The foreign exchange market, also known as forex or FX, is the largest and most liquid financial market in the world. It’s a global marketplace where currencies are traded, influencing everything from international trade and investment to the value of your savings. Navigating this complex world can feel daunting, but understanding the fundamentals of forex can empower you to make informed decisions and potentially reap the benefits of this dynamic market. Whether you’re an individual investor, a business owner, or simply curious about the global economy, this comprehensive overview will provide you with the insights needed to confidently navigate the currency waters.

From understanding the basics of currency pairs and exchange rates to exploring the factors that drive currency fluctuations, we’ll delve into the intricacies of the forex market. We’ll also discuss various trading strategies, risk management techniques, and the tools available to both experienced traders and newcomers. By demystifying the world of foreign exchange, this article aims to equip you with the knowledge and confidence to make informed decisions and potentially capitalize on the opportunities presented by the global currency market.

Understanding the Basics of Forex Trading

The foreign exchange market, commonly known as Forex, is the world’s largest and most liquid financial market. It’s where currencies are bought and sold, allowing individuals and institutions to exchange one currency for another. Forex trading involves speculating on currency price fluctuations, aiming to profit from the difference between the buying and selling price.

The Forex market operates 24 hours a day, five days a week, making it accessible to traders worldwide. It’s a decentralized market, meaning there’s no central exchange or location. Trading occurs electronically through a network of banks, brokers, and other financial institutions.

Understanding the basics of Forex trading is crucial for navigating this dynamic market. Here are some key concepts:

- Currency Pairs: Forex trading involves trading currencies in pairs. For example, EUR/USD represents the exchange rate between the Euro and the US Dollar. When you buy EUR/USD, you’re buying Euros and selling US Dollars, and vice versa.

- Pip (Point in Percentage): The smallest unit of price movement in Forex is called a pip. It represents the fourth decimal place in most currency pairs. For example, a pip change in EUR/USD from 1.1000 to 1.1001 is a one-pip movement.

- Leverage: Forex trading often involves leverage, allowing traders to control a larger position with a smaller amount of capital. Leverage magnifies profits and losses, so it’s crucial to use it cautiously.

- Margin: Margin is the initial deposit required to open a Forex trade. It acts as a security deposit to cover potential losses.

Forex trading can be complex, but with proper research, education, and risk management, it can be an exciting and potentially profitable venture. Consider seeking guidance from experienced traders or reputable financial advisors before engaging in Forex trading.

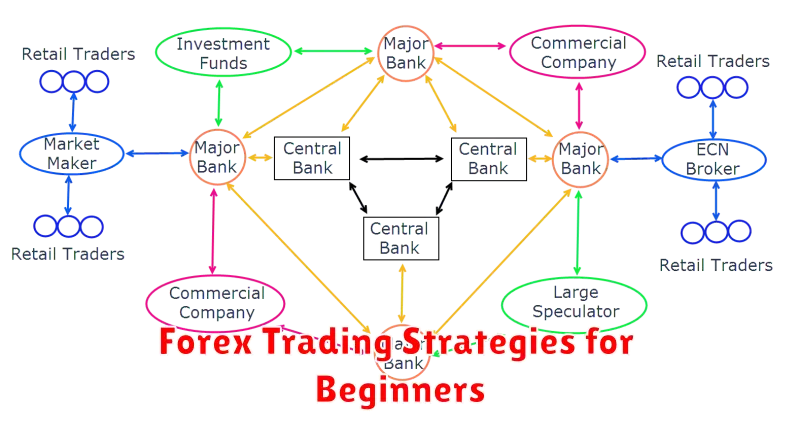

Major Players in the Foreign Exchange Market

The foreign exchange (forex) market is a bustling global marketplace where currencies are traded. It’s the largest and most liquid financial market in the world, with trillions of dollars changing hands daily. Behind this immense activity are several key players, each with distinct roles and motivations.

Central Banks are the primary players, responsible for setting monetary policy and managing their country’s currency. They intervene in the forex market to influence exchange rates, stabilize their currencies, and maintain economic stability. The actions of central banks can significantly impact currency values and market dynamics.

