Navigating the world of cryptocurrencies can be daunting, especially for new investors. With so many exchanges vying for your attention, choosing the right platform for secure and profitable trading is crucial. This Ultimate Guide to the Best Cryptocurrency Exchanges for Secure Trading will provide you with the information you need to make informed decisions and ensure your digital assets are in safe hands.

We will dive into the key features to consider when choosing a cryptocurrency exchange, exploring factors like security protocols, trading fees, user interface, and available cryptocurrencies. From beginner-friendly options to advanced trading platforms, we’ll uncover the top exchanges that cater to diverse needs and experience levels. Whether you’re a seasoned trader or just starting your crypto journey, this comprehensive guide will equip you with the knowledge to select the most suitable exchange for your secure and rewarding trading experience.

Key Features of a Reputable Exchange

In the exciting world of cryptocurrency trading, choosing the right exchange is paramount. A reputable exchange provides a secure and trustworthy platform for buying, selling, and trading cryptocurrencies. Here are some key features to look for when selecting a reputable exchange:

Security is of utmost importance. Look for exchanges with robust security measures like two-factor authentication (2FA), cold storage for a significant portion of their assets, and a proven track record of protecting user funds.

Regulation and Compliance play a crucial role in building trust. Choose exchanges that are licensed and regulated by reputable authorities. This indicates that they adhere to industry standards and are subject to scrutiny.

User Interface and Experience are essential for a smooth trading experience. Look for exchanges with intuitive platforms that are easy to navigate, even for beginners. A responsive customer support team is also a valuable asset.

Fees can significantly impact your profits. Compare fees for trading, deposits, and withdrawals to find exchanges with competitive pricing. Ensure you understand the fee structure before trading.

Trading Volume and Liquidity are crucial factors for successful trading. Exchanges with high trading volume and ample liquidity provide better price stability and execution speed.

Asset Availability is important if you’re looking for specific cryptocurrencies. Make sure the exchange offers the coins and tokens you want to trade.

Reputation and Reviews can provide valuable insights into an exchange’s trustworthiness. Read reviews from other users and research the exchange’s history and any past incidents.

By prioritizing these key features, you can significantly increase your chances of finding a reputable cryptocurrency exchange that meets your trading needs and safeguards your assets.

Top Cryptocurrency Exchanges in the Market

The world of cryptocurrency is vast and ever-evolving, with numerous platforms offering trading opportunities. However, choosing the right cryptocurrency exchange is crucial for a safe and secure trading experience. To help you navigate this exciting landscape, we’ve compiled a list of the top exchanges in the market, each excelling in specific areas.

1. Binance

Binance stands as the undisputed champion in terms of trading volume and user base. Its extensive selection of cryptocurrencies, lightning-fast execution speeds, and user-friendly interface make it a favorite among seasoned traders and beginners alike. Binance offers a comprehensive suite of features, including spot trading, margin trading, futures trading, and even its own native blockchain.

2. Coinbase

Coinbase is renowned for its user-friendly platform and robust security measures, making it a go-to choice for those new to cryptocurrency. Its intuitive interface and straightforward buying and selling processes make it easy to get started. Coinbase also boasts a strong regulatory framework, ensuring a secure trading environment.

3. Kraken

For advanced traders seeking a platform with advanced charting tools, a wide range of trading pairs, and excellent liquidity, Kraken is the ideal choice. It’s known for its professional-grade features, robust security, and commitment to compliance. Kraken also offers margin trading and futures trading options.

4. KuCoin

KuCoin shines with its diverse selection of cryptocurrencies, including lesser-known and emerging altcoins. Its competitive fees, fast transaction speeds, and active community make it a popular destination for those looking to explore the broader crypto ecosystem.

5. Gemini

Gemini is renowned for its focus on security and regulatory compliance. Its user-friendly interface, robust security features, and commitment to transparency make it a trusted platform for both novice and experienced traders. Gemini also offers a range of services, including spot trading, margin trading, and custodial solutions.

Ultimately, the best cryptocurrency exchange for you depends on your individual needs and preferences. Consider factors such as fees, security, user interface, available trading pairs, and regulatory compliance when making your decision.

