Are you looking for a simple and effective way to invest in the stock market and grow your wealth over the long term? Index funds offer a compelling solution, providing broad market exposure and the potential for consistent returns without the need for extensive research and active trading. By tracking a specific market index, such as the S&P 500 or the Nasdaq 100, these funds mirror the performance of a diverse basket of securities, offering a diversified approach to investing.

Choosing the best index funds can be a daunting task, especially for new investors. With a wide range of options available, it’s crucial to consider your investment goals, risk tolerance, and preferred asset classes. This article will guide you through the process of selecting suitable index funds, highlighting key factors to consider and presenting a selection of top performers across different categories. Whether you’re a seasoned investor seeking to optimize your portfolio or a beginner venturing into the world of investing, this comprehensive guide will equip you with the knowledge to make informed decisions and build a solid foundation for long-term growth.

Understanding Index Funds: Passive Investing for Everyone

In the realm of investing, index funds have emerged as a popular and accessible option for individuals seeking to build a diversified portfolio. Unlike actively managed funds, which aim to outperform the market, index funds passively track a specific market index, such as the S&P 500 or the Nasdaq 100.

Here’s a breakdown of the key features of index funds that make them appealing to investors:

Low Costs

Index funds typically have lower expense ratios compared to actively managed funds. This is because they don’t require the same level of research, trading, and management expertise. The lower costs directly translate to higher returns for investors over time.

Diversification

Index funds provide instant diversification by investing in a wide range of securities that represent a particular market segment. This reduces investment risk by spreading your capital across different companies and industries.

Transparency

The composition of an index fund is clearly defined and easily accessible, making it transparent for investors to understand the underlying holdings. This allows you to monitor your investment and make informed decisions.

Long-Term Growth

Index funds are designed to track the long-term performance of the market they represent. By staying invested over the long haul, you can benefit from the overall growth of the economy and the companies within the index.

Easy Accessibility

Index funds are readily available through a variety of brokerage accounts and platforms, making them accessible to investors of all experience levels.

If you’re seeking a straightforward and cost-effective way to invest for the long term, index funds offer a compelling option. Their passive approach, low costs, and inherent diversification make them a solid foundation for any investment portfolio.

Benefits of Index Fund Investing: Diversification and Low Costs

Investing in index funds offers a compelling strategy for long-term growth due to their inherent benefits of diversification and low costs. These features contribute to a robust and efficient investment approach, making index funds a popular choice for investors of all levels.

Diversification is a cornerstone of sound investment practice, and index funds excel in this area. By tracking a specific market index, such as the S&P 500, index funds invest in a wide range of companies across various sectors. This broad exposure minimizes the risk associated with investing in a single company or industry. By spreading your investment across a large basket of securities, you reduce the impact of any individual stock’s performance on your overall portfolio.

Index funds also stand out for their low costs. They typically have lower expense ratios compared to actively managed mutual funds. Expense ratios represent the annual fees charged to manage the fund. Lower costs directly translate into higher returns for investors. With less money going towards fees, more of your investment is working for you. This cost-effectiveness makes index funds particularly attractive for long-term investing, where compounding plays a crucial role in wealth accumulation.

Types of Index Funds: Market Cap-Weighted vs. Equal-Weighted

Index funds are a popular investment choice for many reasons, but understanding the different types is key to choosing the right one for your portfolio. Two primary types stand out: market cap-weighted and equal-weighted. Let’s explore their key differences.

Market cap-weighted index funds allocate holdings based on the market capitalization (market cap) of each company. This means larger companies with higher market caps receive a bigger share of the fund, reflecting their greater influence on the overall market. This approach is common, as it mirrors the performance of the underlying index it tracks. However, it can lead to a concentration of holdings in a few large companies, potentially skewing performance if those companies underperform.

On the other hand, equal-weighted index funds allocate an equal portion of the fund’s assets to each company in the index, regardless of market cap. This approach offers broader diversification by giving smaller companies a more significant voice, potentially leading to higher returns in periods when smaller companies outperform. However, it may require more frequent rebalancing as company prices fluctuate.

The choice between market cap-weighted and equal-weighted index funds depends on your investment goals and risk tolerance. If you believe in the long-term growth potential of large companies, market cap-weighted funds might be suitable. However, if you seek diversification and exposure to smaller companies, equal-weighted funds may be a better option.