Commercial Banks are major players in the forex market, facilitating currency exchange for their clients, including businesses and individuals. They also engage in trading currencies for their own account, seeking to profit from fluctuations in exchange rates. Commercial banks are crucial for the smooth functioning of the forex market, providing liquidity and connecting different market participants.

Hedge Funds and Investment Banks actively participate in the forex market, employing sophisticated trading strategies to capitalize on short-term price movements. They often leverage high levels of debt and utilize complex derivatives to enhance their returns. Their large-scale transactions can significantly influence exchange rates and market sentiment.

Corporations involved in international trade and investment are major participants in the forex market. They need to exchange currencies to settle international transactions, purchase foreign assets, or manage their exposure to currency fluctuations. Corporate demand for foreign currencies can influence exchange rates and create significant trading volumes.

Individuals also play a role in the forex market, engaging in currency exchange for travel, remittances, or investment purposes. While their individual trades may be smaller, the collective activity of millions of individuals can contribute to market movements, particularly in retail forex trading.

Understanding the motivations and actions of these major players is essential for navigating the complexities of the forex market. By analyzing the interplay of central banks, commercial banks, hedge funds, corporations, and individuals, investors and traders can gain valuable insights into currency movements and make informed decisions.

Factors Influencing Exchange Rates

The exchange rate between two currencies is determined by the forces of supply and demand. When the demand for a currency is higher than the supply, its value appreciates. Conversely, when the supply of a currency exceeds demand, its value depreciates. Several factors influence these supply and demand dynamics, ultimately impacting the exchange rate.

Economic Factors:

- Interest Rates: Higher interest rates in a country tend to attract foreign investment, increasing demand for its currency and strengthening its value. Conversely, low interest rates can lead to capital outflows and a weakening currency.

- Economic Growth: Strong economic growth indicates a healthy economy, potentially leading to increased demand for the country’s goods and services, thereby boosting its currency.

- Inflation: High inflation erodes the purchasing power of a currency, making it less attractive to investors and potentially leading to depreciation.

- Government Debt: High levels of government debt can raise concerns about a country’s ability to repay its obligations, potentially weakening its currency.

Political Factors:

- Political Stability: Countries with stable political systems tend to attract more foreign investment, strengthening their currencies. Conversely, political instability can lead to capital flight and currency depreciation.

- Government Policies: Policies that promote economic growth and stability can positively influence a currency’s value. Conversely, policies perceived as harmful to the economy can lead to depreciation.

Other Factors:

- Speculation: Currency traders can influence exchange rates based on their expectations of future economic and political events.

- Global Events: Major global events like wars, natural disasters, or economic crises can impact exchange rates across the world.

- Central Bank Intervention: Central banks can intervene in the foreign exchange market to influence the value of their currencies.

Understanding these factors is crucial for businesses and individuals operating in a globalized economy. By monitoring economic and political developments, traders can make informed decisions and manage currency risk effectively.

Different Types of Forex Orders

Navigating the forex market requires a deep understanding of its intricacies, including the various types of orders available. Forex orders are crucial for executing trades, allowing you to buy or sell currencies at specific prices and conditions. Here’s a breakdown of the different types of Forex orders you should be familiar with:

Market Orders

Market orders are the most straightforward type, ensuring immediate execution at the best available market price. This means you’re essentially accepting the current bid or ask price for the currency pair you’re trading. While this guarantees instant execution, it doesn’t offer control over the price you pay or receive, potentially leading to slippage if the market moves quickly.

Limit Orders

Limit orders provide greater control over the price of your trade. You set a specific price you’re willing to buy or sell a currency at, and the order is only executed if the market reaches that price. Limit orders are ideal for traders seeking to capitalize on specific price levels or limit their potential losses.

Stop Orders

Stop orders are designed to mitigate risk by entering or exiting a trade at a predetermined price. They’re typically used to protect profits or limit losses. A stop-loss order automatically sells a currency when its price falls below a specified level, while a stop-buy order automatically buys a currency when its price rises above a specific level.

