Navigating the stock market can feel like walking a tightrope, especially in times of economic uncertainty. But for savvy investors, 2024 presents a unique opportunity to capitalize on promising sectors poised for growth. This year holds the potential for substantial returns, and understanding the best stocks to invest in is key to unlocking your investment potential. We’ll delve into the promising opportunities within various market segments, identifying those companies with the strongest fundamentals and growth prospects.

From the dynamic world of technology and the ever-evolving landscape of healthcare to the growing demand for renewable energy and the resilience of consumer staples, our expert analysis will guide you through the complexities of the market. We’ll explore the factors driving these sectors, pinpoint the companies that are leading the charge, and provide insights to help you make informed decisions for your investment portfolio. So, buckle up and get ready to discover the best stocks to invest in 2024 and ride the wave of potential success.

Factors to Consider When Choosing Stocks

Choosing the right stocks for your portfolio is crucial for achieving your investment goals. While there’s no foolproof formula for guaranteed returns, considering these key factors can improve your odds of success:

1. Company Fundamentals: A strong foundation starts with a deep dive into the company’s financials. Look at its revenue growth, profitability, debt levels, and cash flow. Analyze the company’s competitive landscape, market share, and long-term growth prospects.

2. Industry Trends: Understand the industry in which the company operates. Is it a growing or declining sector? Are there any upcoming regulations or technological advancements that might impact the industry? Stay informed about the broader economic environment and its potential effects on specific sectors.

3. Management Team: A company’s leadership plays a significant role in its success. Assess the management team’s experience, track record, and vision for the future. Look for strong leadership with a history of making sound decisions.

4. Valuation: Compare the company’s stock price against its intrinsic value. Use valuation metrics such as the price-to-earnings (P/E) ratio, price-to-book (P/B) ratio, and dividend yield to determine if the stock is fairly priced.

5. Risk Tolerance: Consider your personal risk appetite and investment goals. Some stocks are considered higher risk but offer the potential for higher returns, while others are considered lower risk with more stable returns. Align your investments with your risk tolerance.

6. Diversification: Don’t put all your eggs in one basket. Diversify your portfolio by investing in a mix of different sectors, industries, and asset classes. This helps mitigate risk and potentially enhance returns.

7. Long-Term Perspective: Remember, investing in stocks is a long-term game. Don’t get swayed by short-term market fluctuations. Focus on companies with solid fundamentals and a strong track record of growth.

By carefully considering these factors, you can make more informed investment decisions and improve your chances of building a successful portfolio.

Growth Stocks with High Potential

In the ever-evolving world of finance, identifying promising investment opportunities is paramount. While the market offers a diverse range of options, growth stocks stand out as potential avenues for substantial returns. These stocks represent companies experiencing rapid expansion, innovation, and market penetration. While risk is inherent in all investments, growth stocks often carry a higher risk profile due to their rapid expansion. However, the potential for substantial returns can be highly rewarding for investors with a long-term perspective.

Here are some key characteristics of growth stocks with high potential:

- Strong Revenue Growth: Growth stocks typically exhibit consistent and significant increases in revenue, indicating strong demand for their products or services.

- High Profit Margins: Profitability is essential for growth stocks, as it demonstrates their ability to translate revenue into earnings.

- Innovation and Market Leadership: Growth stocks often operate in industries characterized by innovation and disruption. They possess a competitive edge through unique products, services, or business models.

- Expanding Market Share: Growth stocks are typically expanding their market presence, capturing a larger share of their target market.

- Experienced Management Team: A competent and experienced management team is crucial for navigating rapid growth and ensuring long-term sustainability.

Examples of Growth Stocks with High Potential:

While specific recommendations depend on individual investment objectives and risk tolerance, some examples of growth sectors with high potential include:

- Technology: Artificial intelligence, cloud computing, cybersecurity, and e-commerce are rapidly evolving industries with substantial growth potential.

- Healthcare: Advancements in biotechnology, personalized medicine, and digital health are driving significant innovation and market opportunities.

