Navigating the turbulent world of finance can feel like riding a wild bull, with the market soaring and plummeting in unpredictable ways. Understanding market trends is crucial for investors hoping to make informed decisions and ride the wave of prosperity. The financial landscape is often characterized by periods of bullish growth and bearish downturns, each presenting unique opportunities and challenges. This article will delve into the concepts of “riding the bull” and “weathering the bear,” providing insights into the characteristics, strategies, and psychological aspects of each market phase.

For those eager to capitalize on rising markets and potentially maximize returns, “riding the bull” is a coveted strategy. However, the thrill of a bull market can sometimes lead to risky overconfidence. Conversely, “weathering the bear” requires a different mindset, prioritizing preservation of capital and embracing a more cautious approach. By understanding the nuances of each market trend, investors can make informed decisions, manage risk effectively, and ultimately achieve their financial goals.

What Defines a Bull Market?

The term “bull market” is often used to describe a period of sustained growth in the stock market. But what exactly defines a bull market? It’s not just about a few days or weeks of positive performance. There are specific criteria that experts look at to determine whether a market is truly in a bull phase.

While there’s no official definition, a bull market typically involves:

- A sustained rise in stock prices: This is the most obvious indicator. The market needs to show consistent growth over a significant period.

- Increased investor confidence: When investors believe the market is healthy and poised for further growth, they are more likely to invest, further fueling the upward momentum.

- Positive economic conditions: Generally, a healthy economy with low unemployment, stable inflation, and robust growth in key sectors supports a bull market.

- A broad-based rally: This means the increase in prices is not limited to a few specific sectors or stocks but involves a wide range of companies across various industries.

It’s important to remember that a bull market is not a guarantee of continuous upward movement. Even during a bull phase, there can be short-term corrections or periods of volatility. However, the overall trend remains upward, with a sense of optimism and growth prevailing.

Characteristics of a Bull Market

A bull market is a period of sustained growth in the stock market, characterized by rising prices and investor optimism. It’s a time when investors feel confident about the economy and are willing to buy stocks, driving prices higher.

Here are some key characteristics of a bull market:

- Rising Stock Prices: The most obvious sign of a bull market is a sustained upward trend in stock prices. This is often measured by major stock market indexes like the S&P 500 or the Dow Jones Industrial Average.

- Strong Economic Growth: Bull markets typically occur during periods of strong economic growth, low unemployment, and rising corporate profits. When businesses are doing well, they tend to invest more, which fuels further economic growth and stock market gains.

- Low Interest Rates: Low interest rates make it cheaper for businesses to borrow money, encouraging investment and expansion. Lower rates also tend to make stocks more attractive than bonds, as investors seek higher returns.

- Increased Investor Confidence: Bull markets are driven by investor sentiment. When investors are optimistic about the future, they are more likely to buy stocks, driving prices higher.

- High Trading Volume: Increased trading activity is another sign of a bull market. As more investors buy and sell stocks, the volume of trades tends to increase.

It’s important to remember that bull markets don’t last forever. They are cyclical and eventually end. However, understanding the characteristics of a bull market can help investors make more informed decisions about their investments.

What Defines a Bear Market?

In the world of finance, the term “bear market” often evokes feelings of anxiety and uncertainty. It’s a period of sustained decline in the stock market, characterized by widespread pessimism and investor fear. But what exactly defines a bear market?

The most common definition of a bear market is a 20% or more decline from a recent peak in a major market index, such as the S&P 500 or the Nasdaq Composite. This decline is usually observed over a period of several months, and it’s accompanied by a general sense of negativity and a decrease in trading volume.

While a 20% drop is a widely accepted definition, it’s important to note that other factors can also contribute to classifying a market as bearish. These include:

- Widespread economic pessimism: Investors become convinced of a looming recession or economic downturn.

- High volatility: Market fluctuations become more frequent and significant, leading to increased uncertainty.

- Negative news flow: Bad news about companies, industries, or the overall economy fuels negative sentiment.

