The foreign exchange market, commonly known as Forex, is the world’s largest and most liquid financial market, offering unparalleled opportunities for traders of all levels. This dynamic market, fueled by the constant ebb and flow of global currencies, presents an enticing landscape for those seeking to profit from currency fluctuations. If you’re looking to master the currency game and embark on a profitable Forex trading journey, you’ve come to the right place. This comprehensive guide will delve into effective Forex market strategies, empowering you with the knowledge and tools necessary to navigate this complex yet rewarding market.

From understanding fundamental and technical analysis to mastering risk management techniques and utilizing cutting-edge trading tools, we will equip you with a holistic approach to Forex trading. Our expert insights will demystify the intricacies of this vast market, empowering you to make informed trading decisions and maximize your chances of success. Whether you’re a novice trader just starting out or an experienced investor seeking to refine your strategies, this guide will serve as your trusted companion on your path to Forex mastery.

Introduction to the Forex Market and its Mechanics

The foreign exchange market, more commonly known as Forex, is the world’s largest and most liquid financial market. It’s a global marketplace where currencies are traded, and it operates 24 hours a day, five days a week. Unlike traditional stock markets, Forex doesn’t have a physical location; it’s a decentralized network of banks, financial institutions, and individual traders connected electronically.

The core of Forex trading revolves around the buying and selling of currency pairs. Each pair represents the exchange rate between two currencies, such as the USD/EUR (US Dollar against Euro) or the GBP/USD (British Pound against US Dollar). When you buy a currency pair, you’re essentially buying one currency and simultaneously selling the other. For example, buying USD/EUR means you’re buying US Dollars and selling Euros.

The Forex market is driven by a multitude of factors that influence currency values. These factors include:

- Economic data: Economic releases like GDP growth, inflation rates, and unemployment figures can impact a currency’s value.

- Political events: Political instability, elections, and government policies can create volatility in the market.

- Interest rates: Central banks’ decisions on interest rates significantly influence currency movements. Higher interest rates typically attract foreign investment, leading to currency appreciation.

- Market sentiment: Traders’ collective outlook on the economy and political situation also plays a role.

Understanding the mechanics of the Forex market is crucial for any trader. It’s essential to grasp the concept of bid and ask prices, which represent the best prices at which you can buy or sell a currency pair. The difference between these prices, known as the spread, is the broker’s profit margin.

Understanding Currency Pairs and Exchange Rates

The forex market, short for foreign exchange market, is the world’s largest and most liquid financial market. It involves the trading of currencies, where traders buy and sell currencies in pairs, hoping to profit from the difference in their value. Understanding currency pairs and exchange rates is essential for navigating this complex market.

A currency pair is a combination of two currencies, such as EUR/USD (Euro/US Dollar) or GBP/JPY (British Pound/Japanese Yen). The first currency in the pair is known as the base currency, while the second currency is the quote currency. The exchange rate expresses the value of one currency relative to another. For example, an exchange rate of EUR/USD 1.1000 means that one Euro can be exchanged for 1.1000 US Dollars.

The value of a currency pair fluctuates constantly, influenced by various factors such as economic indicators, political events, and market sentiment. When the value of the base currency rises against the quote currency, the exchange rate goes up. Conversely, when the base currency falls, the exchange rate goes down.

Understanding the dynamics of currency pairs and exchange rates is crucial for developing effective forex trading strategies. By analyzing the factors that influence currency movements, traders can identify potential trading opportunities and make informed decisions about buying or selling currencies.

Fundamental Analysis in Forex Trading

Fundamental analysis is a crucial aspect of Forex trading, providing insights into the economic factors that influence currency movements. It involves examining macroeconomic indicators, government policies, and geopolitical events to predict future currency price trends.

Understanding the fundamentals allows traders to identify potential trading opportunities and manage risk effectively. Here are some key areas to focus on:

- Economic Growth: Strong economic growth in a country often leads to currency appreciation, as investors are attracted to its potential for investment and returns.

- Interest Rates: Higher interest rates tend to attract foreign investment, boosting demand for the currency and causing it to appreciate. Conversely, lower interest rates may weaken the currency.

