Are you ready to take control of your financial future and build a solid foundation for your dreams? Crafting your financial roadmap is essential for achieving your goals, whether it’s buying a home, retiring comfortably, or simply securing your financial well-being. But with countless investment options available, navigating the complex world of finance can feel overwhelming.

This article is your guide to understanding the best investment portfolio strategies tailored to your unique circumstances. We’ll demystify the jargon, explore various investment approaches, and equip you with the knowledge to make informed decisions about your money. From understanding your risk tolerance to diversifying your investments, this comprehensive resource will provide you with the tools you need to build a successful financial roadmap that aligns with your aspirations.

Defining Your Investment Goals and Risk Tolerance

Before diving into the exciting world of investment strategies, it’s crucial to lay a solid foundation. This involves understanding your investment goals and risk tolerance.

Investment goals define what you hope to achieve with your investments. Are you saving for retirement, a down payment on a house, or your children’s education? Each goal comes with a specific time horizon and desired outcome.

Your risk tolerance determines how comfortable you are with the potential for losses in your investments. A high risk tolerance means you’re comfortable with greater fluctuations in value, potentially leading to higher returns. A lower risk tolerance prioritizes stability and security, often opting for less volatile investments.

Defining these elements is essential because they form the cornerstone of your financial roadmap. They guide your investment choices and help you create a portfolio that aligns with your personal aspirations and comfort levels.

Asset Allocation: Building a Diversified Portfolio

In the realm of investing, a core principle that underpins success is asset allocation. It is the strategic distribution of your investment capital across different asset classes, such as stocks, bonds, real estate, and commodities. This diversification is crucial for managing risk and maximizing potential returns.

Imagine your portfolio as a well-balanced meal. You wouldn’t just eat one type of food, right? You need a mix of proteins, carbohydrates, and vegetables for a healthy and fulfilling experience. Similarly, your portfolio needs a diverse range of assets to achieve its goals. This diversification helps to mitigate losses during market downturns and potentially enhance returns during market upturns.

The ideal asset allocation strategy is tailored to your individual risk tolerance, investment goals, and time horizon. For instance, younger investors with a longer time horizon might opt for a higher allocation to stocks, which tend to have higher growth potential over the long term. Conversely, older investors closer to retirement may prefer a more conservative allocation with a greater emphasis on bonds, seeking stability and income.

As markets fluctuate, periodically rebalancing your portfolio is crucial to maintain your desired asset allocation. This involves adjusting the proportions of your investments to ensure they remain aligned with your investment plan.

Here are some key considerations for asset allocation:

- Risk Tolerance: How comfortable are you with potential fluctuations in your investment value?

- Investment Goals: What are you aiming to achieve with your investments (e.g., retirement, down payment, education)?

- Time Horizon: How long do you plan to invest?

- Market Conditions: What is the current state of the economy and financial markets?

Remember, asset allocation is an ongoing process. Regular monitoring and adjustments based on your changing circumstances are essential for staying on track with your financial goals.

Understanding Different Asset Classes: Stocks, Bonds, Real Estate

When crafting your financial roadmap, it’s crucial to understand the different asset classes that make up your investment portfolio. Asset classes represent distinct categories of investments, each with its own risk and return characteristics. Three prominent asset classes that form the foundation of many portfolios are stocks, bonds, and real estate. Let’s delve into each of these and explore their key features.

Stocks, also known as equities, represent ownership in a company. When you purchase a stock, you become a shareholder, potentially sharing in the company’s profits and growth. Stocks generally carry higher risk than other asset classes but also have the potential for greater returns. They are considered growth assets, meaning their value is expected to rise over time.

Bonds, on the other hand, represent loans you make to a company or government. When you buy a bond, you are essentially lending money for a specific period of time, receiving regular interest payments in return. Bonds are considered fixed-income investments because they offer a predictable stream of income. They typically carry less risk than stocks but also offer lower potential returns.

Real Estate encompasses physical properties like homes, apartments, commercial buildings, and land. It can be a tangible asset that provides both income and potential for appreciation. Investing in real estate can involve direct ownership or through vehicles like Real Estate Investment Trusts (REITs). Real estate often serves as a hedge against inflation and can provide diversification within your portfolio.

Understanding the unique characteristics of these asset classes is essential for building a well-balanced investment portfolio that aligns with your financial goals, risk tolerance, and time horizon.

