Navigating the financial markets can feel overwhelming, with countless investment options vying for your attention. Enter Exchange-Traded Funds (ETFs), a popular and versatile investment vehicle that has captured the interest of individual investors and seasoned traders alike. This guide delves into the world of ETFs, demystifying their intricacies and unlocking the insights and opportunities they hold. Whether you’re a seasoned investor seeking diversification or a newcomer eager to tap into the market, understanding ETFs is crucial for making informed decisions.

From tracking specific indices to targeting niche sectors, ETFs offer a diverse range of investment strategies. But with a plethora of choices available, it’s essential to understand the fundamentals of ETF investing. We’ll break down key concepts, explore the advantages and disadvantages of ETFs, and equip you with the knowledge to select the right ETFs for your portfolio. So, join us as we decode the ETF market and uncover the vast possibilities it holds.

Understanding Exchange-Traded Funds (ETFs)

Exchange-traded funds (ETFs) have gained immense popularity in recent years, becoming a cornerstone of modern investment portfolios. These investment vehicles offer a compelling alternative to traditional mutual funds, providing investors with a diverse and cost-effective way to access a wide range of asset classes.

At its core, an ETF is a basket of securities, such as stocks, bonds, or commodities, that trade on an exchange just like individual stocks. This means that you can buy and sell ETFs throughout the trading day at the current market price, providing greater flexibility compared to traditional mutual funds, which are typically priced once per day at the end of the trading session.

One of the key benefits of ETFs is their diversification. ETFs often track a specific index, such as the S&P 500 or the Nasdaq 100, providing instant access to a broad range of assets within a single investment. This diversification helps to mitigate risk and reduce volatility in your portfolio.

ETFs also tend to be more cost-effective than traditional mutual funds. They typically have lower expense ratios, which represent the annual fee charged for managing the fund. Lower expenses can translate into higher returns over time.

Furthermore, ETFs offer transparency. The holdings of an ETF are publicly disclosed, allowing investors to understand the specific assets within the fund. This transparency can be beneficial for investors who want to carefully evaluate their investment choices.

Understanding ETFs is crucial for any investor seeking to build a well-diversified and efficient portfolio. With their unique combination of diversification, cost-effectiveness, and transparency, ETFs offer a powerful tool for achieving your investment goals.

Key Drivers of the ETF Market

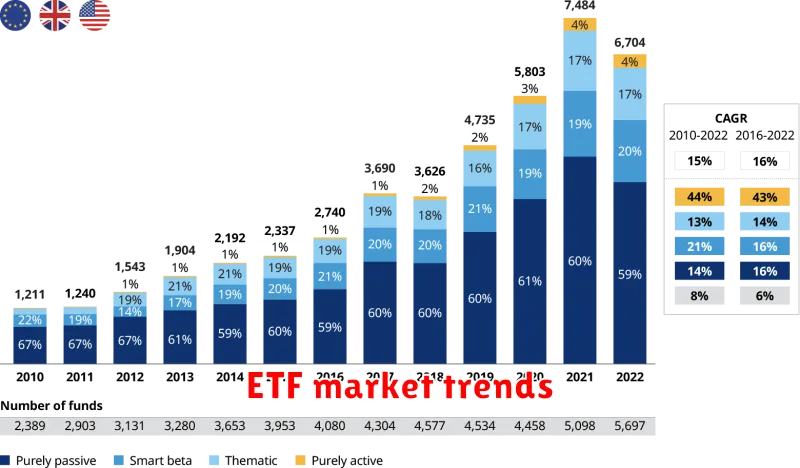

The exchange-traded fund (ETF) market has witnessed explosive growth in recent years, becoming a cornerstone of modern investing. This surge in popularity can be attributed to several key drivers that have propelled ETFs to the forefront of the financial landscape.

Diversification and Accessibility: ETFs offer investors a simple and cost-effective way to diversify their portfolios across various asset classes, sectors, and geographies. Their accessibility, with many ETFs traded on major exchanges, allows investors of all levels to gain exposure to diverse investment strategies.

Low Costs: ETFs generally have lower expense ratios compared to traditional mutual funds, which translates into greater returns for investors. This cost-effectiveness has made ETFs particularly attractive to cost-conscious investors seeking to maximize their investment potential.

Transparency and Liquidity: ETFs are known for their transparency, with their underlying holdings disclosed regularly. This transparency, coupled with their high liquidity, allows investors to easily monitor their investments and trade them efficiently.

