The world of cryptocurrency is constantly evolving, with new developments emerging daily. One of the most significant aspects of this evolution is the increasing focus on regulation. Governments and regulatory bodies around the world are grappling with how to best manage this burgeoning industry, and their decisions are having a profound impact on the cryptocurrency market. From the introduction of new legislation to the enforcement of existing rules, understanding the latest developments in cryptocurrency regulation is crucial for investors, businesses, and anyone interested in this space.

In this article, we’ll delve into the latest news surrounding cryptocurrency regulation. We’ll examine the key regulatory initiatives, analyze the potential impact on the market, and explore the challenges and opportunities that lie ahead. Whether you’re a seasoned crypto enthusiast or just starting to explore this exciting world, understanding the regulatory landscape is essential. Join us as we navigate the complexities of cryptocurrency regulation and its implications for the future.

The Evolving Landscape of Cryptocurrency Regulation

The cryptocurrency landscape is in constant flux, and one of the most significant factors driving this change is the evolving regulatory environment. Governments and regulatory bodies around the world are grappling with how to approach this burgeoning industry, and their decisions have a profound impact on the market. This article will delve into the latest news and developments in cryptocurrency regulation and explore how they are shaping the future of this dynamic sector.

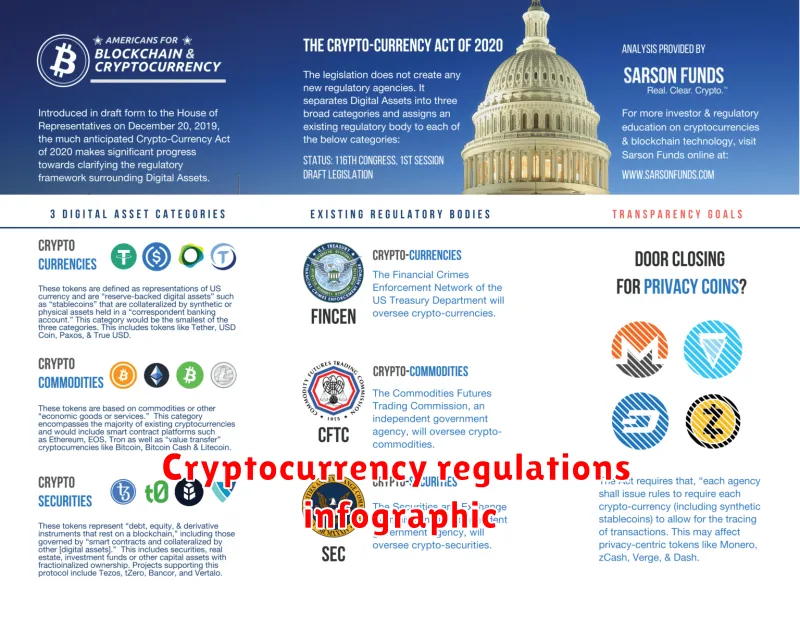

In recent years, we have seen a growing trend towards regulatory clarity and oversight in the cryptocurrency space. This is particularly evident in established financial hubs like the United States and Europe, where authorities are taking a more proactive stance. The US Securities and Exchange Commission (SEC) has been actively classifying various crypto assets, while the European Union is working on comprehensive legislation to govern the entire cryptocurrency ecosystem. These efforts aim to strike a balance between fostering innovation and protecting investors.

One of the key areas of focus for regulators is the classification of crypto assets. Whether a particular token is considered a security, a commodity, or something else entirely has significant implications for how it is regulated. This is a complex issue with far-reaching consequences, and regulators are still navigating the complexities of these classifications.

Beyond classification, regulators are also addressing issues such as anti-money laundering (AML) and combating the financing of terrorism (CFT). These concerns are particularly relevant in the context of decentralized finance (DeFi), where transactions are often anonymous and difficult to trace. Many jurisdictions are introducing regulations to enhance transparency and traceability in the crypto space.

The evolving landscape of cryptocurrency regulation is a critical factor shaping the market’s future. While there are challenges and uncertainties, the trend towards greater clarity and oversight is likely to continue. This will create a more stable and predictable environment for investors, businesses, and developers, fostering innovation and growth within the cryptocurrency ecosystem.

Key Regulatory Bodies and Their Stances

Navigating the world of cryptocurrency requires understanding the regulatory landscape. While the crypto space is evolving rapidly, several key regulatory bodies are actively shaping the industry with their stances on various aspects, including trading, investment, and consumer protection.

The Securities and Exchange Commission (SEC) in the United States has been particularly active, often classifying many cryptocurrencies as securities. This means they fall under the SEC’s regulatory purview, requiring issuers to comply with strict registration and disclosure requirements. The SEC’s focus on investor protection has resulted in increased scrutiny of initial coin offerings (ICOs) and platforms listing digital assets.