Passive vs. Active Investing: Finding the Right Approach

Navigating the world of investments can be daunting, particularly when faced with the choice between passive and active strategies. Both approaches offer distinct paths to financial growth, each with its own set of advantages and disadvantages. Understanding the nuances of each strategy is crucial to crafting a financial roadmap that aligns with your goals and risk tolerance.

Passive investing, as the name suggests, involves a hands-off approach. This strategy revolves around building a diversified portfolio of low-cost index funds or exchange-traded funds (ETFs) that track a specific market index, such as the S&P 500. The idea is to mirror the performance of the overall market rather than attempting to outperform it.

Active investing, on the other hand, demands a more proactive approach. This strategy involves actively researching, selecting, and managing individual stocks or bonds with the aim of beating the market returns. Active investors rely on fundamental and technical analysis to identify undervalued assets and capitalize on market trends.

The key difference lies in the level of involvement and expected returns. Passive investing prioritizes long-term growth and lower costs, making it ideal for investors seeking a less demanding approach. Active investing, while potentially rewarding, requires significant time, effort, and expertise, and its success hinges on the ability to consistently outperform the market, a feat that even seasoned professionals find challenging.

Ultimately, the best approach depends on your individual circumstances. If you’re a beginner investor with limited time and resources, passive investing offers a simple and effective way to build wealth over the long term. However, if you have the time, knowledge, and risk appetite for active management, it could potentially yield higher returns. The key is to choose an approach that aligns with your financial goals, risk tolerance, and personal preferences.

Dollar-Cost Averaging and Other Investment Strategies

Dollar-cost averaging (DCA) is a popular investment strategy that involves investing a fixed amount of money at regular intervals, regardless of the market’s current price. This strategy can help to mitigate risk by reducing the impact of market volatility. When market prices are low, you buy more units of the investment, and when market prices are high, you buy fewer units. Over time, this averaging effect can lead to a lower overall average purchase price.

One of the biggest benefits of DCA is its ability to reduce emotional decision-making. Since you invest a set amount regularly, you avoid the temptation to buy high or sell low, which can be detrimental to your long-term investment goals. It’s a disciplined approach that helps you stay focused on your financial goals.

However, DCA isn’t the only strategy out there. Other popular investment approaches include:

- Value investing: This strategy focuses on identifying undervalued stocks with strong fundamentals and holding them for the long term. Value investors believe that the market eventually recognizes these stocks’ true value, leading to price appreciation.

- Growth investing: Growth investors seek companies with high growth potential and are willing to pay a premium for them. This strategy is often associated with younger companies in rapidly growing industries.

- Index investing: This strategy involves investing in a basket of securities that mirrors a specific market index. This is a passive investment approach that aims to track the overall market performance.

The best investment strategy for you will depend on your individual circumstances, risk tolerance, investment goals, and time horizon. It’s crucial to conduct thorough research, consider your financial goals, and consult with a financial advisor to make informed decisions that align with your financial roadmap.

Rebalancing Your Portfolio for Long-Term Success

Rebalancing is a crucial element of long-term investment success, ensuring your portfolio remains aligned with your financial goals and risk tolerance. It involves adjusting asset allocation, bringing it back in line with your original target percentages. Rebalancing helps mitigate risk by preventing overexposure to specific asset classes that have performed exceptionally well.

Over time, asset values fluctuate, causing deviations from your initial allocation. Rebalancing helps you sell winners and buy underperformers, creating a more balanced and diversified portfolio. This approach reduces the impact of market volatility and helps you stay disciplined in your investment strategy.

To rebalance, compare your current asset allocation to your target allocation. If significant deviations exist, adjust your holdings to restore the desired balance. Rebalancing can be done periodically, such as quarterly, semi-annually, or annually, depending on your investment strategy and market conditions.

The Role of Taxes in Investment Planning

Taxes play a crucial role in investment planning, significantly impacting your overall returns. Understanding how taxes work and incorporating them into your strategy can optimize your investment journey.

Tax efficiency is key. Choosing investments that minimize your tax burden can boost your returns over the long term. For example, taking advantage of tax-advantaged accounts like IRAs and 401(k)s can defer taxes on your investments until retirement.

Capital gains taxes are another important consideration. When you sell an asset for a profit, you may be required to pay capital gains tax. Understanding the different tax brackets and holding periods for short-term and long-term capital gains can help you strategize for tax-efficient selling.