- Renewable Energy: The transition to a more sustainable energy future is fueling growth in solar, wind, and battery technologies.

Important Considerations:

Before investing in growth stocks, it is essential to conduct thorough research and understand the following:

- Valuation: Ensure that the stock’s price is justified by its fundamentals and growth potential.

- Competition: Evaluate the competitive landscape and the company’s ability to maintain its market position.

- Financial Health: Assess the company’s financial stability, including its debt levels and cash flow.

- Investment Horizon: Growth stocks often require a longer investment horizon to realize their full potential.

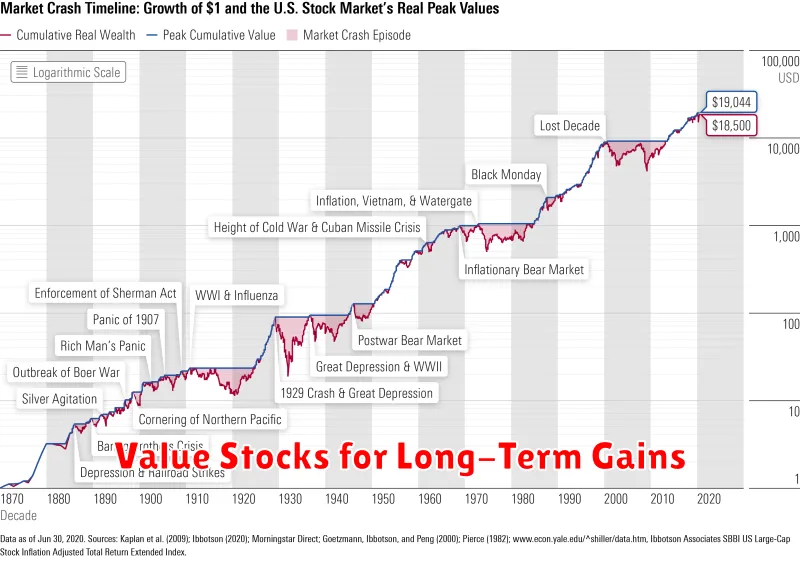

Value Stocks for Long-Term Gains

In the ever-evolving landscape of the stock market, value stocks offer a compelling approach for long-term investors seeking steady growth and potential outperformance. Value investing focuses on identifying companies trading below their intrinsic worth, presenting an opportunity to acquire them at a discount. While the stock market may experience short-term fluctuations, value stocks possess several inherent qualities that make them attractive for long-term wealth creation.

One key advantage of value stocks is their intrinsic value. These companies often possess solid fundamentals, such as strong earnings, low debt levels, and consistent cash flow. By analyzing these metrics, investors can determine a company’s true worth and identify instances where the market has undervalued its potential. By purchasing value stocks at a discount to their intrinsic value, investors position themselves to potentially benefit from future price appreciation as the market corrects its perception of the company’s worth.

Moreover, value stocks often offer higher dividend yields compared to growth stocks. Dividends provide investors with a consistent stream of income, enhancing their overall returns. This passive income stream can be reinvested back into the market, further accelerating wealth accumulation over the long term. While dividends are not guaranteed, value stocks with a history of dividend payments tend to prioritize shareholder value, making them more likely to continue distributing dividends in the future.

In conclusion, value stocks represent an attractive investment strategy for those seeking long-term gains. Their focus on intrinsic value, potential for price appreciation, and higher dividend yields make them a solid addition to a diversified portfolio. By patiently identifying undervalued companies and holding them for the long term, investors can harness the power of value investing to achieve their financial goals.