- Inflation: High inflation erodes the purchasing power of a currency, potentially leading to depreciation. Central banks often raise interest rates to combat inflation.

- Government Debt: High levels of government debt can create concerns about a country’s economic stability, potentially weakening its currency.

- Political Stability: Political instability or uncertainty can negatively impact investor confidence, leading to currency depreciation.

- Trade Balance: A trade surplus (exports exceeding imports) can strengthen a currency, while a trade deficit can weaken it.

Traders can utilize various tools and resources to conduct fundamental analysis, including:

- Economic calendars: These calendars provide a schedule of upcoming economic releases, such as GDP data, inflation figures, and interest rate decisions.

- Central bank statements: Statements from central bank officials often provide insights into their monetary policy intentions, which can influence currency movements.

- News articles and reports: Staying informed about global events and economic developments through reputable news sources is essential for fundamental analysis.

- Economic forecasts: Forecasts from reputable institutions can provide insights into the future trajectory of economic indicators and currency trends.

By combining fundamental analysis with technical analysis, traders can gain a more comprehensive understanding of the Forex market and make informed trading decisions.

Technical Analysis and Chart Patterns

Technical analysis is a crucial aspect of Forex trading, as it helps traders identify potential trading opportunities by analyzing price movements and patterns. Technical analysts believe that past price action can predict future price movements, making it a valuable tool for traders to make informed decisions. This form of analysis focuses on the study of price charts, volume indicators, and other market data to identify trends and patterns that can be used to make predictions about future market movements.

One of the most important aspects of technical analysis is the identification of chart patterns. Chart patterns are recurring formations in price charts that can indicate a potential change in the direction of a trend. Understanding these patterns can help traders to identify potential entry and exit points, as well as to manage their risk.

There are numerous types of chart patterns, but some of the most common and effective include:

- Head and Shoulders: This pattern indicates a potential reversal of an uptrend, as it represents a series of three peaks with the middle peak being the highest. The pattern is confirmed when the price breaks below the neckline, which is a line connecting the lows of the two outside peaks.

- Double Top: A double top pattern is similar to the head and shoulders pattern but has only two peaks. The pattern indicates a potential reversal of an uptrend, as it represents a failure of the price to break above a previous high.

- Triple Bottom: This pattern is the opposite of the double top and indicates a potential reversal of a downtrend. It consists of three lows, with the middle low being the lowest point. The pattern is confirmed when the price breaks above the resistance level, which is a line connecting the highs of the two outside lows.

- Triangles: Triangles are formed when the price consolidates within a range, with the highs and lows converging. They can be either symmetrical or ascending/descending. Triangles typically signal a continuation of the existing trend but can also signal a potential breakout.

- Flags: Flags are short-term consolidation patterns that occur during a strong trend. They are typically characterized by a rectangular or pennant shape, with the price consolidating within a defined range before breaking out in the direction of the original trend.

- Channels: Channels are defined by two parallel trend lines that contain the price action. The price is expected to bounce off the trend lines, providing potential entry and exit points for traders.

Understanding how to identify and interpret chart patterns can give traders a significant advantage in the Forex market. By combining this knowledge with other technical indicators and fundamental analysis, traders can develop a more complete picture of market conditions and make more informed trading decisions.

Risk Management and Position Sizing

In the forex market, risk management and position sizing are paramount to a trader’s success. They are the cornerstones of a sustainable trading strategy, ensuring that even with occasional losses, you can navigate the market’s volatility and protect your capital.

Risk management encompasses a set of strategies to limit potential losses on each trade. It involves determining the maximum amount you’re willing to risk on any given trade, known as your stop-loss order. This order automatically exits a trade when the price reaches a predefined level, preventing further losses.

Position sizing is the process of calculating the appropriate amount of capital to allocate to each trade. It’s directly tied to your risk management strategy. The idea is to ensure that even with a losing trade, your overall account balance isn’t significantly impacted.

