The stock market, a volatile beast, has always been a source of both opportunity and anxiety. Its unpredictable nature can lead to both spectacular gains and devastating losses, leaving investors constantly searching for the next big move. One question that has plagued investors for decades is: Can we predict stock market crashes? This question has become even more relevant in recent times, with the global economy facing unprecedented challenges like rising inflation, geopolitical tensions, and the lingering effects of a pandemic.

While predicting the future is inherently difficult, experts have developed sophisticated tools and strategies to analyze market trends and identify potential warning signs. From studying historical patterns to analyzing economic indicators, the quest to decode stock market crash predictions has led to the development of advanced algorithms, data-driven models, and even artificial intelligence. However, the question remains: are these tools reliable enough to provide accurate and timely warnings of an impending crash? In this article, we’ll delve into the world of stock market crash prediction, exploring the various approaches, their limitations, and the potential for investors to navigate the choppy waters of the market.

The Allure and Danger of Market Crash Predictions

The stock market is a complex and unpredictable beast, and as such, it’s no surprise that many people are fascinated by predictions of market crashes. After all, the potential for profit is tantalizing, but so is the potential for loss. There’s a certain allure to predicting the unpredictable, a desire to be “in the know” and avoid the worst of the storm.

However, it’s important to remember that predicting market crashes is an extremely difficult task. There are countless factors that can influence stock prices, and it’s impossible to account for them all. While some analysts may have a track record of success, even the most experienced investors can be wrong. In fact, many market crashes have occurred unexpectedly, often with little or no warning.

Furthermore, crash predictions can be dangerous. They can lead to panic selling, which can actually exacerbate a market downturn. Investors who sell their stocks based on fear rather than logic can end up losing money that they could have held onto. Additionally, the focus on crash predictions can distract investors from the long-term goals of building wealth through careful, disciplined investing.

Instead of trying to predict the unpredictable, it’s far more important to focus on building a sound investment strategy based on your individual circumstances and risk tolerance. This means diversifying your portfolio, investing for the long term, and sticking to your plan even during market volatility.

Understanding Market Cycles and Volatility

The stock market is a dynamic entity characterized by periods of growth, stagnation, and decline. Understanding these market cycles is crucial for investors seeking to navigate the inevitable fluctuations. Volatility, a measure of price fluctuations, is an inherent aspect of the market, driven by a multitude of factors including economic conditions, investor sentiment, geopolitical events, and company-specific news.

Bull markets are characterized by sustained upward price trends, driven by factors such as strong economic growth, low interest rates, and positive investor sentiment. Conversely, bear markets are characterized by prolonged downward price trends, often fueled by economic recession, rising interest rates, and negative investor sentiment.

It’s important to note that market cycles are not predictable in their timing or duration. The unpredictable nature of the market makes it a challenging endeavor to pinpoint the exact moment of a market crash, which refers to a sudden and significant decline in stock prices.

The market’s volatility is influenced by a range of factors, making it inherently difficult to predict future price movements. While some patterns and indicators may provide insights into market behavior, it’s important to recognize that even experienced investors cannot accurately predict market crashes.

By understanding the cyclical nature of the market and the inherent volatility, investors can adopt strategies to mitigate risk and manage expectations. Diversifying portfolios, investing for the long term, and avoiding emotional decision-making are essential practices for navigating the unpredictable nature of the stock market.

Historical Stock Market Crashes: Lessons Learned

The stock market is inherently volatile, and crashes are an inevitable part of its cyclical nature. While predicting the exact timing and magnitude of a crash is impossible, studying historical events offers valuable insights into the potential triggers, consequences, and lessons learned. By understanding the past, we can better navigate the unpredictable waters of the present and future.

