In the world of finance, the term “market capitalization” often throws investors off guard. You hear it tossed around in financial news and investment discussions, but its true meaning can be elusive. The hype surrounding this metric can lead to confusion and misinterpretations, leaving many wondering – what exactly is market capitalization and why does it matter? This article aims to demystify market capitalization, breaking down its components and highlighting its significance for investors.

Understanding market capitalization is essential for navigating the complex landscape of investments. It provides a crucial insight into a company’s worth, its potential for growth, and its attractiveness to investors. It also helps you make informed decisions when building your portfolio, determining whether a company aligns with your investment goals and risk tolerance. Let’s dive into the intricacies of market capitalization and unravel its significance in the world of finance.

What is Market Capitalization?

In the realm of finance, market capitalization (market cap) is a crucial metric that represents the total value of a publicly traded company. It essentially reflects the collective market belief in the worth of a company’s outstanding shares.

To calculate market cap, you simply multiply the company’s current share price by the total number of outstanding shares. For instance, if a company has 10 million shares outstanding and each share trades at $50, its market cap would be $500 million (10 million x $50).

Market cap is a fundamental indicator that helps investors gauge the size and scale of a company. It provides a snapshot of the company’s overall value in the eyes of the market. A higher market cap generally signifies a larger and more established company, although it’s not always a perfect measure of a company’s true worth.

How to Calculate Market Cap

Market capitalization, or market cap, is a crucial metric in the financial world, representing the total value of a company’s outstanding shares. It reflects the market’s perception of a company’s worth and provides valuable insights for investors. Understanding how to calculate market cap is essential for making informed investment decisions.

Calculating market cap is a straightforward process. It involves multiplying the current share price by the number of outstanding shares. Here’s the formula:

Market Cap = Share Price x Number of Outstanding Shares

For instance, if a company’s share price is $100 and it has 1 million outstanding shares, its market cap would be:

Market Cap = $100 x 1,000,000 = $100,000,000

Market cap is typically expressed in millions or billions of dollars, depending on the company’s size. Investors use market cap to compare the value of different companies, identify potential investment opportunities, and gauge a company’s overall financial health.

Understanding Different Market Cap Categories

Market capitalization, often referred to as market cap, is a crucial metric in the financial world. It represents the total value of a company’s outstanding shares. Understanding the different market cap categories can provide valuable insights into a company’s size, maturity, and potential growth.

Micro-cap companies have a market cap of under $300 million. These companies are typically young, often in the early stages of development, and may have high growth potential. They also carry higher risk, as they are more vulnerable to market fluctuations and may lack a strong track record.

Small-cap companies have a market cap between $300 million and $2 billion. They are generally considered more established than micro-caps but still carry a higher risk than larger companies. Small-caps may offer significant growth opportunities and can be attractive to investors seeking higher returns.

Mid-cap companies have a market cap between $2 billion and $10 billion. They are considered a good balance between growth potential and stability. Mid-caps often have a strong track record and may be less volatile than smaller companies.

Large-cap companies have a market cap over $10 billion. These are typically established companies with a solid financial foundation and well-known brands. They often offer a lower risk profile than smaller companies but may have slower growth potential.

The market cap category can help investors make informed decisions about which companies to invest in. It is important to consider your investment goals, risk tolerance, and investment horizon when evaluating different market cap categories.

Market Cap as a Valuation Metric

In the dynamic realm of finance, understanding a company’s value is paramount. One of the most widely used metrics for gauging a company’s worth is its market capitalization, often shortened to “market cap.” This article will delve into the intricacies of market capitalization, explaining its significance and how it acts as a crucial valuation metric.

Essentially, market capitalization represents the total dollar value of a company’s outstanding shares. It is calculated by multiplying the company’s current share price by the total number of shares outstanding. For example, if a company has 100 million shares outstanding and its current share price is $50, its market cap would be $5 billion (100 million x $50).

Market cap provides a snapshot of a company’s size and value in the eyes of the market. A higher market cap generally suggests that investors perceive the company as larger, more established, and potentially more valuable. Conversely, a lower market cap might indicate a smaller or less established company.

Market capitalization is a crucial metric for several reasons:

- Relative Valuation: It allows investors to compare the size and value of different companies within the same industry or across industries.

- Investment Decisions: Market cap can influence investment decisions, as investors often prefer companies with larger market caps, especially for long-term holdings.

- Company Size and Growth Potential: A company’s market cap can indicate its size and potential for future growth. Companies with higher market caps may have more resources and opportunities for expansion.

- Market Sentiment: Fluctuations in market cap can reflect investor sentiment towards a particular company or industry.