In the European Union, the European Securities and Markets Authority (ESMA) has been instrumental in establishing a more unified regulatory framework for cryptocurrencies. ESMA’s focus is on investor protection, market integrity, and financial stability. It has been actively involved in setting guidelines for crypto-asset service providers, aiming to create a level playing field for investors and businesses operating within the EU.

In the United Kingdom, the Financial Conduct Authority (FCA) has adopted a cautious approach, emphasizing the need for stringent consumer protection measures. The FCA has implemented rules requiring crypto-asset firms to register and adhere to anti-money laundering regulations. The UK government is also exploring the potential of a central bank digital currency (CBDC) while considering the broader impact on financial stability.

The Financial Action Task Force on Money Laundering (FATF) is a global intergovernmental organization that sets standards for combating money laundering and terrorist financing. The FATF’s Travel Rule, which applies to virtual asset service providers (VASPs), aims to enhance transparency and prevent the use of cryptocurrencies for illicit activities. This rule requires VASPs to share information about senders and receivers of crypto transactions, ultimately contributing to a safer and more secure financial ecosystem.

Understanding the evolving stances of these key regulatory bodies is essential for navigating the complex world of cryptocurrency. As regulations continue to shape the industry, investors, businesses, and individuals need to stay informed and adapt to the changing landscape.

Impact of Regulation on Cryptocurrency Prices

The cryptocurrency market is still in its early stages and is characterized by high volatility. One of the key factors that can influence the price of cryptocurrencies is regulation. Regulatory clarity can provide investors with more confidence in the market, leading to increased investment and higher prices. On the other hand, strict regulations can stifle innovation and limit the growth of the industry, potentially leading to lower prices.

Positive impact:

- Increased investor confidence

- Greater market stability

- Reduced risk of fraud and scams

- Increased adoption and use of cryptocurrencies

Negative impact:

- Reduced innovation and experimentation

- Increased compliance costs for businesses

- Limited access to the market for smaller investors

- Possible price suppression due to increased scrutiny

The impact of regulation on cryptocurrency prices is complex and multifaceted. The specific effects will depend on the nature of the regulations, the jurisdiction in which they are implemented, and the overall market sentiment.

As the cryptocurrency market continues to evolve, it is likely that we will see more regulation in the future. This is a positive development for the long-term health of the industry, but it will also have a significant impact on prices in the short term.

Consumer Protection Measures in the Crypto Space

The rapid growth of the cryptocurrency market has brought with it a surge in investor interest, but also raised concerns about consumer protection. Regulators around the world are grappling with how to balance innovation with safeguarding investors.

One key area of focus is anti-money laundering (AML) and combating the financing of terrorism (CFT). Cryptocurrencies can be used to facilitate illicit activities, making it essential to implement robust AML/CFT measures. This includes requiring exchanges and other platforms to verify the identities of their customers and report suspicious transactions.

Another crucial aspect is investor education. Many investors lack a deep understanding of cryptocurrencies and the risks involved. Regulators are promoting financial literacy initiatives to help consumers make informed investment decisions. This includes providing guidance on identifying scams, understanding the intricacies of different crypto assets, and navigating the complexities of the decentralized finance (DeFi) space.

Additionally, there’s a growing emphasis on protecting consumers from fraudulent activities. This involves cracking down on fraudulent initial coin offerings (ICOs) and scams targeting unsuspecting investors. Regulators are working to establish clear regulatory frameworks that define the boundaries of legitimate crypto activity and prevent malicious actors from exploiting loopholes.

The development of consumer protection measures in the crypto space is an ongoing process. It requires a collaborative effort between regulators, industry players, and consumer advocacy groups to ensure a safe and transparent environment for investors. By addressing these challenges proactively, the crypto industry can foster long-term growth while safeguarding the interests of consumers.

Anti-Money Laundering (AML) and Know Your Customer (KYC) Regulations

The cryptocurrency industry is evolving rapidly, and with it comes a growing focus on regulatory compliance. One of the most critical areas is Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations. These measures are designed to prevent financial crime and ensure that cryptocurrency platforms are not being used for illicit activities.

AML regulations require companies to identify and mitigate the risk of money laundering, which involves disguising the origin of illegally obtained funds. KYC regulations mandate that companies verify the identity of their customers to prevent fraud and other financial crimes.

The implementation of AML and KYC regulations in the cryptocurrency space presents unique challenges. Crypto transactions are often anonymous and pseudonymous, making it difficult to track the flow of funds. Furthermore, the decentralized nature of cryptocurrencies makes it more difficult to identify and verify the identities of individuals involved in transactions.