Understanding the characteristics of a bear market is crucial for investors, as it helps them navigate market volatility and make informed investment decisions. It’s important to remember that bear markets are a normal part of the economic cycle, and they eventually give way to periods of growth.

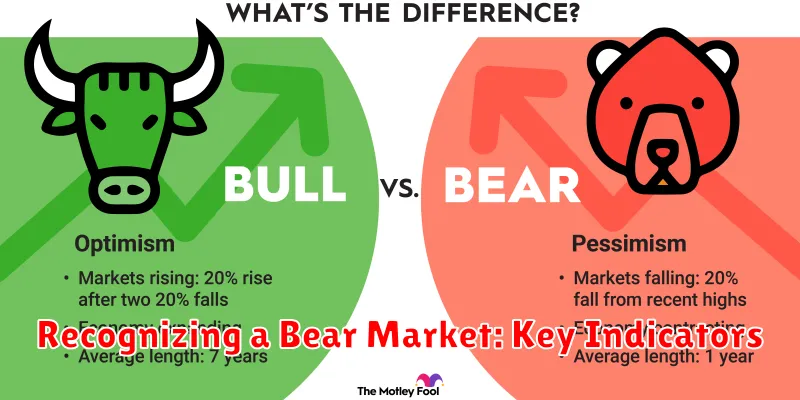

Recognizing a Bear Market: Key Indicators

Bear markets, characterized by a sustained decline in stock prices, can be unsettling for investors. Recognizing the signs of a potential bear market is crucial for making informed investment decisions. While predicting the market with absolute certainty is impossible, understanding key indicators can provide valuable insights.

One of the most prominent indicators is a significant drop in major stock indices like the S&P 500 or Nasdaq. A decline of 20% or more from a recent high is often considered a bear market. Economic indicators like rising inflation, slowing economic growth, and increasing unemployment rates can also signal a potential bear market. These factors can negatively impact corporate earnings, leading to stock price declines.

Another important indicator is investor sentiment. When confidence wanes and investors become pessimistic about the future, they tend to sell their holdings, contributing to further downward pressure on prices. This can be seen in declining trading volumes and increasing volatility in the market. Moreover, rising interest rates can make it more expensive for companies to borrow money, potentially impacting their growth and profitability, which in turn affects stock prices.

Finally, sector-specific indicators can provide clues about a potential bear market. For instance, a decline in the technology sector, which is often a bellwether for the broader market, could indicate a wider market downturn. While no single indicator is foolproof, observing a combination of these factors can help you identify potential bear market conditions.

Bull vs. Bear: Key Differences and Investment Strategies

The stock market, like any other market, experiences periods of growth and decline. These fluctuations are often characterized by the metaphors of a “bull” market and a “bear” market. Understanding the key differences between these two market phases and their associated investment strategies is crucial for any investor, regardless of experience level.

A bull market is defined by a sustained upward trend in stock prices. It is characterized by investor optimism, strong economic growth, and low interest rates. During a bull market, businesses are expanding, consumers are spending, and investors are eager to buy stocks.

In contrast, a bear market is characterized by a prolonged decline in stock prices. Investor sentiment is typically pessimistic, and the economy may be experiencing weakness or recession. During a bear market, businesses may be struggling, consumer spending may be low, and investors are often cautious about investing.

Key Differences Between Bull and Bear Markets

| Characteristic | Bull Market | Bear Market |

|---|---|---|

| Stock Prices | Rising | Falling |

| Investor Sentiment | Optimistic | Pessimistic |

| Economic Growth | Strong | Weak or Recessionary |

| Interest Rates | Low | Potentially Rising |

| Investment Strategy | Growth-oriented | Value-oriented or Defensive |

Investment Strategies for Bull and Bear Markets

The ideal investment strategy depends on the current market phase. Here’s a breakdown:

Bull Market Strategies:

- Growth Stocks: These stocks tend to appreciate more rapidly during bull markets. They often belong to companies in high-growth industries with strong potential.