Stop-Limit Orders

Combining the features of stop and limit orders, stop-limit orders offer a unique approach. They act as a stop order initially but only execute as a limit order once the stop price is triggered. This combination provides greater control over both price and risk management.

Trailing Stop Orders

Trailing stop orders dynamically adjust their stop price as the market moves in your favor, ensuring that your position remains open as long as the market continues to trend in your direction. This helps lock in profits while minimizing potential losses, adapting to market fluctuations seamlessly.

Take Profit Orders

Take profit orders are used to exit a trade when a specific profit target is reached. Similar to stop-loss orders, they automatically close your position once the predefined price is hit, ensuring you capture desired gains.

Understanding the Right Order

Choosing the appropriate order type is essential for successful forex trading. Consider your trading strategy, risk tolerance, and market conditions when deciding which order to use. Market orders provide instant execution, while limit orders offer price control. Stop orders and their variations are ideal for risk management, and take profit orders help lock in profits. By mastering these different order types, you can navigate the currency waters with greater confidence and precision.

Popular Currency Pairs to Trade

The foreign exchange market (Forex) is the world’s largest and most liquid financial market, where currencies are traded. With trillions of dollars exchanged daily, Forex offers numerous trading opportunities for both experienced and novice traders. One of the key aspects of Forex trading is understanding the currency pairs, which represent the exchange rate between two currencies.

Currency pairs are typically quoted as base currency/quote currency, where the base currency is the first currency listed and the quote currency is the second. For example, EUR/USD represents the exchange rate between the Euro (EUR) and the US Dollar (USD), with one Euro being worth a certain amount of US Dollars. The quote currency indicates the price of one unit of the base currency.

Traders often focus on specific currency pairs that offer greater liquidity, volatility, and trading opportunities. Here are some of the most popular currency pairs traded in the Forex market:

- EUR/USD (Euro/US Dollar): This is the most traded currency pair globally, offering high liquidity and significant volatility. It is often influenced by economic news and events affecting the Eurozone and the United States.

- USD/JPY (US Dollar/Japanese Yen): This pair is known for its safe-haven status, as the Japanese Yen tends to appreciate during times of global uncertainty. It’s a popular choice for traders seeking low-risk opportunities.

- GBP/USD (British Pound/US Dollar): This pair is influenced by economic events in the United Kingdom and the United States. It’s known for its volatility and can be affected by political developments and interest rate changes.

- AUD/USD (Australian Dollar/US Dollar): This pair is often considered a commodity currency, as the Australian Dollar’s value is linked to commodity prices, particularly gold and iron ore. It’s attractive to traders seeking exposure to commodity markets.

- USD/CHF (US Dollar/Swiss Franc): Similar to the USD/JPY, this pair offers safe-haven properties. The Swiss Franc is a stable currency and tends to appreciate during periods of economic uncertainty.

These are just a few examples of popular currency pairs traded in the Forex market. Traders should research and understand the factors influencing these pairs before making any trading decisions. Remember, every trade involves risk, and it’s essential to use proper risk management techniques to protect your capital.

Risk Management in Forex Trading

The foreign exchange market, often referred to as Forex, is the largest and most liquid financial market in the world. It involves the trading of currencies, where traders profit from fluctuations in exchange rates. While the potential for significant profits exists, Forex trading also comes with inherent risks. Therefore, effective risk management is crucial for navigating the volatile currency waters and safeguarding your capital.

Understanding Risk in Forex:

Forex trading involves numerous risks, including:

- Market Volatility: Exchange rates can fluctuate significantly due to various factors such as economic data releases, political events, and central bank policies.

- Leverage: Forex trading often involves leverage, which magnifies both profits and losses. While leverage can amplify gains, it can also lead to substantial losses if not managed properly.

- Liquidity Risk: Certain currency pairs may experience periods of low liquidity, making it difficult to enter or exit trades at desired prices.