However, there are also benefits to adopting these regulations. Strong AML and KYC practices can enhance the reputation of the cryptocurrency industry, attract more institutional investors, and promote financial stability. This can ultimately lead to wider adoption and growth of the market.

Various regulatory bodies around the world are actively working on developing comprehensive frameworks for regulating the cryptocurrency industry, including AML and KYC standards. It’s important for cryptocurrency companies to stay abreast of these evolving regulations and ensure their compliance to foster a secure and trustworthy environment for both investors and users.

Tax Implications of Cryptocurrency Investments

The cryptocurrency market is constantly evolving, and with it, the regulatory landscape is shifting. This dynamic environment brings with it a degree of uncertainty, especially when it comes to the tax implications of cryptocurrency investments. It’s crucial for investors to understand how these digital assets are treated for tax purposes to ensure compliance and avoid potential penalties.

Cryptocurrencies are generally considered to be capital assets in most jurisdictions, meaning that profits from their sale or exchange are taxed as capital gains. However, the specific rules can vary depending on the country and the type of transaction. For instance, some jurisdictions may treat cryptocurrency mining as a business activity, subject to different tax treatments. Moreover, the tax implications can differ depending on whether the cryptocurrency is held for short-term or long-term capital gains purposes.

In addition to capital gains, there are other potential tax implications associated with cryptocurrency investments. These can include:

- Income tax: If you earn cryptocurrency through activities like mining or staking, this may be considered taxable income.

- Gift tax: If you gift cryptocurrency to someone, you may be subject to gift tax rules.

- Inheritance tax: If you inherit cryptocurrency, the value of the inherited assets may be subject to inheritance tax.

Given the complexity of these tax issues, it is highly advisable to consult with a qualified tax professional who specializes in cryptocurrency taxation. They can provide personalized guidance based on your specific circumstances and ensure that you are fully compliant with the relevant tax laws. Staying informed about the latest developments in cryptocurrency regulation is essential for investors to navigate the evolving landscape and make informed financial decisions.

The Future of Decentralized Finance (DeFi) Regulation

The rapid growth of Decentralized Finance (DeFi) has sparked intense discussions about regulatory frameworks. While DeFi’s core principles often emphasize decentralization and autonomy, the potential risks associated with this emerging technology necessitate a measured approach to regulation.

One of the key challenges is finding a balance between fostering innovation and protecting investors. Regulators are grappling with how to apply existing laws designed for traditional finance to the decentralized nature of DeFi. This involves considering aspects like stablecoins, decentralized exchanges (DEXs), and yield farming, which operate differently from traditional financial systems.

The future of DeFi regulation likely entails a combination of approaches:

- Risk-based regulation: Tailoring regulatory measures to the level of risk associated with specific DeFi activities.

- Sandboxes: Creating controlled environments where DeFi projects can experiment and test new technologies under regulatory oversight.

- International collaboration: Establishing global standards and coordinating regulatory actions to ensure consistency across jurisdictions.

While the specifics of DeFi regulation remain in flux, it’s crucial for stakeholders to engage in open dialogue and collaboration to shape a regulatory landscape that fosters innovation while addressing legitimate concerns about consumer protection and financial stability.

Navigating Regulatory Uncertainty: Strategies for Investors

The cryptocurrency market has experienced significant growth in recent years, attracting a growing number of investors. However, the lack of clear and consistent regulatory frameworks across the globe presents a challenge for investors seeking to navigate this dynamic space. Regulatory uncertainty can create volatility and unpredictability, making it crucial for investors to understand the latest developments and adopt appropriate strategies.

As regulations evolve, investors need to be aware of the potential impact on their portfolios. This includes understanding how new rules might affect the trading of cryptocurrencies, the issuance of stablecoins, and the operation of decentralized finance (DeFi) platforms. Staying informed about regulatory changes is essential for making informed investment decisions.

For investors seeking to navigate regulatory uncertainty, several strategies can be employed:

- Diversify your portfolio: Investing in a variety of cryptocurrencies and projects can help mitigate risk associated with regulatory changes.

- Focus on established platforms and projects: Platforms and projects with a proven track record and strong regulatory compliance are often less susceptible to regulatory shocks.

- Seek professional advice: Consulting with financial advisors specializing in cryptocurrencies can provide valuable insights and guidance on navigating regulatory uncertainty.

- Stay informed about regulatory developments: Following industry news and regulatory announcements is crucial to understanding the evolving landscape.

The regulatory landscape for cryptocurrencies is constantly evolving, presenting both opportunities and challenges for investors. By staying informed, diversifying portfolios, and seeking professional advice, investors can navigate these uncertainties and potentially capitalize on the growth potential of this emerging market.