- Index Funds: Tracking broad market indexes like the S&P 500 allows you to participate in the overall market growth.

- Active Management: Engaging in stock picking and sector rotation can potentially outperform the market if you have the expertise and time.

Bear Market Strategies:

- Value Stocks: These stocks may be undervalued by the market and offer potential for growth once the bear market ends.

- Defensive Stocks: Companies in essential sectors like healthcare and consumer staples tend to hold their value better during downturns.

- Cash: Holding cash allows you to buy stocks at lower prices during the bear market and capitalize on the rebound.

It’s important to remember that market timing is difficult and there is no guarantee of success. However, understanding the nuances of bull and bear markets can help you make more informed investment decisions.

Impact of Bull and Bear Markets on Investor Psychology

The stock market is a constant dance between bullish and bearish sentiments, each phase significantly impacting investor psychology. A bull market, characterized by rising prices and optimism, often fuels a sense of greed and overconfidence. Investors may become overly aggressive, chasing returns and ignoring potential risks. This can lead to irrational exuberance, where investors buy stocks regardless of their true value, fueled by the belief that the market will continue to climb indefinitely.

Conversely, a bear market, marked by falling prices and pessimism, brings about a wave of fear and panic. Investors may become overly cautious, selling off assets to limit losses and opting for safe-haven investments. This can lead to capitulation, where investors surrender to the market’s downtrend, selling at the bottom and further exacerbating the decline.

Understanding the psychological effects of bull and bear markets is crucial for investors. Recognizing the emotional biases that come with each phase can help investors make more rational decisions. In a bull market, maintaining a healthy dose of skepticism and avoiding over-extension can prevent excessive losses during a potential downturn. In a bear market, staying disciplined and avoiding panic selling can help investors ride out the storm and emerge with their investments intact.

Navigating Market Volatility: Strategies for Both Bull and Bear Markets

The stock market, a dynamic ecosystem driven by economic forces, investor sentiment, and global events, is inherently volatile. It experiences periods of growth, commonly known as bull markets, and periods of decline, referred to as bear markets. While the allure of bull markets is undeniable, navigating bear markets is crucial for long-term financial success. This article will explore strategies for both bull and bear markets, empowering you to ride the highs and weather the lows.

Strategies for Bull Markets:

- Invest strategically: Utilize a diversified portfolio encompassing various asset classes like stocks, bonds, and real estate. This helps mitigate risk and capture growth potential across different sectors.

- Dollar-cost averaging: Invest a fixed amount regularly, regardless of market fluctuations, to average your purchase price over time. This reduces the impact of market volatility.

- Long-term perspective: Avoid short-term trading and focus on long-term goals. Bull markets tend to last longer than bear markets, allowing for substantial growth over time.

Strategies for Bear Markets:

- Stay disciplined: Avoid panic selling and stick to your investment plan. Remember that market corrections are temporary and buying during downturns can lead to long-term gains.

- Rebalance your portfolio: Adjust your asset allocation to mitigate risk. Shift towards more conservative investments like bonds or cash during bear markets.

- Seek professional advice: Consult with a financial advisor for personalized guidance and strategies during turbulent market conditions.

Conclusion:

Navigating market volatility requires a strategic approach, discipline, and a long-term mindset. While bull markets offer exciting growth opportunities, bear markets are an inevitable part of the market cycle. By implementing appropriate strategies for both scenarios, investors can position themselves to ride the waves of volatility and achieve their financial goals.

Long-Term Investing in a Cyclical Market

The stock market is inherently cyclical, meaning it experiences periods of growth (bull markets) followed by periods of decline (bear markets). While it can be tempting to try to time the market and capitalize on these cycles, long-term investing remains the most prudent approach for achieving financial goals.

Long-term investors focus on building a diversified portfolio and holding it for an extended period, typically years or even decades. This approach allows them to ride out market fluctuations and benefit from the long-term growth potential of the stock market. While individual stocks may experience volatility, the overall market trend tends to be upwards over time.

Key benefits of long-term investing in a cyclical market include:

- Reduced risk: Holding investments for the long term mitigates the impact of short-term market swings.