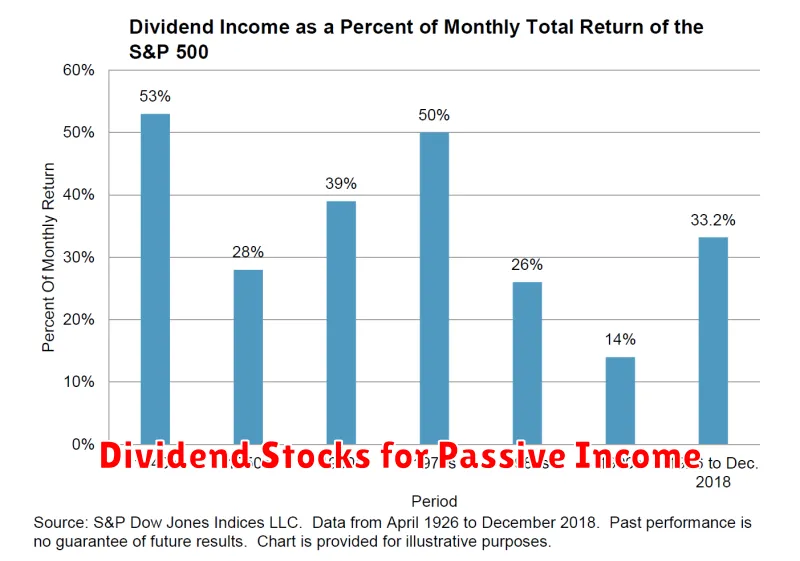

Dividend Stocks for Passive Income

In 2024, investors are looking for stable and reliable income streams. Dividend stocks offer a compelling opportunity to generate passive income and potentially grow your investment portfolio over time. These stocks pay out a portion of their profits to shareholders in the form of regular dividend payments, providing a consistent source of cash flow.

When choosing dividend stocks, consider factors like:

- Dividend Yield: This represents the annual dividend payment as a percentage of the stock’s current price. A higher yield generally means more income, but it’s crucial to analyze the company’s financial health before investing solely based on yield.

- Dividend Growth: Companies with a history of consistently increasing their dividends are a strong indicator of financial stability and a commitment to shareholder returns.

- Payout Ratio: This ratio indicates the percentage of earnings paid out as dividends. A sustainable payout ratio suggests the company can maintain its dividend payments without jeopardizing future growth.

Some popular dividend-paying sectors include:

- Real Estate Investment Trusts (REITs): These companies own and operate income-generating properties, offering attractive dividend yields and the potential for capital appreciation.

- Utilities: Companies providing essential services like electricity and gas tend to have stable earnings and consistent dividend payments.

- Consumer Staples: Companies offering everyday necessities, like food and beverages, generally have steady demand and predictable income streams.

Remember to conduct thorough research, diversify your portfolio across different sectors and industries, and consider your investment goals and risk tolerance before investing in any dividend stock.

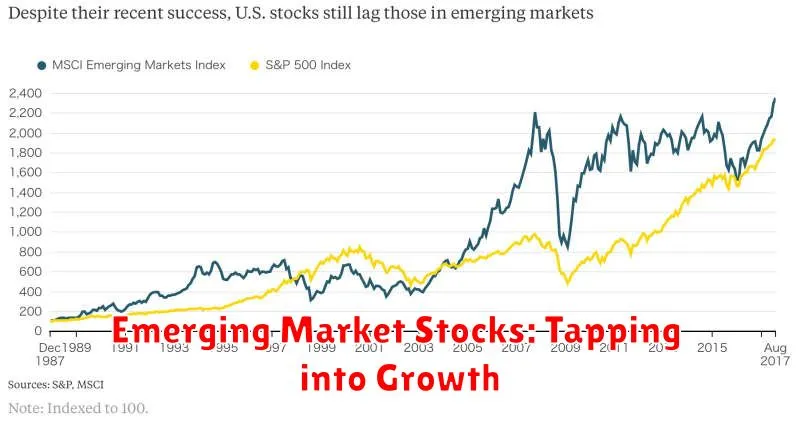

Emerging Market Stocks: Tapping into Growth

Emerging markets are a hot topic in the investment world right now, with many investors looking for opportunities to capitalize on their strong growth potential. Emerging market stocks offer a unique opportunity for investors seeking to diversify their portfolios and gain exposure to fast-growing economies. These markets are characterized by rapid economic growth, rising consumer spending, and a growing middle class, creating attractive investment opportunities across various sectors.