To determine your position size, consider your risk tolerance, the volatility of the currency pair you’re trading, and the potential profit target. Using a risk-reward ratio is a common practice, where you aim to make a certain amount of profit for every dollar you risk.

By prioritizing risk management and position sizing, you’re not only protecting your capital but also laying the foundation for consistent and profitable trading. These strategies enable you to trade with confidence, knowing that you’re in control of your risk exposure.

Developing a Trading Plan and Strategy

A trading plan is essential for any trader, especially in the volatile Forex market. It acts as a roadmap, guiding you through the trading process and keeping you disciplined. A well-defined plan outlines your trading goals, risk tolerance, and specific strategies.

Here are key steps in developing a trading plan:

- Define your trading goals: What are you aiming to achieve with your Forex trading? Set realistic and measurable goals, whether it’s generating a certain income or reaching a specific profit target.

- Determine your risk tolerance: How much are you willing to risk on each trade? A good starting point is 1-2% of your trading capital. Establish stop-loss orders to manage risk effectively.

- Choose a trading strategy: Research and select a strategy that aligns with your risk tolerance and trading style. This could involve technical analysis, fundamental analysis, or a combination of both. Some popular strategies include scalping, day trading, and swing trading.

- Develop a trading system: This is the core of your trading plan. Define your entry and exit points, risk management techniques, and specific indicators or patterns you will use to identify trading opportunities.

- Backtest your strategy: Use historical data to test the effectiveness of your trading system. This helps you identify potential flaws and adjust your strategy accordingly.

- Implement and monitor your plan: Once you are confident in your strategy, start trading with real money. Track your performance and make necessary adjustments based on your results.

Remember, your trading plan is a living document. Be prepared to adapt it as your trading experience grows and market conditions change.

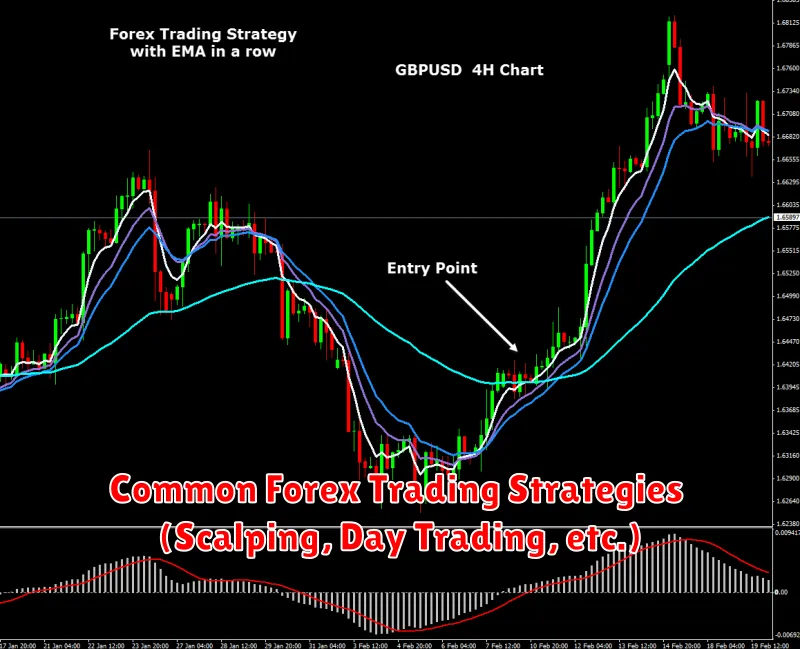

Common Forex Trading Strategies (Scalping, Day Trading, etc.)

Navigating the Forex market requires a solid understanding of effective trading strategies. While there are numerous approaches, some stand out as particularly popular and successful. Here’s a look at common strategies employed by Forex traders:

Scalping

Scalping is a high-frequency trading strategy focused on capturing small profits from minor price fluctuations. Scalpers typically open and close trades within seconds or minutes, aiming to capitalize on tiny price movements. This strategy demands quick reflexes, meticulous analysis, and a high-speed internet connection.