Essential Risk Management Strategies:

To mitigate these risks, Forex traders should adopt a comprehensive risk management approach:

- Set Stop-Loss Orders: Stop-loss orders automatically exit a trade when the price reaches a predetermined level, limiting potential losses.

- Use Position Sizing: Determine the appropriate amount of capital to allocate to each trade based on your risk tolerance and account size.

- Diversify Your Portfolio: Spread your investments across multiple currency pairs to reduce the impact of losses in any single trade.

- Manage Your Emotions: Avoid impulsive trading decisions based on fear or greed. Stick to your trading plan and manage your emotions effectively.

- Continuously Learn and Adapt: The Forex market is constantly evolving. Stay informed about market trends, economic indicators, and geopolitical events to make informed trading decisions.

Conclusion:

Risk management is an indispensable component of successful Forex trading. By implementing the strategies outlined above, traders can minimize potential losses and increase their chances of achieving profitable outcomes in the dynamic and challenging currency market.

Leveraging Technology for Forex Trading

The foreign exchange market, or Forex, is the largest and most liquid financial market in the world. It’s a 24/7 market where currencies are bought and sold, offering traders ample opportunities to profit. However, navigating this complex market effectively requires more than just intuition; it requires strategic use of technology.

Technology has revolutionized Forex trading, providing traders with a range of tools and platforms to analyze market trends, execute trades, and manage risk. Here are some key ways technology empowers Forex traders:

- Real-Time Market Data: Advanced trading platforms provide access to real-time data feeds, including exchange rates, economic indicators, and news updates. This allows traders to make informed decisions based on the latest market conditions.

- Automated Trading: Automated trading systems, also known as robots or expert advisors (EAs), can execute trades based on predefined parameters. These systems can analyze market data and execute trades automatically, eliminating the need for manual intervention. While not without risk, they can be particularly useful for traders seeking to minimize emotional bias and capitalize on short-term market fluctuations.

- Charting and Technical Analysis Tools: Technology provides a variety of charting and technical analysis tools that help traders identify patterns and trends in the market. These tools can help traders make informed predictions about future price movements and develop trading strategies.

- Risk Management Tools: Forex trading comes with inherent risks. Technology offers tools to help traders manage risk effectively. These include stop-loss orders, which automatically close positions when a pre-determined price level is reached, and position sizing calculators, which help traders determine the appropriate trade size based on their risk tolerance.

- Mobile Trading Apps: Today, traders can access the Forex market from anywhere in the world with their mobile devices. This allows traders to monitor their positions and make trades on the go, keeping them connected to the market regardless of their location.

While technology offers a plethora of tools and resources, it is important to remember that Forex trading still requires a sound understanding of market fundamentals, risk management strategies, and a disciplined approach. It is crucial to learn how to use these technologies effectively, as well as to understand their limitations and potential risks.

Technology empowers Forex traders to analyze, execute, and manage trades with greater efficiency and precision. By leveraging the power of technology, traders can gain a competitive edge in the dynamic and complex foreign exchange market.

Staying Updated on Market News and Analysis

Understanding the forex market requires more than just technical analysis. Staying informed about market news and analysis is crucial for making sound trading decisions. Global economic events, political developments, and central bank announcements can significantly influence currency movements.

Here are some key resources to help you stay updated:

- Reputable Financial News Websites: Websites like Bloomberg, Reuters, and Financial Times provide real-time updates on global economic and financial news.

- Economic Calendars: These calendars highlight important economic releases like inflation data, GDP reports, and interest rate decisions, all of which can impact currency values.

- Central Bank Statements: Follow the pronouncements of major central banks (like the Federal Reserve, European Central Bank, and Bank of Japan) as they often signal intentions about monetary policy, influencing exchange rates.

- Market Analysis Platforms: Platforms like TradingView offer insights from analysts and traders, providing valuable perspectives on market trends and sentiment.

- Social Media: While not always reliable, social media can offer quick updates on breaking news and market reactions.

Remember to critically evaluate information from various sources and consider different viewpoints. Staying informed and understanding the drivers of currency movements can significantly enhance your forex trading strategy.