Innovation and Product Variety: The ETF market continues to evolve rapidly, with a growing array of innovative products catering to diverse investment goals. From thematic ETFs targeting specific industries to actively managed ETFs, the options available to investors are constantly expanding.

Technological Advancements: Technological advancements, such as robo-advisors and online trading platforms, have further fueled the growth of the ETF market. These platforms make it easier for investors to access and manage their ETF portfolios, contributing to their widespread adoption.

In conclusion, the combination of diversification, low costs, transparency, liquidity, innovation, and technological advancements has made ETFs a dominant force in the investment world. As the market continues to evolve, we can expect to see even more compelling ETF offerings emerge, further solidifying their position as a vital investment tool for investors of all backgrounds.

Analyzing ETF Performance and Risks

Exchange-traded funds (ETFs) have become increasingly popular among investors, offering diversification, liquidity, and low costs. However, it’s crucial to understand ETF performance and the associated risks before investing. This article will delve into key factors to consider when evaluating ETFs.

Performance Analysis: Start by examining the ETF’s historical performance. Look at its total return, which includes both capital appreciation and dividends. Analyze its performance relative to its benchmark index or peer group. Consider the ETF’s expense ratio, which reflects its management fees. A lower expense ratio generally translates to better returns for investors.

Risk Factors: ETFs, like all investments, carry inherent risks.

- Market Risk: The value of an ETF can fluctuate based on the overall market performance.

- Tracking Error: ETFs aim to track the performance of a specific index, but tracking error can occur due to differences in portfolio holdings or trading strategies.

- Liquidity Risk: Some ETFs may have limited trading volume, making it challenging to buy or sell quickly, potentially impacting returns.

Other Important Considerations:

- ETF Structure: Consider the ETF’s underlying assets, whether they are stocks, bonds, or other securities.

- Investment Strategy: Evaluate if the ETF’s investment strategy aligns with your financial goals and risk tolerance.

- Fund Size: Larger ETFs may offer greater liquidity and lower trading costs.

By conducting thorough due diligence and understanding the performance and risk factors associated with ETFs, investors can make informed decisions to optimize their portfolios. Remember, consult with a financial advisor for personalized guidance.

Exploring Popular ETF Sectors and Themes

Exchange-traded funds (ETFs) have become increasingly popular investment vehicles, offering investors a convenient and cost-effective way to gain exposure to a broad range of assets. From traditional sectors like technology and healthcare to emerging themes such as clean energy and artificial intelligence, ETFs provide a diverse range of options to suit various investment goals.

Technology ETFs remain a popular choice, driven by the rapid growth and innovation in the sector. These ETFs track the performance of companies involved in software, hardware, semiconductors, and other tech-related industries.

Healthcare ETFs provide exposure to companies involved in pharmaceuticals, biotechnology, medical devices, and healthcare services. The healthcare sector is known for its consistent growth and long-term potential, making it an attractive investment for many investors.

Consumer Discretionary ETFs track companies that sell non-essential goods and services, such as automobiles, apparel, and restaurants. These ETFs are often influenced by consumer spending patterns and economic conditions.

Financial Services ETFs focus on companies involved in banking, insurance, and investment management. These ETFs are generally sensitive to interest rate changes and economic growth.

Energy ETFs provide exposure to companies involved in oil and gas exploration, production, and refining. These ETFs are often influenced by global energy demand and supply dynamics.

Emerging Markets ETFs track the performance of companies in developing economies. These ETFs offer investors the opportunity to diversify their portfolios and capitalize on the growth potential of emerging markets.

Sustainable Investing ETFs have gained significant traction in recent years, catering to investors seeking to align their investments with environmental, social, and governance (ESG) principles. These ETFs track companies that meet specific ESG criteria, such as reducing their carbon footprint or promoting diversity and inclusion.

Artificial Intelligence (AI) ETFs focus on companies developing and using AI technologies. The growing adoption of AI across industries is driving innovation and growth in this sector.

Cybersecurity ETFs track companies involved in protecting data and systems from cyberattacks. The increasing threat of cyberattacks has made cybersecurity a critical area of investment.

Cloud Computing ETFs focus on companies providing cloud computing services, such as data storage, software, and infrastructure. The shift to cloud computing is driving growth in this sector.

By understanding the different ETF sectors and themes, investors can make informed decisions about how to allocate their capital and achieve their investment objectives.

ETFs vs. Mutual Funds: Making the Right Choice

When it comes to investing, two popular choices are exchange-traded funds (ETFs) and mutual funds. Both offer diversification and professional management, but they have key differences that can influence your investment strategy.

