Are you looking for expert insights and predictions to help you navigate the unpredictable stock market? If so, you’ve come to the right place. The stock market is a complex and ever-changing landscape, and it can be difficult to know where to turn for reliable advice. That’s why we’ve compiled a list of the top stock market analysts to follow for their expertise and insights. These analysts have a proven track record of success, and they offer valuable perspectives that can help you make informed investment decisions.

From seasoned veterans to rising stars, these stock market analysts provide a wealth of knowledge and insights. Whether you’re a seasoned investor or just starting out, these experts can help you stay ahead of the curve. Get ready to gain access to expert analysis, market predictions, and investment strategies that can help you make the most of your portfolio. So, let’s dive in and discover the top stock market analysts you should be following.

The Role of Stock Market Analysts

Stock market analysts play a crucial role in the financial world by providing insights and predictions about the stock market. They are experts who delve into financial data, company performance, and economic trends to assess the potential value of individual stocks and the overall market. Their primary responsibility is to provide investors with valuable information that can guide investment decisions.

Fundamental analysts focus on a company’s financial statements, industry dynamics, and management quality to determine its intrinsic value. They aim to identify undervalued stocks with strong potential for growth. On the other hand, technical analysts study historical price and volume data to identify patterns and trends. They use charts and indicators to predict future price movements, often relying on mathematical models and statistical analysis.

Stock market analysts can work for various entities, including:

- Brokerage firms: Provide investment recommendations to clients.

- Investment banks: Conduct research for institutional investors.

- Hedge funds: Manage portfolios and make trading decisions.

- Independent research firms: Offer unbiased analysis and reports.

The insights and predictions provided by stock market analysts are valuable for both individual and institutional investors. By leveraging their expertise, investors can make informed decisions about where to allocate their capital, maximize returns, and mitigate risks.

Factors to Consider When Evaluating Analysts

Navigating the stock market can be daunting, especially for novice investors. Seeking guidance from stock market analysts can provide valuable insights and predictions, but it’s crucial to choose the right experts. To make informed decisions, consider these key factors when evaluating analysts:

Track Record and Accuracy: A strong track record is essential. Look for analysts with proven success in predicting market trends and providing accurate recommendations. Analyze their past performance, including their accuracy rate, return on investment, and consistency over time. Websites like TipRanks and Bloomberg provide data on analyst ratings and performance.

Expertise and Industry Knowledge: Analysts should possess deep knowledge and understanding of the industries and companies they cover. Consider their educational background, professional experience, and relevant certifications. Research their areas of specialization and assess their expertise in specific sectors or asset classes.

Objectivity and Transparency: Analysts should provide unbiased and transparent information. Be wary of analysts with potential conflicts of interest, such as holding positions in the companies they recommend. Look for analysts who disclose their investment strategies, methodology, and potential biases.

Communication Style and Accessibility: Effective communication is vital. Choose analysts who can explain complex financial concepts clearly and concisely. Consider their communication style, whether through reports, articles, podcasts, or video content. Look for analysts who are accessible and responsive to questions.

Research and Analysis: Analysts should provide thorough research and analysis to support their recommendations. Examine their research reports, including their sources, data, and rationale for their conclusions. Evaluate the depth and quality of their analysis and their ability to identify key drivers of investment performance.

Top Stock Market Analysts by Reputation and Track Record

Navigating the stock market can be a daunting task, even for seasoned investors. To gain a competitive edge, many investors turn to the expertise of stock market analysts. These individuals provide valuable insights, predictions, and recommendations based on their extensive research and analysis.

While numerous analysts exist, some stand out due to their exceptional reputation and track record. These individuals have consistently delivered accurate forecasts and insightful analysis, earning them the trust and respect of investors and peers alike. Here are some of the top stock market analysts by reputation and track record:

Top Analysts by Reputation and Track Record

1. [Analyst Name]: Known for [brief description of analyst’s expertise and specific achievements]. They are often quoted in major publications and are a respected voice in the market.

2. [Analyst Name]: Known for [brief description of analyst’s expertise and specific achievements]. Their focus on [mention specific area of expertise] has earned them a strong following among investors.

3. [Analyst Name]: Known for [brief description of analyst’s expertise and specific achievements]. They have a proven track record of identifying undervalued stocks and have a knack for predicting market trends.

Where to Find Analyst Ratings and Recommendations

Analyst ratings and recommendations can be a valuable resource for investors, offering insights and predictions from experienced professionals. However, finding reliable and unbiased information can be challenging. Here are some of the top places to find analyst ratings and recommendations:

Financial News Websites

Many reputable financial news websites, such as Bloomberg, Reuters, and The Wall Street Journal, provide analyst ratings and recommendations for a wide range of stocks. These websites often offer detailed reports, including price targets, earnings estimates, and analyst commentary.

