In today’s hyper-connected world, understanding the intricacies of global markets is no longer a luxury but a necessity. Whether you’re a seasoned investor, a budding entrepreneur, or simply someone curious about the world around you, market data analysis plays a pivotal role in navigating the complex landscape of international trade and investment. This data empowers us with insights into consumer behavior, industry trends, economic indicators, and more, providing a roadmap for informed decisions and strategic planning.

This deep dive into market data analysis will equip you with the tools and knowledge to decipher the complexities of global markets. We’ll explore the various sources of data, analyze key metrics and indicators, and delve into powerful data analysis techniques that can unlock valuable insights. Get ready to unlock a world of possibilities, empowering you to make informed choices and achieve success in an increasingly interconnected world.

The Scope of Global Market Data

In today’s interconnected world, understanding the global market landscape is crucial for businesses of all sizes. Global market data encompasses a vast array of information that provides insights into various aspects of international markets. This data encompasses key factors such as:

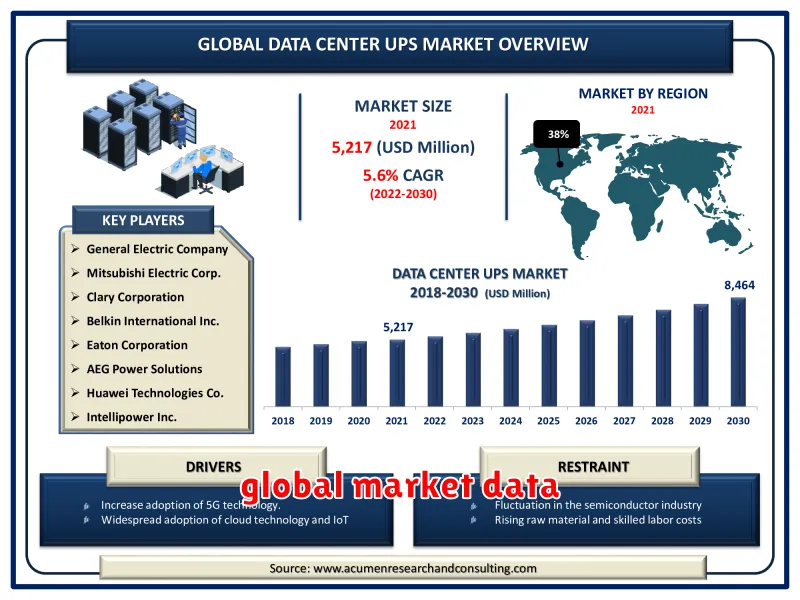

- Market Size and Growth: Understanding the total value of a particular market and its projected growth rate is essential for strategic planning and investment decisions.

- Consumer Behavior and Trends: Analyzing consumer preferences, buying habits, and emerging trends in different regions helps businesses tailor their products and marketing strategies effectively.

- Competitive Landscape: Identifying key players, their market share, and competitive strategies allows businesses to understand their position in the market and develop effective competitive responses.

- Economic and Political Factors: Analyzing macroeconomic indicators, political stability, and regulatory environments in different countries provides valuable insights into potential risks and opportunities.

- Technological Advancements: Keeping abreast of technological innovations and their impact on industries and consumer behavior is vital for staying ahead of the curve.

The scope of global market data extends beyond traditional market research to include a wide range of data sources, such as:

- Market Research Reports: Comprehensive reports published by reputable market research firms offer in-depth analysis of specific industries and markets.

- Government Statistics: Government agencies release valuable data on economic indicators, trade flows, and demographics.

- Industry Associations: Industry associations provide data and insights relevant to specific sectors.

- Social Media Analytics: Social media platforms offer valuable insights into consumer sentiment, brand perception, and trending topics.

- Big Data and Analytics: Advanced analytics techniques can be applied to extract valuable insights from large datasets, such as web traffic, online transactions, and social media interactions.

Sources of Global Market Information

In today’s interconnected world, businesses need to understand the global market landscape to thrive. Accessing reliable and comprehensive market data is crucial for making informed decisions about expansion, product development, and strategic partnerships. This article explores various sources of global market information, empowering you to navigate the complexities of international markets.

Market Research Firms

Professional market research firms provide in-depth analysis and reports on a wide range of industries and geographic regions. These firms, like Nielsen, Euromonitor International, and Mintel, leverage extensive research methodologies, including surveys, interviews, and data analysis, to deliver valuable insights. They offer customized reports, syndicated data, and consulting services tailored to specific business needs.

Government Agencies and International Organizations

Government agencies and international organizations play a pivotal role in collecting and disseminating market data. The World Bank, The International Monetary Fund (IMF), and The United Nations Conference on Trade and Development (UNCTAD) provide comprehensive economic indicators, trade statistics, and market analyses for countries worldwide. These sources offer valuable insights into economic trends, trade patterns, and regulatory environments.