ETFs are baskets of securities that trade on stock exchanges, like individual stocks. They are bought and sold throughout the day at fluctuating prices. Mutual funds are also baskets of securities, but they are only priced once a day, at the end of the trading day. This makes ETFs more liquid and suitable for frequent trading, while mutual funds are better for long-term investments.

Expense ratios, which represent the annual fees charged to manage the fund, are a crucial consideration. ETFs typically have lower expense ratios than mutual funds. This is because ETFs are passively managed, meaning they track a specific index, while mutual funds are actively managed, with portfolio managers making investment decisions.

Tax efficiency is another important factor. ETFs generally have lower capital gains taxes compared to mutual funds. This is due to the “tax-loss harvesting” strategy employed by ETFs, which allows investors to offset gains with losses, reducing their overall tax liability.

The best choice between ETFs and mutual funds depends on your individual investment goals, risk tolerance, and trading frequency. Consider your investment horizon, desired level of liquidity, and tax implications to determine the right fit for your portfolio.

Building a Diversified Portfolio with ETFs

Exchange-traded funds (ETFs) have become a cornerstone of modern investing, providing investors with a powerful tool to build diversified portfolios. ETFs offer a cost-effective and efficient way to gain exposure to a wide range of assets, from stocks and bonds to commodities and real estate.

One of the key benefits of ETFs is their ability to diversify your portfolio across various sectors, industries, and asset classes. This reduces your overall risk by spreading your investments across different sources. By holding a basket of securities, ETFs mitigate the impact of any single investment’s performance on your overall portfolio.

Here are some strategies for building a diversified portfolio with ETFs:

- Invest in broad market ETFs: These ETFs track major market indices like the S&P 500 or the Nasdaq 100, providing exposure to a wide range of companies across various sectors.

- Utilize sector-specific ETFs: These ETFs allow you to target specific industries, such as technology, healthcare, or energy. By investing in sector-specific ETFs, you can capitalize on specific industry trends while diversifying your portfolio.

- Explore international ETFs: Investing in international ETFs provides access to global markets, further diversifying your portfolio and mitigating risk by exposing you to different economic cycles and growth opportunities.

- Incorporate bond ETFs: Bonds play a crucial role in diversifying portfolios by providing a hedge against equity market volatility. Bond ETFs offer exposure to various fixed-income securities, including government bonds, corporate bonds, and high-yield bonds.

- Consider commodity ETFs: Commodities such as gold, oil, and agricultural products can provide a portfolio hedge against inflation and economic uncertainty. Commodity ETFs offer a convenient way to access these assets.

When selecting ETFs for your portfolio, consider factors such as:

- Expense ratio: A lower expense ratio indicates lower management fees, which translates to higher returns for you.

- Trading volume: High trading volume ensures liquidity and allows you to buy or sell shares easily.

- Track record: Look for ETFs with a proven track record of consistent performance and strong management.

Building a diversified portfolio with ETFs is a powerful strategy for long-term investment success. It allows you to reduce risk, potentially enhance returns, and gain exposure to a wide range of investment opportunities, all within a convenient and cost-effective framework.

The Future of ETFs: Trends and Predictions

Exchange-traded funds (ETFs) have revolutionized the investment landscape, offering investors a convenient and cost-effective way to access diversified portfolios. As the ETF market continues to evolve, several exciting trends are shaping its future.

Thematic ETFs are gaining momentum, allowing investors to capitalize on specific investment themes such as technology, healthcare, or sustainable investing. These ETFs offer targeted exposure to sectors or trends that are expected to grow in the future.

ESG investing is another key trend driving ETF growth. Investors are increasingly seeking investments that align with their values, and ESG ETFs provide a way to invest in companies that prioritize environmental, social, and governance factors.

Active ETFs are also becoming more popular, challenging the traditional passive ETF model. These ETFs utilize active management strategies to generate returns, offering investors access to specialized expertise and potentially higher returns.

Blockchain technology is also making its mark on the ETF market. Blockchain-based ETFs offer greater transparency, efficiency, and security, enhancing the overall investment experience.

Looking ahead, the future of ETFs is bright. As the market matures, we can expect to see even more innovative products and services emerge. These trends will continue to democratize investing, making it more accessible and efficient for all types of investors.

ETFs for Beginners: A Step-by-Step Guide

Exchange-traded funds (ETFs) have become increasingly popular investment vehicles, offering a simple and diversified way to access the market. But for beginners, the world of ETFs can seem confusing. This guide will break down the basics of ETFs, making them accessible and understandable.