While emerging markets may carry a higher risk than developed markets, they also offer the potential for higher returns. Investing in emerging market stocks can be a strategic move for investors seeking long-term growth, but it’s essential to do thorough research and understand the unique risks and rewards involved.

Here are some key reasons why emerging markets offer attractive investment opportunities:

- Rapid Economic Growth: Many emerging markets are experiencing significant economic expansion, driven by factors such as population growth, urbanization, and technological advancements. This growth translates into increased demand for goods and services, creating opportunities for companies operating in these markets.

- Rising Consumer Spending: As incomes rise and the middle class expands, consumer spending is on the upswing in emerging markets. This surge in demand presents attractive opportunities for companies in consumer-oriented sectors, such as retail, consumer goods, and hospitality.

- Technological Advancements: Emerging markets are rapidly adopting new technologies, driving innovation and creating new industries. Investing in companies at the forefront of this technological revolution can offer significant returns.

- Government Support: Many emerging market governments are implementing policies to foster economic growth and attract foreign investment. These supportive measures can create a favorable environment for businesses to thrive.

However, it’s important to note that investing in emerging market stocks comes with its own set of risks:

- Political Instability: Some emerging markets face political instability, which can create uncertainty and volatility in the markets.

- Economic Volatility: Emerging economies can be more susceptible to economic shocks, such as currency fluctuations or commodity price swings.

- Regulatory Challenges: The regulatory environment in emerging markets can differ significantly from developed markets, which can pose challenges for foreign investors.

- Lack of Transparency: Corporate governance and financial reporting standards may not be as robust in some emerging markets, which can make it difficult to assess company performance.

Despite these risks, emerging market stocks can be a valuable addition to a well-diversified investment portfolio. Investors considering investing in this sector should consult with a financial advisor to assess their risk tolerance, investment goals, and understand the specific risks and rewards associated with emerging markets.

Tech Stocks Driving Innovation

The tech sector continues to be a hotbed of innovation, with companies pushing the boundaries of what’s possible in areas like artificial intelligence, cloud computing, and renewable energy. These technological advancements are not only transforming the way we live and work, but also presenting exciting investment opportunities for savvy investors. In 2024, several tech stocks stand out as promising bets, poised to capitalize on the industry’s growth and drive even more groundbreaking innovations.

Artificial Intelligence (AI) is one area where tech stocks are making significant strides. Companies developing AI-powered solutions for various industries are attracting significant investor interest. From chatbots and machine learning to autonomous vehicles and medical diagnostics, AI is revolutionizing multiple sectors, driving demand for tech companies at the forefront of this revolution.

Cloud Computing remains a crucial driver of tech innovation. As businesses increasingly adopt cloud solutions to enhance efficiency and scalability, cloud providers are experiencing tremendous growth. Investing in companies offering robust cloud infrastructure, data storage, and software solutions can be a strategic move for investors seeking exposure to this ever-expanding market.

Renewable Energy is another sector where tech stocks are playing a key role. As the world transitions towards sustainable energy sources, companies developing innovative technologies for solar, wind, and other renewable energy solutions are well-positioned for growth. Investing in companies driving this transition can be a way to align with both environmental goals and potential investment returns.

The tech sector is constantly evolving, and staying informed about emerging trends and innovative companies is crucial for investors. By carefully researching and considering the potential of tech stocks driving innovation, investors can potentially capture significant returns while supporting the development of groundbreaking technologies.

