Navigating the bond market can be a complex endeavor, especially in today’s volatile economic environment. With interest rates on the rise and inflation still a concern, investors are seeking strategies to preserve their capital and generate returns. This article serves as your comprehensive guide to understanding the current bond market outlook, identifying key trends, and exploring effective investment strategies. Whether you’re a seasoned investor or just starting your journey, this article will provide valuable insights to navigate the complexities of the bond market.

The bond market plays a crucial role in the overall financial system, offering investors a way to diversify their portfolios and potentially earn steady income. However, understanding the nuances of bond investing is essential to make informed decisions. We’ll delve into the factors influencing bond yields, analyze the performance of different bond categories, and discuss strategies for managing risk and maximizing returns.

Understanding the Basics of Bond Investing

Bonds are a fundamental part of a well-diversified investment portfolio. Unlike stocks, which represent ownership in a company, bonds represent a loan you make to a borrower, such as a corporation or the government. When you buy a bond, you’re essentially lending money to the issuer, who agrees to pay you back the principal amount at a specific maturity date, along with regular interest payments, known as coupon payments.

Bonds can offer a predictable income stream, making them an attractive option for investors seeking to preserve capital and earn a steady return. However, like any investment, bonds come with risks. One of the most significant risks is interest rate risk. When interest rates rise, the value of existing bonds typically falls, as new bonds are issued with higher interest rates, making older bonds less appealing. Therefore, understanding the basics of bond investing is crucial to making informed decisions.

Key Concepts in Bond Investing:

- Face Value (Par Value): The amount the bond issuer promises to repay at maturity.

- Coupon Rate: The annual interest rate paid on the bond’s face value.

- Maturity Date: The date when the bond issuer will repay the principal amount.

- Yield: The annual return an investor can expect to receive from the bond, taking into account the coupon rate and the bond’s current market price.

Understanding these basic concepts will help you navigate the world of bond investing and make informed decisions that align with your financial goals. Remember to consult with a financial advisor for personalized advice tailored to your specific situation.

Factors Influencing Bond Market Performance

The bond market, a crucial component of the global financial system, is influenced by a complex interplay of economic, political, and market-specific factors. Understanding these factors is essential for investors seeking to navigate the bond market and make informed investment decisions.

Interest Rates: The most significant factor impacting bond prices is interest rates. When interest rates rise, existing bonds become less attractive, leading to a decline in their prices. Conversely, falling interest rates boost bond prices as investors seek higher yields. The Federal Reserve’s monetary policy plays a crucial role in determining interest rate levels.

Inflation: High inflation erodes the purchasing power of future interest payments, making bonds less appealing. Consequently, rising inflation typically leads to higher interest rates, impacting bond prices negatively. Conversely, low inflation is generally favorable for bond markets.

Economic Growth: Strong economic growth can lead to higher interest rates as businesses and consumers borrow more money. However, excessive growth can trigger inflation, which, as mentioned earlier, can have a negative impact on bond markets. Conversely, weak economic growth can lead to lower interest rates and a more favorable environment for bonds.

Government Debt: High levels of government debt can raise concerns about the government’s ability to repay its obligations. This can lead to higher interest rates on government bonds, impacting the overall bond market.

Risk Aversion: During periods of uncertainty or heightened risk aversion, investors tend to favor safer investments like government bonds, driving their prices higher. Conversely, during periods of low risk aversion, investors may seek higher returns in riskier assets, putting downward pressure on bond prices.

Market Liquidity: The ease with which bonds can be bought and sold influences their prices. High market liquidity tends to support stable bond prices, while low liquidity can lead to volatility.

Credit Ratings: The creditworthiness of bond issuers plays a significant role in bond prices. Bonds issued by companies with strong credit ratings generally offer lower yields but are considered less risky. Conversely, bonds issued by companies with weak credit ratings may offer higher yields but carry a higher risk of default.