It’s important to note that market cap is a dynamic figure that can change frequently based on factors such as share price fluctuations, stock splits, and buybacks. While market cap offers valuable insights, it shouldn’t be the sole factor in evaluating a company. Other financial metrics and qualitative factors must be considered for a comprehensive assessment.

Limitations of Using Market Cap Alone

While market capitalization, often referred to as market cap, provides a quick glimpse into a company’s value, solely relying on this metric can be misleading. It’s crucial to understand the limitations of market cap and consider other factors when assessing a company’s true worth.

Here are some key limitations:

- Debt: Market cap doesn’t account for a company’s debt. A company with a high market cap but significant debt may be less valuable than a company with a lower market cap but less debt.

- Cash flow: Market cap doesn’t reflect a company’s ability to generate cash flow. Companies with high market caps might not necessarily translate to strong cash flow, impacting their long-term sustainability.

- Growth potential: Market cap only reflects the current value of a company. It doesn’t consider future growth potential, which can significantly impact its value over time.

- Market sentiment: Market cap can be influenced by market sentiment, leading to inflated or depressed valuations. This can create a disconnect between a company’s true value and its market cap.

- Share structure: Market cap is influenced by the number of shares outstanding. Companies with fewer shares outstanding can have a higher market cap even if their underlying value is not significantly different from companies with more shares.

In conclusion, while market cap is a useful starting point, it shouldn’t be the sole determinant of a company’s value. It’s essential to consider other factors, such as a company’s financial health, growth prospects, and industry dynamics, to get a more comprehensive understanding of its true worth.

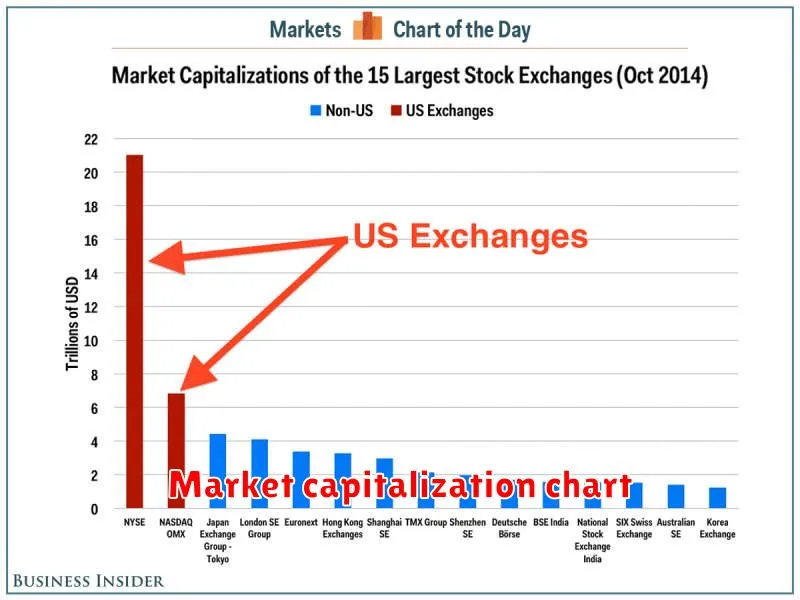

Comparing Companies Based on Market Cap

Market capitalization, or market cap, is a crucial metric in the world of finance. It represents the total value of a company’s outstanding shares in the market. By comparing the market cap of different companies, investors can gauge their relative size, potential, and risk.

Market cap = Current Share Price x Number of Outstanding Shares

For example, if a company has a share price of $100 and 1 million shares outstanding, its market cap would be $100 million.

Here’s how market cap can be used to compare companies:

- Size comparison: A company with a higher market cap is generally considered larger and more established. However, it’s essential to note that market cap can fluctuate significantly based on market conditions and company performance.

- Growth potential: Companies with larger market caps often have more resources and established market positions, which can translate to greater growth potential. However, smaller companies with lower market caps may offer higher growth potential due to their ability to disrupt existing markets.

- Risk assessment: Companies with lower market caps tend to be more volatile and may carry higher risks. However, they also offer the potential for greater returns.

While market cap is a valuable metric, it’s crucial to remember that it’s not the only factor to consider when evaluating a company. Other important factors include financial performance, industry outlook, management team, and competitive landscape.

In conclusion, understanding market capitalization is essential for making informed investment decisions. By comparing market cap across different companies, investors can gain insights into their relative size, growth potential, and risk levels.

Market Cap vs. Enterprise Value

In the world of finance, two key metrics are often used to gauge the size and value of a company: market capitalization (market cap) and enterprise value (EV). While they both provide insights into a company’s worth, they differ in their scope and what they represent.

