding the correlation between oil and other assets can be helpful for investors in making informed decisions about their portfolios. For example, if an investor believes that oil prices are likely to rise, they may consider investing in assets that are positively correlated with oil, such as energy stocks or commodities. Conversely, if they believe that oil prices are likely to fall, they may consider investing in assets that are negatively correlated with oil, such as gold or bonds.