Are you looking for ways to diversify your investment portfolio and tap into new growth opportunities? If so, you need to consider emerging markets. These dynamic economies are experiencing rapid growth and offer investors a unique chance to capitalize on their potential. From technology and consumer goods to infrastructure and healthcare, emerging markets are brimming with exciting sectors ripe for investment.

This comprehensive guide will provide you with all the information you need to understand the key characteristics of emerging markets, the potential risks and rewards associated with investing in them, and how to navigate the opportunities that exist. We will explore different investment strategies, provide valuable insights from experienced investors, and arm you with the knowledge to make informed decisions for your portfolio. Get ready to unlock the potential of emerging markets and discover a world of exciting investment opportunities.

Defining Emerging Markets: Characteristics and Growth Drivers

Emerging markets, also known as developing economies, represent a diverse group of countries experiencing rapid economic growth and structural transformation. These nations are often characterized by rising living standards, increasing urbanization, and a growing middle class.

Key Characteristics of Emerging Markets

Emerging markets share several common characteristics, including:

- Rapid Economic Growth: Emerging markets typically exhibit high rates of GDP growth, driven by factors such as industrialization, technological advancements, and rising productivity.

- Growing Middle Class: The emergence of a substantial middle class contributes to increased consumer spending and economic activity.

- Favorable Demographics: Many emerging markets have relatively young populations, indicating a potential for continued economic growth and workforce expansion.

- Investment Opportunities: Emerging markets offer attractive investment opportunities in sectors such as infrastructure, technology, and consumer goods.

- Market Volatility: While promising, emerging markets are also susceptible to volatility due to factors such as political instability, economic fluctuations, and currency fluctuations.

Growth Drivers in Emerging Markets

Several key factors contribute to the growth of emerging markets:

- Economic Diversification: Many emerging economies are actively diversifying their economies away from traditional industries to sectors with higher value-added potential.

- Technological Adoption: The rapid adoption of new technologies, such as mobile internet and digital payments, is driving innovation and productivity.

- Government Reforms: Many governments in emerging markets are implementing reforms to improve business environments, attract foreign investment, and enhance market competitiveness.

- Rising Consumer Demand: The expanding middle class in emerging markets is driving strong growth in consumer spending, particularly in sectors such as automobiles, consumer electronics, and retail.

- Infrastructure Development: Investments in infrastructure, such as transportation, energy, and telecommunications, are essential for supporting economic growth and attracting investment.

Understanding the characteristics and growth drivers of emerging markets is crucial for investors seeking to capitalize on the potential of these dynamic economies.

Identifying Promising Emerging Market Economies

Emerging market economies are fast-growing and rapidly developing economies with significant potential for investors. However, not all emerging markets are created equal. To identify promising emerging market economies, investors need to consider a range of factors, including:

Economic Growth and Stability

Look for countries with strong and sustainable economic growth, low inflation, and a stable political environment. Strong government institutions and sound macroeconomic policies are also crucial.

Demographics and Labor Force

A young and growing population can fuel economic growth, but investors should also consider the quality of the labor force, education levels, and the availability of skilled workers.

Infrastructure and Technology

Robust infrastructure, including transportation, energy, and telecommunications, is vital for economic development. A country’s adoption and development of technology can also be a key indicator of its growth potential.

Investment Climate

Investors should consider factors such as the ease of doing business, the availability of capital, and the strength of legal frameworks. A favorable investment climate encourages both domestic and foreign investment.

Political Stability and Transparency

A stable political system and transparent government are essential for long-term economic growth and investor confidence. Corruption can hinder investment and economic development.

Risk Factors

It’s also important to consider potential risks, such as political instability, currency volatility, and economic crises. Investors should carefully assess the risk profile of each country before making investment decisions.

Investment Strategies for Emerging Markets

Emerging markets offer enticing investment opportunities due to their rapid economic growth, expanding middle class, and potential for higher returns. However, navigating these markets requires careful consideration and a well-defined strategy. Here are some key investment strategies for maximizing returns in emerging markets:

Diversification: Spreading your investments across different emerging markets, sectors, and asset classes is crucial to mitigate risks. This helps balance out the volatility inherent in emerging markets and provides a broader range of opportunities.

