Are you tired of the constant ups and downs of the stock market? Do you dream of building lasting wealth through smart investments? If so, then you need to learn about the long game. Playing the long game in the stock market is all about investing for the long term, focusing on steady growth and compounding returns. It’s a strategy that prioritizes patience, discipline, and a deep understanding of the fundamentals, rather than chasing short-term gains. In this comprehensive guide, we’ll delve into the secrets of successful long-term stock market investments, equipping you with the knowledge and tools to navigate the market with confidence.

From understanding the power of compounding to mastering asset allocation and risk management, we’ll cover every crucial aspect of long-term investing. We’ll also explore the importance of staying informed about market trends, choosing the right investments, and navigating market volatility. This isn’t just another get-rich-quick scheme; it’s a proven roadmap for building a secure financial future through strategic stock market investments. Whether you’re a seasoned investor or just starting your journey, this guide will provide you with the insights you need to make informed decisions and achieve your financial goals.

Understanding the Principles of Long-Term Investing

Long-term investing is a strategy that involves holding investments for a prolonged period, typically several years or even decades. It’s often considered a more passive approach to investing, focusing on long-term growth potential rather than short-term market fluctuations. This approach embraces the concept of time in the market, believing that over the long run, markets tend to rise.

Here are some key principles of long-term investing:

1. Patience and Discipline

Long-term investing requires patience and discipline. Market fluctuations are inevitable, and short-term downturns are common. The key is to avoid panicking and selling during these periods. Instead, stay invested and let your portfolio grow over time. Patience allows you to ride out the ups and downs, reaping the benefits of long-term market growth.

2. Diversification

Diversification is crucial in any investment strategy, but it’s particularly essential for long-term investing. It involves spreading your investments across different asset classes, such as stocks, bonds, real estate, and commodities. Diversification reduces risk by ensuring that your portfolio is not overly reliant on any single asset or sector. This helps to mitigate losses during market downturns.

3. Cost-Effective Investing

Long-term investors prioritize cost-effective investing. This means choosing investment vehicles with low fees and expenses. High fees can eat into your returns over time, significantly impacting your long-term gains. Consider using low-cost index funds or exchange-traded funds (ETFs) to minimize expenses.

4. Dollar-Cost Averaging

Dollar-cost averaging involves investing a fixed amount of money at regular intervals, regardless of market conditions. This strategy helps to smooth out price fluctuations and reduces the risk of buying high and selling low. By investing consistently over time, you gradually accumulate assets without being overly influenced by short-term market swings.

5. Long-Term Perspective

Long-term investing requires a long-term perspective. Don’t get caught up in short-term market noise or try to time the market. Focus on your investment goals and the long-term growth potential of your portfolio. Remember that the market is cyclical, and downturns are just part of the process.

Benefits and Risks of Long-Term Investments

Long-term investments, particularly in the stock market, are often lauded as a pathway to financial security and wealth accumulation. But like any investment, they come with their own set of advantages and disadvantages. It’s crucial to understand both sides of the coin before making any decisions.

Benefits:

One of the most significant benefits of long-term investing is the potential for substantial returns. Over time, the stock market has historically shown a tendency to rise, allowing investors to capitalize on this growth. Compounding, the snowball effect of earning interest on interest, plays a crucial role in maximizing these returns. Another advantage is the ability to ride out market fluctuations. Short-term market swings are less impactful in the long run. Long-term investors have more time to recover from dips and benefit from the overall upward trend. Furthermore, long-term investments can be a powerful tool for building wealth and securing financial independence. Consistent investing over the long haul can pave the way for achieving financial goals like retirement, college funding, or purchasing a home.

Risks:

Despite the potential rewards, long-term investments are not without risks. One of the biggest is the possibility of market downturns. While the stock market has historically recovered, there’s no guarantee that future performance will mirror the past. It’s essential to be prepared for potential market corrections and volatility. Another risk is inflation, which can erode the purchasing power of investments over time. Additionally, opportunity cost is a factor to consider. Money tied up in long-term investments is unavailable for other potential uses. Lastly, long-term investments can be illiquid, meaning it can be difficult to access the funds quickly if needed.

Identifying Your Investment Goals and Risk Tolerance

Before you dive into the exciting world of long-term stock market investments, it’s crucial to understand your own investment goals and risk tolerance. This forms the foundation for building a successful investment strategy that aligns with your needs and aspirations.

Investment Goals: What are you hoping to achieve with your investments? Are you saving for retirement, a down payment on a house, your child’s education, or simply building wealth over time? Define your goals clearly and set specific financial targets.