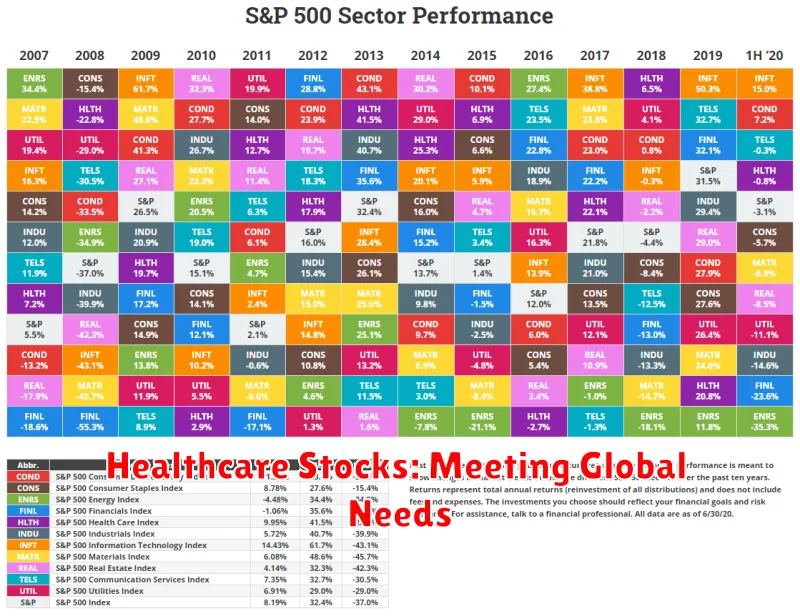

Healthcare Stocks: Meeting Global Needs

The healthcare industry is a global powerhouse, consistently demonstrating resilience and growth. As the world’s population ages and demand for innovative medical solutions escalates, healthcare stocks present compelling investment opportunities. These companies are at the forefront of tackling critical challenges such as chronic diseases, aging populations, and emerging infectious outbreaks.

Investing in healthcare stocks allows you to tap into a sector that is essential for human well-being. From pharmaceutical giants developing life-saving drugs to medical device manufacturers revolutionizing treatment approaches, healthcare companies are driving progress and improving lives. This industry’s fundamental role in addressing global health needs makes it a strategic investment choice for discerning investors.

Healthcare stocks offer a diverse range of investment possibilities, encompassing pharmaceutical companies, biotechnology firms, medical device manufacturers, healthcare providers, and healthcare technology innovators. This diversity provides investors with ample options to align their investment strategies with their risk tolerance and long-term goals. By carefully selecting healthcare stocks that demonstrate strong fundamentals, innovative products or services, and a commitment to research and development, investors can capitalize on the industry’s growth potential.

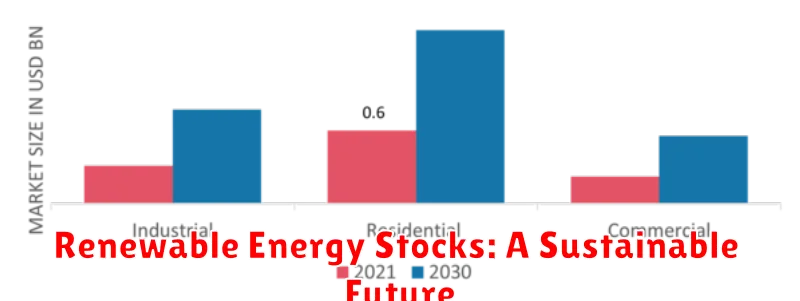

Renewable Energy Stocks: A Sustainable Future

The world is transitioning towards a cleaner, more sustainable future, and renewable energy is at the forefront of this change. Investing in renewable energy stocks presents a unique opportunity to align your portfolio with this global trend, potentially generating both financial returns and a positive environmental impact.

As the demand for renewable energy sources like solar, wind, and hydro continues to rise, companies in this sector are poised for significant growth. Investing in these stocks can offer a diversified approach to your portfolio, providing exposure to a rapidly evolving industry.

Before making any investment decisions, it’s crucial to research individual companies thoroughly. Consider factors such as their financial performance, technology, market position, and commitment to sustainability. Seeking advice from a financial advisor can also be beneficial in making informed choices.

Investing in renewable energy stocks isn’t just about financial gains; it’s about contributing to a greener future. By supporting companies committed to renewable energy solutions, you’re actively participating in the transition towards a more sustainable world.