Long-Term Perspective: Emerging markets tend to experience periods of both growth and volatility. A long-term investment horizon allows you to ride out short-term fluctuations and capture the long-term growth potential. Patience and a commitment to your investment strategy are essential.

Understanding Market Dynamics: Thorough research is crucial to identify promising emerging markets. Consider factors such as economic growth, political stability, infrastructure development, and regulatory environment. It’s also essential to stay updated on geopolitical events that can impact market performance.

Local Expertise: Partnering with fund managers or advisors with expertise in emerging markets can be invaluable. They provide in-depth knowledge of local market dynamics, regulatory complexities, and potential investment opportunities. Their insights can enhance your investment decisions.

Risk Management: Emerging markets carry higher risks compared to developed markets. Implementing risk management strategies is crucial to protect your investment. This includes setting stop-loss orders, diversifying your portfolio, and carefully evaluating the financial health of companies before investing.

Currency Exposure: Fluctuations in emerging market currencies can significantly impact investment returns. Carefully consider currency exposure and implement hedging strategies if necessary to mitigate potential losses.

ESG Considerations: Environmental, social, and governance (ESG) factors are increasingly important in emerging markets. Investing in companies that prioritize sustainability and ethical practices can generate both financial and social returns.

Emerging markets present exciting investment opportunities, but they require a thoughtful approach. By employing these strategies, investors can unlock the potential of emerging markets and achieve their long-term investment goals.

Risks and Rewards of Emerging Market Investment

Investing in emerging markets can offer exciting opportunities for growth and diversification, but it also comes with inherent risks. Emerging markets, characterized by rapidly developing economies, offer unique investment opportunities due to their potential for rapid economic growth, rising consumer spending, and expanding industries. However, investors should be aware of the potential risks associated with these markets.

One of the biggest risks is political instability. Emerging markets often experience political and social unrest, which can disrupt businesses and impact investment returns. Currency fluctuations and inflation are also major concerns, as emerging economies often have less stable currencies and higher inflation rates than developed economies. Another key risk is a lack of transparency and regulatory oversight in some emerging markets, which can make it difficult to assess the true value of investments and potentially lead to fraud or corruption.

Despite the risks, emerging markets offer numerous potential rewards. One significant advantage is the opportunity for high growth potential. Emerging economies are experiencing rapid economic development, driving higher growth rates in key sectors such as consumer goods, technology, and infrastructure. This growth can translate into strong returns for investors. Furthermore, emerging markets offer diversification benefits. By investing in a basket of emerging market assets, investors can reduce their overall portfolio risk and potentially increase returns. Finally, as emerging markets continue to develop and integrate into the global economy, they present an opportunity for long-term investment growth.

Ultimately, the decision to invest in emerging markets requires careful consideration of both the potential risks and rewards. Investors must conduct thorough research, assess their risk tolerance, and diversify their investments to mitigate potential losses. By carefully navigating the challenges and opportunities presented by emerging markets, investors can unlock a world of investment potential.

Managing Volatility and Currency Fluctuations

Emerging markets offer enticing investment opportunities, but they come with inherent risks, particularly volatility and currency fluctuations. Understanding and managing these factors is crucial for successful investing in these dynamic markets.

Volatility, characterized by rapid price swings, is a defining feature of emerging markets. This can be attributed to various factors, including political instability, economic uncertainty, and rapid growth. While volatility can lead to significant gains, it also poses considerable risks. Diversification across asset classes, regions, and sectors can help mitigate this risk.

Currency fluctuations can further complicate investment decisions. Emerging market currencies are often susceptible to external shocks, such as global economic trends and political events. Currency hedging strategies, such as using derivatives or investing in currency-hedged funds, can help protect against potential losses due to currency depreciation.

Moreover, it’s essential to consider the long-term perspective when investing in emerging markets. These markets are characterized by cyclical upswings and downturns. By staying focused on the long-term growth potential and weathering short-term fluctuations, investors can reap the rewards of these dynamic economies.

Ultimately, managing volatility and currency fluctuations requires a disciplined approach, a deep understanding of the specific market dynamics, and a willingness to stay informed. By embracing these principles, investors can navigate the complexities of emerging markets and unlock their significant potential for growth.