Choosing the Right Forex Broker for You

The foreign exchange (Forex) market is the world’s largest and most liquid financial market, offering traders a wide range of opportunities to profit from currency fluctuations. However, navigating this complex and dynamic market requires the right tools and partners, and choosing a reputable and reliable Forex broker is essential for success.

With so many brokers vying for your attention, selecting the one that best suits your needs can feel overwhelming. Consider the following factors when choosing a Forex broker:

Key Considerations When Selecting a Forex Broker:

- Regulation and Licensing: Ensure that your chosen broker is regulated by a reputable financial authority, such as the Financial Conduct Authority (FCA) in the UK, the Securities and Exchange Commission (SEC) in the US, or the Australian Securities and Investments Commission (ASIC). Regulation provides an extra layer of security and safeguards your funds.

- Trading Platforms: Look for a broker offering a user-friendly and intuitive trading platform with advanced charting tools, real-time market data, and order execution capabilities. Popular options include MetaTrader 4 (MT4) and MetaTrader 5 (MT5).

- Trading Instruments and Assets: Choose a broker that provides access to a wide range of currency pairs and other financial instruments, such as commodities, indices, and shares, depending on your trading preferences.

- Spreads and Fees: Compare the spreads, which represent the difference between the bid and ask prices, and other fees charged by brokers. Look for brokers offering competitive spreads and transparent pricing structures.

- Account Types and Minimum Deposits: Different brokers offer various account types with varying minimum deposit requirements. Select an account type that aligns with your trading style and capital.

- Customer Support and Education: Choose a broker that provides excellent customer support and educational resources to help you understand the Forex market and navigate trading strategies.

- Security Measures: Ensure that your chosen broker implements robust security measures, such as encryption and two-factor authentication, to protect your personal and financial information.

By carefully considering these factors, you can choose a reliable and reputable Forex broker that empowers you to navigate the currency waters with confidence.

Common Mistakes to Avoid in Forex Trading

The foreign exchange market (forex) is the largest and most liquid financial market globally, attracting individuals and institutions alike. However, despite its potential for lucrative returns, forex trading also carries inherent risks, and many novice traders often fall victim to common pitfalls. Understanding and avoiding these mistakes can significantly improve your chances of success in this dynamic market.

1. Lack of Proper Research and Education: Entering the forex market without adequate knowledge is a recipe for disaster. It’s crucial to understand the basics of currency pairs, market dynamics, and technical analysis. A thorough understanding of fundamental analysis, including economic indicators and political events impacting currency values, is also essential.

2. Trading Without a Strategy: A well-defined trading strategy is your compass in the forex market. Without one, you’re essentially gambling. Develop a clear plan outlining your entry and exit points, risk management techniques, and profit targets. Stick to your strategy consistently, avoiding emotional decisions driven by market fluctuations.

3. Overtrading and Lack of Discipline: Forex trading demands discipline and patience. Avoid overtrading, which can lead to excessive losses. Set realistic trading goals and stick to your allocated risk limits. Emotions can cloud judgment; use tools like stop-loss orders to manage risk effectively.

4. Ignoring Risk Management: Risk management is paramount in forex trading. Never risk more than you can afford to lose. Employ stop-loss orders to limit potential losses on individual trades. Diversify your portfolio across different currency pairs to mitigate risk.

5. Chasing Trends: Chasing trends can lead to late entries and significant losses. While recognizing trends is valuable, focus on confirming signals and entering trades at appropriate entry points rather than chasing price movements.

6. Not Keeping Up with Market Developments: The forex market is constantly evolving. Staying updated on economic news, geopolitical events, and central bank announcements is crucial. Monitor market sentiment and adjust your trading strategy accordingly.

7. Lack of a Trading Journal: Documenting your trades in a journal helps you track your performance, identify patterns, and learn from your mistakes. Analyze your wins and losses, evaluate your trading decisions, and optimize your strategy based on the insights gained.