Staying Updated on Cryptocurrency Regulation News

The cryptocurrency market is constantly evolving, and one of the most important factors influencing its trajectory is regulation. As governments around the world grapple with how to regulate this new asset class, staying informed about the latest developments is crucial for both investors and businesses.

There are several key sources to keep an eye on when it comes to cryptocurrency regulation news:

- Official Government Websites: Check the websites of your local financial regulators and central banks for official announcements, policy proposals, and legislative updates.

- Cryptocurrency News Outlets: Dedicated crypto news platforms often provide detailed coverage of regulatory developments, including analysis and expert opinions.

- Legal and Financial Publications: Major publications covering finance, law, and technology often publish articles on cryptocurrency regulation.

- Industry Associations: Organizations representing the cryptocurrency industry often release statements and reports on regulatory issues.

- Social Media: While not always the most reliable source, social media platforms can provide real-time updates on regulatory developments.

Understanding the impact of regulations on the crypto market is vital for investors. Regulatory clarity can lead to increased investor confidence and market stability, while uncertainty can create volatility and potentially deter investment. It’s important to remember that regulations are constantly evolving, so staying up-to-date is crucial for making informed decisions.

Understanding the Global Regulatory Landscape

The cryptocurrency landscape is constantly evolving, and a key driver of this evolution is the increasing attention from global regulators. While the decentralized nature of cryptocurrencies initially promised a space free from traditional financial oversight, the rapid growth of the market and the increasing adoption of crypto assets have prompted governments worldwide to take action.

Understanding the global regulatory landscape is crucial for anyone involved in the cryptocurrency ecosystem. This includes investors, traders, businesses, and developers. A clear understanding of regulatory frameworks, including licensing requirements, tax implications, and consumer protection measures, is essential to navigate the evolving legal landscape and ensure compliance.

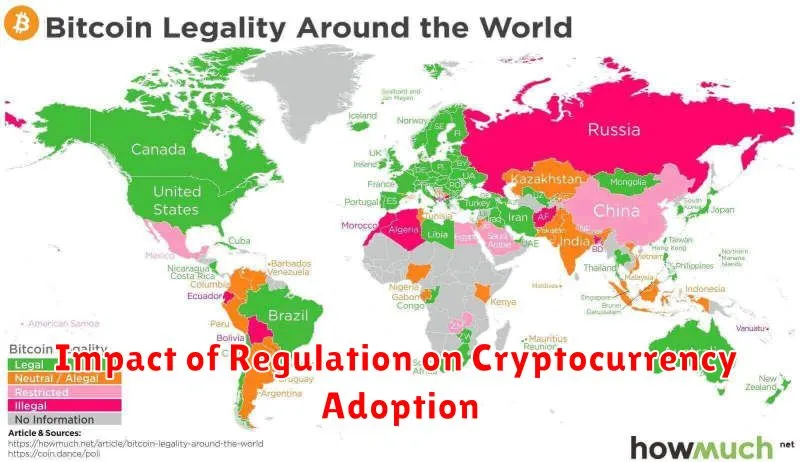

Different jurisdictions have adopted varying approaches to regulating cryptocurrencies. Some countries have chosen to embrace the technology, creating favorable environments for the growth of the industry. Others have taken a more cautious approach, focusing on mitigating risks and protecting consumers.

Impact of Regulation on Cryptocurrency Adoption

The cryptocurrency market has witnessed significant growth in recent years, attracting investors and businesses worldwide. However, the lack of clear and comprehensive regulations has created uncertainty and potential risks. As governments around the world grapple with how to regulate cryptocurrencies, the impact of these regulations on adoption is a crucial topic.

Regulation can foster confidence and security for investors and businesses. Clear rules and guidelines can help reduce fraud and market manipulation, providing a more stable and predictable environment. This can encourage greater participation and investment, ultimately driving adoption.

However, overly restrictive regulations can hinder innovation and adoption. Complicated regulations may make it challenging for businesses to operate in the crypto space, discouraging entrepreneurs and hindering the development of new projects. Furthermore, excessive regulation could stifle the decentralized nature of cryptocurrencies, leading to centralized control and reducing their core principles.

Finding the right balance is key. Regulations should aim to protect consumers and ensure financial stability while fostering innovation and competition. Transparent and collaborative efforts between regulators and the industry are essential to create a conducive environment for responsible and sustainable growth.

The future of cryptocurrency adoption is intrinsically linked to the regulatory landscape. As the world grapples with this evolving technology, governments and industry stakeholders must work together to ensure responsible growth and unlock the full potential of this transformative innovation.