Day Trading

Day traders hold positions for shorter periods, usually within the same trading day. They capitalize on intraday price swings, employing technical analysis and chart patterns to identify potential entry and exit points. Day trading requires vigilance and a robust understanding of market dynamics.

Swing Trading

Swing traders aim to capitalize on larger price swings, holding positions for several days or weeks. They use technical indicators and fundamental analysis to identify potential trend reversals or continuation patterns. Swing trading requires a more long-term perspective and a tolerance for holding positions longer.

Trend Trading

Trend traders seek to ride established market trends, identifying the direction of the price movement and entering trades in alignment with the trend. This strategy often involves using trendlines, moving averages, and other technical indicators to confirm the trend’s strength and direction.

News Trading

News traders focus on market reactions to economic data releases and geopolitical events. They analyze the impact of news announcements on currency pairs and capitalize on the resulting price volatility. This strategy requires a deep understanding of macroeconomic indicators and the ability to quickly assess their implications.

Choosing the right Forex trading strategy depends on your individual trading style, risk tolerance, and time commitment. Consider your goals, experience level, and resources before deciding on the most suitable approach.

Choosing the Right Forex Broker

In the exciting realm of foreign exchange trading, your choice of Forex broker is crucial for success. A reliable broker acts as your gateway to the global currency markets, providing the tools and infrastructure necessary for profitable trading. With a myriad of brokers vying for your attention, navigating this landscape can feel daunting.

To make an informed decision, consider these vital factors:

- Regulation and Security: Opt for brokers regulated by reputable authorities, ensuring client funds are protected and trading practices adhere to strict standards. Look for licenses from bodies like the Financial Conduct Authority (FCA) or the National Futures Association (NFA).

- Trading Platform: The trading platform is your interface to the markets. Choose one that is user-friendly, offers advanced charting tools, real-time quotes, and customizable settings to suit your trading style. Popular platforms include MetaTrader 4 (MT4) and MetaTrader 5 (MT5).

- Trading Costs: Brokers charge fees in various forms, including spreads, commissions, and inactivity fees. Analyze these costs carefully, comparing them across different brokers to find the most competitive rates.

- Account Types and Features: Brokers offer different account types catering to various trading needs. Assess whether their offerings, such as leverage options, margin requirements, and account minimums, align with your trading strategy and risk tolerance.

- Customer Support: Reliable customer support is paramount for addressing queries, resolving issues, and seeking guidance. Evaluate the broker’s responsiveness, availability, and communication channels.

Remember, choosing the right Forex broker is an investment in your trading journey. By carefully considering these factors, you can partner with a broker that empowers you to navigate the currency markets confidently and effectively.

Utilizing Trading Tools and Indicators

In the dynamic and often unpredictable world of Forex trading, the use of trading tools and indicators is crucial for gaining an edge. These tools provide valuable insights into market trends, sentiment, and potential price movements, empowering traders to make informed decisions. Let’s explore some of the essential tools and indicators that can significantly enhance your Forex trading strategy.

Technical Indicators: These mathematical calculations based on historical price data help identify patterns and trends, providing signals for potential buy or sell opportunities. Popular technical indicators include:

- Moving Averages (MA): Smooth out price fluctuations, highlighting trends and potential support/resistance levels.

- Relative Strength Index (RSI): Measures the magnitude of recent price changes to evaluate overbought or oversold conditions.

- Bollinger Bands: Indicate price volatility and potential breakout points.

Trading Platforms: Modern Forex trading platforms offer a wide array of tools and features to facilitate effective trading. These platforms typically provide:

- Real-time charting: Visualize price movements and analyze technical indicators.

- Order execution: Place and manage trades with speed and efficiency.

- News and economic data: Stay updated on market-moving events and economic releases.

Economic Calendars: By monitoring economic calendars, traders can anticipate potential market volatility based on upcoming economic releases, such as interest rate decisions or employment data. This information can be crucial for adjusting trading strategies and managing risk.

Risk Management Tools: Effective risk management is paramount in Forex trading. Tools like stop-loss orders and position sizing calculators help traders control potential losses and protect their capital.

