Are you ready to take control of your financial future and start growing your money? Investing can seem daunting, especially if you’re a beginner, but it doesn’t have to be. This simple guide will walk you through the basics of investment strategies, demystifying common terms and providing actionable steps to help you get started. Whether you’re looking to save for retirement, a down payment on a house, or simply build a financial safety net, this guide will equip you with the knowledge and confidence to begin your investment journey.

No matter your income level or experience, there’s an investment strategy out there for you. This guide covers everything from choosing the right investment accounts to understanding different asset classes and identifying suitable investment options. We’ll explore the fundamentals of stock market investing, the benefits of real estate investing, and the importance of diversifying your portfolio. By the end, you’ll have a clear understanding of how to start growing your money and working towards your financial goals.

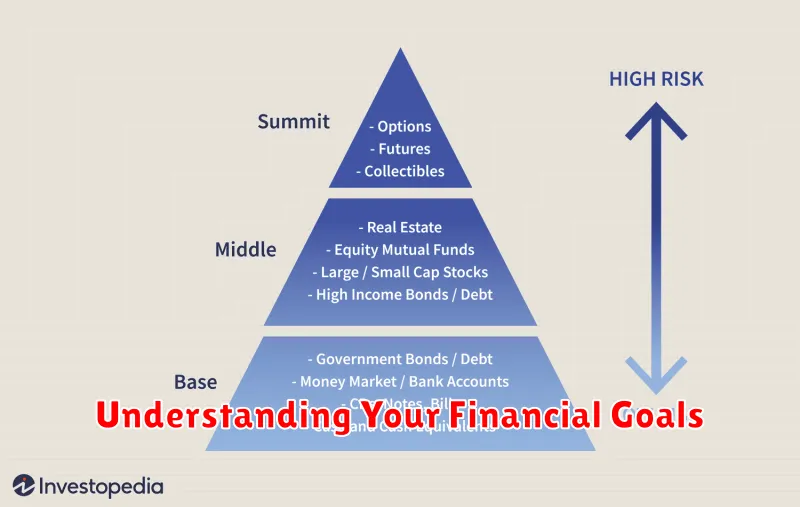

Understanding Your Financial Goals

Before you dive into the world of investing, it’s crucial to understand your financial goals. What are you hoping to achieve with your investments? Are you saving for a down payment on a house, retirement, or your child’s education? Knowing your goals will help you choose the right investment strategies and stay motivated along the way.

To define your goals effectively, consider the following:

- Short-term vs. long-term goals: Short-term goals might involve saving for a vacation in a year or two. Long-term goals could include retirement planning or funding your child’s college education.

- Specific financial needs: Do you have specific needs like paying off debt, covering unexpected expenses, or building an emergency fund?

- Desired timeframe: How long do you have to reach your goals? This will influence your investment choices.

- Risk tolerance: How comfortable are you with potential losses? Your risk tolerance will determine the types of investments you pursue.

Once you have a clear understanding of your financial goals, you can start developing a personalized investment strategy that aligns with your needs and aspirations.

Creating a Budget for Investment

Before you begin investing, it’s essential to establish a solid financial foundation. This involves creating a budget that prioritizes your needs and savings.

Start by tracking your income and expenses for a few months. This will give you a clear picture of where your money is going. Once you have a grasp of your spending habits, you can identify areas where you can cut back. These savings can then be allocated towards your investment goals.

A useful tool is the 50/30/20 rule. This method suggests allocating 50% of your income towards needs (essentials like rent, groceries, utilities), 30% towards wants (entertainment, dining out, hobbies), and 20% towards savings and debt repayment. Adjust these percentages based on your individual circumstances and prioritize saving a significant portion for investments.

Creating a budget doesn’t have to be complicated. Several free budgeting apps and spreadsheets are available to help you manage your finances effectively. Remember, a well-defined budget provides the financial security and flexibility you need to confidently embark on your investment journey.