Navigating the bond market requires a thorough understanding of these factors and their potential impact on bond prices. By carefully analyzing economic conditions, monetary policy, and market dynamics, investors can make informed decisions that align with their risk tolerance and investment goals.

Current Economic Outlook and Its Impact on Bonds

The current economic outlook is characterized by a complex interplay of factors, including persistent inflation, rising interest rates, and geopolitical uncertainties. These elements have a significant impact on the bond market, influencing both yields and investment strategies.

Inflation remains a major concern, as central banks worldwide grapple with price pressures. While inflation rates have begun to moderate in some regions, they remain elevated, prompting central banks to continue raising interest rates. This aggressive monetary policy tightening has resulted in higher yields on bonds, as investors demand a greater return to compensate for the erosion of purchasing power.

Rising interest rates have a direct impact on bond prices. As rates climb, the value of existing bonds with fixed interest payments declines. This inverse relationship between interest rates and bond prices is known as “interest rate risk.” Investors who hold bonds during periods of rising interest rates face the potential for capital losses.

Geopolitical uncertainties, such as the ongoing war in Ukraine and heightened tensions between major powers, also contribute to market volatility. These uncertainties can lead to investor risk aversion and a flight to safety, which can push bond yields lower.

In this challenging environment, investors must carefully consider the impact of the current economic outlook on their bond investment strategies.

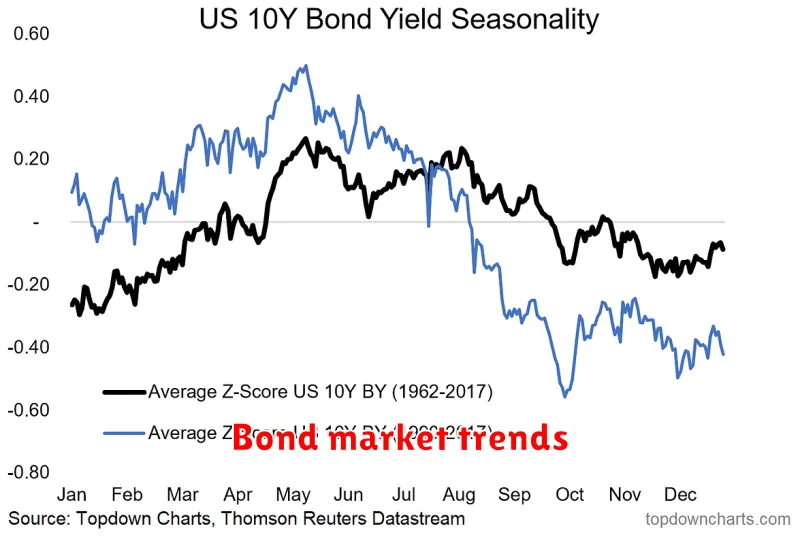

Interest Rate Trends and Bond Yields

Understanding the relationship between interest rates and bond yields is crucial for navigating the bond market. As interest rates rise, bond yields generally follow suit. This is because new bonds issued at higher rates make existing bonds with lower rates less attractive, leading to a decrease in their price. Conversely, when interest rates decline, bond yields tend to fall as well, making older bonds with higher rates more desirable.

The Federal Reserve plays a significant role in setting interest rate trends. When the Fed raises rates, it becomes more expensive for businesses and individuals to borrow money, which can slow economic growth. Conversely, lowering rates can stimulate borrowing and spending. These actions influence the overall interest rate environment and impact bond yields.

Inflation is another key factor affecting interest rates and bond yields. As inflation rises, investors demand higher returns to compensate for the erosion of their purchasing power. This often leads to increased interest rates, which in turn drive up bond yields. However, it’s important to note that high inflation can also create uncertainty in the economy, potentially leading to volatile bond markets.

In addition to these macro-economic factors, bond-specific factors also play a role in determining yields. These factors include the issuer’s creditworthiness, the maturity date, and the bond’s coupon rate. For example, bonds issued by governments with strong credit ratings tend to have lower yields compared to bonds issued by companies with weaker creditworthiness.