What are ETFs?

Imagine a basket filled with different stocks, bonds, or other assets. An ETF is like that basket, but instead of physical items, it holds a collection of securities that track a specific index, sector, or commodity. You can buy or sell shares of this basket on an exchange, just like you would with individual stocks.

Why Choose ETFs?

ETFs offer several benefits over traditional mutual funds:

- Lower Costs: ETFs typically have lower expense ratios than mutual funds.

- Transparency: You can see the exact holdings of an ETF, providing greater transparency.

- Flexibility: ETFs can be bought and sold throughout the trading day, offering more flexibility than mutual funds.

- Diversification: ETFs offer instant diversification across a wide range of assets, reducing risk.

How to Invest in ETFs

Investing in ETFs is straightforward:

- Choose a Broker: Select a brokerage account that allows ETF trading.

- Research and Select ETFs: Identify ETFs that align with your investment goals and risk tolerance.

- Place an Order: Buy shares of your chosen ETFs through your brokerage account.

- Monitor Your Investments: Regularly check the performance of your ETFs and adjust your portfolio as needed.

Tips for Beginners

Here are some tips for beginners entering the ETF market:

- Start Small: Begin with a small investment amount to gain experience and build confidence.

- Diversify: Don’t put all your eggs in one basket. Invest in different ETFs across various asset classes.

- Long-Term Perspective: ETFs are designed for long-term growth. Avoid trying to time the market or make short-term trades.

- Seek Professional Advice: If you’re unsure, consult a financial advisor for personalized guidance.

ETFs can be a powerful tool for building a diverse and profitable portfolio. By understanding the basics and following these steps, you can confidently navigate the ETF market and achieve your investment goals.

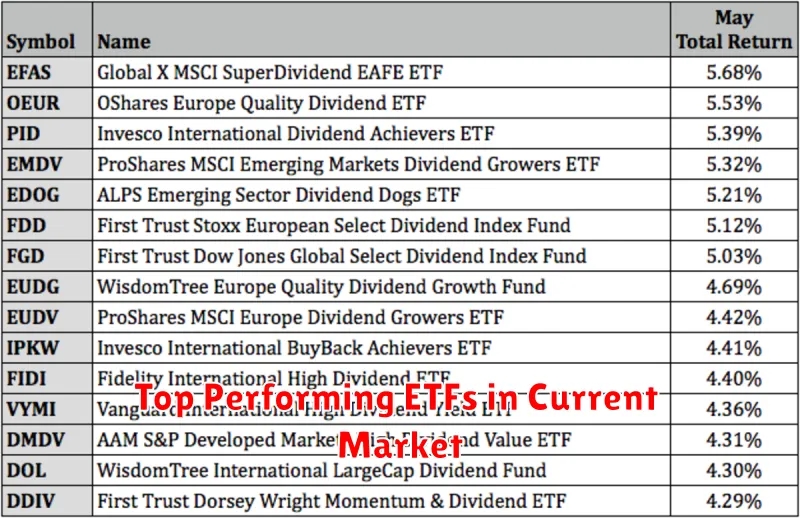

Top Performing ETFs in Current Market

Exchange-traded funds (ETFs) have become increasingly popular investment vehicles due to their diversity, flexibility, and cost-effectiveness. As the market navigates through various challenges and opportunities, identifying the top-performing ETFs can provide valuable insights for investors. This article will explore some of the leading ETFs in the current market, highlighting their strategies and potential for growth.

Sector-Specific ETFs: Sectors like technology, healthcare, and energy have exhibited robust growth in recent times. ETFs focused on these sectors, such as the Technology Select Sector SPDR Fund (XLK), Health Care Select Sector SPDR Fund (XLV), and Energy Select Sector SPDR Fund (XLE), have delivered impressive returns, reflecting the strength of these industries.

Growth-Oriented ETFs: Investors seeking to capitalize on companies with high growth potential have found success in ETFs like the Invesco QQQ Trust (QQQ) and the Vanguard Growth ETF (VUG). These ETFs track indices composed of large-cap growth companies, providing exposure to innovative and rapidly expanding businesses.

Value ETFs: Value investing focuses on companies that are undervalued by the market. ETFs like the Vanguard Value ETF (VV) and the iShares Value ETF (IVE) have provided attractive returns by targeting companies with strong fundamentals but potentially lower market valuations.

