The investment world is a dynamic landscape, constantly shifting with economic trends, market fluctuations, and emerging technologies. Staying ahead of the curve in this environment is crucial for investors seeking to maximize returns and mitigate risks. Navigating this complex terrain requires staying informed about the latest market updates, analyzing data, and understanding the forces shaping investment opportunities.

This comprehensive guide aims to equip you with the knowledge and insights you need to make informed investment decisions. We’ll delve into the latest market trends, analyze key economic indicators, explore emerging investment opportunities, and provide actionable strategies to navigate the ever-changing landscape. Whether you’re a seasoned investor or just starting your journey, this guide will empower you to make confident decisions and build a robust investment portfolio.

Understanding Market Volatility

Market volatility is a natural and inevitable part of investing. It refers to the degree of price fluctuations in financial markets, which can be influenced by various factors such as economic data, political events, and investor sentiment.

Understanding volatility is crucial for investors as it can significantly impact investment returns and risk. High volatility can lead to large price swings, both upward and downward, creating opportunities for profit but also increasing the potential for losses.

Here are some key factors that contribute to market volatility:

- Economic data: Releases of economic indicators like inflation, unemployment rates, and GDP growth can influence investor expectations and market sentiment.

- Political events: Major political developments, such as elections, policy changes, and international conflicts, can create uncertainty and volatility.

- Interest rate changes: Central bank decisions on interest rates can impact borrowing costs, economic growth, and the attractiveness of different asset classes.

- Investor sentiment: Shifts in market sentiment, driven by factors like news, media coverage, and social media trends, can lead to rapid changes in prices.

While volatility can be challenging, it also presents opportunities for investors who can adapt to changing market conditions. Understanding the drivers of market volatility and developing a robust investment strategy can help you navigate the ups and downs of the market and potentially achieve your financial goals.

Key Economic Indicators to Watch

Staying ahead of the investment curve requires a keen eye on key economic indicators. These metrics offer valuable insights into the current state of the economy and can help you make informed investment decisions.

Here are some of the crucial economic indicators to keep your attention:

Gross Domestic Product (GDP)

GDP measures the total value of goods and services produced in a country. A healthy GDP growth rate indicates economic expansion and a strong demand for goods and services. Conversely, a declining GDP suggests an economic contraction.

Inflation

Inflation reflects the rate at which prices for goods and services increase over time. High inflation erodes purchasing power, making it more expensive to live and potentially impacting investment returns. Central banks closely monitor inflation and implement monetary policy to keep it within a target range.

Unemployment Rate

The unemployment rate represents the percentage of the labor force actively seeking work but unable to find employment. A low unemployment rate signals a healthy economy with strong job creation. Conversely, a high unemployment rate indicates economic weakness and potential challenges for businesses.

Interest Rates

Interest rates determine the cost of borrowing money. Lower interest rates encourage borrowing and spending, boosting economic activity. However, rising interest rates can make borrowing more expensive, potentially slowing down economic growth.

Consumer Confidence

Consumer confidence reflects consumer sentiment about the economy’s health and their personal financial situations. Strong consumer confidence translates to increased spending, supporting economic growth. Conversely, low consumer confidence can lead to reduced spending and economic slowdown.

By closely monitoring these key economic indicators, you can gain a comprehensive understanding of the economic landscape and make informed investment decisions.

Impact of Geopolitical Events

Geopolitical events can have a significant impact on the investment market. They can create uncertainty, volatility, and risk, which can affect investor sentiment and market performance. These events can also lead to changes in government policies and regulations, which can impact businesses and industries.

Some common geopolitical events that can affect the investment market include:

- Wars and conflicts

- Political instability

- Trade disputes

- Sanctions

- Terrorist attacks

- Natural disasters

The impact of geopolitical events can vary depending on the event, the region affected, and the time frame. For example, a war in a major oil-producing country could lead to higher oil prices, which could negatively impact the economy and the stock market. A political crisis in a key trading partner could disrupt supply chains and lead to lower economic growth. And a terrorist attack could create fear and uncertainty, leading to a decline in investor confidence.

Investors need to be aware of geopolitical events and their potential impact on the investment market. They should also consider diversifying their portfolios to reduce their risk exposure.

Sector-Specific Performance Updates

Understanding sector-specific performance is crucial for making informed investment decisions. This section provides insights into the current performance trends of key sectors, helping you stay ahead of the curve and identify potential opportunities.

Technology: The technology sector remains a key driver of growth, fueled by advancements in artificial intelligence, cloud computing, and cybersecurity. However, recent concerns about rising interest rates and potential economic slowdown have led to some volatility in this sector.

Healthcare: The healthcare sector is generally considered a defensive investment, as demand for healthcare services tends to remain steady even during economic downturns. Emerging trends in genomics, personalized medicine, and telemedicine are driving growth in this sector.