- Compounded growth: Consistent investment allows for the power of compounding, where returns generate further returns over time.

- Emotional detachment: Long-term investors are less likely to panic sell during market downturns, leading to better decision-making.

While market cycles are unavoidable, focusing on long-term goals and maintaining a disciplined investment strategy can help navigate them effectively. By riding the bull markets and weathering the bear markets, investors can maximize their chances of achieving their financial aspirations.

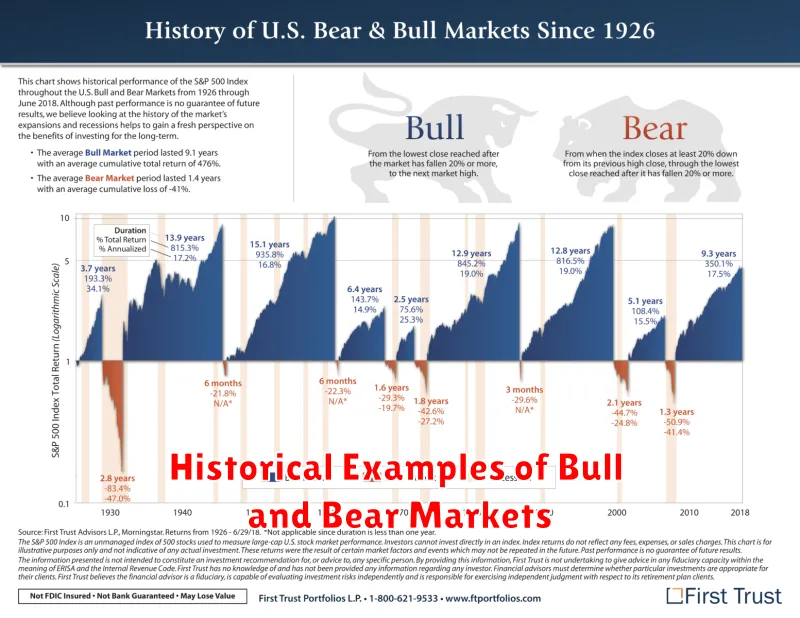

Historical Examples of Bull and Bear Markets

Understanding bull and bear markets is crucial for any investor. A bull market is characterized by rising prices, investor optimism, and economic growth. Conversely, a bear market is marked by declining prices, pessimism, and economic contraction. Let’s delve into some historical examples to illustrate these market trends.

The Roaring Twenties (1920s) was a prime example of a bull market. The period saw rapid economic expansion, fueled by technological advancements and consumer spending. The stock market soared, with the Dow Jones Industrial Average (DJIA) gaining over 400% during this decade. However, this bull market ended abruptly with the infamous Wall Street Crash of 1929, marking the beginning of the Great Depression. This crash serves as a stark reminder that bull markets, like all market cycles, are not eternal.

The 1980s, under the presidency of Ronald Reagan, witnessed a robust bull market fueled by deregulation, tax cuts, and a surge in technological innovation. The DJIA rose by over 300% during this period, propelling the American economy to new heights. This bull market exemplified the power of economic policy in driving market growth.

The dot-com bubble of the late 1990s and early 2000s presented a classic example of a speculative bull market. Fueled by the internet revolution, many technology companies saw their stock prices skyrocket, leading to an unsustainable bubble. The bubble burst in 2000, marking a sharp decline in the stock market. This episode underscores the importance of differentiating between sustainable growth and speculative frenzy.

The 2008 financial crisis serves as a powerful example of a bear market. The crisis, triggered by a collapse in the housing market and subprime mortgage defaults, led to a global economic downturn. Major stock indices plummeted, and investors suffered significant losses. This bear market highlighted the interconnectedness of global markets and the potential impact of systemic risks on the financial system.

By examining historical bull and bear markets, investors can gain valuable insights into market cycles and understand the factors that drive them. This knowledge helps them make informed decisions and navigate market volatility with a greater sense of preparedness.