Dividend ETFs: For investors seeking regular income, dividend ETFs are an excellent choice. ETFs like the Vanguard Dividend Appreciation ETF (VIG) and the Schwab U.S. Dividend Equity ETF (SCHD) focus on companies with a history of dividend growth, providing both potential capital appreciation and consistent income streams.

It’s essential to remember that past performance is not indicative of future results. While these ETFs have performed well in the current market, their performance may vary in the future. It’s crucial to conduct thorough research, understand the underlying assets, and consider your individual investment goals before making any investment decisions.

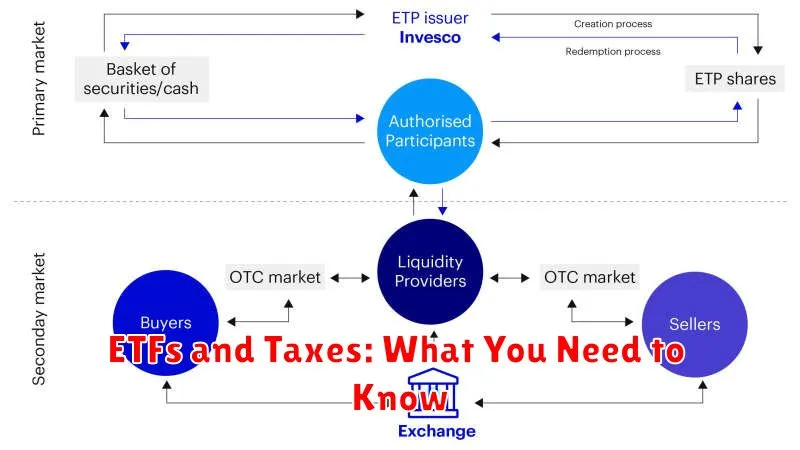

ETFs and Taxes: What You Need to Know

Exchange-traded funds (ETFs) have become increasingly popular investments, offering diversification and lower costs than traditional mutual funds. However, understanding the tax implications of investing in ETFs is crucial to maximizing your returns. This guide will help you navigate the tax landscape of ETFs and ensure you’re making informed decisions.

Capital Gains Taxes: One of the primary tax considerations for ETFs is capital gains. When you sell shares of an ETF for a profit, you realize a capital gain, which is subject to taxes. The tax rate depends on your holding period: short-term gains (held for less than a year) are taxed at your ordinary income tax rate, while long-term gains (held for over a year) are taxed at preferential rates.

Dividend Distributions: ETFs often distribute dividends to shareholders, which are also subject to taxation. The type of dividend received (ordinary or qualified) affects the tax treatment. Qualified dividends are taxed at the same rates as long-term capital gains, while ordinary dividends are taxed as ordinary income.

Tax-Loss Harvesting: ETFs allow for a tax strategy called tax-loss harvesting. This involves selling losing investments to offset capital gains and potentially reduce your overall tax liability. However, wash-sale rules restrict the ability to repurchase the same or substantially similar investments shortly after selling, so it’s essential to understand the rules before engaging in this strategy.

Tax Efficiency: ETFs are generally considered tax-efficient investments due to their low turnover rates. Lower turnover means fewer taxable events, resulting in less frequent capital gains distributions. However, the tax efficiency of individual ETFs can vary, so it’s essential to research and compare options.

Consult a Tax Professional: The complexity of ETF tax implications can vary depending on your individual circumstances. It’s always recommended to consult with a qualified tax professional to discuss your specific situation and ensure you are making informed decisions regarding your ETF investments and tax liabilities.

How to Choose the Right ETFs for Your Portfolio

Exchange-traded funds (ETFs) are popular investment vehicles that allow investors to diversify their portfolios by tracking a specific index, sector, commodity, or strategy. While ETFs offer significant benefits, choosing the right ETFs for your portfolio is crucial. Here’s a step-by-step guide to help you navigate the ETF market and make informed decisions.

1. Define Your Investment Goals and Risk Tolerance

Before investing in any ETF, it’s essential to clearly define your investment goals and risk tolerance. What are you trying to achieve with your investments? Are you looking for long-term growth, income generation, or a specific sector exposure? Understanding your objectives will guide your ETF selection process.

2. Determine Your Investment Horizon

Your investment horizon, or the time frame for your investments, is a critical factor in ETF selection. Short-term investors might favor ETFs with higher volatility and potential for quick gains, while long-term investors may prefer ETFs that offer stable returns over time.

