Are you seeking a lucrative investment avenue to grow your wealth? The financial landscape offers numerous options, but two prominent contenders stand out – cryptocurrency and the stock market. Both present exciting prospects, but understanding their differences is crucial before diving in. This comprehensive comparison delves into the intricacies of each investment avenue, shedding light on their unique characteristics, risks, and potential returns.

Whether you’re a seasoned investor or just starting your financial journey, grasping the nuances between cryptocurrency investing and stock market investing is essential. This guide explores the core aspects of both, empowering you to make informed decisions aligned with your financial goals and risk tolerance. Join us as we navigate this complex but rewarding world of investments, equipping you with the knowledge to make sound choices and achieve financial success.

Understanding the Basics: Stocks vs. Cryptocurrencies

Investing in stocks and cryptocurrencies can be a thrilling and profitable endeavor, but it’s crucial to grasp the fundamental differences between these two asset classes before diving in. While both offer potential for growth, they operate under distinct mechanisms and carry varying levels of risk.

Stocks represent ownership in a company. When you buy stock, you become a shareholder, entitled to a portion of the company’s profits and voting rights. Stock prices fluctuate based on factors like company performance, market sentiment, and economic conditions. They are regulated by government agencies and traded on exchanges like the New York Stock Exchange (NYSE) and Nasdaq.

Cryptocurrencies, on the other hand, are decentralized digital currencies. They operate on blockchain technology, a secure and transparent ledger that records every transaction. Unlike stocks, cryptocurrencies are not backed by any physical asset or government. Their value is determined by supply and demand, often driven by speculation and technological advancements. Examples of popular cryptocurrencies include Bitcoin, Ethereum, and Dogecoin.

Market Capitalization and Liquidity

Market capitalization, often referred to as “market cap,” represents the total value of a company’s outstanding shares. It’s calculated by multiplying the current share price by the number of outstanding shares. In the context of cryptocurrencies, market cap is calculated by multiplying the current price of a cryptocurrency by its total circulating supply. A cryptocurrency with a higher market cap is generally considered to be more established and have a larger user base.

Liquidity refers to the ease with which an asset can be bought or sold in the market without affecting its price significantly. In other words, it’s the ability to convert an asset into cash quickly and efficiently. High liquidity implies a large number of buyers and sellers, making it easier to execute trades without causing price fluctuations.

In the stock market, large-cap companies generally have higher liquidity than small-cap companies. This is because they are more widely traded and have a larger number of investors.

In the cryptocurrency market, liquidity varies significantly across different cryptocurrencies. Major cryptocurrencies like Bitcoin and Ethereum have high liquidity, while smaller, less established coins may have lower liquidity.

Understanding the concepts of market capitalization and liquidity is crucial for investors in both the stock and cryptocurrency markets. This information can help you assess the risk and potential returns of different investments, as well as determine the ease with which you can enter and exit a trade.

Volatility and Risk Assessment

Both cryptocurrencies and the stock market are known for their volatility, but the degree and nature of their fluctuations differ significantly. The stock market, while prone to swings, generally exhibits a more predictable pattern of volatility over longer periods. It is influenced by factors such as company performance, macroeconomic trends, and investor sentiment. Cryptocurrency markets, on the other hand, are significantly more volatile, characterized by rapid price swings even within short time frames. This heightened volatility stems from factors like limited regulation, speculative trading, and a lack of fundamental analysis underpinning their value.

When it comes to risk assessment, the stock market offers a more established framework for gauging investment risk. Historical data, financial statements, and market analysis tools provide investors with valuable insights to assess the risks associated with specific stocks. While the stock market inherently involves risk, the ability to analyze and mitigate it is more established compared to the cryptocurrency market. Cryptocurrency investments carry inherent risks due to their nascent nature, regulatory uncertainty, and susceptibility to hacks and fraud. The lack of a well-defined risk assessment framework makes it challenging for investors to accurately gauge and manage the risks involved.

It’s essential to consider your risk tolerance when making investment decisions. If you are comfortable with high volatility and uncertain returns, cryptocurrencies might be an option for you. However, if you prefer a more predictable investment with lower risk, the stock market might be a better choice.