Tax loss harvesting is a strategy that allows you to offset capital gains with capital losses. By selling losing investments and realizing the losses, you can potentially reduce your tax liability.

It’s crucial to consult with a qualified financial advisor who can provide personalized guidance on incorporating taxes into your investment plan. By understanding the tax implications of your investment decisions, you can make informed choices that help you achieve your financial goals.

Investing for Retirement: IRAs and 401(k)s

Retirement planning is crucial for a financially secure future. Two powerful tools in your arsenal are Individual Retirement Accounts (IRAs) and 401(k)s. These retirement savings plans offer tax advantages and the potential for significant long-term growth.

IRAs are personal retirement accounts that allow you to contribute pre-tax dollars, which grow tax-deferred. You can choose to open a Traditional IRA, where contributions are tax-deductible in the current year and withdrawals are taxed in retirement, or a Roth IRA, where contributions are made with after-tax dollars, but withdrawals in retirement are tax-free.

401(k)s are employer-sponsored retirement savings plans. With a 401(k), you can contribute a portion of your paycheck before taxes, reducing your taxable income. Many employers also offer a matching contribution, meaning they’ll contribute a percentage of your salary to your 401(k) account. These contributions grow tax-deferred, just like IRAs, and you won’t be taxed until you withdraw the money in retirement.

Both IRAs and 401(k)s allow you to invest in a variety of assets, such as stocks, bonds, and mutual funds. The specific investment options will vary depending on your chosen plan and provider. It’s essential to consider your risk tolerance, investment goals, and time horizon when making investment decisions within these plans.

The best strategy for you will depend on your individual circumstances. Consult a financial advisor to determine the most suitable combination of IRAs and 401(k)s for your retirement plan.

Working with a Financial Advisor: When and Why?

Navigating the world of finance can feel daunting, especially when it comes to building a solid investment portfolio. While DIY approaches can be tempting, seeking professional guidance from a financial advisor often proves invaluable. But when does it make sense to enlist their expertise?

The decision to work with a financial advisor depends largely on your individual circumstances and goals. Here are some key indicators that suggest it’s time to consider professional help:

- Complexity of your financial situation: Multiple income streams, significant debt, or complex assets like real estate or trusts can benefit from an advisor’s organized approach.

- Lack of financial knowledge: If you’re unsure about investment basics, risk tolerance, or asset allocation, a financial advisor can provide crucial education and guidance.

- Specific financial goals: Whether you’re planning for retirement, saving for a down payment, or funding your children’s education, a professional can help develop a tailored strategy.

- Time constraints: Managing your investments takes time and effort. If you lack the bandwidth, an advisor can handle the research, analysis, and execution.

- Need for accountability: A financial advisor can hold you accountable for your financial goals and keep you on track with your plan.

The benefits of working with a financial advisor extend beyond simply managing your money. They offer a valuable second opinion, helping you make informed decisions based on your unique circumstances. They can also provide emotional support, navigating the ups and downs of the financial markets.

Ultimately, the decision to work with a financial advisor is a personal one. However, if you’re serious about crafting a solid financial roadmap, seeking professional guidance can offer a significant advantage in achieving your goals.

Staying Informed About Market Trends and Economic Outlook

Before diving into specific portfolio strategies, it’s crucial to understand the landscape you’re navigating. Staying informed about market trends and the economic outlook is the bedrock of any successful investment strategy. This involves being aware of factors such as:

- Interest rate movements: Interest rates significantly impact investment returns, especially in bond markets.

- Inflation: High inflation erodes purchasing power and can impact corporate earnings.

- Economic growth: A strong economy typically translates to higher stock market valuations.

- Geopolitical events: Global events like wars or trade tensions can create market volatility.

- Industry trends: Identifying emerging industries and technological advancements can offer investment opportunities.

There are numerous resources available to stay informed. Reputable financial news sources, economic data releases from government agencies, and research reports from investment firms can provide valuable insights. Engaging with financial advisors can also offer personalized guidance tailored to your individual circumstances.

Remember, the goal is not to predict the future, but to be prepared for various scenarios. By understanding the broader economic context, you can make informed decisions about your investment portfolio.