3. Research and Analyze ETFs

Once you have defined your investment goals and risk tolerance, it’s time to research and analyze specific ETFs. Consider factors such as:

- Expense Ratio: The annual fee charged by the ETF manager. A lower expense ratio generally translates to higher returns.

- Assets Under Management (AUM): The total value of assets managed by the ETF. A higher AUM indicates the ETF’s popularity and potential for liquidity.

- Tracking Error: The difference between the ETF’s performance and the underlying index it tracks. A lower tracking error indicates a closer correlation to the benchmark.

- Performance History: Analyze the ETF’s past performance to assess its track record and risk profile.

4. Consider Diversification

Diversification is crucial for mitigating risk. Invest in a variety of ETFs across different asset classes, sectors, and geographies to reduce your exposure to any single investment.

5. Rebalance Regularly

Market fluctuations can lead to imbalances in your portfolio. Regularly rebalance your ETF holdings to maintain your desired asset allocation and ensure that your portfolio remains aligned with your investment goals.

6. Monitor and Adjust

Monitor your ETF investments regularly and adjust your portfolio as needed. Market conditions and your financial goals may change over time, requiring adjustments to your ETF strategy. Stay informed and adapt your investment approach accordingly.

Choosing the right ETFs for your portfolio is an ongoing process that requires careful consideration and research. By following these steps, you can make informed decisions and build a well-diversified portfolio that aligns with your investment goals and risk tolerance.

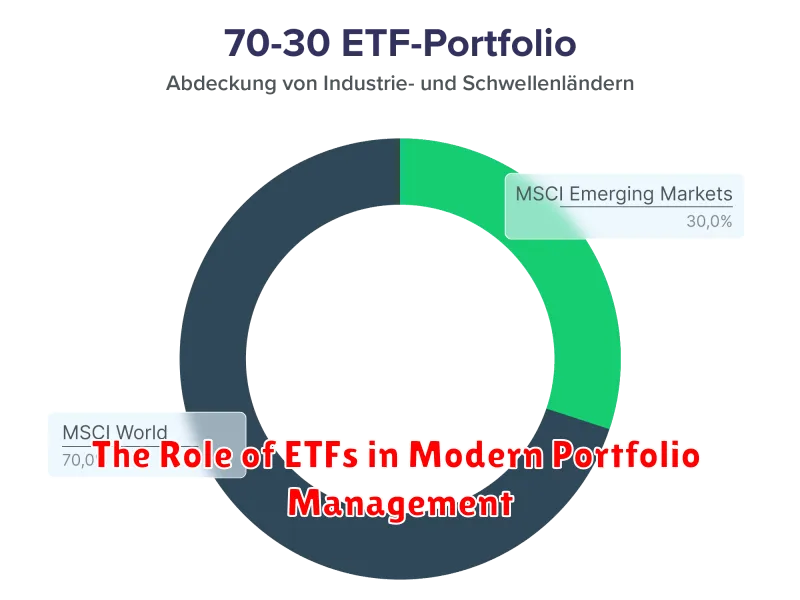

The Role of ETFs in Modern Portfolio Management

Exchange-traded funds (ETFs) have revolutionized the investment landscape, offering investors a powerful tool for portfolio management. ETFs provide an efficient and cost-effective way to gain exposure to a wide range of assets, from stocks and bonds to commodities and real estate. Their flexibility and accessibility make them an integral part of modern portfolio construction.

One of the key roles ETFs play is in diversification. ETFs allow investors to build diversified portfolios across different asset classes, sectors, and geographies with a single investment. This helps mitigate risk by spreading investments across various assets, reducing the impact of any single investment’s performance on the overall portfolio.

ETFs also facilitate strategic asset allocation. By investing in ETFs tracking specific indices or asset classes, investors can easily adjust their portfolio weights according to their investment goals and risk tolerance. This allows for a more systematic approach to portfolio management, ensuring that assets are allocated in a manner that aligns with the investor’s long-term objectives.

Moreover, ETFs offer cost efficiency. Compared to mutual funds, ETFs generally have lower expense ratios, meaning investors pay less in fees. This allows for higher returns and improved portfolio performance over time. The transparent nature of ETFs, with their underlying holdings readily available, also adds to their appeal.

In conclusion, ETFs have become an indispensable tool for modern portfolio management. Their ability to diversify, facilitate strategic asset allocation, and offer cost efficiency make them a compelling choice for investors of all levels. By understanding the benefits and features of ETFs, investors can leverage these innovative instruments to build well-diversified, cost-effective portfolios that align with their individual investment goals.