Navigating the currency waters demands a combination of knowledge, discipline, and a well-defined trading plan. By avoiding these common mistakes, you can enhance your trading journey, manage risk effectively, and increase your chances of achieving profitability in the exciting and dynamic forex market.

The Future of the Foreign Exchange Market

The foreign exchange market, also known as Forex, is the largest and most liquid financial market in the world. It is a global marketplace where currencies are traded, and it plays a crucial role in the global economy. As technology continues to evolve and the world becomes increasingly interconnected, the Forex market is poised for significant changes in the years to come.

One of the most significant trends shaping the future of Forex is the rise of fintech. Fintech companies are developing innovative technologies that are transforming the way people trade currencies. These technologies include artificial intelligence (AI), machine learning, and blockchain. AI-powered trading platforms can analyze vast amounts of data and identify trading opportunities that human traders may miss. Blockchain technology can facilitate faster and more secure transactions.

Another important trend is the growing importance of regulation. As the Forex market becomes more complex, regulators are taking steps to ensure its stability and protect investors. This includes strengthening anti-money laundering (AML) and know your customer (KYC) regulations. These regulations are likely to have a significant impact on the way Forex brokers operate and the types of products and services they offer.

The increasing adoption of digital currencies is also likely to reshape the Forex market. Cryptocurrencies like Bitcoin and Ethereum are gaining popularity as alternative forms of payment and investment. The emergence of stablecoins, which are pegged to traditional currencies, could further blur the lines between traditional and digital finance.

Finally, the future of Forex will be shaped by the global economic landscape. Factors such as interest rate differentials, economic growth, and political stability will continue to influence currency values. As the world navigates geopolitical uncertainties and economic fluctuations, the Forex market will likely see increased volatility and complexity.

In conclusion, the future of the Forex market is bright, but it will be a dynamic and evolving landscape. Fintech, regulation, digital currencies, and global economic conditions will all play a significant role in shaping the market. Traders and investors need to stay informed about these trends to navigate the currency waters successfully.

Forex Trading Strategies for Beginners

The foreign exchange market, commonly known as Forex, is the largest and most liquid financial market in the world. It’s a dynamic marketplace where currencies are traded against each other, offering opportunities for both seasoned traders and beginners. If you’re new to Forex trading, understanding the basics and developing a solid strategy is crucial for success. This article will guide you through some essential Forex trading strategies for beginners.

Fundamental Analysis

Fundamental analysis involves examining the economic factors that influence currency values. These factors can include:

- Economic data releases: GDP growth, inflation rates, unemployment figures, and interest rate decisions can all affect a currency’s strength.

- Political stability: Political instability or uncertainty in a country can weaken its currency.

- Government policies: Fiscal and monetary policies can significantly impact currency values.

By understanding these fundamental factors, you can identify potential currency trends and make informed trading decisions.

Technical Analysis

Technical analysis focuses on using historical price charts and indicators to identify patterns and trends in currency movements. This approach uses mathematical and statistical tools to predict future price action. Some common technical indicators include:

- Moving averages: These help identify trend direction and potential support and resistance levels.

- Relative Strength Index (RSI): This indicator measures the magnitude of recent price changes to evaluate overbought or oversold conditions.

- MACD (Moving Average Convergence Divergence): This indicator identifies trend changes and potential momentum shifts.

Technical analysis can provide valuable insights into potential entry and exit points for your trades.

Scalping

Scalping is a high-frequency trading strategy where traders aim to profit from small price fluctuations in a short time frame. Scalpers typically open and close trades multiple times a day, seeking to capitalize on small price movements. This strategy requires a high degree of technical expertise and quick decision-making skills. It’s important to note that scalping can be highly risky due to its fast-paced nature.

Day Trading

Day trading involves opening and closing trades within the same trading day. Day traders focus on identifying short-term price trends and using technical analysis to capitalize on intraday price movements. Unlike scalping, day traders hold trades for a longer period, ranging from minutes to hours. While day trading can offer opportunities for significant profits, it also carries considerable risk.

