Are you looking to dive into the exciting world of trading but feeling overwhelmed by the sheer number of platforms available? Don’t worry, you’re not alone! Choosing the right trading platform is crucial for a successful and enjoyable trading journey. This comprehensive guide will equip you with the knowledge and insights to make an informed decision, comparing the top contenders based on key factors like user interface, trading tools, fees, and security. Whether you’re a seasoned investor or a curious beginner, this comparison will help you find the perfect platform to match your needs and goals.

From mobile-first trading apps to powerful desktop platforms, this guide covers the best options for both beginners and experienced traders. We’ll explore the pros and cons of each platform, highlighting their unique features and helping you understand which one is best suited for your trading style. So, buckle up and get ready to discover the best trading platforms in the market, allowing you to confidently navigate the world of investments and reach your financial aspirations.

Key Features to Consider When Choosing a Platform

Choosing the right trading platform is crucial for success in the financial markets. With so many options available, it can be overwhelming to decide which one is best for you. To help you navigate this decision, here are some key features to consider:

Trading Platform Type:

- Web-based Platforms: Accessible through a web browser, these platforms are convenient but may have limited features.

- Desktop Platforms: Offer more advanced features and customization options but require downloading and installing software.

- Mobile Platforms: Provide on-the-go trading capabilities but may have limited functionality compared to desktop versions.

Trading Instruments:

- Stocks: Equities of publicly traded companies.

- Futures: Contracts to buy or sell an asset at a specific price on a future date.

- Options: Contracts that give the holder the right, but not the obligation, to buy or sell an asset at a specific price.

- Cryptocurrencies: Digital currencies that operate independently of central banks.

- Forex: Trading of currencies.

Order Types:

- Market Orders: Execute trades at the current market price.

- Limit Orders: Specify the price at which you want to buy or sell, ensuring you don’t pay more or sell for less than your desired price.

- Stop Orders: Trigger a trade when the market reaches a specific price, used to limit losses or lock in profits.

Fees and Commissions:

- Trading Fees: Charged per trade or based on volume.

- Inactivity Fees: Charged if you don’t trade for a certain period.

- Withdrawal Fees: Charged when transferring funds out of your account.

Research and Analytics:

- Charting Tools: Visualize market data to identify patterns and trends.

- Technical Indicators: Provide insights based on historical price data.

- Fundamental Data: Company financials and news, helping you understand a company’s performance.

Customer Support:

- Availability: 24/7 support is ideal, especially for international traders.

- Response Time: Timely responses are crucial for resolving issues quickly.

- Communication Channels: Phone, email, and live chat are common support options.

By considering these key features, you can choose a trading platform that aligns with your individual trading needs and preferences, enhancing your chances of success in the financial markets.