Energy: The energy sector is undergoing a significant transformation, driven by the transition to renewable energy sources and the increasing demand for energy efficiency. Investors are closely watching developments in renewable energy, energy storage, and carbon capture technologies.

Financial Services: The financial services sector benefits from rising interest rates, which boost profits for banks and other financial institutions. However, the sector also faces challenges related to increasing regulations and competition.

Consumer Discretionary: The consumer discretionary sector is sensitive to economic conditions, as consumer spending tends to rise during economic expansions and decline during recessions. Investors are closely watching consumer sentiment and inflation trends in this sector.

It is important to note that these are just general trends and individual sector performance can vary significantly. Conduct thorough research and consult with a financial advisor before making any investment decisions based on sector-specific performance updates.

Expert Opinions and Predictions

Navigating the investment market can feel like a rollercoaster ride. But amidst the ups and downs, having access to expert opinions and predictions can provide valuable insights and help you make informed decisions. These experts, often seasoned financial analysts, economists, and market strategists, leverage their knowledge and experience to analyze market trends, forecast future movements, and provide recommendations.

While no one can predict the market with absolute certainty, expert insights can offer a valuable perspective. They can help you understand the potential risks and rewards associated with different asset classes, identify emerging trends, and make adjustments to your portfolio based on their analysis.

By following expert opinions, you can stay ahead of the curve and make more informed investment choices. Remember, it’s crucial to approach these predictions with a critical eye and consider your own investment goals and risk tolerance. Not all experts will agree, and market conditions can change rapidly.

How to Interpret Market Data

Navigating the investment market can be overwhelming, with a constant barrage of information and data points. To make informed decisions, you need to understand how to interpret market data effectively. This guide provides insights into deciphering market trends and making strategic choices.

Start with the basics: Familiarize yourself with key economic indicators like Gross Domestic Product (GDP), inflation rates, and unemployment figures. These provide a broad picture of the overall economic health.

Analyze market indices: Indices like the S&P 500 and NASDAQ reflect the performance of specific sectors and companies. Monitoring their trends reveals broader market sentiment and potential investment opportunities.

Look beyond the headlines: Don’t rely solely on news articles for market insights. Dive into company earnings reports, industry-specific data, and expert analyses to gain a comprehensive understanding.

Consider fundamental analysis: Evaluate companies based on their financial health, management, and competitive landscape. This helps identify undervalued stocks with strong growth potential.

Don’t forget technical analysis: This method uses historical price and volume data to predict future market movements. Chart patterns and indicators can provide valuable insights into market momentum and potential turning points.

Stay informed and adapt: The market is constantly evolving. Be vigilant in staying updated on news and events that could impact your investments. Remember, flexibility and adaptability are key to navigating market fluctuations successfully.

By applying these strategies, you can confidently interpret market data and make informed investment decisions. Remember, investing involves risks, and it’s essential to do your research and consult with financial professionals when necessary.

[object Object]

Resources for Staying Updated: Financial News Websites

Staying informed about the latest developments in the financial markets is crucial for investors of all levels. Financial news websites provide a wealth of information, analysis, and insights that can help you make informed investment decisions. Here are some of the top resources to keep you ahead of the curve:

Bloomberg: Known for its comprehensive coverage of global finance, Bloomberg offers real-time market data, news, and analysis from a variety of sources. Its website features articles, videos, and interactive tools that provide a deep dive into various financial topics.

Financial Times: A respected source for business and financial news, the Financial Times provides in-depth reporting, expert commentary, and data-driven insights. Its website is a valuable resource for investors looking for a global perspective on financial markets.

Reuters: Reuters is a leading provider of global news and financial data. Its website offers real-time updates, market data, and analysis from a team of experienced journalists.

Investopedia: This website is designed for investors of all experience levels. It offers articles, tutorials, and tools to help you understand financial concepts and markets. Investopedia is a great resource for learning about different investment strategies and managing your portfolio.

The Wall Street Journal: The Wall Street Journal is a highly regarded source for business and financial news. Its website provides in-depth reporting, analysis, and market data. While it may require a subscription, its coverage of financial markets is comprehensive and insightful.

MarketWatch: MarketWatch is a popular website for financial news and market data. It offers real-time updates, articles, and analysis on a wide range of financial topics, making it a valuable resource for staying informed about market trends.

Yahoo Finance: Yahoo Finance is a comprehensive website that offers a wealth of financial information. It features market data, news, analysis, and interactive tools that make it a valuable resource for investors of all levels.

By regularly checking these websites, you can stay up-to-date on the latest market movements, economic indicators, and financial trends. This knowledge will help you make informed investment decisions and potentially improve your overall portfolio performance.

Resources for Staying Updated: Investment Blogs and Podcasts

Staying informed about the investment market is crucial for making sound financial decisions. With the constant flux of news and data, it can be challenging to keep up. Fortunately, there are numerous resources available to help you stay ahead of the curve.