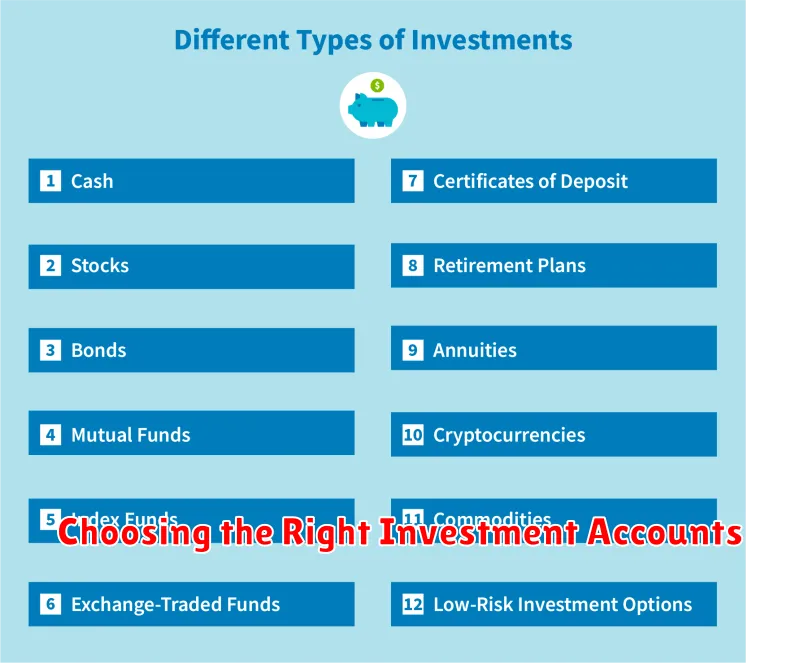

Choosing the Right Investment Accounts

Starting your investment journey can feel overwhelming, especially if you’re a beginner. One of the first steps is choosing the right investment accounts. The type of account you choose will determine how you invest, how much you pay in taxes, and how accessible your money is. Here’s a breakdown of popular options for beginners:

Traditional IRA

This is a retirement account that allows pre-tax contributions to grow tax-deferred. You won’t pay taxes on your earnings until you withdraw them in retirement. This option is excellent if you’re looking to reduce your current tax burden and want to grow your money long-term.

Roth IRA

Similar to a traditional IRA, a Roth IRA is a retirement account. However, contributions are made with after-tax dollars. This means you won’t pay taxes on your withdrawals in retirement. If you expect to be in a higher tax bracket in retirement, a Roth IRA may be a better option.

401(k)

Offered by many employers, a 401(k) is a retirement savings plan that allows pre-tax contributions directly from your paycheck. Your employer may also offer a matching contribution, essentially free money for your retirement. If your employer offers a 401(k), you should take advantage of it.

Brokerage Account

A brokerage account allows you to buy and sell a wide range of investments, including stocks, bonds, ETFs, and mutual funds. These accounts offer more flexibility than retirement accounts, but earnings are typically taxed annually. Brokerage accounts are a good option for investors who want to have more control over their investments and potentially benefit from tax-loss harvesting.

High-Yield Savings Account

These accounts offer a higher interest rate than traditional savings accounts, making them ideal for keeping your emergency fund or short-term savings. While not technically an investment account, they can offer a safe place to hold your money and earn a modest return.

Choosing the right investment accounts is crucial for your financial success. Consider your investment goals, risk tolerance, and tax situation when making a decision. It’s also a good idea to consult with a financial advisor to get personalized advice.

Exploring Different Investment Options

Investing can seem daunting, especially for beginners. But it doesn’t have to be! Understanding the basics and exploring different options can help you get started on your financial journey.

One of the first things to consider is your risk tolerance. Are you comfortable with potentially losing some of your investment, or do you prefer a more conservative approach? Your risk tolerance will influence the types of investments you choose.

Types of Investments

There are many different investment options available, and each one comes with its own set of risks and potential rewards.

- Stocks: Represent ownership in a company. Stock prices can fluctuate based on company performance and market conditions.

- Bonds: Loans to companies or governments. Bonds typically offer lower returns than stocks but are considered less risky.

- Mutual Funds: Pools of money invested in a variety of securities. They provide diversification and professional management.

- Exchange-Traded Funds (ETFs): Similar to mutual funds, but traded on stock exchanges like individual stocks.

- Real Estate: Investing in physical property, such as houses, apartments, or commercial buildings.

- Commodities: Raw materials, such as gold, oil, and agricultural products. Commodity prices are influenced by supply and demand.

It’s essential to research each investment type and understand its pros and cons before investing.

Diversification

Don’t put all your eggs in one basket! Diversification means spreading your investments across different asset classes to reduce risk. By diversifying, you can minimize the impact of any one investment performing poorly.

Investing is a journey, not a race. Start small, learn as you go, and adjust your strategy as your financial goals and circumstances change.