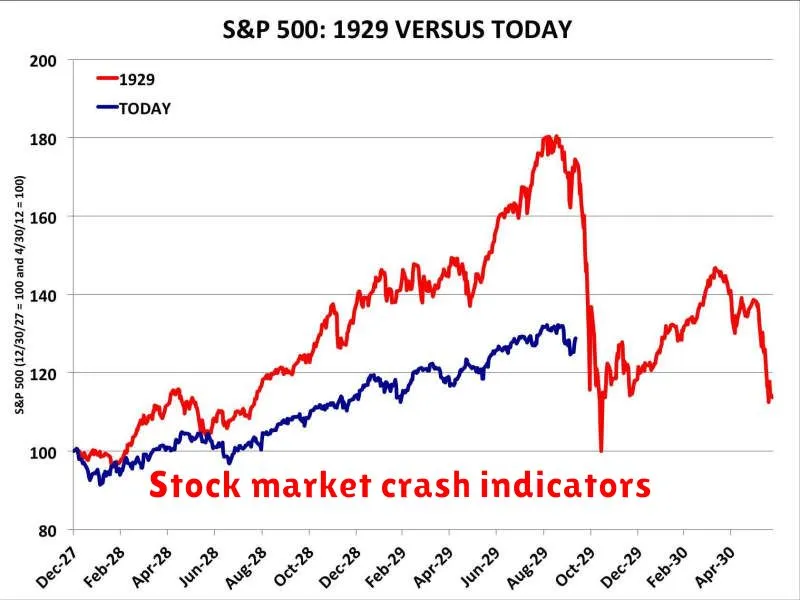

The 1929 Crash: A Tale of Speculation and Panic

The Wall Street Crash of 1929, often referred to as the Great Crash, remains a defining moment in financial history. Fueled by rampant speculation and loose credit, the market experienced an unprecedented boom followed by a devastating bust. This crash exposed the dangers of excessive leverage, irrational exuberance, and the fragility of market confidence. It also underscored the importance of sound financial regulation and investor awareness.

The 1987 Crash: Black Monday and the Power of Technology

The Black Monday crash of 1987 saw a staggering 22.6% drop in the Dow Jones Industrial Average, the largest single-day decline in history. While the exact cause remains debated, it is believed to have been triggered by a combination of factors, including computer-driven trading algorithms, global economic uncertainty, and a general sentiment of market overvaluation. This event highlighted the potential for technology to amplify market volatility and the need for robust risk management strategies.

The 2008 Financial Crisis: A Systemic Collapse

The 2008 financial crisis, originating in the US housing market, was a global event that sent shockwaves through the financial system. It exposed the risks associated with subprime mortgages, complex financial instruments, and interconnectedness of global markets. The crisis underscored the importance of responsible lending practices, financial transparency, and regulatory oversight to mitigate systemic risks.

Lessons Learned: A Path Forward

Historical stock market crashes offer valuable lessons for investors, policymakers, and the financial industry. They highlight the importance of:

- Diversification: Spreading investments across different asset classes and sectors to mitigate risk.

- Risk Management: Implementing strategies to manage and control potential losses.

- Long-Term Perspective: Avoiding short-term speculation and focusing on long-term value creation.

- Financial Literacy: Educating investors about market dynamics and financial concepts.

- Regulatory Oversight: Establishing strong regulations to prevent excessive risk-taking and protect investors.

While predicting the unpredictable remains a challenge, understanding the lessons from past crashes can help us better navigate the inherent volatility of the stock market and make informed decisions for the future.

Economic Indicators to Watch for Potential Crashes

While predicting a stock market crash is notoriously difficult, understanding and monitoring key economic indicators can provide valuable insights into potential vulnerabilities. These indicators act as early warning systems, signaling potential shifts in the economic landscape that could trigger market downturns.

Interest Rates

Rising interest rates can significantly impact businesses and investors. When rates climb, borrowing costs increase, making it more expensive for companies to fund operations and for investors to acquire assets. This can lead to reduced economic activity, lower corporate profits, and a decline in stock prices.

Inflation

Persistent high inflation erodes purchasing power and can force central banks to raise interest rates aggressively to curb price increases. Elevated inflation can lead to uncertainty and volatility, making investors hesitant to invest and potentially triggering a market correction.

Unemployment Rate

A sudden surge in unemployment can indicate a weakening economy. High unemployment weakens consumer spending, impacting businesses and leading to lower profits, which can ultimately translate into declining stock prices.

Consumer Confidence

Consumer confidence reflects the overall optimism and spending habits of consumers. When confidence declines, consumers tend to cut back on spending, leading to reduced demand for goods and services. This can trigger a domino effect, impacting businesses and ultimately affecting stock market performance.

Housing Market Activity

The housing market is a significant component of the economy. A sharp downturn in housing prices or sales activity can be a sign of broader economic weakness, influencing investor sentiment and market performance.