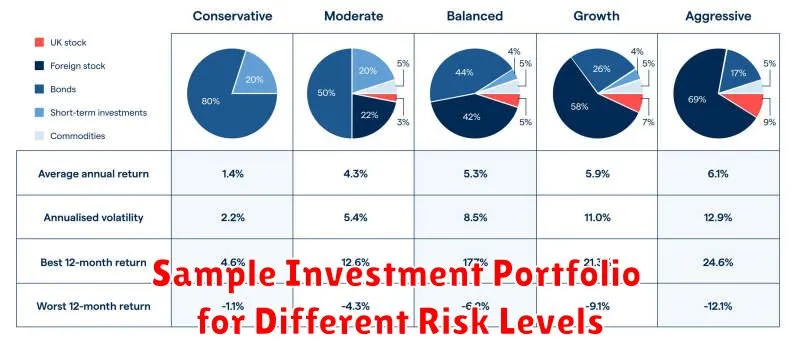

Sample Investment Portfolio for Different Risk Levels

Investing can be daunting, but it doesn’t have to be. Understanding your risk tolerance is key to creating an investment portfolio that aligns with your financial goals. Here are some sample portfolios for different risk levels:

Conservative Portfolio

For those seeking low risk and stability, a conservative portfolio might consist of:

- High-yield savings accounts: Offer higher interest rates than traditional savings accounts.

- Certificates of deposit (CDs): Offer fixed interest rates for a set period.

- Short-term bonds: Less volatile than stocks and offer regular income.

- Real estate investment trusts (REITs): Offer exposure to the real estate market without direct ownership.

Moderate Portfolio

This portfolio balances growth potential with risk management. It might include:

- Stocks: Invest in a diversified mix of large-cap and mid-cap companies.

- Bonds: A mix of short-term and long-term bonds for income and diversification.

- Mutual funds: Offer diversification and professional management.

- Exchange-traded funds (ETFs): Similar to mutual funds but traded on exchanges, providing more flexibility.

Aggressive Portfolio

For investors seeking higher returns and willing to accept greater risk, an aggressive portfolio might include:

- Small-cap stocks: Invest in smaller companies with higher growth potential.

- Emerging market stocks: Invest in companies from developing countries.

- Options: Derivatives that allow investors to speculate on price movements.

- Cryptocurrencies: Highly volatile digital assets with potential for significant returns.

It’s essential to remember that these are just examples, and your individual portfolio should be tailored to your specific needs, risk tolerance, and financial goals. Consulting with a financial advisor can help you create a personalized investment strategy.

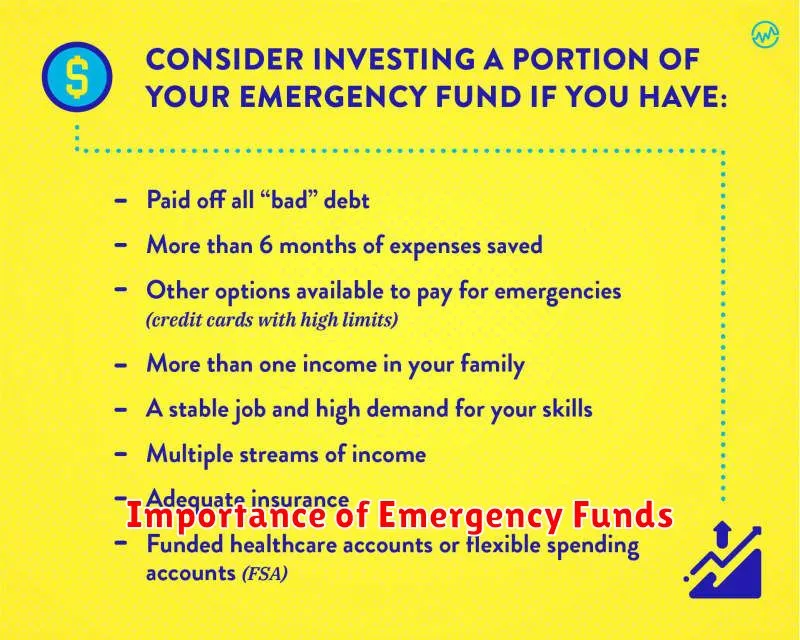

Importance of Emergency Funds

In the grand scheme of crafting your financial roadmap, emergency funds often take a backseat to flashy investment strategies. However, emergency funds are the cornerstone of a secure financial future, acting as a crucial buffer against unexpected life events. They provide peace of mind, allowing you to navigate unforeseen circumstances without derailing your long-term financial goals.

