The cryptocurrency market is a volatile beast, fluctuating wildly with every piece of news, regulatory update, and technical development. But amidst the chaos, many are looking for answers, seeking to decipher the cryptic signals and predict what lies ahead. Enter the cryptocurrency market predictions, those coveted insights that promise to guide investors toward profit or, at the very least, offer a glimpse into the future of this rapidly evolving space.

From seasoned analysts to self-proclaimed prophets, everyone seems to have an opinion on where crypto is headed. But with so much noise and speculation, it can be difficult to separate fact from fiction. This article dives deep into the world of cryptocurrency market predictions, exploring the methodologies, biases, and potential pitfalls that come with attempting to forecast the future of digital assets. We’ll examine the various factors that influence these predictions, analyze the track records of different analysts, and ultimately, provide you with the tools to critically evaluate and make informed decisions in this unpredictable landscape.

The Challenge of Predicting Cryptocurrency Markets

Predicting the future of cryptocurrency markets is a notoriously difficult task. The volatile nature of this emerging asset class, coupled with the complex interplay of factors influencing its price movements, makes it a true challenge for even the most seasoned analysts.

One key difficulty lies in the lack of established historical data. Unlike traditional financial markets with decades of historical records, cryptocurrencies are relatively new, with limited data available for analysis. This makes it difficult to identify trends and patterns that could predict future price movements.

Another significant challenge is the impact of external factors. Cryptocurrency prices are influenced by a wide range of external events, including regulatory changes, technological advancements, media sentiment, and macroeconomic conditions. These factors are often unpredictable and can drastically impact market sentiment and price volatility.

Moreover, the decentralized nature of cryptocurrency makes it difficult to accurately track market sentiment and identify key players influencing price movements. The lack of a central authority or regulatory oversight further adds to the complexity and uncertainty surrounding the market.

Despite the challenges, predicting cryptocurrency markets is a crucial task for investors and traders. However, it’s important to recognize the limitations and complexities involved and approach predictions with a healthy dose of skepticism. While some tools and techniques can provide insights, relying solely on predictions can be risky. It’s essential to conduct thorough research, consider multiple perspectives, and make informed decisions based on a comprehensive understanding of the market.

Factors Influencing Future Price Movements

Predicting cryptocurrency prices is a challenging endeavor, akin to gazing into a crystal ball. While no one can definitively say what the future holds, understanding the factors that influence price movements can provide valuable insights. These factors can be broadly categorized into fundamental, technical, and external elements.

Fundamental factors are the underlying characteristics of cryptocurrencies that drive their value. This includes factors like:

- Adoption: Wider adoption by businesses, individuals, and governments increases demand and can push prices higher.

- Technology: Innovations in blockchain technology and the development of new applications can enhance the utility of cryptocurrencies, potentially boosting their value.

- Supply and Demand: The scarcity of a cryptocurrency and its circulating supply play a crucial role in determining its price. A limited supply coupled with strong demand can lead to price appreciation.

- Regulatory Landscape: Clear and favorable regulations can foster confidence and attract investors, positively impacting prices.

Technical factors involve analyzing charts and historical data to identify patterns and trends. These can include:

- Moving averages: These indicators smooth out price fluctuations and provide insights into price trends.

- Relative Strength Index (RSI): This metric measures the magnitude of recent price changes to evaluate whether a cryptocurrency is overbought or oversold.

- Support and Resistance Levels: These are price levels that act as potential barriers to further price movements.

External factors refer to broader macroeconomic conditions and events that can influence the cryptocurrency market. These include:

- Global economic conditions: Volatility in stock markets, interest rates, and inflation can impact investor sentiment and cryptocurrency prices.

- Geopolitical events: Wars, political instability, and other significant events can create uncertainty and affect market dynamics.

- Media coverage and sentiment: Positive or negative news coverage can influence investor perception and drive price movements.

While these factors can provide a framework for understanding cryptocurrency price movements, it is important to remember that the market is constantly evolving. Therefore, it is crucial to stay informed, conduct thorough research, and exercise caution when making investment decisions.

Technical Analysis and Chart Patterns

Technical analysis is a method of forecasting future price movements of an asset by studying past price data. It involves using charts and indicators to identify trends, patterns, and signals that can provide insights into market sentiment and potential future price movements. While not a foolproof method, it can be a valuable tool for traders and investors who want to make informed decisions.

One of the key components of technical analysis is the identification of chart patterns. These are recurring formations on price charts that can signal potential price reversals, breakouts, or continuations of trends. Some common chart patterns include:

- Head and Shoulders: This pattern signals a potential reversal of an uptrend and is characterized by a peak (the head) flanked by two smaller peaks (the shoulders).