Security Measures to Look For

When choosing a cryptocurrency exchange, security should be your top priority. Here are some key security measures to look for:

- Two-Factor Authentication (2FA): This adds an extra layer of security by requiring you to enter a code from your phone or email in addition to your password when logging in.

- Cold Storage: This refers to storing the majority of the exchange’s cryptocurrency offline, making it inaccessible to hackers.

- Multi-Signature Wallets: This requires multiple individuals to approve transactions, adding an extra layer of security.

- Regular Security Audits: Reputable exchanges should undergo regular independent security audits to identify and fix vulnerabilities.

- Encryption: The exchange should use strong encryption to protect your personal data and transactions.

- Insurance: Some exchanges offer insurance to protect users in case of a hack or other security breach.

- KYC/AML Compliance: Look for exchanges that comply with Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations, which helps prevent fraud and money laundering.

Always research the security practices of any exchange you’re considering before depositing your funds.

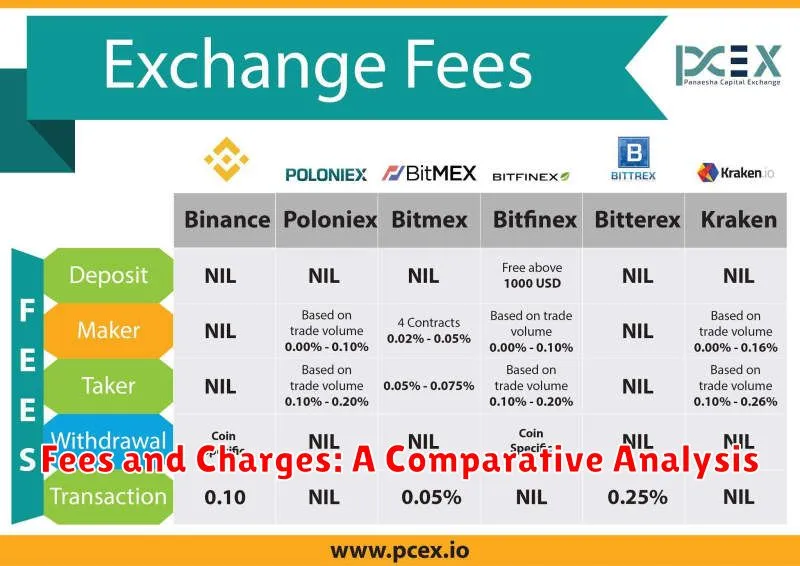

Fees and Charges: A Comparative Analysis

Navigating the world of cryptocurrency exchanges can be overwhelming, especially when considering the various fees associated with trading. Understanding these fees is crucial for maximizing your returns and minimizing unnecessary expenses. This section will provide a comprehensive analysis of the fee structures employed by leading cryptocurrency exchanges, enabling you to make informed decisions about where to trade.

Exchanges typically charge fees for two main activities: trading and withdrawals. Trading fees are charged on every buy or sell order, and they usually vary depending on the trading volume, payment method, and the specific cryptocurrency pair involved. Some exchanges charge a flat fee per trade, while others employ a tiered fee structure where the fee decreases as your trading volume increases.

Withdrawal fees are charged when you transfer your cryptocurrency from the exchange to an external wallet. These fees often vary based on the specific cryptocurrency and the withdrawal method. Some exchanges may offer free withdrawals for certain cryptocurrencies, while others may charge a fixed fee.

It is essential to consider the combined impact of trading and withdrawal fees when choosing an exchange. Some exchanges may have lower trading fees but higher withdrawal fees, while others offer the opposite. Ultimately, the best exchange for you will depend on your individual trading volume, preferred cryptocurrencies, and withdrawal frequency.

Here’s a breakdown of the fee structures of some popular exchanges:

- Binance: Binance is known for its low trading fees, with a tiered structure starting at 0.1%. They also offer a “Binance Coin” (BNB) discount, where users can pay fees in BNB to receive a 25% discount.

- Coinbase: Coinbase offers a straightforward fee structure, typically charging a flat percentage fee for each trade. They also offer a “Coinbase Pro” platform with lower fees for experienced traders.