Regulation and Security Considerations

The regulatory landscape for cryptocurrencies is still evolving and varies significantly across jurisdictions. Some countries have embraced cryptocurrencies, offering clear frameworks and legal recognition, while others have adopted a more cautious approach or even outright bans. This lack of global consistency can create uncertainty for investors and businesses.

Stock markets, on the other hand, are generally subject to well-established regulations overseen by government agencies such as the Securities and Exchange Commission (SEC) in the United States. These regulations aim to protect investors by ensuring market transparency, fair practices, and preventing fraud.

From a security perspective, cryptocurrencies face unique challenges. The decentralized nature of blockchain technology means that there is no central authority to control or guarantee the security of transactions. This opens the door to potential security vulnerabilities, including hacking, theft, and scams. While exchanges and wallets are increasingly adopting robust security measures, the risk of losing funds remains a concern for many investors.

Stock markets, although not immune to security breaches, generally have more established security protocols and safeguards in place. Regulatory oversight, combined with the centralized nature of exchanges, provides a certain level of protection for investors.

It’s important for investors to thoroughly research the regulatory and security considerations surrounding both cryptocurrencies and stock markets before making any investment decisions. Understanding the risks involved and the level of protection available is crucial to making informed choices.

Accessibility and Trading Hours

One of the key distinctions between cryptocurrency and stock market investing lies in accessibility and trading hours. The cryptocurrency market operates 24/7, allowing investors to buy, sell, or trade digital assets at any time. This continuous trading provides flexibility and potential opportunities for profit even outside of traditional market hours. However, it also means potential volatility and the need for constant monitoring.

In contrast, the stock market has specific trading hours, typically from 9:30 AM to 4:00 PM EST. This structured schedule provides a degree of predictability but limits trading opportunities to those times. While some after-hours trading platforms exist, they often have higher fees and limited liquidity. This difference in trading hours can significantly impact your investment strategy and decision-making process.

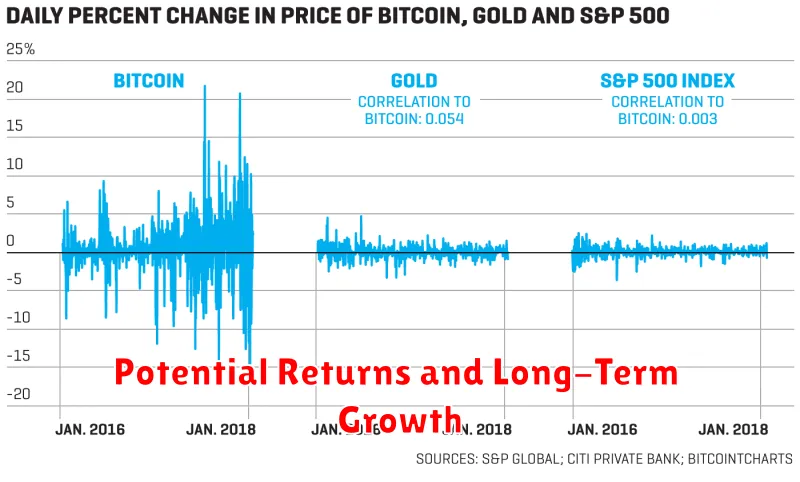

Potential Returns and Long-Term Growth

Both cryptocurrencies and the stock market offer the potential for significant returns, but they also come with different levels of risk. The volatility of the cryptocurrency market is notorious, with prices experiencing wild swings both upwards and downwards. This volatility can lead to rapid gains, but also the possibility of substantial losses. However, the growth potential of cryptocurrencies is undeniable, with some coins experiencing exponential growth in their early stages. This is especially true for innovative projects that disrupt existing industries.

On the other hand, the stock market is generally considered more stable than the cryptocurrency market. While stocks can fluctuate, they tend to be less volatile in the long term. However, it is important to note that even the stock market can experience significant downturns, as seen during the 2008 financial crisis. The stock market, through its established history, has demonstrated a consistent track record of long-term growth, offering a solid foundation for wealth building and retirement planning.