- Double Top/Double Bottom: These patterns indicate a possible reversal of a trend. A double top signifies a potential reversal of an uptrend, while a double bottom signals a possible reversal of a downtrend.

- Triangles: Triangles are consolidation patterns that can signal a breakout in either direction, depending on the type of triangle.

- Flags and Pennants: These patterns are continuation patterns, meaning they suggest that the existing trend will continue after a brief pause.

It’s important to remember that technical analysis is not an exact science. Market conditions can be unpredictable, and patterns can sometimes fail to play out as expected. However, when used in conjunction with other forms of analysis, technical analysis can provide valuable insights into the cryptocurrency market and help traders make more informed decisions.

On-Chain Metrics and Sentiment Analysis

Navigating the cryptocurrency market can feel like peering into a fog-filled crystal ball. The volatility and unpredictability make forecasting future price movements a daunting task. However, recent advancements in data analysis have provided us with powerful tools to shed light on market trends. On-chain metrics and sentiment analysis are two such tools that offer valuable insights into the market’s current state and potential future direction.

On-chain metrics delve into the underlying blockchain activity, providing a quantifiable lens into the actions of market participants. By examining data like transaction volume, active addresses, and network hash rate, we can gain insights into market sentiment, investor behavior, and potential market shifts. For example, a surge in active addresses might indicate increased user participation and potential future price growth.

Sentiment analysis, on the other hand, focuses on the emotional tone surrounding a specific cryptocurrency or the market as a whole. By analyzing social media conversations, news articles, and online forum discussions, analysts can gauge the overall market sentiment. Positive sentiment can lead to price increases, while negative sentiment may foreshadow price dips. Combining these two approaches provides a comprehensive view of the cryptocurrency market.

While on-chain metrics and sentiment analysis are powerful tools, it’s crucial to remember they are not foolproof predictors of future price movements. The cryptocurrency market is dynamic and influenced by a multitude of factors. However, by leveraging these analytical techniques, investors can gain a deeper understanding of the market, make more informed decisions, and navigate the turbulent waters with greater confidence.

Expert Opinions and Market Sentiment

The cryptocurrency market is notoriously volatile, making accurate predictions a challenging feat. However, gleaning insights from expert opinions and market sentiment can offer valuable guidance. Many renowned analysts and investors share their perspectives on market trends, price movements, and future outlook. These opinions, while not foolproof, can provide a broader understanding of prevailing sentiments and potential drivers of market behavior.

Market sentiment, often gauged through social media buzz, news coverage, and trading activity, can also be a useful indicator. A surge in positive sentiment might suggest growing investor confidence and potential price rallies, while negativity could signal a bearish outlook. However, it’s crucial to remember that sentiment can be fickle and prone to exaggeration, making it essential to consider other factors.

While expert opinions and market sentiment provide valuable insights, it’s crucial to approach them with a critical eye. Remember that these are opinions, not guaranteed outcomes. Conducting thorough research, diversifying investments, and adopting a long-term perspective are key to navigating the dynamic cryptocurrency landscape.

Long-Term vs. Short-Term Predictions

Navigating the volatile world of cryptocurrency requires a clear understanding of the distinction between long-term and short-term predictions. While both types of forecasts play a role in investment strategies, their underlying principles and potential outcomes differ significantly.

Short-term predictions focus on analyzing market trends and sentiment within a shorter time frame, typically days, weeks, or even months. They leverage technical indicators, news events, and social media buzz to identify potential price fluctuations. Short-term predictions are inherently riskier, as they are more susceptible to sudden shifts in market dynamics. However, they can provide opportunities for quick profits for experienced traders who can capitalize on short-term volatility.

Long-term predictions, on the other hand, delve deeper into the fundamental value of a cryptocurrency, its adoption rate, technological advancements, and the broader regulatory landscape. They consider the long-term potential of the underlying technology and its impact on the future of finance and other industries. Long-term predictions are less affected by short-term fluctuations and offer a more stable and sustainable investment approach. They are typically based on research, analysis, and a belief in the underlying value of the cryptocurrency.

Ultimately, choosing between long-term and short-term predictions depends on your individual investment goals, risk tolerance, and time horizon. Short-term predictions are suitable for those seeking quick gains, while long-term predictions are better suited for those with a longer-term vision and a greater emphasis on fundamental value.

The Impact of Regulation and Government Policies

The cryptocurrency market, known for its volatility and rapid growth, is heavily influenced by regulation and government policies. These external factors can significantly impact the trajectory of the market, fostering both opportunities and challenges for investors and businesses alike.

Government regulations can create a sense of legitimacy and security, attracting more institutional investors and driving mainstream adoption. Clear rules and guidelines can help establish investor confidence, promoting responsible growth and mitigating risks. However, overly stringent regulations can stifle innovation and hinder the growth of the industry.