Market cap is the total market value of a company’s outstanding shares. It’s calculated by multiplying the current share price by the number of outstanding shares. Market cap essentially reflects what the market believes a company is worth at a given point in time.

Enterprise value, on the other hand, takes a broader perspective. It represents the total value of a company, considering not just its equity but also its debt and cash. The formula for EV is: Market Cap + Total Debt + Preferred Stock – Cash & Cash Equivalents.

The main difference between market cap and EV lies in their inclusion of debt and cash. Market cap only considers the value of equity, while EV incorporates the value of the company’s debt and cash, which are essential components of its overall financial health.

Why is this distinction important?

Understanding the difference between market cap and EV can help investors make more informed decisions. For instance, a company with a high market cap may seem attractive, but if it has a large amount of debt, its EV might be significantly higher. This could suggest that the company’s valuation is inflated.

Furthermore, EV is often used as a more comprehensive metric when comparing different companies, particularly in acquisition scenarios. By factoring in debt and cash, EV provides a more accurate picture of the total value of the target company.

In conclusion, market cap and EV offer different perspectives on a company’s value. While market cap focuses on the equity component, EV provides a broader picture by including debt and cash. Understanding the nuances of these metrics is crucial for investors seeking to make informed decisions about their investments.

The Role of Market Cap in Investment Decisions

Market capitalization, often referred to as market cap, is a crucial metric used by investors to understand the size and value of a company. It represents the total value of all outstanding shares of a company in the public market. While market cap alone doesn’t dictate the success or failure of an investment, it plays a significant role in shaping investment decisions.

For investors, market cap acts as a gauge of a company’s scale and influence. Large-cap companies, characterized by a high market cap, tend to be well-established with a proven track record. They often operate in mature industries with stable revenue streams. Conversely, small-cap companies, with smaller market caps, are typically newer and more volatile. They may be in rapidly growing sectors but carry a higher risk profile.

Market cap can help investors make informed choices based on their risk tolerance and investment goals. Risk-averse investors may favor large-cap companies for their stability and predictable returns. Growth-oriented investors may prefer small-cap companies for their potential for higher growth, albeit with increased risk.

Furthermore, market cap can influence liquidity. Large-cap companies, with a large number of outstanding shares, often have high liquidity, making it easier for investors to buy and sell their shares. Small-cap companies may have lower liquidity, which can pose challenges for investors seeking to enter or exit their positions.

In conclusion, market cap is a fundamental metric that provides valuable insights into a company’s size, stability, and potential growth. It helps investors assess risk, choose suitable investments, and navigate the dynamic world of equity markets.

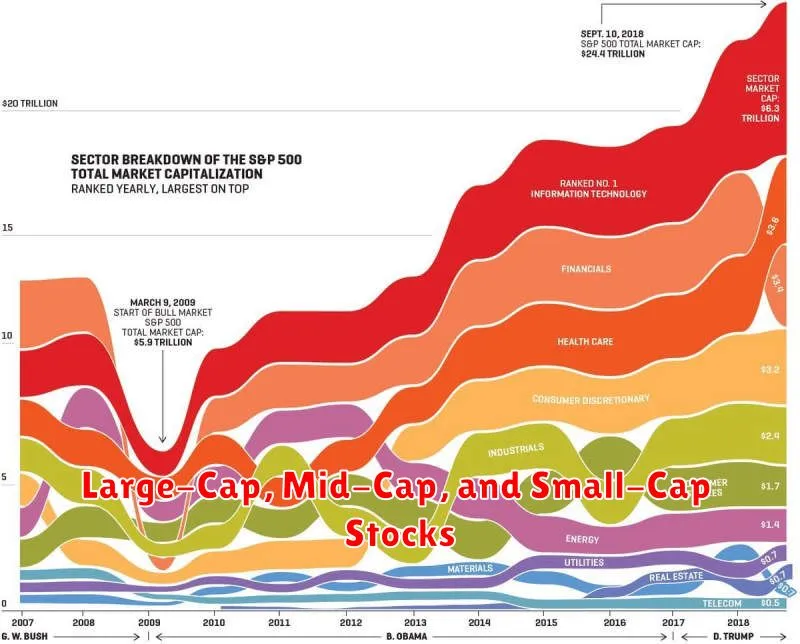

Large-Cap, Mid-Cap, and Small-Cap Stocks

When it comes to investing, understanding the size of a company is crucial. Market capitalization, often shortened to market cap, refers to the total value of a company’s outstanding shares. This metric helps investors categorize companies into three primary groups: large-cap, mid-cap, and small-cap.