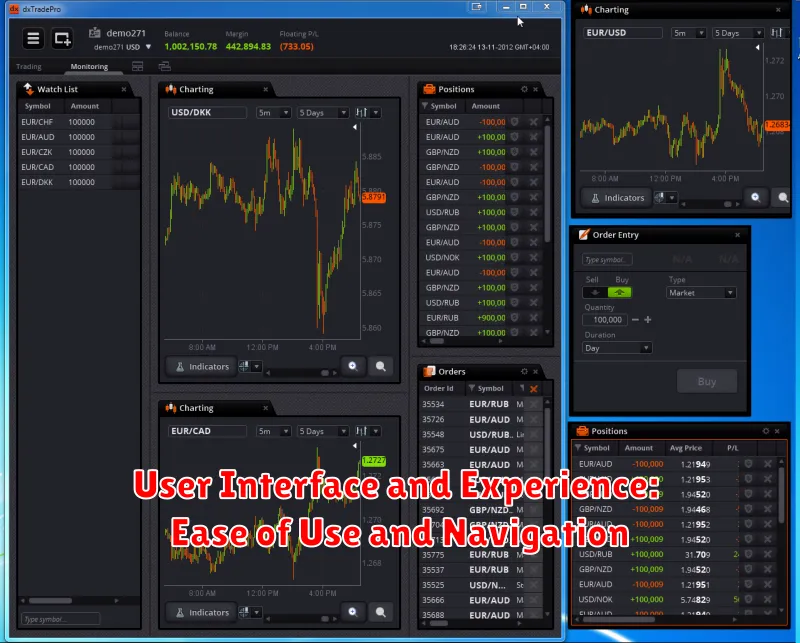

User Interface and Experience: Ease of Use and Navigation

The user interface (UI) and user experience (UX) of a trading platform are crucial factors to consider. A good UI should be intuitive and easy to navigate, while a good UX should be user-friendly and efficient.

Look for a platform with a clean and uncluttered layout that is easy to understand and use.

Consider these factors when evaluating the UI and UX of a trading platform:

- Ease of account setup and funding: The process of opening an account and depositing funds should be straightforward and secure.

- Intuitive navigation and search functions: The platform should be easy to navigate, with clear menus, search bars, and filters.

- Clear and concise charts and data visualization: Trading platforms should provide clear and easy-to-read charts and data that is easily understood.

- Responsive customer support: A platform should offer responsive customer support through multiple channels, such as email, chat, or phone.

- Mobile app functionality: A good trading platform should have a mobile app that is as feature-rich and easy to use as the desktop version.

A good UI and UX can make a big difference in your trading experience. By choosing a platform that is easy to use and navigate, you can focus on making informed trading decisions rather than struggling with the platform itself.

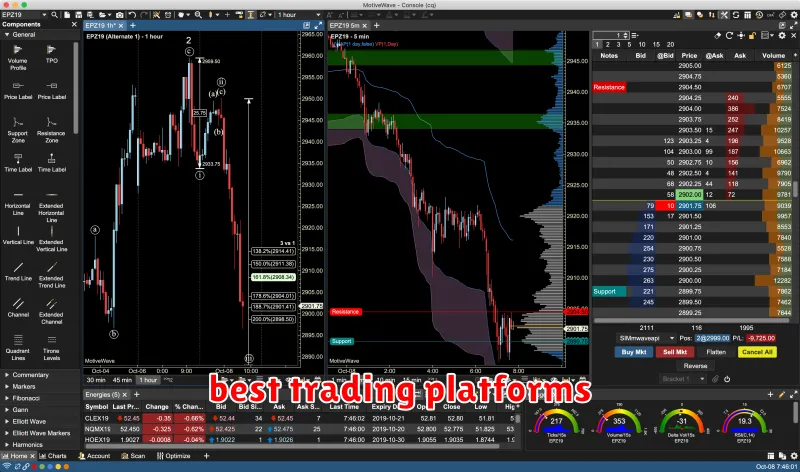

Trading Tools and Resources: Charts, Indicators, and Research

A good trading platform should provide you with a robust suite of tools and resources to help you make informed trading decisions. These include charts, indicators, and research tools.

Charts are the visual representation of price movements over time. They allow you to identify trends, patterns, and support and resistance levels. Most platforms offer a variety of chart types, including line charts, bar charts, candlestick charts, and point and figure charts. They also provide customization options, such as the ability to add indicators, drawing tools, and different timeframes.

Indicators are mathematical calculations that are used to analyze price data and identify potential trading opportunities. There are many different types of indicators, including technical indicators, fundamental indicators, and sentiment indicators. Some popular technical indicators include moving averages, MACD, RSI, and Bollinger Bands. These indicators can help you identify trends, overbought/oversold conditions, and potential breakout points.

Research tools can help you gather information and make informed trading decisions. These tools can include news feeds, economic calendars, analyst ratings, and fundamental data. Some platforms offer access to third-party research providers, which can provide you with in-depth analysis and insights. Research tools can help you understand market conditions, identify potential trading opportunities, and manage your risk.

When choosing a trading platform, it is important to consider the types of charts, indicators, and research tools that are available. You should also make sure that the platform is user-friendly and meets your specific needs.