Government policies concerning taxation, financial inclusion, and financial crime prevention can have a profound impact on the cryptocurrency landscape. Favorable tax policies can encourage investment and stimulate economic activity, while restrictive policies can discourage participation.

The impact of regulation and government policies on the cryptocurrency market remains a subject of ongoing discussion. As the industry continues to evolve, navigating the ever-changing regulatory landscape will be crucial for its future.

Bitcoin’s Dominance and Altcoin Potential

The cryptocurrency market is constantly evolving, with new projects emerging and existing ones vying for dominance. While Bitcoin remains the undisputed king, its dominance is being challenged by a growing number of altcoins. Understanding the interplay between Bitcoin’s dominance and altcoin potential is crucial for navigating this dynamic landscape.

Bitcoin’s dominance, measured by its market capitalization share, has been steadily declining in recent years. This trend suggests that investors are increasingly looking beyond Bitcoin for alternative investment opportunities. This shift is driven by various factors, including:

- Innovation and Utility: Altcoins offer a wide range of innovative features and use cases, such as decentralized finance (DeFi), non-fungible tokens (NFTs), and privacy-focused solutions.

- Scalability and Efficiency: Some altcoins address Bitcoin’s limitations in terms of transaction speed and costs, providing faster and more cost-effective solutions.

- Risk and Diversification: Investors seeking diversification and higher returns may allocate a portion of their portfolio to altcoins, even if they maintain a core position in Bitcoin.

While altcoins present exciting opportunities, it’s essential to approach them with caution. The cryptocurrency market is volatile and unpredictable, and many altcoins lack the established track record and infrastructure of Bitcoin. Therefore, it is crucial to conduct thorough research and understand the underlying technology, team, and market fundamentals before investing in any altcoin.

The future of the cryptocurrency market will likely involve a coexistence of Bitcoin and altcoins. Bitcoin will likely remain the dominant digital asset due to its established brand, strong community, and limited supply. However, altcoins will continue to innovate and cater to specific needs, potentially capturing significant market share and offering investors unique investment opportunities.

The Role of Institutional Investors

Institutional investors, such as hedge funds, pension funds, and insurance companies, are increasingly playing a significant role in the cryptocurrency market. Their entrance is bringing about a new era of maturity and legitimacy to the space. These investors are attracted by the potential for high returns and the growing acceptance of cryptocurrencies as a legitimate asset class.

The influence of institutional investors is evident in several key ways:

- Increased liquidity: Large institutional trades can significantly increase market liquidity, making it easier for individual investors to buy and sell cryptocurrencies.

- Price stability: Institutional investors tend to hold cryptocurrencies for longer periods, contributing to price stability and reducing volatility.

- Regulatory clarity: As institutional investors enter the market, they push for regulatory clarity, which can further legitimize the space and attract even more capital.

- Infrastructure development: Institutional investors are driving the development of better infrastructure, such as custodial services, trading platforms, and analytics tools, which make it easier for others to participate in the market.

However, it’s important to note that the entry of institutional investors also brings its own set of challenges. Some concerns include:

- Market manipulation: The sheer size of institutional trades could potentially influence market prices, potentially leading to market manipulation.

- Increased competition: As more institutional investors enter the market, the competition for profits could intensify, potentially squeezing out smaller players.

Overall, the role of institutional investors in the cryptocurrency market is complex and evolving. While their entrance brings significant benefits, such as increased liquidity and regulatory clarity, it also poses potential challenges, such as market manipulation and increased competition. As the market continues to mature, it will be crucial to monitor the impact of institutional investors and understand their role in shaping the future of cryptocurrencies.

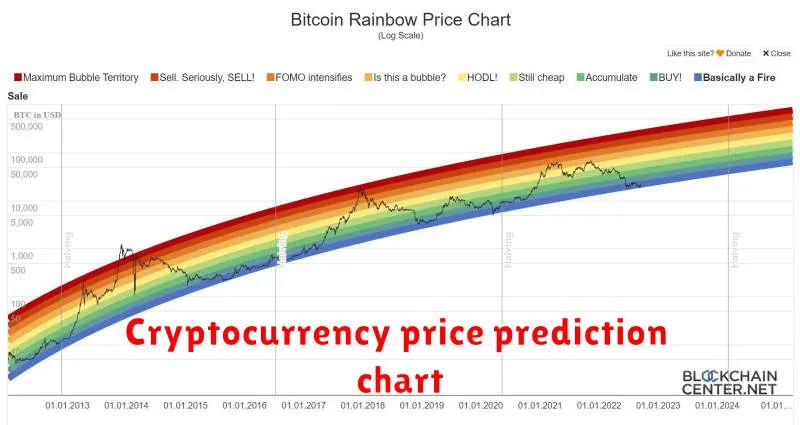

Understanding Market Cycles and Trends

The cryptocurrency market, like any other financial market, operates within a cyclical pattern. This pattern is influenced by various factors, including market sentiment, investor behavior, technological advancements, and regulatory changes. Understanding these cycles and trends is crucial for investors and traders alike, as it helps them make informed decisions and navigate the volatile nature of the market.