By carefully monitoring these economic indicators, investors can gain a more comprehensive understanding of market dynamics and potentially identify early warning signs of a potential crash. However, it is crucial to remember that these indicators are just part of a complex puzzle, and their interpretation should be considered within the broader economic context.

Technical Analysis and Chart Patterns: Predicting Market Turns

Technical analysis, a powerful tool in the stock market, utilizes chart patterns and historical data to identify trends and predict future market movements. While it doesn’t offer guaranteed predictions, it provides valuable insights and helps traders make informed decisions. Chart patterns, recurring formations on price charts, can signal potential market turns. These patterns emerge due to investor behavior and can offer clues about the future direction of an asset’s price.

One popular chart pattern is the head and shoulders pattern, which indicates a potential reversal of an uptrend. It consists of three peaks, with the middle peak being the highest (“head”) and the two outer peaks being lower (“shoulders”). A breakout below the neckline, a line connecting the two troughs, confirms the pattern and suggests a bearish trend.

Another pattern, the double top, is formed when a stock reaches a peak twice and then fails to break through it. It signals a possible shift from an uptrend to a downtrend.

These patterns are not foolproof but can be utilized in conjunction with other indicators to enhance decision-making. By analyzing charts and identifying these patterns, traders can potentially gain an edge in predicting market turns.

Sentiment Indicators: Gauging Investor Fear and Greed

In the realm of finance, predicting market movements is a perpetual quest. While predicting a stock market crash with pinpoint accuracy remains elusive, understanding the prevailing sentiment among investors can provide valuable insights into potential market trends. Sentiment indicators, often referred to as “fear and greed” gauges, offer a glimpse into the emotional landscape of investors, revealing their level of optimism or pessimism.

These indicators are based on various data points, including:

- Market Volatility: A spike in market volatility, measured by indexes like the VIX, can signal heightened fear among investors.

- Investor Positioning: Data on margin debt, short interest, and put/call ratios provide insights into the level of bullishness or bearishness among investors.

- Media Sentiment: Analyzing the tone of financial news articles and social media posts can reveal the prevailing sentiment in the market.

- Survey Data: Regular surveys of investor sentiment, conducted by organizations like the American Association of Individual Investors (AAII), can provide a snapshot of how investors are feeling.

While sentiment indicators can offer valuable insights, it’s crucial to interpret them with caution. They are not foolproof predictors of market crashes and should be used in conjunction with other fundamental and technical analysis tools. Moreover, the interpretation of these indicators can be subjective, with different analysts drawing different conclusions from the same data.

By monitoring sentiment indicators, investors can gain a better understanding of the prevailing market psychology and make more informed decisions. However, it’s important to remember that the market is driven by a complex interplay of factors, and sentiment alone cannot predict the future with certainty.

The Role of Black Swan Events in Market Crashes

While economic indicators, sentiment analysis, and technical analysis play their roles in market predictions, Black Swan events remain a significant challenge for investors and analysts alike. These unpredictable, high-impact events often defy traditional models and forecasts, disrupting market stability and driving significant price fluctuations.

The term “Black Swan,” coined by Nassim Nicholas Taleb, refers to an event with three key characteristics: it is unexpected, it has a significant impact, and it is retrospectively explainable. Examples include the 9/11 terrorist attacks, the 2008 financial crisis, and the COVID-19 pandemic. These events, while unforeseen, often trigger a chain reaction across various sectors, leading to market instability and volatility.

The role of Black Swan events in market crashes is undeniable. They can trigger a sudden loss of confidence, leading to widespread panic selling and a rapid decline in asset prices. The unpredictable nature of these events makes it difficult for investors to hedge against their potential impact, further amplifying their effects.

While predicting Black Swans remains a daunting task, understanding their potential impact and incorporating their unpredictability into market analysis is crucial for informed investment decisions. Recognizing that extreme events can happen, even when seemingly improbable, allows investors to develop more resilient strategies and better navigate the complexities of the financial world.

Can You Really Predict a Stock Market Crash?

Predicting a stock market crash is like trying to catch a falling star – it’s possible, but incredibly difficult and often inaccurate. While many believe they possess the secret formula, the truth is that the stock market is a complex beast, influenced by countless factors that are often unpredictable and intertwine in unexpected ways.

There’s no crystal ball, no single indicator, no magic formula that can reliably signal an impending crash. Economic data, historical trends, and expert opinions are all valuable tools, but they are not foolproof. They can offer insights, but they cannot eliminate the inherent uncertainty of the market.