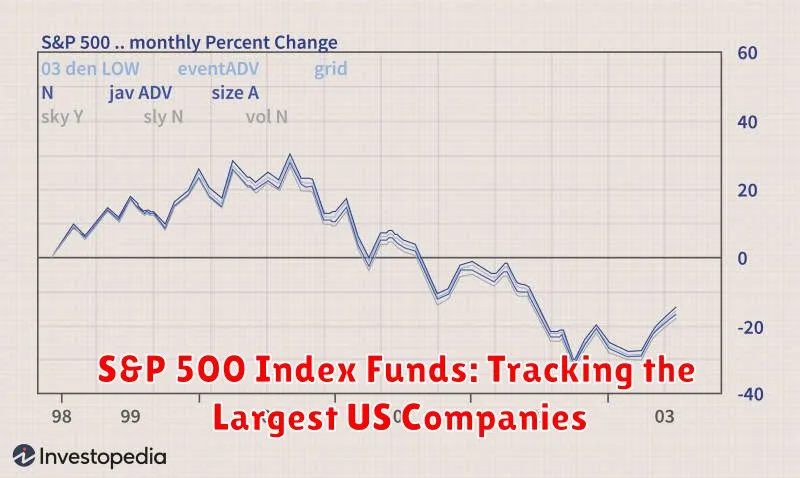

S&P 500 Index Funds: Tracking the Largest US Companies

The S&P 500 is a stock market index that tracks the performance of 500 of the largest publicly traded companies in the United States. It represents a broad cross-section of the U.S. economy, covering sectors like technology, healthcare, finance, and consumer goods. Investing in an S&P 500 index fund allows you to passively track the performance of these leading companies, offering a diversified and cost-effective way to participate in long-term growth.

Index funds aim to replicate the performance of a specific market index, such as the S&P 500. They do this by holding a basket of stocks that mirror the composition of the index. This passive approach allows investors to benefit from the growth of the underlying companies without actively picking individual stocks.

S&P 500 index funds are known for their:

- Diversification: Spreading your investments across hundreds of companies, reducing risk.

- Low Costs: Index funds generally have lower expense ratios than actively managed funds.

- Simplicity: Investing in an index fund requires less research and monitoring than picking individual stocks.

If you’re looking for a simple and effective way to invest in the US stock market, S&P 500 index funds provide a solid foundation for long-term growth. They offer diversification, low costs, and a straightforward approach to building a diversified portfolio. Before investing, remember to consult with a financial advisor and consider your individual risk tolerance and investment goals.

Total Market Index Funds: Broad Market Exposure

Total market index funds offer a simple and effective way to invest in the entire stock market. They track a broad market index, such as the S&P 500 or the CRSP US Total Market Index, which includes a wide range of companies across various sectors and industries.

By investing in a total market index fund, you gain exposure to the entire US stock market, allowing you to diversify your portfolio and reduce risk. These funds are designed to mirror the performance of the underlying index, providing you with a passive investment approach that reflects the overall market trends.

Here are some key advantages of total market index funds:

- Broad Diversification: Total market funds provide extensive diversification across different sectors and industries, minimizing portfolio risk.

- Low Costs: Index funds typically have low expense ratios, meaning they charge lower fees than actively managed funds.

- Simplicity: Investing in a total market index fund is a straightforward way to achieve market exposure with minimal effort.

- Long-Term Growth Potential: Over the long term, the stock market has historically generated positive returns, making total market index funds a suitable option for long-term investors.

If you are looking for a simple and effective way to invest in the stock market and achieve broad market exposure, consider investing in a total market index fund. These funds provide a diversified, low-cost, and convenient approach to building a long-term portfolio.

International Index Funds: Global Diversification

Investing in international index funds is a smart way to achieve global diversification. By investing in a basket of stocks representing a broad range of international markets, you can gain exposure to a wider range of growth opportunities and mitigate risk.

International index funds offer several advantages:

- Global diversification: By investing in international index funds, you’re not limited to the performance of the U.S. stock market. You gain exposure to a wider range of companies and industries around the world, potentially reducing portfolio volatility.

- Lower costs: Index funds are generally passively managed, which means they have lower expense ratios than actively managed funds. This translates to lower fees and higher returns over time.

- Accessibility: International index funds are readily available through most brokerage accounts, making it easy to invest in them.

When choosing an international index fund, consider factors like:

- Expense ratio: Look for funds with low expense ratios to maximize your returns.