Brokerage Platforms

Most online brokerage platforms, like TD Ameritrade, E*TRADE, and Charles Schwab, provide analyst ratings and recommendations for their clients. These platforms typically integrate the ratings into their research tools and allow users to filter stocks by analyst sentiment.

Dedicated Analyst Research Platforms

Specialized platforms, like Morningstar, Seeking Alpha, and TipRanks, focus exclusively on providing analyst ratings and research. These platforms often offer a more comprehensive view of analyst opinions, including consensus ratings, price targets, and historical performance.

Company Websites

Many companies publish analyst ratings and recommendations on their investor relations websites. This information is often available in the “News & Events” or “Investor Relations” sections of the company’s website.

Remember that analyst ratings and recommendations should be considered one piece of the puzzle when making investment decisions. It’s essential to conduct your own research, assess the analyst’s track record, and consider various factors before making any investment choices.

Understanding Different Analytical Approaches

Navigating the stock market successfully often relies on understanding different analytical approaches. While there’s no single guaranteed path to success, combining various perspectives can be highly beneficial. Here are some popular approaches used by top analysts:

Fundamental Analysis

This method focuses on evaluating the intrinsic value of a company. Analysts look at factors like financial statements, management quality, industry trends, and competitive landscape. If the company’s intrinsic value is higher than its current market price, it could be considered a good investment opportunity.

Technical Analysis

This approach studies price and volume data to identify patterns and trends. Analysts use charts, indicators, and other tools to predict future price movements. It’s based on the idea that market sentiment and past price behavior can offer insights into potential future moves.

Quantitative Analysis

Also known as quant analysis, this approach uses mathematical models and statistical techniques to identify investment opportunities. Analysts employ algorithms and data-driven methods to analyze large datasets and identify patterns that might not be apparent to human observation.

Behavioral Finance

This field recognizes the impact of human psychology on financial decision-making. Analysts consider factors like investor sentiment, cognitive biases, and herd behavior. Understanding these psychological influences can help investors make more informed decisions.

Remember, no single approach is perfect. Successful investors often integrate multiple analytical methods to create a well-rounded investment strategy.

The Importance of Independent Research

While seeking advice from top stock market analysts can provide valuable insights, it’s crucial to remember that independent research is the cornerstone of informed investment decisions. Relying solely on analyst recommendations can lead to biases and potentially misleading information.

Independent research empowers you to critically evaluate analyst opinions, understand the underlying fundamentals of companies and industries, and make well-informed decisions based on your own analysis. It allows you to develop a deeper understanding of market dynamics, identify potential risks and opportunities, and form your own investment strategy.

Conducting independent research involves:

- Analyzing financial statements and company reports

- Investigating industry trends and competitive landscapes

- Reading industry publications and market research

- Evaluating economic data and geopolitical factors

Remember, independent research is an ongoing process, requiring continuous learning, critical thinking, and a willingness to adapt your strategies based on new information. While expert insights are valuable, ultimately, the responsibility for your investment decisions lies with you.

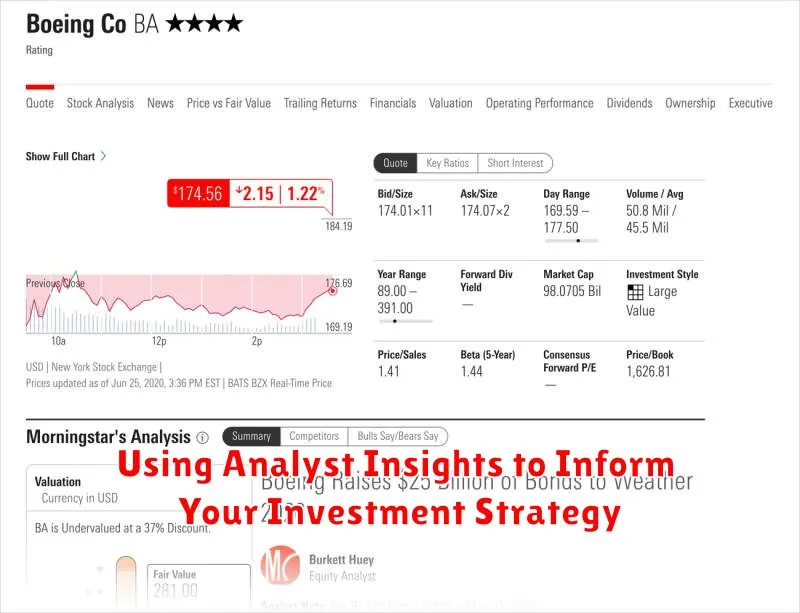

Using Analyst Insights to Inform Your Investment Strategy

In the dynamic world of the stock market, navigating the choppy waters of investment decisions can be a daunting task. However, armed with the right information, you can make informed choices that propel your portfolio towards success. Analyst insights serve as a valuable compass, guiding you through the complexities of the market and offering valuable perspectives on potential investment opportunities.