Order Types and Execution Speed: Market, Limit, and Stop Orders

Understanding different order types and their impact on execution speed is crucial for traders. There are three main order types: market orders, limit orders, and stop orders.

Market orders are executed immediately at the best available price. They offer the fastest execution but can result in slippage, where the order fills at a less favorable price than the current market price. Limit orders, on the other hand, allow you to set a specific price at which you’re willing to buy or sell. They guarantee the price but don’t guarantee execution. Your order may not be filled if the market price doesn’t reach your specified limit. Stop orders are placed above or below the current market price and are triggered when the market reaches your stop price. They are often used to limit losses or protect profits but are also subject to slippage.

The execution speed of each order type varies depending on the trading platform and market conditions. Market orders are generally the fastest as they are filled immediately. Limit orders can take longer, especially during periods of low liquidity, as the market needs to reach your specified price. Stop orders also have a delay, as they wait for the market to hit your stop price.

The choice of order type depends on your trading strategy and risk tolerance. If you need to execute an order immediately, a market order is the best option. However, if you want to control the price at which you trade, a limit order is more suitable. Stop orders can help manage risk and limit losses but can also lead to unwanted executions if the market moves quickly.

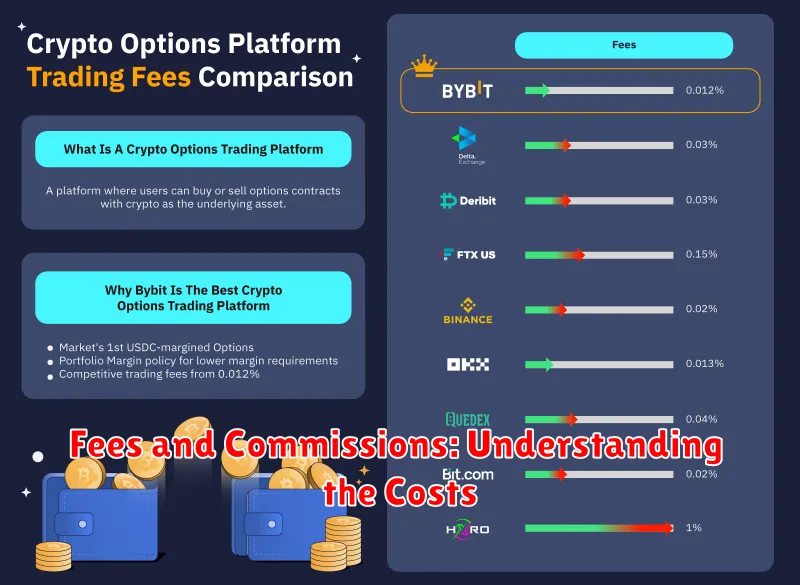

Fees and Commissions: Understanding the Costs

When choosing a trading platform, one of the most critical factors to consider is the fees and commissions charged. These costs can significantly impact your overall profitability, so it’s essential to understand how they work and compare them across different platforms.

Trading Fees: These are charged for each trade you execute. They can be based on factors such as the amount traded, the type of asset traded, and the trading platform’s pricing model.

Commission Fees: These are charged as a percentage of the trade value or as a fixed amount per trade. They are typically levied by brokers for facilitating your trades.

Inactivity Fees: Some platforms may charge inactivity fees if you don’t trade for a certain period. These fees are generally small but can add up over time if you’re not actively trading.

Withdrawal Fees: These are charged when you withdraw funds from your trading account. The fees can vary depending on the withdrawal method and the platform.

Data Fees: Some platforms may charge fees for accessing real-time market data or advanced charting tools.

Other Fees: Platforms may also charge for services like account maintenance, margin interest, or overnight holding fees.

Transparency: It’s essential to choose a platform that is transparent about its fee structure. Look for platforms that clearly disclose their fees and commissions, preferably with a detailed fee schedule.

Comparison: Compare the fees and commissions charged by different platforms to find the most competitive option for your trading needs. Consider the type of trading you plan to do, your trading volume, and the overall cost of trading on each platform.