Time Horizon: How long do you plan to invest your money? Long-term investments typically involve holding stocks for several years, even decades. A longer time horizon allows you to weather market fluctuations and potentially benefit from the power of compounding.

Risk Tolerance: This is your ability and willingness to accept potential losses in exchange for the possibility of higher returns. A high-risk tolerance might lead you towards more volatile stocks, while a low-risk tolerance may favor safer investments like bonds.

Assessing Your Risk Tolerance: Several factors influence your risk tolerance, including your age, financial situation, and overall investment experience. A younger investor with a longer time horizon might be more comfortable with higher risk than someone nearing retirement.

Understanding Your Goals and Risk Tolerance is Essential: This knowledge guides your investment decisions, helping you make informed choices that support your financial journey. As you progress, your goals and risk tolerance may evolve, so regular review and adjustments are important.

Fundamental Analysis for Long-Term Growth

When it comes to the stock market, it’s easy to get caught up in the day-to-day fluctuations and short-term trends. However, for long-term investors seeking to build wealth over time, a different approach is crucial. Fundamental analysis plays a pivotal role in identifying companies with solid foundations for sustainable growth, forming the backbone of a winning long-term strategy.

Fundamental analysis involves dissecting a company’s financial health, management team, industry landscape, and competitive advantage. It’s about looking beyond the surface and understanding the intrinsic value of a business. By focusing on key metrics such as revenue growth, profitability, cash flow, and debt levels, investors can gain insights into a company’s ability to generate profits and create value for shareholders.

One powerful tool in fundamental analysis is the income statement. This statement reveals a company’s revenue, cost of goods sold, expenses, and net income over a period of time. By analyzing trends in these metrics, investors can gauge a company’s sales performance, efficiency, and profitability. Another critical document is the balance sheet, which provides a snapshot of a company’s assets, liabilities, and equity at a specific point in time. This information helps investors assess a company’s financial strength, solvency, and ability to fund future growth.

Beyond financial data, fundamental analysis also incorporates qualitative factors. Understanding a company’s management team, competitive landscape, industry trends, and regulatory environment can provide valuable insights into its long-term prospects. A strong management team with a proven track record can drive growth and innovation, while a favorable industry outlook can create opportunities for expansion and market share gains.

Ultimately, fundamental analysis empowers long-term investors to make informed decisions based on a thorough understanding of a company’s underlying fundamentals. By focusing on companies with strong financials, capable management, and promising market prospects, investors can increase their chances of achieving long-term financial success.

Choosing the Right Investment Strategy

When it comes to long-term stock market investing, choosing the right investment strategy is paramount. It’s the foundation upon which your financial future is built. There is no one-size-fits-all approach, as individual circumstances, risk tolerance, and financial goals vary significantly.

Here are key factors to consider when selecting a strategy:

- Time Horizon: The longer your investment timeline, the more risk you can potentially take on. This allows for greater potential for growth and recovery from market fluctuations.

- Risk Tolerance: How comfortable are you with market volatility? A higher risk tolerance might lead you towards a portfolio with a larger allocation to growth stocks, while a lower tolerance might favour a more conservative approach with bonds and dividend-paying stocks.

- Financial Goals: What are you saving for? Are you aiming for retirement, a down payment on a house, or funding your children’s education? Understanding your goals will help determine your investment objectives.

- Investment Knowledge and Experience: Do you have the time and expertise to manage your own investments, or do you prefer to work with a financial advisor? There are various investment options, ranging from actively managed mutual funds to passive index funds.

Diversification is another crucial element. A well-diversified portfolio spreads risk across different asset classes, industries, and geographies. This helps to minimize the impact of individual stock performance on your overall portfolio.

Ultimately, choosing the right investment strategy requires careful consideration and planning. It’s essential to do your research, seek professional advice if needed, and make informed decisions that align with your individual circumstances and financial goals. Remember, long-term investing is a journey, not a sprint, and patience and discipline are key to success.

Diversification: Spreading Your Investment Portfolio

Diversification is a fundamental principle in investing, particularly when it comes to the long-term stock market. It’s the act of spreading your investment across various assets, industries, and even geographical regions. This strategy helps mitigate risk by reducing the impact of any single investment’s performance on your overall portfolio.

Think of it like this: Imagine putting all your eggs in one basket. If that basket falls, you lose everything. But if you spread your eggs across multiple baskets, the loss of one basket won’t completely cripple you. Diversification in investing operates in a similar way.

Here are some key aspects of diversification:

- Asset Classes: Diversify across different asset classes like stocks, bonds, real estate, and commodities. Each asset class reacts differently to economic conditions, so holding a mix can offer stability.