Ultimately, the potential returns and long-term growth of both cryptocurrencies and the stock market depend on a multitude of factors, including market conditions, investor sentiment, and technological advancements. While the volatility of cryptocurrencies presents the opportunity for higher returns, it also comes with a higher risk profile. The stock market, with its established history and relative stability, provides a more traditional and potentially less risky avenue for long-term investment. The choice between these two asset classes is highly personal and should be made based on individual risk tolerance, investment goals, and financial circumstances.

Investment Strategies for Each Market

Investing in cryptocurrency and the stock market requires different strategies due to their inherent differences in volatility, liquidity, and regulatory frameworks. Here’s a breakdown of key strategies for each market:

Cryptocurrency

The cryptocurrency market is known for its high volatility, making it crucial to have a well-defined risk management strategy. Here are some common approaches:

- Dollar-Cost Averaging (DCA): Investing a fixed amount of money at regular intervals, regardless of price fluctuations, helps reduce the impact of volatility.

- Diversification: Spreading investments across various cryptocurrencies with different market caps and use cases reduces portfolio risk.

- Short-Term Trading: Capitalizing on short-term price swings requires technical analysis skills and a high tolerance for risk.

- Long-Term Holding (Hodling): Holding onto cryptocurrencies for the long term can potentially yield significant returns but requires patience and conviction in the underlying technology.

- Staking and Yield Farming: Locking up your cryptocurrencies to earn passive income through staking or yield farming provides additional returns.

Stock Market

The stock market offers a wider range of investment options, with strategies ranging from passive to active investing. Key strategies include:

- Index Funds and ETFs: Passive investing allows you to track the performance of entire market indices, such as the S&P 500, with low fees.

- Value Investing: Seeking undervalued stocks with strong fundamentals and potential for growth.

- Growth Investing: Focusing on companies with high growth potential, even if they are currently unprofitable.

- Dividend Investing: Investing in companies that regularly pay dividends to shareholders, providing a steady stream of income.

- Active Trading: Employing technical and fundamental analysis to identify short-term trading opportunities.

Ultimately, the best investment strategy for you depends on your individual risk tolerance, financial goals, and time horizon. It’s essential to conduct thorough research and seek advice from qualified professionals before making any investment decisions.

Tax Implications of Crypto and Stock Trading

While both cryptocurrency and stock market investing offer potential for profit, understanding the tax implications is crucial. Here’s a breakdown of the key differences:

Cryptocurrency:

In the US, the IRS treats cryptocurrency as property, not currency. This means any gains from selling or trading crypto are considered capital gains, subject to taxation. Capital gains can be short-term (held for less than a year) or long-term (held for more than a year), with different tax rates applying to each. Furthermore, cryptocurrency transactions, including staking and mining, can also trigger tax obligations.

Stock Market:

In the US, stock trading is also subject to capital gains taxes. However, there are some key differences:

- Dividends from stocks are taxed as ordinary income, not capital gains, at your individual tax bracket.

- Losses from stock trading can be used to offset gains, potentially reducing your tax liability.

Key Considerations:

No matter where you invest, it’s crucial to keep accurate records of all your transactions, including purchase dates, prices, and sale dates. Consult with a qualified tax professional to ensure you’re properly reporting your crypto and stock trades and understanding your tax obligations.