Imagine facing a sudden job loss, a medical emergency, or a major car repair. Without an emergency fund, these events can quickly spiral into debt and financial hardship. Emergency funds serve as a safety net, preventing these situations from snowballing into insurmountable challenges. They empower you to make rational decisions during stressful times, without resorting to desperate measures.

Beyond financial security, emergency funds offer invaluable peace of mind. Knowing you have a financial cushion to fall back on reduces stress and anxiety, allowing you to focus on your well-being and long-term goals. This sense of stability enhances your overall quality of life and empowers you to make confident decisions regarding your finances.

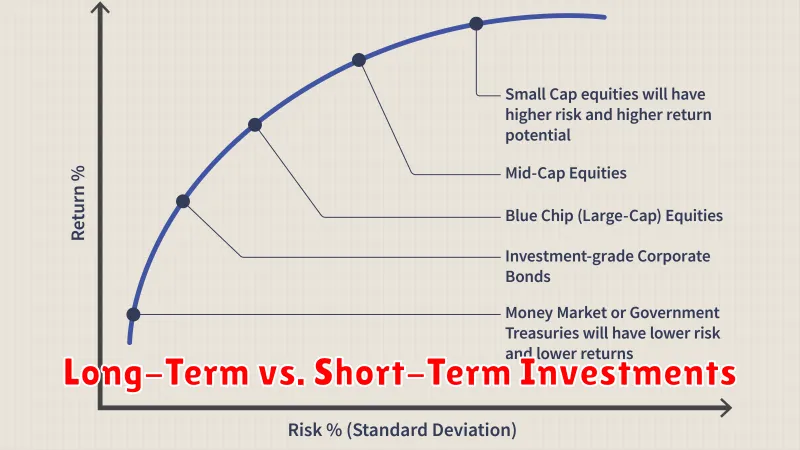

Long-Term vs. Short-Term Investments

Investing is a crucial part of building a secure financial future. But with so many options available, it can be overwhelming to decide where to put your money. One of the most important considerations is the investment horizon – how long you plan to hold your investments.

Long-term investments typically involve holding assets for several years, even decades. This approach prioritizes growth over immediate returns. Examples include stocks, mutual funds, and real estate. These investments have the potential for higher returns over time, but they also carry a higher level of risk.

Short-term investments, on the other hand, are held for a shorter period, usually less than a year. They prioritize liquidity and stability over substantial growth. Examples include high-yield savings accounts, certificates of deposit (CDs), and money market funds. While these investments offer lower returns, they are considered safer as they are less susceptible to market fluctuations.

The best investment strategy depends on your individual goals, risk tolerance, and time horizon. If you’re young and have a long time horizon, you may be more comfortable with a higher risk tolerance and can invest a larger portion of your portfolio in long-term assets. If you’re closer to retirement and need access to your funds soon, you might prioritize short-term investments for greater security.

It’s important to remember that investing is a long-term game. While short-term market fluctuations can be unsettling, focus on your overall investment goals and stick to your plan. A well-diversified portfolio that balances long-term and short-term investments can help you achieve your financial objectives and build a secure future.