The Role of Political and Economic Stability

Emerging markets, characterized by rapid growth and potential, often attract investors seeking high returns. However, the success of any investment hinges on the underlying political and economic stability of the region. Political stability, manifested in consistent and predictable governance, fosters a favorable business environment. It minimizes disruptions and uncertainties, encouraging both domestic and foreign investment. When political systems are stable, investors feel confident about their long-term prospects, promoting economic growth and development.

Economic stability, characterized by low inflation, sustainable growth, and manageable debt levels, is equally crucial. A stable economic environment provides a predictable framework for businesses to operate and thrive. It ensures that currency fluctuations are minimized, inflation remains controlled, and consumers have the confidence to spend. This fosters a virtuous cycle of economic activity, attracting further investments and generating employment opportunities.

In conclusion, political and economic stability serve as the bedrock for unlocking the potential of emerging markets. When these factors are present, investors can confidently allocate capital, knowing that their investments are protected and poised for growth. It’s crucial to meticulously analyze these factors before making any investment decisions, ensuring a balanced approach that considers both the potential rewards and the inherent risks associated with emerging markets.

Diversification Benefits of Emerging Markets

Emerging markets offer a compelling diversification opportunity for investors seeking to enhance portfolio returns and mitigate risks. These economies are characterized by rapid economic growth, rising consumer spending, and a growing middle class, presenting unique investment opportunities. Diversifying into emerging markets can provide several benefits:

Reduced Portfolio Volatility: Emerging markets tend to have low correlations with developed markets, meaning their price movements are often independent. This lack of correlation helps reduce overall portfolio volatility by offsetting potential losses in other asset classes.

Enhanced Returns: Emerging markets often exhibit higher growth potential than developed markets, driven by factors like technological advancements, infrastructure development, and increasing urbanization. Investors can potentially capture this growth potential by allocating a portion of their portfolio to these markets.

Access to Unique Investment Opportunities: Emerging markets offer exposure to a diverse range of industries and sectors that may not be readily available in developed markets. This provides investors with opportunities to invest in companies with high growth potential and innovative business models.

Long-Term Growth Potential: Emerging markets are expected to play an increasingly significant role in the global economy in the coming decades. By diversifying into these markets, investors can position themselves for long-term growth and capitalize on the potential of emerging economies.

It’s important to remember that investing in emerging markets carries certain risks, including political instability, currency fluctuations, and regulatory uncertainties. However, by carefully considering these factors and conducting thorough due diligence, investors can potentially reap the rewards of diversification and unlock the growth potential of emerging markets.

ESG Considerations in Emerging Market Investing

As investors increasingly seek opportunities beyond traditional developed markets, emerging markets are gaining traction. These economies offer significant growth potential, but investors must also consider the environmental, social, and governance (ESG) factors that can influence their success and sustainability.

Environmental considerations in emerging markets include issues like pollution, climate change, and resource depletion. These factors can impact a company’s operations and financial performance, and investors should assess how companies are managing these risks and opportunities. For example, companies in sectors like energy and agriculture have a crucial role to play in transitioning to a low-carbon economy.

Social considerations include factors like labor rights, human rights, and community relations. Investors should consider how companies are treating their employees, ensuring fair labor practices, and contributing to the well-being of the communities in which they operate.

Governance refers to a company’s internal controls, corporate transparency, and accountability. Strong governance practices are essential for sustainable growth and investor confidence. Investors should look for companies with robust corporate governance structures that promote ethical behavior and responsible decision-making.

By integrating ESG considerations into their investment strategies, investors can help to promote sustainable development in emerging markets. This can lead to both financial and social returns, creating a positive impact on the world.

Long-Term Outlook for Emerging Market Growth

Emerging markets are characterized by rapid economic growth, rising living standards, and a growing middle class. This makes them attractive investment destinations for investors seeking long-term growth potential. However, emerging markets also face a number of challenges, including political instability, economic volatility, and a lack of infrastructure. Despite these challenges, the long-term outlook for emerging market growth remains positive.

Several factors suggest that emerging markets are poised for continued growth in the coming years. These include:

- Growing middle class: As incomes rise in emerging markets, consumers have more disposable income to spend on goods and services, driving domestic demand.

- Technological advancements: Emerging markets are increasingly adopting new technologies, which can boost productivity and economic growth.

- Favorable demographics: Many emerging markets have a young and growing population, which provides a large and expanding workforce.