By understanding the different fees and commissions involved, you can choose a trading platform that aligns with your budget and maximizes your profitability.

Account Types and Minimum Deposits: Finding the Right Fit

When choosing a trading platform, understanding the different account types and their minimum deposit requirements is crucial. Different platforms offer various account types tailored to diverse trader needs and risk appetites. These accounts can vary in their features, trading tools, and minimum investment amounts, directly impacting your trading experience.

Standard Accounts are often the entry point for new traders. They typically have lower minimum deposit requirements, making them accessible to beginners. However, these accounts may offer fewer features and limited access to advanced trading tools.

Premium Accounts, on the other hand, are designed for more experienced traders. They often have higher minimum deposit requirements and come equipped with advanced features like dedicated account managers, lower trading commissions, and access to premium research and analysis tools.

Islamic Accounts are specifically designed for Muslim traders who adhere to Islamic finance principles. These accounts typically prohibit interest payments and ensure trades are conducted in accordance with Islamic law.

Micro Accounts are ideal for beginner traders looking to start with smaller capital investments. They have significantly lower minimum deposit requirements, allowing you to dip your toes into the world of trading with minimal risk.

Demo Accounts are free, risk-free practice environments that mimic real trading conditions. These accounts offer a great way to familiarize yourself with the platform, test your strategies, and gain confidence before risking your own capital.

When selecting an account type, consider your trading experience, risk tolerance, and financial goals. It’s essential to choose an account that aligns with your needs and provides the features and tools you require for success. Always remember to factor in the minimum deposit requirements and ensure they are within your budget.

Customer Support and Educational Resources

When venturing into the world of trading, reliable customer support and comprehensive educational resources are crucial. You’ll want a platform that provides readily available assistance and equips you with the knowledge you need to navigate the market confidently.

Look for platforms that offer multiple channels of support, including live chat, email, phone, and even social media. The more options available, the better your chances of getting timely and efficient help when you need it. In addition to responsiveness, consider the knowledge base of their support team. Are they knowledgeable about the platform’s features and the intricacies of trading? Can they offer insightful guidance and solutions to your queries?

Regarding educational resources, a good trading platform will go beyond basic tutorials. They should offer a variety of learning materials, such as:

- Beginner-friendly guides and courses: These should provide a strong foundation in trading principles and concepts.

- Advanced tutorials and webinars: These cater to more experienced traders, offering insights into specific strategies and market analysis techniques.

- Interactive tools and simulators: These allow you to practice trading in a risk-free environment and refine your skills before entering real-world markets.

- Market research and analysis tools: These provide valuable data and insights to support your trading decisions.

Investing in your trading education is vital for success. Choose a platform that prioritizes customer support and offers comprehensive educational resources that empower you to make informed trading decisions.

Security and Reliability: Protecting Your Investments

When choosing a trading platform, security and reliability should be paramount. Your hard-earned money and personal data are at stake. Look for platforms that prioritize robust security measures to safeguard your investments.

Essential security features include:

- Two-factor authentication (2FA): This adds an extra layer of protection by requiring a code from your phone or email, in addition to your password.

- Encryption: Data should be encrypted both in transit and at rest, making it impossible for unauthorized parties to access it.

- Regular security audits: Independent audits ensure that the platform’s security practices are up to par.

- Strong password policies: Ensure that you can create strong, unique passwords and use a password manager to keep track of them.

Reliability is equally important. A reliable platform should be available when you need it, with minimal downtime. Look for platforms with:

- High uptime: This indicates how often the platform is available for trading. Look for platforms with a 99.9% or higher uptime guarantee.

- Robust infrastructure: A well-maintained, scalable infrastructure ensures smooth operation even during peak trading times.

- Responsive customer support: A reliable platform provides readily available customer support to help you with any issues or queries.

Always do your research and read reviews before choosing a platform. By prioritizing security and reliability, you can protect your investments and trade with confidence.