Swing Trading

Swing trading involves holding trades for a few days to several weeks, aiming to capture larger price swings. Swing traders rely on both fundamental and technical analysis to identify potential trends and support and resistance levels. This strategy offers a lower risk profile compared to day trading and scalping, but it also requires patience and discipline.

Conclusion

Forex trading can be a profitable venture, but it’s essential to approach it with a sound strategy and a thorough understanding of the market dynamics. By combining fundamental and technical analysis, choosing a suitable trading style, and managing your risk effectively, you can increase your chances of success in this challenging yet rewarding field.

Technical Analysis in Forex Trading

Technical analysis is a key component of trading in the forex market. It involves studying past price action and trading volume to identify trends, patterns, and potential future price movements. This approach relies on the idea that history tends to repeat itself in financial markets, and that price movements are driven by both psychological and economic factors. By examining charts and using various technical indicators, traders can gain insights into market sentiment, identify entry and exit points, and manage risk effectively.

Key Concepts in Technical Analysis

Technical analysis involves several key concepts that traders need to understand. These include:

- Trend Identification: Identifying the overall direction of the market (uptrend, downtrend, or sideways).

- Support and Resistance Levels: Identifying price levels where buying or selling pressure is expected to be strong.

- Chart Patterns: Recognizing recurring patterns in price action that can indicate potential future movements.

- Technical Indicators: Using mathematical calculations to analyze price and volume data and generate trading signals.

Types of Technical Indicators

There are numerous technical indicators available to traders, each offering a different perspective on price action. Some popular types include:

- Moving Averages: Used to identify trends and potential reversals.

- Momentum Indicators: Measure the speed and strength of price movements, such as the Relative Strength Index (RSI).

- Volatility Indicators: Measure the degree of price fluctuations, such as the Average True Range (ATR).

- Oscillators: Identify overbought and oversold conditions, such as the Stochastic Oscillator.

Benefits of Technical Analysis in Forex Trading

Technical analysis provides traders with several advantages, including:

- Objectivity: Relies on data and patterns rather than subjective opinions.

- Identifiable Entry and Exit Points: Provides clear signals for entering and exiting trades based on price action and indicators.

- Risk Management: Helps traders set stop-loss orders and manage their risk exposure.

- Adaptability: Can be applied to different time frames, allowing traders to analyze market movements at various levels.

Conclusion

Technical analysis is an essential tool for forex traders, offering a systematic approach to identifying trends, patterns, and potential price movements. By understanding the key concepts and indicators, traders can enhance their trading decisions, manage risk effectively, and potentially improve their profitability in the dynamic forex market.

Fundamental Analysis in Forex Trading

Fundamental analysis in forex trading delves into the economic and political factors that influence currency values. It focuses on understanding the underlying strength of a nation’s economy, which in turn affects its currency’s value. Economic indicators such as GDP growth, inflation rates, interest rates, and unemployment figures play a crucial role in fundamental analysis. A strong economy typically leads to a stronger currency, as investors are attracted to its stability and potential for growth.

Political stability is another key aspect of fundamental analysis. Countries with stable political systems and sound government policies are generally seen as more attractive investment destinations, leading to stronger currencies. Conversely, political turmoil or uncertainty can weaken a currency. Global events like elections, trade agreements, and geopolitical tensions can also influence currency values.

Central bank policies are a major driver of currency fluctuations. Central banks use various monetary policy tools, such as interest rate adjustments and quantitative easing, to manage inflation and stimulate economic growth. These actions can significantly impact currency valuations. For instance, a central bank raising interest rates often makes a currency more attractive to foreign investors, leading to appreciation.

Trade imbalances also influence currency values. Countries with significant trade deficits may see their currencies weaken, as more money is flowing out of the country to pay for imports. On the other hand, countries with trade surpluses often have stronger currencies. This is because their exports generate more foreign currency inflows.

Fundamental analysis can help forex traders make informed trading decisions by providing insights into the long-term trends and drivers of currency movements. By understanding the underlying economic and political factors that influence currencies, traders can identify potential opportunities and mitigate risks.

[object Object]