- Industries: Don’t just invest in a single industry. Spread your investments across various sectors, such as technology, healthcare, energy, and consumer goods. This helps mitigate risks associated with specific industry downturns.

- Company Sizes: Include investments in both large-cap (large companies) and small-cap (smaller companies) stocks. This diversifies your portfolio based on company size and growth potential.

- Geographic Locations: Investing in companies from different countries can reduce the impact of local economic fluctuations. This strategy adds international diversification to your portfolio.

By embracing diversification, you can potentially reduce risk, enhance stability, and improve your chances of achieving long-term financial goals in the stock market.

Investing in Different Sectors and Industries

When it comes to long-term investing, understanding different sectors and industries is crucial. It’s not just about picking individual stocks; it’s about recognizing the broader economic trends and how they impact specific sectors. By diversifying your portfolio across different sectors, you can mitigate risk and potentially maximize returns. Let’s explore some key sectors to consider for your long-term investment strategy.

Technology

The technology sector is constantly evolving, with artificial intelligence, cloud computing, and cybersecurity driving growth. Investing in tech giants like Apple, Microsoft, and Amazon can offer substantial potential for long-term gains, but remember that this sector can also be volatile.

Healthcare

Healthcare remains a stable and consistently growing sector. As the global population ages, demand for healthcare services and pharmaceuticals will increase. Consider investing in companies like Johnson & Johnson, Pfizer, and UnitedHealth Group.

Consumer Discretionary

This sector includes companies that provide non-essential goods and services, such as restaurants, retailers, and automakers. This sector tends to be cyclical, meaning it’s highly sensitive to economic fluctuations. However, it also offers opportunities for growth in times of economic prosperity.

Financials

The financial sector encompasses banks, insurance companies, and investment firms. These companies benefit from a strong economy and rising interest rates. Consider investing in large financial institutions like JPMorgan Chase, Bank of America, and Berkshire Hathaway.

Energy

The energy sector is a critical part of the global economy, supplying oil, gas, and renewable energy. As the world transitions towards a cleaner energy future, companies involved in renewable energy sources, such as solar and wind, are attracting significant investment. Keep an eye on companies like ExxonMobil, Chevron, and NextEra Energy.

Materials

The materials sector includes companies that extract and process raw materials, such as metals, minerals, and chemicals. This sector’s performance is often tied to global economic growth and infrastructure development. Companies like Alcoa, Dow Chemical, and Rio Tinto offer opportunities within this sector.

It’s important to remember that researching and diversifying your portfolio across different sectors are crucial for successful long-term investing. While some sectors may outperform others, no single sector is guaranteed to consistently generate high returns. By analyzing the economic landscape and understanding the intricacies of each sector, you can make informed investment decisions and achieve your long-term financial goals.

The Power of Compound Interest Over Time

One of the most powerful forces in finance is compound interest. It’s the snowball effect of earning interest on your initial investment, and then earning interest on that interest, and so on. This might seem like a small difference at first, but over long periods, it can create a massive difference in your wealth.

Imagine you invest $10,000 at an average annual return of 7%. After one year, you’ll have $10,700. In the second year, you’ll earn interest not just on the initial $10,000 but also on the $700 in interest you earned the previous year. This pattern continues, and the power of compounding becomes more evident as time goes on.

Let’s look at some examples:

- After 10 years, your $10,000 investment will grow to $19,671.51.

- After 20 years, it will grow to $38,696.83.

- After 30 years, it will grow to $76,122.55.

As you can see, the longer you let your money compound, the greater the returns. This is why long-term investing is so powerful. By letting your money work for you over decades, you can achieve substantial financial growth.

The key to harnessing the power of compound interest is to start early and be patient. The earlier you invest, the more time you have for your money to compound. The more patient you are, the less likely you are to make impulsive decisions that could derail your long-term goals.

Remember, while short-term market fluctuations can be tempting to focus on, the real magic of investing lies in the long game. Embrace the power of compounding and watch your wealth grow over time.