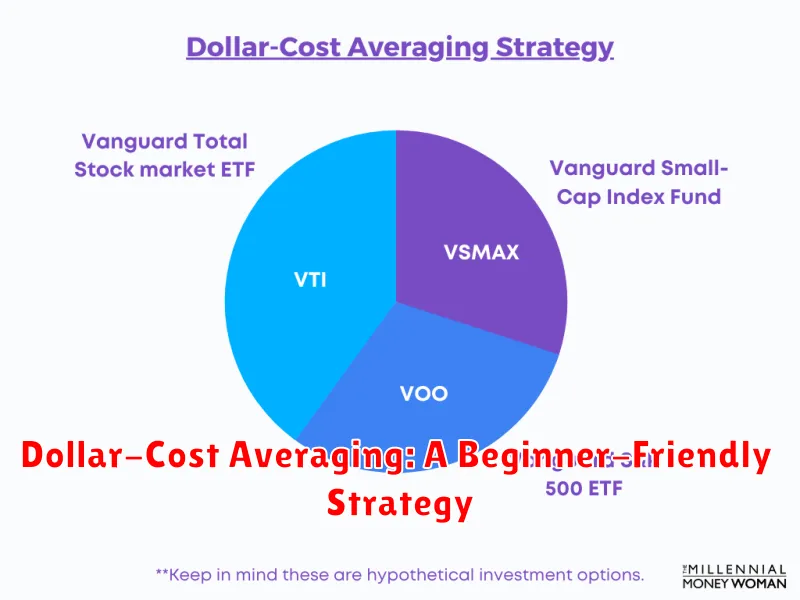

Dollar-Cost Averaging: A Beginner-Friendly Strategy

Dollar-cost averaging (DCA) is a simple yet powerful investment strategy that can help you navigate market volatility and build wealth over time. This strategy involves investing a fixed amount of money in a specific asset at regular intervals, regardless of the asset’s current price. By investing consistently, you smooth out the impact of market fluctuations, potentially reducing your overall investment risk.

Here’s how DCA works in practice. Imagine you want to invest $100 every month in a particular stock. If the stock price is $10 on the first month, you buy 10 shares. The next month, the price might drop to $8, and you buy 12.5 shares. If the price rises to $12, you buy 8.33 shares. By averaging your purchases over time, you effectively lower your average purchase price. If the stock’s price falls, you buy more shares, and vice versa.

The key benefits of DCA include:

- Reduced Risk: By buying consistently, you avoid the temptation to time the market, which is notoriously difficult and often leads to losses. DCA helps you stay invested through market upswings and downswings, allowing you to ride out the volatility.

- Disciplined Investing: DCA promotes a disciplined approach to investing. Setting a regular investment schedule encourages consistent savings and helps you build a solid investment portfolio.

- Emotional Control: As a long-term strategy, DCA helps you stay focused on your financial goals, minimizing emotional decisions driven by market fluctuations.

While DCA is a valuable tool, it’s important to remember that it’s not a foolproof method. Here are some considerations:

- Potential Underperformance: If the asset’s price appreciates significantly in the early stages, you might miss out on potential gains by investing gradually.

- Time Horizon: DCA works best when you have a long-term investment horizon. Short-term investors may find it less beneficial.

Overall, dollar-cost averaging is a beginner-friendly investment strategy that can help you build wealth over time. By investing consistently and avoiding market timing, you can mitigate risk and potentially achieve your financial goals.

Diversifying Your Portfolio

Diversification is a key principle in investing, and it’s particularly important for beginners. It involves spreading your investments across different asset classes, such as stocks, bonds, real estate, and commodities. This helps to reduce risk by mitigating the impact of any one investment performing poorly.

Here’s how diversification works in practice:

- Don’t put all your eggs in one basket: Instead of investing all your money in a single stock, for example, you can spread it across a variety of stocks, bonds, and other assets.

- Reduce volatility: When different asset classes perform differently, the overall impact on your portfolio is lessened.

- Increase potential returns: Diversification allows you to capture potential growth from various sectors of the market.

There are many ways to diversify your portfolio, and the best approach will depend on your individual circumstances and investment goals. Some common strategies include:

- Investing in mutual funds or exchange-traded funds (ETFs): These funds pool money from multiple investors to purchase a basket of assets, offering instant diversification across a broad range of investments.

- Investing in different sectors: Instead of only investing in technology stocks, consider spreading your investments across different sectors like healthcare, energy, or consumer goods.

- Investing in international markets: This can help to reduce risk and potentially improve returns by diversifying your portfolio beyond your domestic market.

Remember, diversification is not a one-time event. It’s an ongoing process that should be reviewed and adjusted periodically to reflect changes in your investment goals, risk tolerance, and market conditions. By diversifying your portfolio, you can create a more resilient investment strategy and potentially achieve better long-term results.

Starting with Low-Cost Index Funds

As a beginner investor, navigating the world of finance can feel overwhelming. With countless investment options, it’s easy to get lost in jargon and complexity. However, a simple and effective strategy for building wealth is to start with low-cost index funds.

Index funds are passively managed funds that track a specific market index, like the S&P 500. They aim to mirror the performance of the index, buying and selling securities in the same proportions as the underlying index. This means you’re investing in a diversified basket of stocks, reducing risk and benefiting from the overall market growth.