Analyzing Bond Market Risks and Opportunities

The bond market, a cornerstone of many investment portfolios, presents both risks and opportunities for investors. Understanding these dynamics is crucial for navigating the current environment and making informed decisions.

One significant risk is rising interest rates. As the Federal Reserve continues to raise rates to combat inflation, existing bonds become less attractive, leading to potential capital losses. Additionally, inflation itself poses a risk, eroding the purchasing power of fixed-income investments.

However, there are also opportunities within the bond market. With interest rates rising, newly issued bonds offer higher yields, potentially providing attractive returns. Short-term bonds, with their lower duration, are less sensitive to interest rate fluctuations, making them a potentially safer bet.

Diversification across different bond sectors, such as corporate bonds, government bonds, and high-yield bonds, can mitigate risk and enhance returns. Active management, with a focus on credit quality and duration, can further optimize bond portfolios.

Ultimately, navigating the bond market requires a careful assessment of both risks and opportunities. Investors should consider their investment goals, risk tolerance, and the current economic environment when making decisions. By understanding the key factors at play, investors can position themselves to capitalize on the potential rewards while managing the inherent risks.

Bond Investment Strategies for Different Time Horizons

Bonds can be a valuable part of any investment portfolio, providing diversification and income. However, choosing the right bond strategy depends on your investment goals and time horizon. Here’s a breakdown of bond strategies for different timeframes:

Short-Term (1-3 Years)

For investors with a short-term horizon, high-quality, short-term bonds are generally recommended. These bonds offer lower returns but are less volatile and less susceptible to interest rate changes. Treasury bills and money market funds are suitable options for this timeframe.

Medium-Term (3-7 Years)

Investors with a medium-term horizon have more flexibility. They can consider a blend of intermediate-term bonds, such as Treasury notes, and investment-grade corporate bonds. These bonds provide a balance between potential return and risk.

Long-Term (7+ Years)

Long-term investors can explore long-term bonds, including Treasury bonds and corporate bonds with longer maturities. These bonds have the potential for higher returns but carry higher interest rate risk. High-yield bonds, often referred to as “junk bonds,” can also be considered for a portion of a long-term portfolio as they offer higher potential returns but come with greater risk.

Key Considerations

Regardless of your time horizon, here are some essential factors to consider when crafting your bond strategy:

- Interest Rate Environment: Rising interest rates typically impact bond prices negatively. Be aware of the current economic climate and the potential for rate changes.

- Inflation: Inflation erodes the purchasing power of your investments. Consider inflation-protected bonds, like Treasury Inflation-Protected Securities (TIPS), to help mitigate inflation risk.

- Risk Tolerance: Understand your comfort level with risk. While higher-risk bonds offer potential for greater returns, they also come with the possibility of greater losses.

It’s always wise to consult with a financial advisor to create a personalized bond strategy that aligns with your specific circumstances and financial goals.

Government Bonds vs. Corporate Bonds: Understanding the Differences

The bond market offers investors a range of opportunities to generate income and diversify their portfolios. Among the most popular bond types are government bonds and corporate bonds. While both represent debt securities, they differ significantly in terms of risk, return potential, and suitability for different investors. Understanding these distinctions is crucial for making informed investment decisions.

Government bonds, also known as treasuries, are issued by national governments to finance their operations and fund various projects. The U.S. Treasury issues several types of bonds, including Treasury bills (T-bills), Treasury notes, and Treasury bonds. These bonds are considered relatively safe because they are backed by the full faith and credit of the government. As a result, government bonds typically offer lower interest rates than corporate bonds. However, they provide a relatively stable and predictable source of income.

Corporate bonds, on the other hand, are issued by companies to raise capital for expansion, acquisitions, or other business purposes. The risk associated with corporate bonds is generally higher than government bonds because the company’s financial health and ability to repay its debt are factors. Consequently, corporate bonds typically offer higher interest rates to compensate investors for taking on this additional risk.