By following the recommendations of reputable analysts, you gain access to a wealth of knowledge and experience. These experts spend countless hours researching companies, analyzing financial data, and dissecting industry trends. Their insights provide a nuanced understanding of market dynamics, enabling you to make more informed decisions about which stocks to buy, sell, or hold.

However, it is crucial to remember that analysts are not infallible. Their predictions are not guarantees of future performance. Instead, use their insights as a starting point for your own research. Consider their rationale, analyze their track records, and compare their perspectives with other analysts and your own due diligence. This multi-faceted approach fosters a well-rounded understanding of the investment landscape, empowering you to make well-informed decisions.

Remember, the ultimate goal is to develop a sound investment strategy that aligns with your financial goals and risk tolerance. Analyst insights are valuable tools, but they should not replace your own critical thinking and careful consideration. By combining expert knowledge with your own analysis, you can navigate the stock market with greater confidence and clarity.

Following Analyst Predictions: Proceed with Caution

While it’s tempting to rely on the expertise of stock market analysts for investment guidance, it’s crucial to approach their predictions with a healthy dose of caution. While analysts can offer valuable insights and perspectives, their predictions are not foolproof, and relying solely on them can lead to poor investment decisions.

Here are some key reasons to exercise caution when following analyst predictions:

- Past performance is not indicative of future results. Just because an analyst has been right in the past doesn’t guarantee their future success. Market conditions are constantly changing, and what worked yesterday may not work tomorrow.

- Analysts can have biases. Every analyst has their own unique perspective and may be influenced by factors such as their firm’s interests or personal beliefs.

- Predictions are subject to interpretation. Even when analysts agree on a particular prediction, their interpretations and recommendations may vary widely.

- Market volatility can derail even the best predictions. Unexpected events, such as economic downturns, natural disasters, or political instability, can significantly impact market performance and render even the most accurate predictions obsolete.

Instead of blindly following analyst predictions, consider them as one piece of the puzzle. Conduct your own research, analyze market trends, and consult with a financial advisor to develop a well-rounded investment strategy. Remember, the ultimate responsibility for your investments lies with you.

Developing Your Own Market Understanding

While following top stock market analysts can provide valuable insights and predictions, developing your own market understanding is crucial for making informed investment decisions. Here are some steps to cultivate your own market savvy:

1. Understand Fundamental Analysis: Delve into the financial health of companies you’re interested in. Analyze their revenue, earnings, debt levels, and other key metrics. Explore their industry dynamics and competitive landscape.

2. Master Technical Analysis: Learn to interpret charts and patterns to identify trends and predict future price movements. Explore indicators like moving averages, Bollinger Bands, and MACD to gain insights.

3. Stay Informed about Macroeconomic Factors: Keep abreast of global economic trends, interest rates, inflation, and geopolitical events. These factors significantly impact market sentiment and stock prices.

4. Develop a Disciplined Investment Approach: Establish a clear investment strategy, whether it’s value investing, growth investing, or a hybrid approach. Stick to your plan and avoid impulsive decisions based solely on short-term market fluctuations.

5. Continuous Learning: The market is constantly evolving, so continuous learning is essential. Read industry publications, attend webinars, and engage in discussions with other investors to stay ahead of the curve.

Remember, building your own market understanding takes time and effort, but the rewards of making informed and confident investment decisions are well worth it. By combining the insights from top analysts with your own research and analysis, you can navigate the stock market with greater clarity and success.

The Value of Diversified Opinions

The stock market is a complex and unpredictable beast. There are countless factors that can impact the value of stocks, making it difficult to predict future movements. This is why it is crucial to seek out expert opinions from a variety of sources. Following a diverse group of stock market analysts provides a well-rounded perspective and helps you make informed investment decisions.

While some analysts may focus on specific sectors or industries, others may have a broader outlook on the market as a whole. By listening to multiple voices, you gain access to different viewpoints, strategies, and predictions. This diversity of opinions is invaluable for identifying potential risks and opportunities that you might otherwise miss.

It’s important to remember that even the most experienced analysts can make mistakes. No single analyst holds all the answers. By considering a range of perspectives, you can mitigate the risk of relying on a single source and gain a more accurate understanding of the market dynamics. This allows you to develop a more nuanced investment strategy, increasing your chances of success in the long run.