The key to understanding the unpredictability of stock market crashes lies in the very nature of human behavior. Panic, fear, and herd mentality play a significant role in driving market fluctuations. These emotions can amplify both positive and negative events, making it even harder to forecast precise market movements.

Instead of relying on predictions, focus on building a strong financial foundation and understanding your own risk tolerance. Diversify your investments, maintain a long-term perspective, and stay informed about the market, but don’t let predictions dictate your financial decisions. Remember, the stock market is a marathon, not a sprint, and long-term growth is more important than chasing short-term gains.

Strategies for Navigating Market Volatility and Downturns

Market volatility and downturns are inevitable aspects of investing. While predicting these events with certainty is impossible, understanding the dynamics at play and adopting sound strategies can help investors navigate these turbulent periods successfully. Here are some key strategies to consider:

1. Diversify Your Portfolio: A well-diversified portfolio across asset classes, sectors, and geographies helps mitigate risk. Holding a mix of stocks, bonds, real estate, and commodities can cushion the impact of any single asset class’s decline.

2. Maintain a Long-Term Perspective: Market fluctuations are temporary. Focusing on your long-term financial goals and remaining invested through periods of volatility can lead to greater returns over time.

3. Utilize Dollar-Cost Averaging: Investing a fixed amount at regular intervals, regardless of market conditions, helps average out purchase prices and reduce the impact of market swings.

4. Rebalance Your Portfolio Regularly: Over time, your portfolio’s asset allocation can drift. Periodically rebalancing ensures that your investments align with your risk tolerance and financial goals.

5. Consider a Prudent Emergency Fund: Having a cash reserve for unexpected expenses can provide financial security and reduce the need to sell investments during market downturns.

6. Seek Professional Advice: Consulting with a financial advisor can provide personalized guidance based on your specific circumstances and investment objectives.

By implementing these strategies, investors can navigate market volatility and downturns with greater confidence, minimizing potential losses and maximizing long-term investment success.

Protecting Your Portfolio: Risk Management Strategies

Predicting market crashes is a fool’s game, but managing risk is a wise investor’s game. While you can’t control the market, you can control your portfolio. Here are some key strategies to weather any storm:

Diversification: Don’t put all your eggs in one basket. Spread your investments across different asset classes, such as stocks, bonds, real estate, and commodities. This helps mitigate losses if one asset class performs poorly.

Rebalancing: Regularly review your portfolio and adjust your asset allocation. Over time, certain assets may grow faster than others, throwing your balance off. Rebalancing helps ensure your portfolio aligns with your risk tolerance and investment goals.

Emergency Fund: A well-stocked emergency fund provides a financial safety net. Having 3-6 months of living expenses readily available helps you weather unexpected events without liquidating investments at a loss.

Long-Term Perspective: Market crashes are temporary fluctuations. Focus on your long-term goals and remember that time is your ally. Avoid panic selling during market downturns, as you may end up locking in losses.

Professional Guidance: Consider working with a financial advisor. They can help you craft a personalized investment strategy, manage your risk, and provide expert guidance during volatile market periods.

Stay Informed: Stay updated on market trends, economic news, and relevant events that could impact your portfolio. Informed decision-making is crucial in navigating market fluctuations.

Remember, risk management is an ongoing process, not a one-time event. By taking proactive steps, you can protect your portfolio and ride out market storms with greater confidence.

The Importance of a Long-Term Investment Perspective

In the unpredictable world of stock markets, it’s tempting to get caught up in the day-to-day fluctuations and try to predict the next crash. While understanding market cycles is important, fixating on short-term predictions can be detrimental to your investment strategy. A long-term perspective is crucial for weathering market volatility and achieving your financial goals.

The stock market is not a sprint, it’s a marathon. Focusing on the long-term allows you to ride out inevitable market fluctuations and capitalize on the power of compounding. History has shown that the stock market has consistently risen over time, even with periodic downturns. By staying invested through the ups and downs, you benefit from the long-term growth potential.

A long-term perspective also fosters a disciplined approach to investing. It encourages you to avoid impulsive decisions based on short-term market noise. Instead, you focus on your investment goals, diversify your portfolio, and regularly rebalance your holdings to maintain your desired risk level.

While short-term predictions may be tempting, remember that the stock market is inherently unpredictable. Instead of trying to time the market, adopt a long-term mindset, focus on your investment goals, and let time work its magic. The power of compounding and disciplined investing will reward your patience in the long run.