Industry Associations and Trade Publications

Industry associations and trade publications offer specialized information and insights into specific sectors. These sources, such as the National Association of Manufacturers (NAM) and Forbes, provide industry-specific data, market trends, and competitive analysis. They often host conferences and webinars, creating opportunities for networking and knowledge sharing within your industry.

Online Databases and Platforms

The internet provides a wealth of information for market research. Online databases like Statista and MarketLine offer comprehensive market data, reports, and analyses on various sectors and regions. Platforms like LinkedIn and Twitter can be valuable for accessing industry trends, expert opinions, and competitor activities.

Competitor Analysis and Secondary Research

Understanding your competitors’ strategies and market share is crucial for informed decision-making. Analyzing competitor websites, publications, and public filings can provide valuable insights into their offerings, market positioning, and customer base. This secondary research complements primary data collection, offering a comprehensive view of the competitive landscape.

By leveraging these diverse sources of global market information, businesses can gain a competitive edge in the international marketplace. Accessing reliable data empowers you to make informed decisions, identify opportunities, and navigate the complexities of the global economy.

Key Economic Indicators: GDP, Inflation, Unemployment

Understanding the global economic landscape is crucial for businesses and investors alike. While numerous factors influence market dynamics, three key economic indicators stand out as crucial barometers of a nation’s health: Gross Domestic Product (GDP), Inflation, and Unemployment.

GDP, the total value of goods and services produced within a country, offers a broad measure of economic activity. A rising GDP typically indicates economic growth and expansion, while a declining GDP suggests contraction. However, relying solely on GDP can be misleading, as it doesn’t account for factors like income inequality or environmental impact.

Inflation, the rate at which prices for goods and services rise, is a critical indicator of purchasing power. High inflation erodes the value of money, making it harder for individuals and businesses to plan for the future. Central banks use various tools to manage inflation, aiming to maintain a stable and predictable economic environment.

Unemployment, the percentage of the labor force without work, reflects the health of the job market. High unemployment rates signal economic weakness, as it indicates a lack of job opportunities and potential for decreased consumer spending. Low unemployment, however, can sometimes lead to labor shortages and upward pressure on wages, potentially contributing to inflation.

Monitoring these three key economic indicators provides valuable insights into the overall economic health of a nation. By understanding their trends and interrelationships, businesses can make informed decisions about investment, pricing, and resource allocation. Moreover, investors can gain a clearer picture of potential risks and opportunities within different markets.

Industry-Specific Data and Trends

Understanding industry-specific data and trends is crucial for navigating the global landscape. By analyzing these insights, businesses can gain a competitive advantage and make informed decisions. This involves delving into key performance indicators (KPIs), market share, consumer behavior, emerging technologies, and regulatory changes. By monitoring these trends, businesses can identify opportunities and mitigate risks effectively.

For example, in the e-commerce industry, businesses must track metrics like conversion rates, average order value, and customer acquisition cost. Analyzing these data points helps identify areas for improvement and optimize marketing strategies. In the healthcare sector, understanding trends in disease prevalence, patient demographics, and emerging treatments is critical for developing effective healthcare solutions.

Furthermore, it’s essential to consider the impact of globalization and digital transformation on industry trends. Businesses must adapt to changing consumer preferences, evolving business models, and the rise of new technologies. By staying ahead of these trends, businesses can position themselves for success in the global market.

Competitive Analysis and Market Share

In the dynamic world of business, understanding your competitive landscape and your market share is paramount. Competitive analysis provides a comprehensive view of your industry, identifying your key competitors, their strengths and weaknesses, and their market positioning. This information is crucial for making informed strategic decisions.

Here’s how competitive analysis helps you:

- Identify opportunities: By understanding your competitors’ offerings, you can identify gaps in the market and develop new products or services that meet unmet customer needs.

- Develop effective marketing strategies: Analyzing your competitors’ marketing strategies helps you differentiate your brand and reach the right target audience.

- Set pricing strategies: Understanding your competitors’ pricing models allows you to set competitive prices that are both profitable and appealing to customers.

- Track your market share: Monitoring your market share over time provides insights into your business performance and highlights areas for improvement.

By conducting thorough competitive analysis and regularly monitoring your market share, you gain valuable insights into your position in the market. This empowers you to make strategic decisions that drive growth, improve profitability, and ultimately, lead to success.

Tools for Global Market Data Analysis

In today’s interconnected world, businesses need to navigate a complex global landscape to succeed. To achieve this, a comprehensive understanding of global market trends and consumer behavior is paramount. Fortunately, a wide array of powerful tools and resources are available to help businesses delve deep into market data analysis.