Remember, while trading tools and indicators can provide valuable insights, they should be used in conjunction with a comprehensive trading strategy and careful analysis. It’s essential to understand the limitations of these tools and to backtest their effectiveness before applying them in real-time trading.

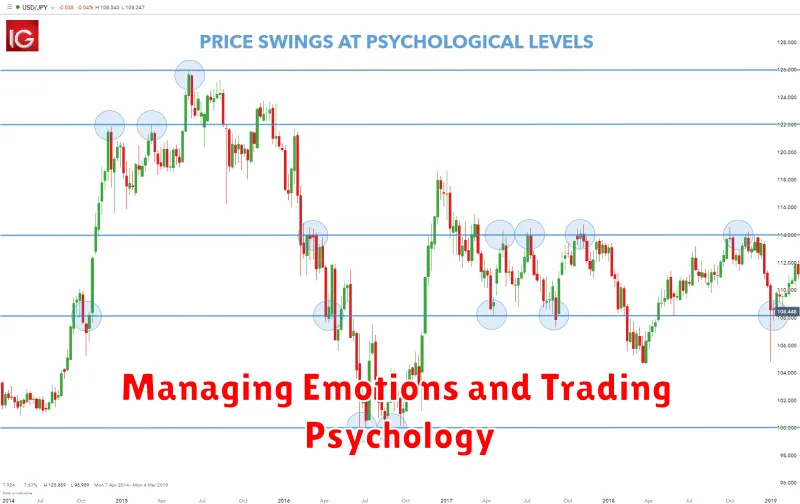

Managing Emotions and Trading Psychology

In the dynamic and often volatile world of Forex trading, mastering the currency game goes beyond technical analysis and market trends. The ability to manage emotions and develop a robust trading psychology is crucial for consistent success. This aspect often gets overlooked, but it’s the bedrock of sustainable profitability.

Fear and greed are powerful emotions that can lead to impulsive decisions and detrimental trading habits. Fear can cause traders to exit positions prematurely, missing out on potential profits. Conversely, greed can entice traders to hold onto losing trades, hoping for a rebound that may never come.

To navigate these emotions effectively, traders must cultivate a disciplined mindset. This involves:

- Sticking to a well-defined trading plan: A plan provides structure and objectivity, preventing emotional reactions from taking over.

- Setting realistic profit targets and stop-loss orders: These tools limit potential losses and prevent overtrading.

- Accepting losses as a part of the game: Recognizing that every trade won’t be profitable is crucial for maintaining a healthy perspective.

- Managing stress and maintaining a calm demeanor: Techniques like mindfulness, meditation, or regular exercise can help traders stay grounded.

Moreover, developing a strong trading psychology involves understanding your personality and its influence on your trading decisions. Are you prone to impulsivity? Do you have a tendency to overanalyze? Identifying these tendencies can help you tailor your trading style to minimize their impact.

Remember, trading is a marathon, not a sprint. Patience, discipline, and emotional control are the cornerstones of consistent success in the Forex market. By mastering these elements, traders can position themselves for long-term profitability.

Staying Informed: News and Economic Calendar Events

In the dynamic world of forex trading, staying ahead of the curve is paramount. One of the most crucial aspects of effective trading is staying informed about upcoming news and economic calendar events. These events can significantly impact currency movements, offering both opportunities and risks to traders.

Economic calendar events, such as interest rate decisions, inflation reports, and employment data, provide valuable insights into the health and trajectory of a country’s economy. These releases can cause substantial volatility in the forex market, making it essential for traders to monitor them closely.

News events, encompassing political developments, geopolitical tensions, and global economic trends, can also create significant market fluctuations. Unexpected events, such as a natural disaster or a major policy announcement, can trigger rapid price changes, presenting opportunities for skillful traders.

By staying informed about upcoming news and economic calendar events, traders can:

- Anticipate potential market shifts

- Adjust their trading strategies accordingly

- Identify potential entry and exit points

- Minimize risk and maximize profitability

Numerous online resources provide comprehensive economic calendars and news updates. Leveraging these resources effectively is a crucial step in mastering the currency game and achieving consistent success as a forex trader.