Low-cost index funds are particularly advantageous because they have lower expense ratios compared to actively managed funds. Expense ratios represent the annual fees charged by the fund manager, which can significantly impact your returns over time. By choosing funds with lower expense ratios, you retain more of your hard-earned money for investment growth.

Investing in low-cost index funds is a simple and cost-effective way to get started with investing. They offer diversification, potential for long-term growth, and low costs, making them an ideal choice for beginners. Remember, consistency is key! By regularly investing in these funds over time, you can build a solid financial foundation for your future.

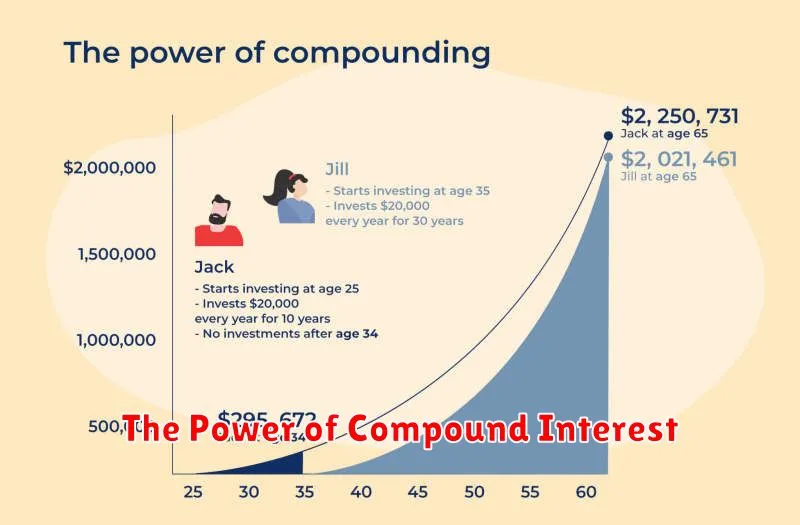

The Power of Compound Interest

Compound interest is often referred to as the “eighth wonder of the world” and for good reason. It is the key to building wealth over the long term and can be one of the most powerful tools in your investment arsenal. In simple terms, compound interest is interest earned on both your original investment and the accumulated interest.

Think of it like a snowball rolling downhill: the longer it rolls, the bigger it gets. The same principle applies to compound interest – the longer your money stays invested and earns interest, the faster it grows.

For example, let’s say you invest $1,000 at a 10% annual return. After one year, you’ll have $1,100. The next year, you’ll earn 10% on the $1,100, which is $110, bringing your total to $1,210. As you can see, you are earning interest on your initial investment plus the interest you earned in the previous year.

The power of compound interest lies in its ability to amplify your returns over time. Even small amounts invested consistently can grow significantly over the long term. The earlier you start investing, the greater the benefit of compound interest.

To maximize the power of compound interest, focus on:

- Investing early: The earlier you start investing, the more time your money has to grow.

- Investing regularly: Consistent investing, even small amounts, can make a big difference over time.

- Choosing investments with good returns: Research and choose investments that have a history of strong returns.

- Staying invested: Avoid the temptation to sell your investments during market downturns. Remember, the power of compound interest works best over the long term.

While compound interest is a powerful force, it’s important to remember that it doesn’t happen overnight. Be patient and stay consistent with your investment strategy. Over time, the magic of compound interest will work its wonders and help you achieve your financial goals.

Managing Investment Risks

Investing is about growing your money over time, but it also comes with the potential for loss. Managing investment risks is essential for every investor, especially beginners. It’s about understanding the potential downsides and taking steps to minimize them.

Here are some key strategies for managing investment risks:

- Diversify your portfolio: Don’t put all your eggs in one basket. Spread your investments across different asset classes like stocks, bonds, and real estate. This helps to reduce the impact of any single investment performing poorly.

- Invest for the long term: Short-term market fluctuations are normal. Focus on long-term goals and ride out temporary downturns. Time in the market beats timing the market.

- Understand your risk tolerance: How much risk are you comfortable taking? Knowing your risk tolerance helps you choose investments that align with your comfort level.

- Start small and gradually increase your investments: Don’t invest more than you can afford to lose. Start small and gradually increase your investments as you become more comfortable with the market.

- Do your research: Before investing in anything, understand the potential risks and rewards. Research companies, industries, and investment strategies.

- Seek professional advice: Consider consulting with a financial advisor who can help you create a personalized investment plan and manage your risks effectively.

Remember, no investment is risk-free. However, by understanding and managing investment risks, you can increase your chances of achieving your financial goals.

[object Object]