Market Research Platforms: These platforms, like Statista, Euromonitor International, and Nielsen, provide access to a wealth of data on global markets, including demographics, consumer spending, industry trends, and competitive landscapes. They often offer customizable reports and data visualizations for in-depth analysis.

Data Analytics Software: Tools like Tableau, Power BI, and Qlik Sense empower businesses to analyze and visualize large datasets, uncovering hidden patterns and insights. These platforms allow for data cleaning, transformation, and reporting, enabling data-driven decision making.

Social Media Listening Tools: Platforms like Brand24, Hootsuite, and Sprout Social monitor social media conversations, allowing businesses to gauge public sentiment, identify emerging trends, and track competitor activity. This real-time data provides valuable insights into consumer preferences and market dynamics.

Web Analytics Tools: Google Analytics and similar platforms track website traffic, user behavior, and conversion rates, providing insights into user engagement, website performance, and marketing campaign effectiveness. This data is crucial for understanding online customer journeys and optimizing digital strategies.

Economic Data Providers: Organizations like the World Bank, IMF, and OECD offer comprehensive economic data on global markets, including GDP growth, inflation rates, and trade statistics. This data helps businesses understand the economic context of their target markets.

By utilizing these tools, businesses can gain a competitive edge by making informed decisions based on robust data analysis. This empowers them to identify opportunities, understand risks, and navigate the global market landscape with confidence.

Data Visualization and Reporting Techniques

Effective data visualization and reporting techniques are crucial for navigating the global market landscape and gaining meaningful insights from complex data sets. Visualizing data helps to identify trends, patterns, and outliers, while comprehensive reports present a clear and concise overview of key findings.

Key Techniques for Data Visualization:

- Line Charts: Ideal for showcasing trends over time, such as sales performance or website traffic.

- Bar Charts: Effective for comparing categories or groups, like market share or customer demographics.

- Scatter Plots: Useful for identifying relationships between variables, such as price and demand.

- Heat Maps: Illustrate data density and distribution across geographical areas or matrices.

- Dashboards: Interactive platforms that allow users to monitor key performance indicators (KPIs) and track progress over time.

Essential Components of Effective Reports:

- Executive Summary: A concise overview of the report’s key findings and recommendations.

- Methodology: A detailed explanation of the data sources, collection methods, and analysis techniques used.

- Findings: A clear and organized presentation of the data analysis results, supported by visualizations.

- Conclusions and Recommendations: Actionable insights derived from the data analysis, with specific recommendations for improvement.

By utilizing these data visualization and reporting techniques, businesses can effectively analyze market data, identify opportunities, and make informed decisions that drive growth and success in the global landscape.

Identifying Investment Opportunities

In the dynamic world of finance, identifying profitable investment opportunities is paramount. Market data analysis plays a crucial role in this process, providing investors with valuable insights into global trends, industry performance, and individual company valuations.

One effective approach is to analyze macroeconomic indicators, such as GDP growth, inflation rates, and interest rates. These metrics reveal the overall health of an economy and can influence investment decisions. For example, a strong GDP growth rate may suggest a favorable environment for businesses and potentially higher returns on investment.

Industry-specific data is also critical. Investors can examine industry trends, market share dynamics, and competitive landscapes to identify promising sectors. Emerging industries with high growth potential or established sectors experiencing consolidation can present attractive investment opportunities.

Finally, fundamental analysis of individual companies is essential. This involves evaluating their financial statements, management quality, and competitive advantages. By identifying companies with strong fundamentals and a compelling growth story, investors can increase their chances of success.

In conclusion, market data analysis is an indispensable tool for identifying investment opportunities. By understanding macroeconomic indicators, industry trends, and company fundamentals, investors can make informed decisions and navigate the global landscape with confidence.

Managing Risk in Global Markets

In the dynamic world of global markets, navigating the complex interplay of economic forces, political landscapes, and market trends is crucial for success. One of the most critical aspects of this navigation is managing risk. Global markets are inherently volatile, presenting a myriad of potential challenges that can impact investment returns and overall financial well-being.

Understanding and mitigating risk is paramount. It involves a comprehensive approach that considers a wide range of factors, including:

- Economic risks: Fluctuations in currency exchange rates, inflation, interest rates, and economic growth can significantly influence market performance.

- Political risks: Geopolitical events, government policies, and regulatory changes can create uncertainty and volatility in markets.

- Market risks: Market volatility, liquidity issues, and sudden shifts in investor sentiment can lead to unexpected losses.

- Operational risks: Internal factors such as operational inefficiencies, fraud, and cybersecurity threats can also pose significant risks.