When choosing between government and corporate bonds, it’s crucial to consider your investment goals, risk tolerance, and time horizon. Investors with a low risk tolerance and a short-term investment horizon might prefer the stability and safety of government bonds. Investors with a higher risk tolerance and a longer investment horizon might consider the potential for higher returns offered by corporate bonds.

In conclusion, understanding the key differences between government and corporate bonds is essential for making well-informed investment decisions. While government bonds offer lower returns with lower risk, corporate bonds provide the potential for higher returns but come with greater risk. Ultimately, the best choice depends on your individual investment objectives and risk appetite.

The Role of Bonds in a Diversified Portfolio

Bonds play a crucial role in a diversified portfolio by providing a balance to riskier assets like stocks. They are considered a conservative investment, offering stability and lower volatility. This makes them a vital element in a well-rounded portfolio, helping to mitigate overall risk and smooth out returns over time.

Bonds function differently from stocks, representing loans made to borrowers, such as governments or companies. Investors receive regular interest payments (coupon payments) and the principal amount (face value) at maturity. This predictable income stream is a key benefit, especially for investors seeking income and preservation of capital.

The inclusion of bonds in a portfolio provides several advantages:

- Risk Reduction: Bonds tend to move in the opposite direction of stocks, acting as a buffer during market downturns. This negative correlation helps to reduce overall portfolio volatility and protect your investments.

- Income Generation: Bonds offer consistent income through coupon payments, providing a steady stream of cash flow for investors.

- Diversification: By allocating a portion of your portfolio to bonds, you diversify your investments across different asset classes, reducing the overall risk of your portfolio.

The ideal allocation to bonds depends on various factors, such as your investment goals, risk tolerance, and time horizon. For instance, younger investors with a longer time horizon might allocate a smaller portion to bonds, while retirees with a shorter time horizon may prefer a larger bond allocation for stability.

Bond Market Outlook: Expert Predictions and Analysis

The bond market is a critical component of the global financial system, providing investors with a means to diversify portfolios and generate income. However, navigating the bond market can be challenging, particularly in today’s environment of rising interest rates and heightened inflation. Understanding the current outlook, key trends, and expert predictions can be invaluable for investors seeking to make informed decisions.

Interest Rate Expectations: The Federal Reserve has been aggressively raising interest rates to combat inflation. While the pace of rate hikes may moderate in the coming months, experts anticipate that interest rates will remain elevated for a considerable period. This implies that bond yields, which move inversely to prices, are likely to continue their upward trajectory.

Inflation and its Impact: Inflation continues to be a significant concern for investors. While inflation appears to be easing, it remains above the Fed’s target. This persistent inflationary environment makes it challenging for bond investors to predict future returns. High inflation erodes the purchasing power of fixed-income investments, making it crucial to consider inflation-protected bonds, such as Treasury Inflation-Protected Securities (TIPS).

Economic Growth and Recession Risks: The global economy is facing a multitude of challenges, including the ongoing war in Ukraine, supply chain disruptions, and persistent inflation. While some economists anticipate a recession in the near future, others believe the economy can navigate these headwinds. This uncertainty makes it difficult to assess the outlook for bond yields and credit spreads.

Investment Strategies: Given the current environment, investors may consider diversifying their portfolios with a mix of fixed-income strategies. Short-term bonds may offer some protection from rising interest rates, while high-quality corporate bonds can provide income and potential capital appreciation. Inflation-linked bonds are also a viable option for mitigating the impact of inflation.

Expert Insights: Market experts generally believe that the bond market will remain volatile in the short term. They advise investors to carefully assess their risk tolerance, investment horizon, and specific goals before making any investment decisions. Regularly reviewing and adjusting portfolio allocations based on changing market conditions is also essential.