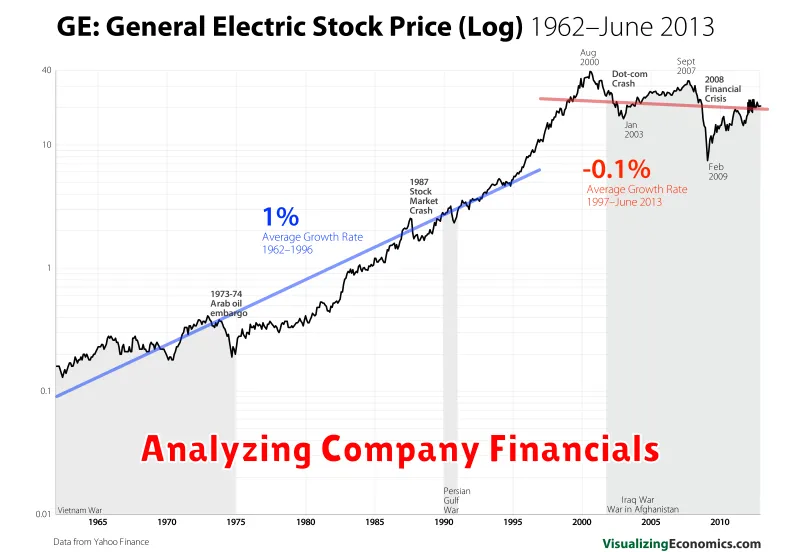

Analyzing Company Financials

Before diving into specific stocks, it’s crucial to understand how to analyze company financials. This process helps you identify potentially promising investments and avoid risky ones.

Key Financial Statements

Start by examining a company’s three primary financial statements:

- Income Statement: Shows a company’s revenue, expenses, and net income over a specific period.

- Balance Sheet: Provides a snapshot of a company’s assets, liabilities, and equity at a specific point in time.

- Cash Flow Statement: Tracks the movement of cash into and out of a company, revealing its ability to generate and manage cash.

Important Ratios and Metrics

To gain deeper insights, calculate and analyze key ratios and metrics:

- Profitability Ratios: (e.g., gross profit margin, net profit margin) reveal a company’s efficiency in generating profits.

- Liquidity Ratios: (e.g., current ratio, quick ratio) assess a company’s ability to meet short-term obligations.

- Solvency Ratios: (e.g., debt-to-equity ratio, interest coverage ratio) measure a company’s ability to meet long-term obligations.

- Valuation Ratios: (e.g., price-to-earnings ratio, price-to-sales ratio) help compare a company’s stock price relative to its earnings or sales.

Beyond the Numbers

Financial analysis should not solely rely on numbers. Consider qualitative factors like:

- Management Team: Their experience, track record, and vision.

- Industry Trends: Growth potential, competition, and regulatory landscape.

- Competitive Advantage: Unique products, services, or intellectual property.

Assessing Market Trends and Competition

Investing in the stock market can be an excellent way to grow your wealth, but it requires careful planning and research. Before making any investment decisions, it is crucial to assess market trends and competition. This step helps you identify promising opportunities and mitigate risks.

Economic Outlook: Understanding the overall economic climate is essential. Factors like inflation, interest rates, and GDP growth can significantly impact stock market performance. Look for signals of a robust economy or signs of potential slowdowns.

Industry Trends: Identifying industries with growth potential is key. Consider sectors like technology, healthcare, renewable energy, and e-commerce that are experiencing rapid innovation and expansion. Research companies within these sectors that are well-positioned to benefit from these trends.

Competitive Landscape: Analyze the competitive landscape within your chosen industry. Look for companies with strong market share, a differentiated product or service, and a competitive advantage. Consider factors like brand reputation, innovation, and pricing strategies.

Financial Performance: Evaluate the financial health of companies you are considering. Analyze their revenue growth, profitability, debt levels, and cash flow. Look for companies with a solid track record of financial performance.

Risk Assessment: Understand the potential risks associated with each investment. Consider factors like market volatility, industry competition, and company-specific risks. Diversify your portfolio across different industries and asset classes to mitigate risk.