To effectively manage risk in global markets, investors and businesses must adopt a proactive and data-driven approach. This involves:

- Diversification: Spreading investments across different asset classes, sectors, and geographies to reduce exposure to any single risk factor.

- Risk assessment and monitoring: Continuously analyzing market data, identifying potential risks, and implementing appropriate mitigation strategies.

- Scenario planning: Developing contingency plans for various market scenarios and potential disruptions.

- Strategic asset allocation: Balancing risk and return by allocating investments to assets that align with specific risk tolerance levels.

In today’s interconnected world, effective risk management is not just about minimizing losses, but also about maximizing opportunities. By understanding and mitigating potential risks, investors and businesses can navigate the global landscape with greater confidence and unlock the full potential of global markets.

Case Studies: Successful Global Market Analysis

Global market analysis is crucial for businesses seeking international expansion. By understanding the intricacies of different markets, companies can tailor their strategies for success. Here are some case studies that showcase the power of effective global market analysis:

1. Netflix: Netflix’s global expansion is a prime example of successful market analysis. The streaming giant meticulously studied the preferences of audiences worldwide, adapting its content library and pricing models to cater to diverse tastes. Their commitment to localized content production and strategic partnerships has been key to their international success.

2. IKEA: This furniture giant has achieved global dominance by understanding the needs of different cultural markets. IKEA adapts its product offerings and marketing messages to appeal to local preferences while maintaining its core brand identity. Their focus on affordability and accessibility has resonated with consumers globally.

3. Amazon: Amazon’s global success is fueled by its sophisticated market analysis techniques. They leverage big data and analytics to identify potential markets and optimize their logistics and supply chains for international operations. Amazon’s agility and ability to adapt to diverse regulatory environments have been instrumental in their global expansion.

These case studies demonstrate the importance of rigorous global market analysis. By studying consumer behavior, competitor strategies, and market trends, businesses can make informed decisions to achieve success in the global marketplace.

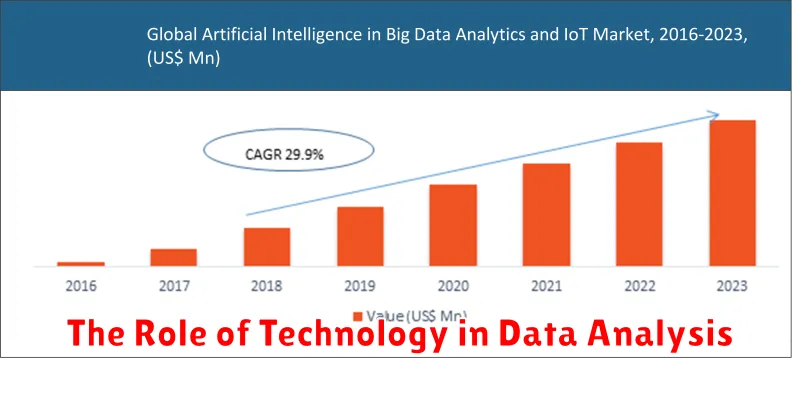

The Role of Technology in Data Analysis

In the ever-evolving global landscape, market data analysis plays a crucial role in driving informed decision-making. As businesses navigate complex and dynamic markets, the ability to extract insights from vast datasets is paramount. Technology has become an indispensable tool, enabling businesses to unlock the potential of data and gain a competitive edge.

Data collection and integration tools have revolutionized the way businesses gather and consolidate information. Automated data extraction, real-time data feeds, and cloud-based data warehousing solutions have made it easier to collect and store large volumes of data from multiple sources. This allows for a holistic view of the market, encompassing customer behavior, competitor activities, and macroeconomic trends.

Data visualization and analysis tools provide powerful capabilities for interpreting complex data patterns. Dashboards, charts, and interactive visualizations enable analysts to identify trends, anomalies, and potential opportunities. Advanced analytics techniques like machine learning and artificial intelligence can uncover hidden insights and predict future outcomes, helping businesses make more accurate forecasts and informed decisions.

Collaboration and communication tools facilitate the sharing of insights and knowledge across teams. Real-time dashboards and collaborative platforms empower analysts to work together, fostering data-driven decision-making. These technologies enable businesses to respond to market changes swiftly and effectively.

The adoption of data governance and security measures is essential for ensuring the integrity and confidentiality of sensitive market data. Secure data storage, access controls, and data encryption protocols are crucial for safeguarding valuable information and protecting against cyber threats.

In conclusion, technology is driving a transformative shift in market data analysis. By leveraging these powerful tools, businesses can gain a deeper understanding of market dynamics, make more informed decisions, and stay ahead of the competition in the global landscape.