- Kraken: Kraken is known for its competitive trading fees, which are typically lower than those charged by other major exchanges. They also offer a tiered fee structure for high-volume traders.

Before choosing an exchange, carefully research and compare their fee structures. Remember to factor in both trading and withdrawal fees to make an informed decision that optimizes your profitability.

Trading Options and Order Types

Cryptocurrency exchanges offer a variety of trading options and order types to cater to different trading styles and strategies. Understanding these options is crucial for maximizing your trading efficiency and managing risk.

Order Types

- Market Order: This is the most basic order type, where you buy or sell an asset at the best available price in the market. This is generally the fastest way to execute a trade but you might not get the exact price you want.

- Limit Order: With a limit order, you set a specific price at which you’re willing to buy or sell an asset. This allows you to control your entry and exit points, but it may take longer to execute, especially if the market price doesn’t reach your specified limit.

- Stop-Limit Order: This combines elements of both market and limit orders. You set a stop price and a limit price. When the market price hits your stop price, a limit order is triggered to buy or sell at your specified limit price. This allows you to manage risk by limiting losses or capturing profits.

Trading Options

- Spot Trading: This is the most common form of cryptocurrency trading, where you buy or sell digital assets at their current market price for immediate delivery.

- Margin Trading: This allows you to borrow funds from the exchange to amplify your trading position and potentially increase your profits. However, it also increases your risk, as losses can be amplified as well.

- Futures Trading: Futures contracts allow you to lock in a price for a cryptocurrency at a future date. This can be used to hedge against price fluctuations or speculate on price movements.

- Options Trading: Options give you the right, but not the obligation, to buy or sell a cryptocurrency at a specific price within a specified timeframe. This can be used to manage risk or speculate on volatility.

Choosing the right trading options and order types depends on your individual trading goals, risk tolerance, and market conditions. It’s essential to do your research and understand the nuances of each option before using them in your trading strategy.

User Experience and Interface

When choosing a cryptocurrency exchange, user experience (UX) and interface (UI) are crucial aspects to consider. A user-friendly platform can make your trading journey smoother, more enjoyable, and less prone to errors. Look for exchanges that offer the following:

- Intuitive Navigation: The platform should be easy to navigate, with clear menus and intuitive layout. Finding the features you need should be a breeze.

- Responsive Design: The exchange should be accessible on various devices, including desktops, laptops, tablets, and smartphones. A responsive design ensures consistency and ease of use across different platforms.

- Clear Charts and Data: Visualizing market data is essential for making informed trading decisions. The exchange should offer clear and customizable charts, as well as detailed order books and trading history.

- User-Friendly Order Placement: Placing orders should be straightforward. The interface should provide clear instructions and options for different order types (market, limit, stop-loss, etc.).

- Security Features: The exchange should prioritize security and offer features like two-factor authentication (2FA), cold storage for digital assets, and regular security audits.

- Customer Support: Reliable customer support is vital in case of issues or questions. Look for exchanges with responsive and helpful support channels, such as live chat, email, and phone.

By prioritizing these UX and UI factors, you can find a cryptocurrency exchange that aligns with your trading style and preferences, ultimately enhancing your overall trading experience.

Customer Support and Reviews

Customer support is critical when choosing a cryptocurrency exchange. You need to be confident that you can get help quickly and easily if you encounter any problems. Look for exchanges that offer 24/7 support through multiple channels, such as live chat, email, and phone. Consider reading reviews from other users to get an idea of the quality of customer service.

Reviews can provide valuable insights into an exchange’s reputation and reliability. Look for reviews on websites like Trustpilot and Reddit, and pay attention to both positive and negative feedback. Also, check the exchange’s rating on independent review websites like CoinMarketCap and CoinGecko.

Remember, a good customer support team is essential for a seamless and secure trading experience. By carefully evaluating customer support and reviews, you can increase your chances of finding a trustworthy and reliable cryptocurrency exchange.