- Government support: Governments in emerging markets are increasingly committed to promoting economic growth and attracting foreign investment.

While emerging markets face risks, their long-term potential for growth is undeniable. Investors who are willing to take on some risk can potentially benefit from the significant returns that these markets offer.

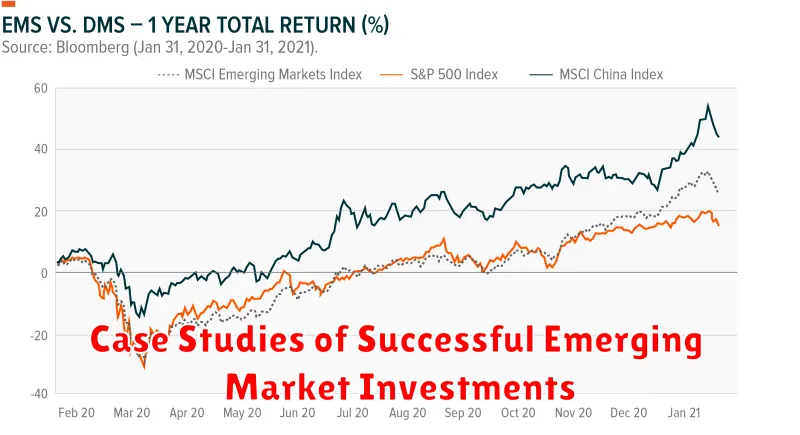

Case Studies of Successful Emerging Market Investments

Emerging markets present a compelling opportunity for investors seeking growth and diversification. While risks exist, a carefully curated portfolio can unlock significant returns. Let’s delve into some compelling case studies of successful emerging market investments:

1. Investing in Chinese Technology: The rise of Chinese tech giants like Alibaba and Tencent has been a phenomenal success story. Investors who recognized the potential of the booming e-commerce and mobile payments sectors in China reaped substantial rewards. Alibaba’s initial public offering (IPO) in 2014 generated enormous interest, and its stock price has soared since then.

2. Betting on India’s Consumer Market: India’s rapidly growing middle class and expanding consumption patterns have made it an attractive investment destination. Companies catering to this demographic, such as Reliance Industries and Hindustan Unilever, have delivered consistent returns to investors.

3. Unlocking the Potential of Brazil’s Resources: Brazil, rich in natural resources like iron ore and soybeans, has attracted investors seeking exposure to commodity markets. Companies like Vale, the world’s largest iron ore producer, have thrived on the back of strong global demand.

These case studies highlight the potential for long-term success in emerging markets. However, it’s crucial to understand the inherent risks associated with these investments. Political instability, currency fluctuations, and regulatory changes can impact investment returns. Thorough research, diversification, and a long-term investment horizon are essential for navigating these markets effectively.

Investing in Emerging Market Funds and ETFs

Emerging markets offer exciting investment opportunities, but navigating these markets can be complex. Fortunately, mutual funds and exchange-traded funds (ETFs) provide a convenient and diversified way to gain exposure to these dynamic economies.

Emerging market funds pool money from investors to invest in a basket of securities from developing countries. They offer diversification across different sectors, industries, and countries, reducing the risk associated with investing in individual companies. These funds can be actively managed or passively tracked to a specific index.

Emerging market ETFs are similar to mutual funds but trade on stock exchanges like individual stocks. ETFs provide a transparent and cost-effective way to invest in emerging markets, offering lower expense ratios compared to actively managed funds. They can track broad market indices or focus on specific sectors like technology or healthcare.

When choosing emerging market funds or ETFs, consider factors such as:

- Fund objective and strategy: Understand the fund’s investment approach, such as its geographic focus, sector emphasis, and whether it is actively or passively managed.

- Performance history: Analyze the fund’s historical returns and risk profile, considering its consistency and benchmark performance.

- Expense ratio: Compare the fees charged by different funds, as they can significantly impact long-term returns.

- Fund size: Larger funds may offer more liquidity and lower trading costs.

- Currency risk: Consider the impact of currency fluctuations between the fund’s underlying assets and your home currency.

Investing in emerging markets offers potential for higher returns, but it comes with inherent risks. Political instability, economic volatility, and regulatory challenges are factors to consider. Before investing, conduct thorough research, consult a financial advisor, and ensure you understand the risks and potential rewards associated with emerging market investments.