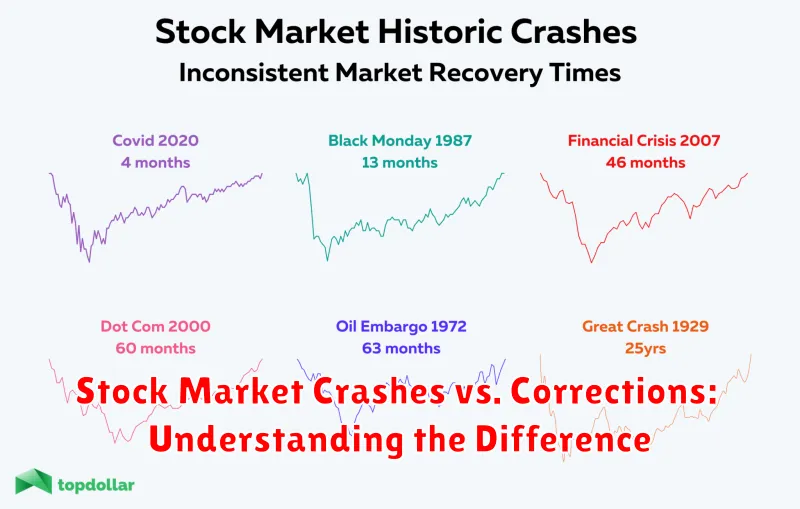

Stock Market Crashes vs. Corrections: Understanding the Difference

The stock market, a constantly fluctuating beast, can be a source of both excitement and anxiety for investors. While the potential for growth is always alluring, the prospect of market downturns is a looming concern. This is where the terms “crash” and “correction” often get thrown around, sometimes interchangeably. However, it’s crucial to understand the distinction between these two market phenomena, as they have different implications for investors.

A stock market correction refers to a decline of 10% or more in a major market index, such as the S&P 500, over a relatively short period. Corrections are considered to be normal and healthy occurrences in the market cycle, serving as a way to reset valuations and allow for future growth. While they can be unsettling for investors, corrections are typically short-lived, lasting anywhere from a few weeks to a few months.

A stock market crash, on the other hand, is a much more severe and prolonged decline. It’s characterized by a rapid and dramatic drop in stock prices, often exceeding 20% or more. Crashes are typically triggered by significant economic or geopolitical events, such as wars, recessions, or financial crises. They can lead to widespread panic and investor sentiment, and their recovery can take years, if not longer.

The key difference between a correction and a crash lies in their severity and duration. Corrections are temporary setbacks, while crashes are more catastrophic and have a long-lasting impact on the market. While both can be disruptive to investors, understanding the difference is crucial for making informed investment decisions.

Investing During a Market Crash: Opportunities and Risks

Market crashes are a normal part of the economic cycle, and predicting them is notoriously difficult. However, understanding the opportunities and risks associated with investing during a market crash can be crucial for long-term investment success.

Opportunities:

- Lower Prices: A market crash often results in significantly lower prices for stocks and other assets, providing a chance to buy quality assets at a discount.

- Potential for Higher Returns: Historically, markets have always recovered from crashes, and those who invest during downturns often experience higher returns in the long run.

- Access to Previously Unaffordable Investments: Lower prices can make high-quality companies or assets more accessible to individual investors.

Risks:

- Market Volatility: Market crashes are characterized by extreme volatility, making it difficult to time the market and potentially leading to significant losses.

- Economic Uncertainty: Market crashes often occur during periods of economic uncertainty, which can impact the profitability and future prospects of businesses.

- Emotional Decisions: Fear and panic can drive investors to make irrational decisions, such as selling assets at a loss or investing in risky ventures.

Investing during a market crash requires a disciplined and long-term approach. It’s crucial to:

- Stay informed: Monitor economic indicators and company news to make informed investment decisions.

- Focus on fundamentals: Invest in companies with strong financial positions and growth potential.

- Avoid panic selling: Resist the temptation to sell assets during a market downturn.

- Have a diversified portfolio: Allocate investments across different asset classes to mitigate risk.

Ultimately, the decision to invest during a market crash should be based on individual circumstances, risk tolerance, and financial goals. It’s important to consult with a financial advisor to develop a personalized investment strategy.