Conclusion: The bond market is likely to continue facing challenges in the near future. However, with careful planning, informed decision-making, and a well-diversified portfolio, investors can navigate these uncertainties and potentially achieve their financial objectives.

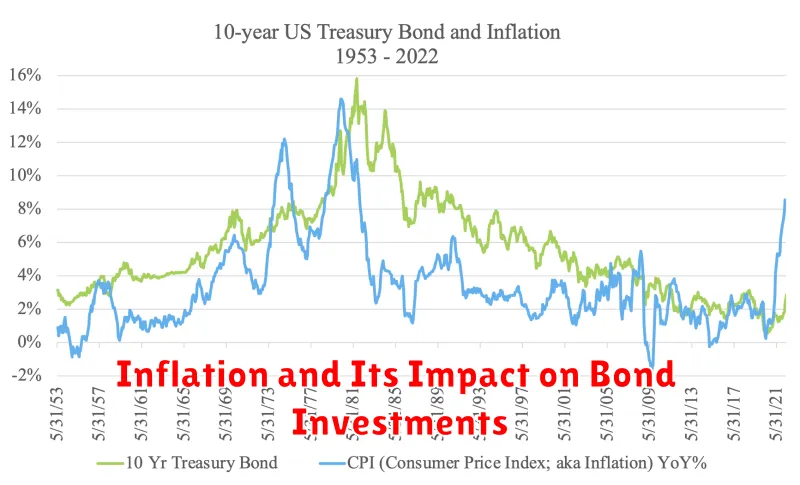

Inflation and Its Impact on Bond Investments

Inflation is a major concern for investors, particularly those holding bonds. As prices rise, the purchasing power of fixed-income investments like bonds diminishes. This is because the future cash flows promised by bonds, such as coupon payments and principal repayment, are worth less in real terms when inflation is high.

Rising interest rates are a typical response to inflation. When central banks raise interest rates to control inflation, it puts downward pressure on bond prices. This is because newly issued bonds offer higher yields, making existing bonds with lower yields less attractive.

The impact of inflation on bonds can be significant, especially for long-term bonds. Long-term bonds are more sensitive to interest rate changes than short-term bonds. If interest rates rise, the value of long-term bonds can decline more sharply.

Despite the challenges, there are strategies to mitigate the impact of inflation on bond investments. Diversification across different types of bonds, including inflation-linked bonds, can help. Shortening the duration of the bond portfolio can also reduce the sensitivity to interest rate fluctuations.

Bond Market Volatility: Managing Risk in Uncertain Times

The bond market, traditionally a haven for conservative investors seeking stability, has been experiencing a wave of volatility in recent times. This volatility is driven by a confluence of factors including rising interest rates, inflation, and geopolitical uncertainty. While this creates challenges for investors, it also presents opportunities for those who understand the dynamics of the market and employ appropriate risk management strategies.

One of the primary drivers of bond market volatility is the Federal Reserve’s aggressive interest rate hikes. As the Fed raises rates to combat inflation, bond yields increase, leading to a decline in bond prices. This inverse relationship between bond prices and yields can result in significant losses for investors, particularly for those holding longer-term bonds.

Inflation also plays a crucial role in shaping bond market dynamics. When inflation is high, investors demand higher returns to compensate for the eroding purchasing power of their investments. This leads to higher interest rates and, consequently, lower bond prices. The current inflationary environment, driven by supply chain disruptions and strong consumer demand, has added to the volatility in the bond market.

Geopolitical uncertainty, such as the ongoing conflict in Ukraine and heightened tensions between the US and China, can also impact bond market sentiment. Investors tend to seek safe haven assets, such as US Treasury bonds, during times of geopolitical instability. This increased demand for safe haven bonds can drive down yields and create volatility in the broader bond market.

Managing risk in the current volatile bond market environment requires a multifaceted approach. Investors should:

- Diversify their portfolios: Investing in a mix of bonds with different maturities, credit ratings, and sectors can help mitigate risk. This approach allows for exposure to different segments of the bond market, reducing the impact of fluctuations in any single asset class.