- Tracking error: A low tracking error indicates that the fund’s performance closely matches its underlying benchmark index.

- Market coverage: Ensure the fund invests in a broad range of countries and industries.

Investing in international index funds is a simple and effective way to achieve global diversification and potentially enhance your long-term returns.

Bond Index Funds: Fixed Income for Stability

When building a diversified investment portfolio, it’s important to consider not just the potential for growth but also the need for stability. This is where bond index funds come in. They offer a way to invest in a broad range of bonds, providing a degree of stability and income that can complement the growth potential of stocks.

Bond index funds track a specific bond index, such as the Bloomberg Barclays U.S. Aggregate Bond Index. This means they hold a basket of bonds that mirror the composition of that index. By investing in a bond index fund, you gain exposure to a wide range of bonds, mitigating the risk associated with individual bond investments.

Here are some key benefits of bond index funds:

- Diversification: A single bond index fund can provide exposure to hundreds or even thousands of bonds, offering diversification across sectors, maturities, and credit ratings.

- Low Costs: Bond index funds typically have low expense ratios, meaning they charge less in fees compared to actively managed bond funds.

- Stability: Bonds generally offer lower returns than stocks, but they also tend to be less volatile, providing a ballast to your portfolio in times of market uncertainty.

- Regular Income: Bonds pay interest, which provides a regular stream of income, especially valuable during retirement.

Bond index funds can be a valuable addition to any investment portfolio. They offer diversification, stability, and income, complementing the growth potential of stocks and helping to achieve long-term financial goals.

Target-Date Funds: A Hands-Off Approach to Retirement

If you’re looking for a simple and hands-off way to save for retirement, target-date funds are a great option. These funds automatically adjust their asset allocation based on your target retirement date, becoming more conservative as you get closer to retirement.

Target-date funds are a type of mutual fund or exchange-traded fund (ETF) that invests in a diversified mix of stocks, bonds, and other assets. They are designed to provide investors with a balanced portfolio that grows over time while managing risk.

The beauty of target-date funds lies in their automatic rebalancing. As your retirement date approaches, the fund gradually shifts its investments from higher-risk assets like stocks to lower-risk assets like bonds. This helps to protect your nest egg from market volatility during your retirement years.

Investing in a target-date fund can be a smart choice for several reasons:

- Simplicity: You don’t need to choose individual stocks or bonds, making investment decisions much easier.

- Diversification: Target-date funds invest in a mix of assets, reducing your overall risk.

- Automatic Rebalancing: The fund automatically adjusts its asset allocation to match your time horizon.

- Low Costs: Target-date funds typically have lower expense ratios than other mutual funds.

If you’re not sure where to begin with retirement investing, consider a target-date fund. They offer a hassle-free way to build a diversified portfolio and achieve your long-term financial goals.

Choosing the Right Index Funds for Your Portfolio

Index funds offer a simple and cost-effective way to invest in the market. They track a specific market index, such as the S&P 500 or the Nasdaq 100, providing broad diversification across a wide range of companies. However, choosing the right index fund for your portfolio is crucial for achieving your financial goals.

Here are some key factors to consider when selecting index funds:

Investment Goals and Time Horizon

Your investment goals and time horizon will determine the appropriate type of index fund. If you’re saving for retirement in the long term, a broad-market index fund such as the S&P 500 or the Total Stock Market Index could be suitable. For shorter-term goals, you might consider sector-specific index funds or those tracking specific industries.

Expense Ratios

Expense ratios represent the annual fees charged by a mutual fund or ETF. Look for index funds with low expense ratios, as even small differences can significantly impact your returns over time. Aim for funds with expense ratios of 0.10% or less.

Market Capitalization

Index funds can be categorized based on the market capitalization of the companies they track. Large-cap funds invest in large companies, while small-cap funds focus on smaller companies. Consider your risk tolerance and growth expectations when choosing between different market capitalization categories.

Index Tracking Performance

While index funds aim to replicate the performance of their underlying index, some funds may deviate slightly. Evaluate the fund’s track record and compare its performance to the index it tracks. Look for funds that have consistently tracked their index closely.

Tax Efficiency

Tax efficiency is an important consideration for index funds. Look for funds that minimize capital gains distributions, which can reduce your overall returns. This is particularly crucial for taxable accounts.

By carefully considering these factors, you can choose the right index funds for your portfolio and build a diversified investment strategy that aligns with your financial goals.