Choosing the Right Exchange for Your Needs

Navigating the world of cryptocurrency exchanges can be overwhelming, with a plethora of options vying for your attention. But fear not, finding the perfect exchange for your specific needs doesn’t have to be a daunting task. Let’s break down the key factors to consider when making this crucial decision:

Supported Cryptocurrencies: The first and foremost consideration is whether the exchange supports the cryptocurrencies you intend to trade. Some exchanges specialize in a limited range of assets, while others offer a vast selection. Consider your trading goals and research the available coins on each platform.

Fees and Trading Costs: Trading fees can significantly impact your profits, so carefully analyze the fee structure of different exchanges. Look for transparency in their fee breakdown, including trading fees, deposit fees, and withdrawal fees. Compare various fee models, such as flat fees, tiered fees, and maker/taker fees, to find the most cost-effective option.

Security Measures: Security should be paramount when choosing a cryptocurrency exchange. Look for platforms that prioritize robust security features like two-factor authentication (2FA), cold storage for digital assets, and regular security audits. It’s also wise to research the exchange’s history and reputation for handling security breaches.

User Interface and Experience: A user-friendly interface and intuitive navigation are essential for a smooth trading experience. Explore different platforms and assess their interface design, ease of use, and available educational resources. Consider features like charting tools, order types, and mobile app availability.

Customer Support: Reliable customer support is crucial when navigating technical issues or facing any problems. Research the exchange’s responsiveness, availability of different support channels (live chat, email, phone), and the quality of their customer service.

Regulation and Compliance: Choosing a regulated exchange adds an extra layer of security and assurance. Verify if the platform operates under a reputable regulatory framework and complies with industry standards. Regulatory oversight helps ensure fair trading practices and consumer protection.

By considering these factors and carefully evaluating each exchange, you can find the perfect platform to suit your cryptocurrency trading needs. Remember, your choice of exchange plays a significant role in your overall trading experience and can impact your profitability and security. Research diligently, compare options, and make an informed decision to ensure a safe and successful journey in the world of cryptocurrencies.

Tips for Secure Cryptocurrency Trading

Trading cryptocurrencies can be a lucrative venture, but it also comes with its fair share of risks. Security is paramount when navigating the world of digital assets, and taking the right precautions can safeguard your investments. Here are some essential tips for secure cryptocurrency trading:

1. Use a Reputable Exchange: Choose an exchange with a proven track record of security, regulatory compliance, and robust security measures. Look for platforms that offer two-factor authentication (2FA), cold storage for a majority of their assets, and have implemented measures to protect against hacks and other security threats.

2. Enable Two-Factor Authentication (2FA): 2FA adds an extra layer of protection by requiring you to enter a unique code generated by an authenticator app or sent to your phone in addition to your password. This significantly reduces the risk of unauthorized access to your account.

3. Secure Your Device: Ensure your trading device is protected with strong passwords, antivirus software, and a firewall. Avoid using public Wi-Fi networks for trading, as they are more susceptible to hacking.

4. Be Cautious of Phishing Scams: Scammers often target cryptocurrency users with phishing emails, websites, and social media messages that mimic legitimate exchanges or platforms. Be wary of suspicious links and never share your private keys or login credentials with anyone.

5. Protect Your Private Keys: Your private keys are essential for accessing your cryptocurrencies. Keep them safe and secure, preferably stored offline in a hardware wallet. Avoid sharing them with anyone and never save them in a text file on your computer.

6. Stay Informed: The cryptocurrency world is constantly evolving. Stay up-to-date with the latest security threats and best practices. Subscribe to reputable security blogs and forums, and be aware of potential vulnerabilities.

7. Diversify Your Investments: Don’t put all your eggs in one basket. Spread your investments across different cryptocurrencies and exchanges to mitigate risk. Diversification can help protect your portfolio against market volatility and unexpected events.

8. Consider Hardware Wallets: Hardware wallets are physical devices that store your private keys offline, providing an extra layer of security against hacking and theft. They are considered the most secure way to store your cryptocurrency.

9. Use Strong Passwords: Create strong and unique passwords for each of your cryptocurrency accounts. Avoid using easily guessable information and use a password manager to help you keep track of them.

By following these tips, you can significantly improve your cryptocurrency trading security and minimize the risks associated with this dynamic and often volatile market. Remember, a proactive approach to security is essential for a safe and successful trading experience.