Market Cycles are recurring periods of growth and decline that are characterized by specific phases: Bull Market, where prices rise steadily, fueled by strong investor confidence and positive sentiment; Bear Market, where prices fall significantly, driven by negative sentiment, fear, and uncertainty; and Consolidation, a period of sideways trading where prices fluctuate within a specific range, typically after a bull or bear market.

Market Trends refer to the overall direction of the market over a specific period. They can be Uptrend, indicating increasing prices and bullish sentiment; Downtrend, indicating decreasing prices and bearish sentiment; and Sideways Trend, indicating price fluctuations within a range.

Recognizing and understanding market cycles and trends can be achieved through various tools and techniques, including technical analysis, fundamental analysis, and historical data analysis. By studying charts, indicators, and market news, investors and traders can identify potential turning points and adjust their strategies accordingly.

Risk Management and Responsible Investing

The cryptocurrency market is notorious for its volatility, leaving investors constantly seeking ways to navigate its turbulent waters. While predictions abound, understanding the inherent risks and embracing responsible investing strategies are crucial for weathering the storms and making informed decisions.

Risk Management is paramount in this space. Diversification across various cryptocurrencies, employing stop-loss orders to limit potential losses, and maintaining a healthy risk tolerance are essential principles to adopt.

Responsible Investing focuses on aligning investments with personal values and ethical considerations. It involves scrutinizing the projects behind cryptocurrencies, assessing their environmental impact, and considering their potential societal benefits.

Gazing into the crystal ball of market predictions is exciting, but responsible investing demands a sober approach. By embracing risk management and ethical considerations, investors can navigate the dynamic cryptocurrency landscape with greater confidence and purpose.

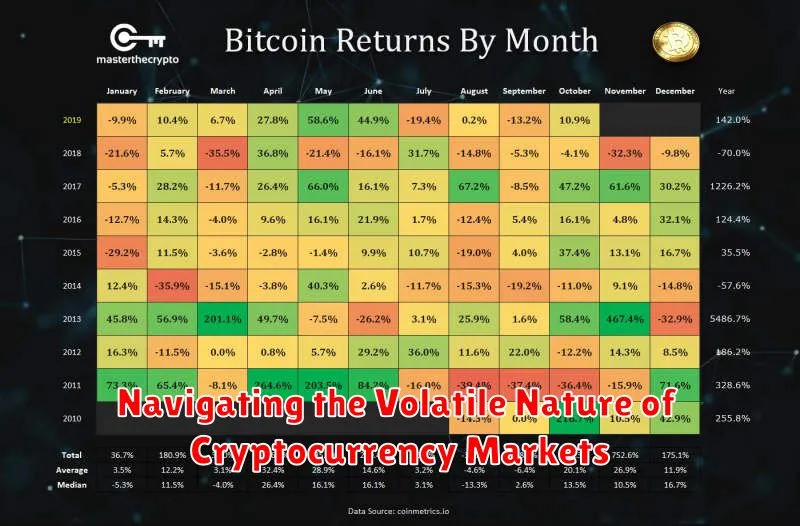

Navigating the Volatile Nature of Cryptocurrency Markets

The cryptocurrency market is known for its volatility. Prices can swing wildly in both directions, making it a challenging environment for investors. Understanding the factors that contribute to this volatility is crucial for navigating this market effectively.

One key driver of volatility is the lack of regulation in the crypto space. Without clear rules and oversight, the market is more susceptible to speculative trading and manipulation. This can lead to rapid price fluctuations as investors react to news, rumors, and sentiment.

Another factor is the inherent risk associated with cryptocurrencies. Unlike traditional assets like stocks or bonds, cryptocurrencies are not backed by tangible assets. Their value is derived from their perceived utility and adoption. This inherent risk can lead to heightened volatility as investors adjust their expectations.

Furthermore, market sentiment plays a significant role in driving price movements. When investor confidence is high, prices tend to rise. Conversely, negative sentiment can lead to sell-offs and price drops. The rapid spread of information in the digital age amplifies the impact of sentiment on the market.

Despite the volatility, the cryptocurrency market presents both risks and opportunities. Understanding the factors that contribute to price fluctuations can help investors make informed decisions and manage their exposure effectively. By carefully analyzing market trends, staying informed about regulatory developments, and managing risk, investors can navigate the volatile nature of the cryptocurrency market and potentially reap the rewards.