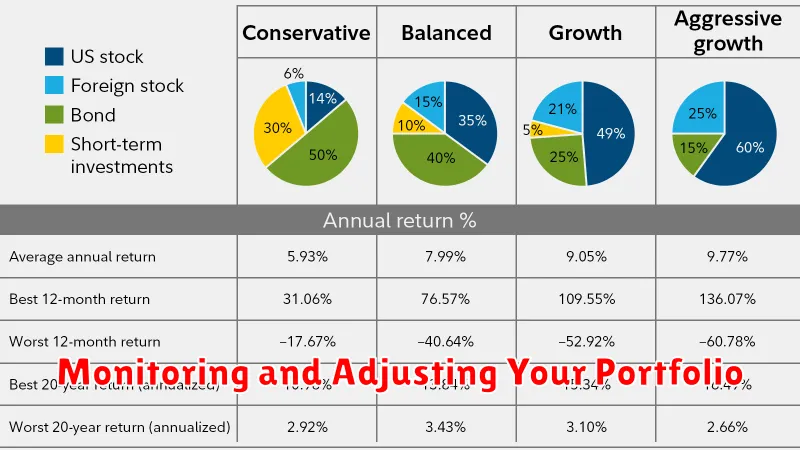

Monitoring and Adjusting Your Portfolio

Once you’ve built your investment portfolio, it’s crucial to monitor and adjust it over time. The market is constantly changing, and your investment goals and risk tolerance may shift as well.

Regularly review your portfolio’s performance and make necessary adjustments. Consider these key factors:

- Performance: Track the returns of your individual investments and your portfolio as a whole. Are they meeting your expectations?

- Market Conditions: Stay informed about current market trends and economic conditions. How might these factors affect your investments?

- Risk Tolerance: Reassess your risk appetite. Has it changed since you initially built your portfolio? Are you comfortable with the level of risk you’re taking?

- Investment Goals: Are your goals still achievable with your current portfolio? Do you need to adjust your investment strategy to align with your goals?

Remember, adjusting your portfolio is a normal part of long-term investing. Don’t be afraid to make changes as needed to ensure your investments remain aligned with your financial objectives.

[object Object]

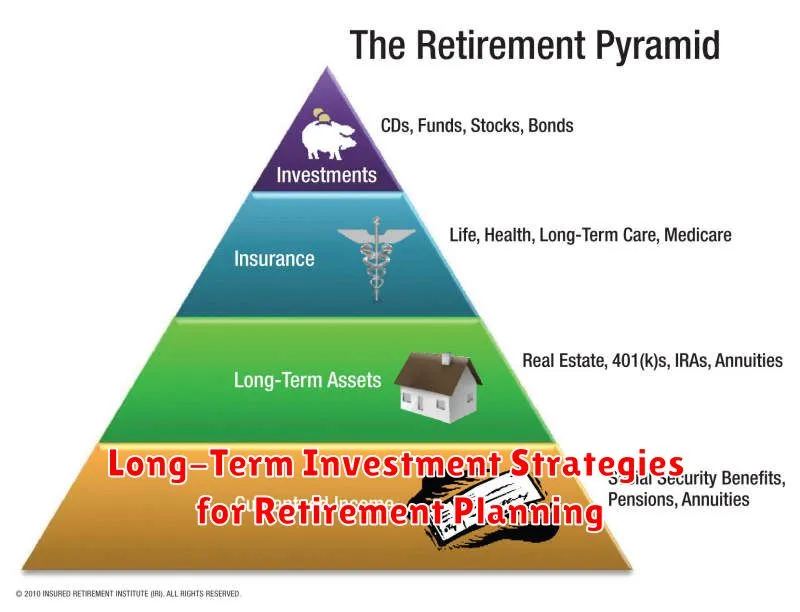

Long-Term Investment Strategies for Retirement Planning

Retirement planning is a journey, not a sprint. Securing a comfortable future requires a long-term investment strategy that aligns with your financial goals and risk tolerance. The stock market, despite its inherent volatility, offers a potent avenue for wealth accumulation over time. Here’s a breakdown of effective long-term strategies for retirement planning:

1. Dollar-Cost Averaging: This strategy involves investing a fixed amount of money at regular intervals, regardless of market fluctuations. This helps to mitigate risk by averaging your purchase price over time, smoothing out the impact of market volatility.

2. Index Funds: Index funds track the performance of a specific market index, such as the S&P 500. They offer broad market exposure at a low cost, making them ideal for long-term growth.

3. Diversification: Don’t put all your eggs in one basket! Diversify your portfolio across different asset classes like stocks, bonds, and real estate. This helps to reduce overall risk and enhance potential returns.

4. Rebalancing: Over time, the proportions of your asset allocation may shift due to market performance. Rebalancing ensures that your portfolio remains aligned with your original risk tolerance by adjusting asset weights periodically.

5. Patience and Discipline: The stock market is a marathon, not a sprint. Avoid impulsive decisions driven by short-term market fluctuations. Stay disciplined and stick to your long-term investment plan.

6. Regular Review and Adjustment: Market conditions and your own financial circumstances can change over time. Regularly review your investment strategy and make adjustments as needed to align with your evolving goals.

Remember, retirement planning is a personalized journey. Consulting a qualified financial advisor can provide tailored guidance and help you create a long-term investment strategy that sets you up for a secure and fulfilling future.