- Consider shorter-term bonds: Shorter-term bonds are less sensitive to interest rate changes than longer-term bonds. Investing in shorter-term bonds can help minimize potential losses during periods of rising interest rates.

- Monitor interest rate movements: Understanding the Federal Reserve’s monetary policy stance and its impact on interest rates is crucial for managing bond market risk. Investors should closely monitor interest rate trends and adjust their portfolios accordingly.

- Seek professional advice: Consulting with a financial advisor experienced in bond market investments can provide valuable guidance on managing risk and navigating market volatility.

While the current bond market environment presents challenges, it also offers opportunities for investors who understand the dynamics at play. By employing effective risk management strategies, investors can navigate the volatility and potentially reap the rewards of a diversified bond portfolio.

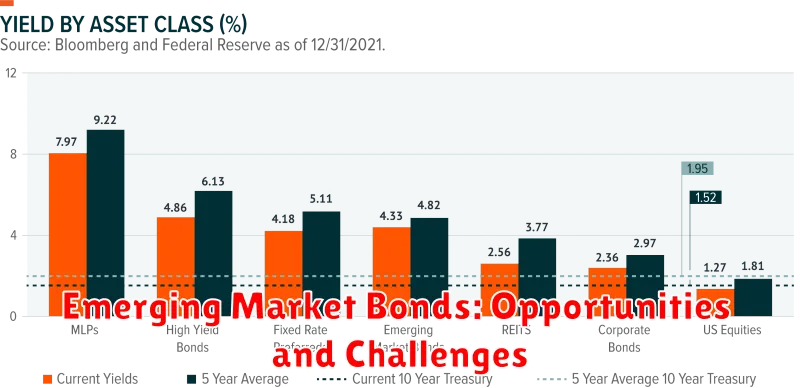

Emerging Market Bonds: Opportunities and Challenges

Emerging market bonds offer investors a compelling opportunity to diversify their portfolios and potentially enhance returns. These bonds, issued by governments and corporations in developing economies, can provide exposure to fast-growing regions with higher growth potential compared to developed markets. However, investing in emerging market bonds also comes with its share of challenges and risks.

Opportunities:

- Higher Yields: Emerging market bonds typically offer higher yields than developed market bonds due to a combination of factors, including higher inflation, currency risk, and potential for higher growth.

- Diversification: Emerging market bonds can help diversify a portfolio by providing exposure to different countries and sectors, reducing overall portfolio risk.

- Growth Potential: Emerging markets are characterized by rapid economic expansion, infrastructure development, and rising consumer spending, which can translate into strong bond performance.

Challenges:

- Currency Risk: Fluctuations in emerging market currencies can impact the value of bond holdings, potentially leading to losses.

- Political and Economic Instability: Emerging markets can be more susceptible to political and economic instability, which can affect the creditworthiness of bond issuers.

- Liquidity Risk: Emerging market bonds can be less liquid than developed market bonds, making it challenging to buy or sell them quickly.

- Credit Risk: Emerging market bonds may have higher credit risk compared to developed market bonds, as some issuers may have weaker credit ratings.

Investment Strategies:

Investing in emerging market bonds requires a well-defined strategy. Investors should consider factors such as:

- Risk Tolerance: Emerging market bonds are generally riskier than developed market bonds, so investors should assess their risk tolerance before investing.

- Investment Horizon: Emerging market bonds can be more volatile in the short term, but they may offer higher returns over the long term.

- Diversification: Spreading investments across different emerging markets and sectors can mitigate risk.

- Professional Expertise: Seeking advice from experienced investment professionals who specialize in emerging markets can be helpful.

Emerging market bonds present a unique investment opportunity for those seeking diversification, higher yields, and exposure to fast-growing regions. However, investors should carefully assess the associated risks and develop a well-informed strategy to navigate this challenging yet potentially rewarding asset class.