Large-cap stocks represent companies with a market cap of over $10 billion. These are typically well-established, mature companies like Apple, Microsoft, and Amazon. Large-caps tend to be less volatile and offer more stability, making them suitable for long-term investors seeking consistent growth.

Mid-cap stocks, with market caps between $2 billion and $10 billion, fall in the middle ground. These companies are often growing rapidly and have the potential for significant returns. Examples include Netflix, Chipotle, and Starbucks. Mid-caps offer a balance between growth and stability, appealing to investors seeking a blend of potential and security.

Small-cap stocks are companies with market caps below $2 billion. These are typically younger and less established, offering higher growth potential but also higher risk. Think of companies like Tesla, Beyond Meat, or Zoom. Small-caps can be ideal for investors with a higher risk tolerance and a longer time horizon, as they have the potential to generate impressive returns.

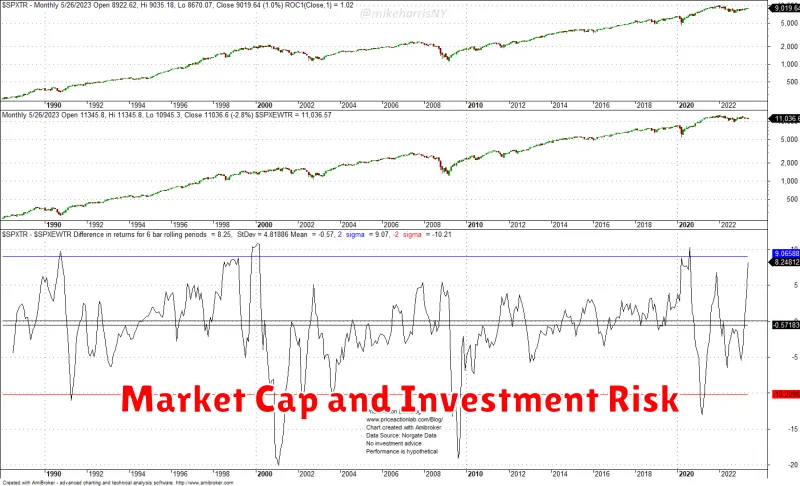

Market Cap and Investment Risk

Market capitalization, often simply referred to as market cap, is a crucial metric in the financial world. It represents the total value of a company’s outstanding shares in the market. To calculate it, multiply the company’s current share price by the total number of outstanding shares.

Market cap provides valuable insights into a company’s size and financial health. It helps investors understand the scale of a company’s operations and its potential for growth. While a larger market cap doesn’t always guarantee better performance, it generally indicates a larger, more established company.

Market cap plays a significant role in determining investment risk. A company with a larger market cap is often considered less risky because it has a larger pool of capital to draw upon and its operations are less susceptible to significant fluctuations in share price. Smaller market cap companies, known as small-cap or micro-cap companies, can be more volatile and present a higher risk profile. They have fewer resources and rely more heavily on market sentiment.

For investors, understanding the relationship between market cap and risk is crucial. While small-cap companies offer the potential for higher returns, they also come with greater volatility. Large-cap companies, on the other hand, provide more stability and potentially lower returns. The level of risk an investor is willing to take on should dictate their investment choices.

In conclusion, market capitalization is an essential tool for assessing a company’s size, financial health, and risk profile. It provides a valuable benchmark for investors to evaluate potential investments and make informed decisions.

The Importance of Market Cap in Portfolio Diversification

In the world of investing, it’s easy to get caught up in the hype surrounding hot new stocks. But before you jump on the bandwagon, it’s crucial to understand the concept of market capitalization, or market cap, and how it plays a vital role in portfolio diversification.

Market cap is simply the total value of a company’s outstanding shares. It’s calculated by multiplying the current share price by the number of shares in circulation. A company with a large market cap is considered a large-cap company, while a company with a small market cap is a small-cap company.

Why does market cap matter for diversification? Because it helps you spread your risk across different types of companies. Here’s why:

- Large-cap companies tend to be more established and mature, with a track record of stability. They can offer a degree of safety and steady growth, particularly during times of economic uncertainty.

- Small-cap companies, on the other hand, are often younger, more volatile, and potentially riskier. They may offer higher growth potential but also carry a higher chance of failure.

By including a mix of large-cap and small-cap stocks in your portfolio, you create a diversified portfolio that can potentially weather market fluctuations. You’re essentially balancing the potential for steady returns with the potential for higher growth.

In addition to large and small-cap companies, there’s also the category of mid-cap companies, which fall somewhere in between. These companies can offer a good balance of growth potential and stability.

Remember, diversification is a key principle of sound investing. Understanding market cap and its impact on your portfolio is crucial to making informed investment decisions and achieving your financial goals.