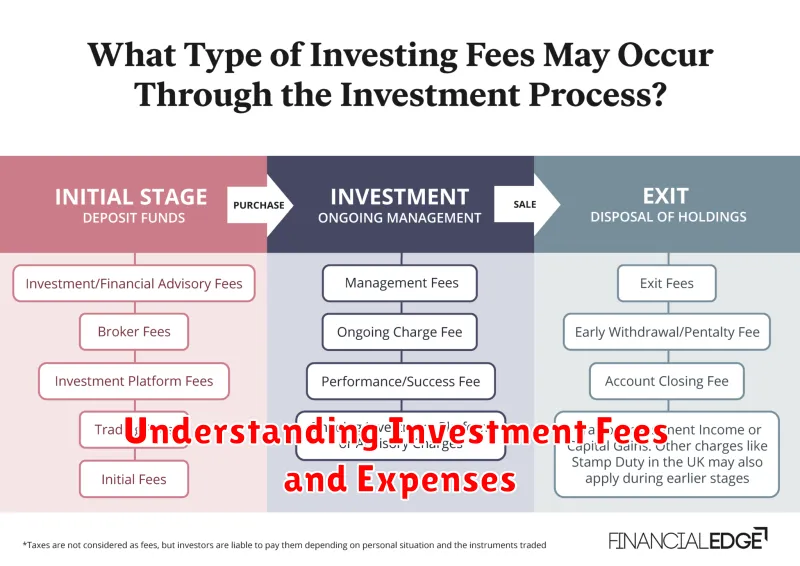

Understanding Investment Fees and Expenses

Investment fees and expenses are a critical aspect of any investment strategy. They are costs associated with managing and maintaining your investments, and they can significantly impact your overall returns. While it’s crucial to be aware of these fees, understanding their various forms and implications is equally important.

Investment management fees are charged by investment professionals for managing your portfolio. These fees can vary depending on the type of service, the asset class, and the investment manager’s experience. Some common types of investment management fees include:

- Advisory fees: Charged for providing investment advice and portfolio management.

- Performance-based fees: Paid based on the performance of the investment portfolio.

- Asset-under-management (AUM) fees: Calculated as a percentage of the total assets invested.

Fund expenses are associated with mutual funds and exchange-traded funds (ETFs). They cover administrative costs, marketing, and trading expenses. Common types of fund expenses include:

- Expense ratio: An annual percentage fee charged by the fund to cover its operating costs.

- Trading expenses: Costs incurred when buying or selling securities within the fund.

- Management fees: Paid to the fund’s portfolio manager for managing the investments.

Brokerage fees are charged by online brokers for executing trades. These fees can vary depending on the broker, the type of trade, and the volume of transactions.

Understanding and comparing investment fees and expenses is crucial for making informed investment decisions. High fees can erode your returns over time, so it’s essential to consider them carefully when choosing investments. By being informed and proactive, you can make choices that align with your financial goals and maximize your investment potential.

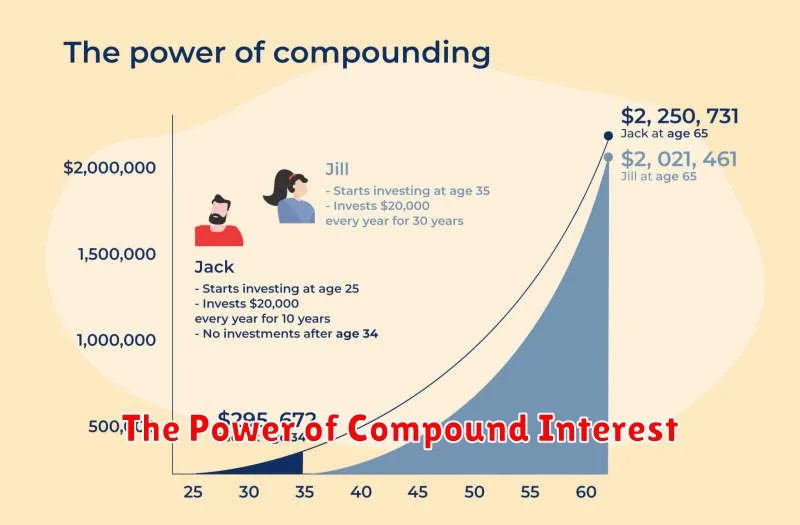

The Power of Compound Interest

When it comes to building wealth, the power of compound interest is a force to be reckoned with. It’s the magic of earning interest on your initial investment, as well as on the accumulated interest. This snowball effect allows your money to grow exponentially over time. Think of it like planting a seed – with consistent effort and time, it can blossom into a mighty tree.

Imagine investing $10,000 at an annual rate of return of 7%. After the first year, you’ll have earned $700, bringing your total to $10,700. In the second year, you’ll earn interest not only on the initial $10,000 but also on that $700, resulting in a slightly larger gain. This process repeats, and over time, the growth accelerates significantly. The longer your money is invested and the higher the rate of return, the more powerful compound interest becomes.

The beauty of compound interest lies in its ability to work for you even when you’re not actively involved. As long as your investment stays in the market and continues to generate returns, compound interest does its job silently and steadily, amplifying your wealth over the long haul.

This is why starting early is crucial. The earlier you begin investing, the more time your money has to work for you, allowing compound interest to maximize its impact. Even small, consistent contributions can yield remarkable results over decades. So, embrace the power of compound interest, let it be your financial ally, and watch your wealth flourish with time.