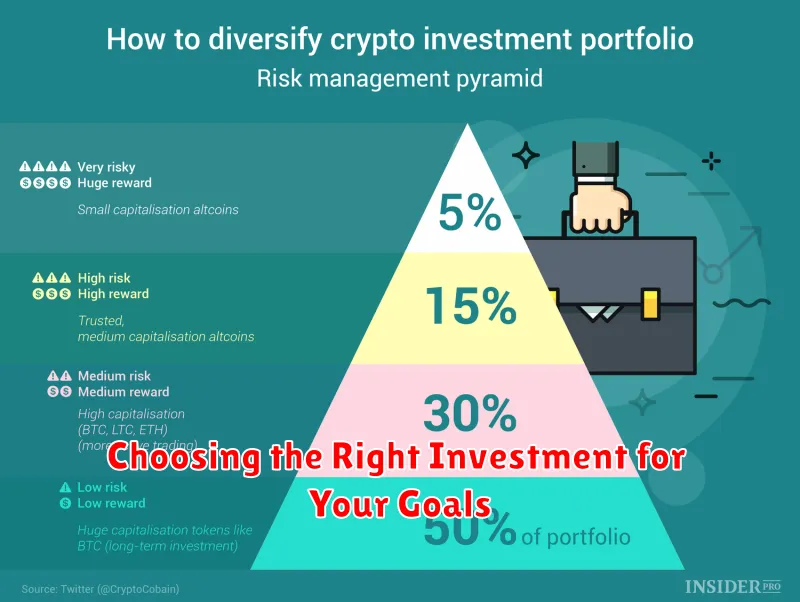

Diversifying Your Portfolio: Stocks, Crypto, and More

In the realm of investing, diversification is a fundamental principle that can significantly enhance your portfolio’s resilience and potential for growth. A diversified portfolio spreads your investment across various asset classes, reducing your exposure to any single risk factor. Two prominent asset classes, stocks and cryptocurrencies, offer distinct characteristics and opportunities, making them attractive additions to a well-rounded investment strategy.

Stocks represent ownership in publicly traded companies. They offer potential for capital appreciation and dividends, but they also carry inherent market risk. On the other hand, cryptocurrencies are digital assets that utilize cryptography for secure transactions. They have emerged as a highly volatile but potentially lucrative asset class, characterized by their decentralized nature and potential for innovation.

While stocks and cryptocurrencies might appear distinct, their integration into a diversified portfolio can create a compelling strategy. By allocating a portion of your investment capital to both, you can benefit from the strengths of each asset class while mitigating potential risks. Stocks offer a more traditional and established path to wealth creation, while cryptocurrencies provide exposure to cutting-edge technology and decentralized finance.

Beyond stocks and cryptocurrencies, other asset classes that can enhance portfolio diversification include:

- Real Estate: Offers potential for rental income, capital appreciation, and inflation hedge.

- Bonds: Provide fixed-income returns and act as a portfolio stabilizer in turbulent markets.

- Commodities: Include precious metals (gold, silver) and raw materials (oil, wheat), offering diversification and potential for inflation protection.

Ultimately, the optimal level of diversification depends on your individual financial goals, risk tolerance, and time horizon. Consulting with a financial advisor can help you create a personalized investment strategy that aligns with your specific needs and aspirations. Remember, diversification is not just a strategy for mitigating risk but also a pathway to achieving long-term financial success.

Choosing the Right Investment for Your Goals

The world of investing can be daunting, with countless options vying for your attention. Two prominent players in the investment landscape are cryptocurrency and the stock market. While both offer the potential for growth, they differ significantly in their risk profiles, volatility, and long-term prospects. Choosing the right investment depends heavily on your individual financial goals, risk tolerance, and investment horizon.

If you’re looking for high-risk, high-reward potential, cryptocurrency might be an appealing option. Its decentralized nature and potential for rapid price fluctuations can lead to substantial gains, but it also carries significant risks. Volatility is a defining characteristic of the crypto market, with prices often experiencing wild swings. It’s crucial to understand that cryptocurrencies are relatively new and lack the established regulatory framework of traditional markets.

On the other hand, the stock market offers a more established and regulated environment. Investing in stocks represents ownership in publicly traded companies, providing a way to participate in the growth of various industries. The stock market generally exhibits lower volatility compared to cryptocurrencies, making it a potentially more stable investment option. However, it’s important to note that even the stock market can experience fluctuations, and no investment is guaranteed to generate profits.

Ultimately, the best investment for you depends on your individual circumstances. Consider your investment goals, risk tolerance, and time horizon when making your decision. If you’re seeking long-term growth and prefer a more stable investment, the stock market might be a suitable choice. If you’re willing to embrace higher risk for the potential of substantial returns, cryptocurrency might appeal to you. Remember to conduct thorough research, understand the risks involved, and consult with a financial advisor before making any investment decisions.