Mobile Trading Capabilities: Trading on the Go

In today’s fast-paced world, the ability to trade from anywhere, anytime is a must-have. Mobile trading capabilities have revolutionized the way traders interact with the market. Top trading platforms offer robust mobile apps that allow you to execute trades, monitor your portfolio, and stay informed about market movements all from your smartphone or tablet.

When evaluating a trading platform, it’s essential to consider the features and functionalities of its mobile app. Look for apps that offer a user-friendly interface, real-time market data, advanced charting tools, and secure access to your accounts. The ability to place orders quickly and easily, manage your positions, and access educational resources is crucial for mobile traders.

The best mobile trading platforms are also designed for security. Look for apps with multi-factor authentication and encryption to protect your personal and financial information.

Trading on the go provides several advantages:

- Convenience: Trade from anywhere with an internet connection.

- Accessibility: Stay informed about market movements and react quickly to opportunities.

- Flexibility: Manage your portfolio and execute trades at your own pace.

While mobile trading offers numerous benefits, it’s important to use it responsibly. Avoid trading when distracted or under emotional pressure. Familiarize yourself with the platform’s features and ensure you understand the risks involved.

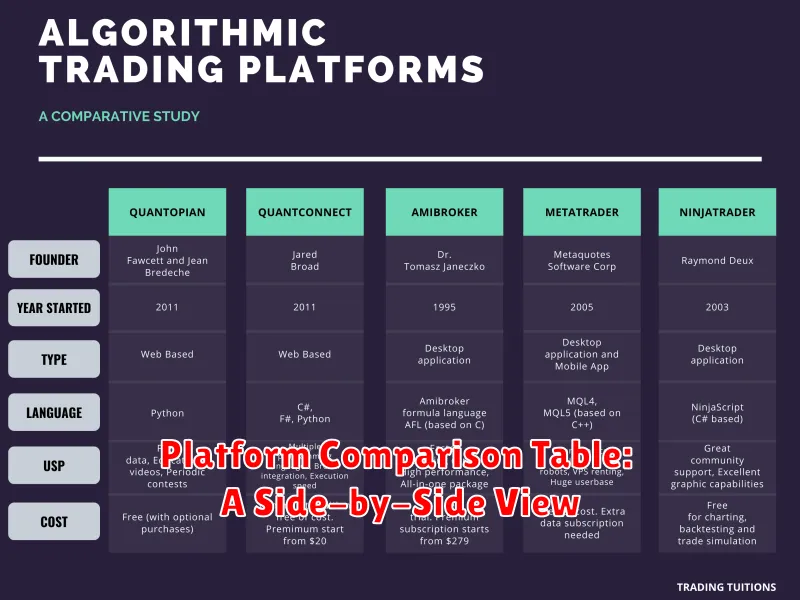

Platform Comparison Table: A Side-by-Side View

Choosing the right trading platform can be overwhelming, with so many options available. To help you make an informed decision, we’ve compiled a comprehensive comparison table that highlights key features and functionalities across different platforms. This side-by-side view allows you to quickly assess which platform best aligns with your trading needs and preferences.

| Platform | Trading Fees | Available Assets | Research & Analysis Tools | Mobile App | Customer Support |

|---|---|---|---|---|---|

| Platform A | Low trading fees, commission-free for stocks | Stocks, ETFs, Options, Futures, Forex | Real-time charting, advanced technical indicators | User-friendly, intuitive interface | 24/7 customer support via phone, email, and live chat |

| Platform B | Competitive trading fees, tiered pricing based on volume | Stocks, ETFs, Options, Cryptocurrency | Fundamental data, news feeds, analyst ratings | Seamless experience across devices | Responsive support via email and chat |

| Platform C | High trading fees, but offers fractional shares | Stocks, ETFs, Options | Basic charting tools, market data | Simple and easy to use | Limited support options |

This table provides a snapshot of key features, but it’s crucial to conduct thorough research on each platform. Consider factors like your trading style, risk tolerance, and budget to make the best choice for your individual needs.