Investment Blogs provide a wealth of insights, analysis, and commentary from industry experts. They offer a diverse range of perspectives and cover various topics, from market trends to individual stocks. Popular investment blogs include:

- The Motley Fool: Known for its in-depth analysis and actionable investment advice.

- Seeking Alpha: Features articles from professional investors, analysts, and bloggers.

- Investopedia: Provides educational resources and news on a wide range of financial topics.

Investment Podcasts offer a convenient way to consume financial information while on the go. These podcasts feature interviews with experts, discussions on market trends, and practical advice for investors. Some noteworthy investment podcasts include:

- Planet Money: Explores the global economy and financial issues in an engaging and accessible manner.

- The Tim Ferriss Show: Features interviews with successful investors and entrepreneurs on a wide range of topics, including investing.

- InvestED: Hosted by financial advisors, this podcast provides practical advice and insights for investors of all levels.

By leveraging these resources, you can gain a deeper understanding of the investment market, identify potential opportunities, and make more informed decisions. Remember to choose sources that are reputable, objective, and aligned with your investment goals.

Resources for Staying Updated: Social Media Platforms

Staying informed about market trends is crucial for making smart investment decisions. While traditional news sources are valuable, social media platforms offer a unique advantage for investors. They provide real-time insights, diverse perspectives, and direct access to industry experts.

Here are some popular social media platforms that can keep you ahead of the curve:

- Twitter: Known for its fast-paced updates, Twitter is a hub for financial news, market analysis, and discussions. Follow reputable financial journalists, analysts, and investors for quick insights and breaking news.

- LinkedIn: This platform is excellent for connecting with professionals in the finance industry. Join relevant groups, follow thought leaders, and engage in discussions to learn from experienced individuals.

- Reddit: Reddit’s financial subreddits, like r/investing and r/stocks, provide a platform for community-driven discussions. You can find insightful analysis, trading strategies, and real-time market sentiment from fellow investors.

- Facebook: While Facebook isn’t as specialized as other platforms, it’s still a valuable resource for news and information. Follow financial institutions, investment firms, and industry publications to stay updated.

Remember, always exercise caution when relying on information from social media. Verify facts, be aware of potential biases, and don’t solely base your investment decisions on social media opinions.

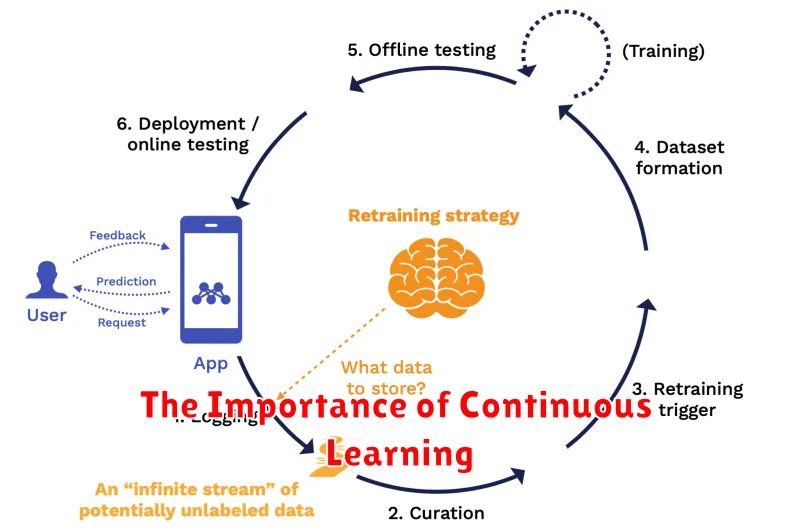

The Importance of Continuous Learning

In the dynamic world of investment, staying ahead of the curve is crucial. With markets constantly evolving and new trends emerging, continuous learning is not just an advantage, it’s a necessity. This means keeping abreast of market updates, economic indicators, and industry shifts to make informed investment decisions.

Continuous learning allows investors to:

- Identify emerging opportunities: By staying informed about new sectors, technologies, and market trends, investors can spot promising investment avenues that might otherwise go unnoticed.

- Adapt to changing market conditions: The investment landscape is constantly shifting. Continuous learning helps investors navigate volatility and adjust their strategies to capitalize on new trends and mitigate potential risks.

- Enhance risk management skills: Understanding market dynamics and the factors influencing investment performance empowers investors to make more informed risk assessments and develop effective risk management strategies.

- Gain a competitive edge: In a competitive investment environment, staying ahead of the knowledge curve is essential for outperforming peers and achieving long-term financial success.

Whether you’re a seasoned investor or just starting your journey, embracing a culture of continuous learning is vital. This involves actively seeking out information from reputable sources, engaging in industry discussions, and continuously refining your investment knowledge and skills.