In the dynamic world of finance, understanding market liquidity is crucial for investors, traders, and market participants alike. Market liquidity, often referred to as the ease with which an asset can be bought or sold at a fair price, plays a significant role in shaping market trends and influencing investment decisions. As market conditions evolve, so too do liquidity patterns, presenting both opportunities and challenges for market participants.

This article delves into the intricacies of navigating the flow, providing insights into the key factors driving market liquidity trends. We will explore the forces that influence liquidity, including economic indicators, regulatory changes, and investor sentiment. By gaining a comprehensive understanding of these trends, individuals can make informed decisions and capitalize on the opportunities presented by the ever-changing market landscape.

What is Market Liquidity?

Market liquidity refers to the ease and speed with which an asset can be bought or sold in the market without significantly affecting its price. It’s a crucial concept in finance, as it directly impacts the ability to enter and exit trades efficiently.

Think of it like this: if you’re selling a house and there are many potential buyers eager to purchase it, the house is considered liquid. However, if there are few buyers interested, the house is illiquid. The same principle applies to financial assets like stocks, bonds, or currencies.

Key factors influencing market liquidity include:

- Trading volume: High trading volume indicates a large number of buyers and sellers, making it easier to execute trades.

- Order book depth: A deep order book means there are many buy and sell orders at various price points, ensuring that trades can be filled quickly without significant price fluctuations.

- Market volatility: High market volatility can make it difficult to find buyers or sellers at desirable prices, leading to decreased liquidity.

Understanding market liquidity is essential for investors, traders, and businesses alike. It directly impacts investment strategies, portfolio management, and overall market risk.

[object Object]

Factors Affecting Market Liquidity

Market liquidity, the ease with which an asset can be bought or sold at a fair price, is a crucial factor in financial markets. Understanding the factors that influence market liquidity is essential for investors, traders, and policymakers alike. This article delves into the key drivers of market liquidity, shedding light on the dynamics that shape the flow of capital and assets.

Economic Factors

Economic conditions play a significant role in market liquidity. When the economy is strong and growing, investors are more confident and willing to invest, leading to higher trading volumes and increased liquidity. Conversely, during economic downturns, investors tend to become more risk-averse, resulting in reduced trading and lower liquidity.

Market Structure and Regulation

The structure and regulation of a market also influence liquidity. Markets with robust trading platforms, efficient clearing and settlement systems, and clear regulatory frameworks tend to have higher liquidity. Conversely, markets with fragmented structures, complex regulations, or limited trading infrastructure may experience lower liquidity.

Investor Sentiment and Risk Appetite

Investor sentiment and risk appetite are crucial determinants of market liquidity. When investors are optimistic and willing to take on risk, trading volumes tend to increase, leading to higher liquidity. However, if investors become fearful or risk-averse, trading activity may decline, resulting in lower liquidity.

Market Size and Concentration

The size and concentration of a market can also impact liquidity. Large, diversified markets with many participants typically have higher liquidity than smaller, concentrated markets. This is because there are more buyers and sellers in larger markets, making it easier to find counterparties for trades.

Trading Costs and Transaction Fees

Trading costs and transaction fees can also affect market liquidity. High costs can discourage trading, leading to lower liquidity. Conversely, markets with low transaction costs and efficient trading mechanisms tend to have higher liquidity.

Technological Advancements

Technological advancements, such as electronic trading platforms and high-frequency trading, have significantly increased market liquidity. These innovations have made it easier and faster to execute trades, reducing transaction costs and increasing trading volumes.

In conclusion, market liquidity is a complex phenomenon influenced by a multitude of factors. Understanding these factors is crucial for navigating the flow of capital and assets in financial markets. By staying informed about economic conditions, market structure, investor sentiment, and other key drivers, investors and policymakers can make more informed decisions and contribute to the smooth functioning of markets.

Measuring Market Liquidity: Key Indicators

Market liquidity, the ability to buy or sell an asset quickly and easily without significantly impacting its price, is a crucial aspect of any market. It’s essential for investors, traders, and market participants alike, as it determines the ease of entry and exit from positions. Understanding market liquidity trends is critical for navigating the market effectively.

Various indicators can be used to measure market liquidity. These indicators provide insights into the depth and breadth of a market, helping investors assess its efficiency and stability. Here are some key indicators:

1. Bid-Ask Spread:

The bid-ask spread represents the difference between the highest price a buyer is willing to pay (bid) and the lowest price a seller is willing to accept (ask). A narrow spread indicates high liquidity, implying a ready market with many buyers and sellers. Conversely, a wide spread signifies low liquidity, suggesting limited market participation.

2. Trading Volume:

Trading volume refers to the total number of shares or contracts traded in a specific period. High trading volume indicates robust market activity, signifying a high level of liquidity. Conversely, low trading volume suggests limited interest and potentially low liquidity.

3. Order Book Depth:

The order book depth reveals the number of buy and sell orders at different price levels. A deep order book with numerous orders at various price points suggests high liquidity. It indicates that there are many willing buyers and sellers, minimizing price fluctuations.

4. Market Impact:

Market impact refers to the price change that occurs when a large order is placed. A low market impact indicates high liquidity, implying that the large order can be executed without causing significant price movement. Conversely, a high market impact suggests low liquidity, signifying that large orders can influence prices considerably.

5. Volatility:

Volatility, measured by the fluctuation in asset prices, can also provide insights into market liquidity. High volatility often indicates low liquidity, as prices can swing dramatically with limited buy and sell orders. Conversely, low volatility suggests higher liquidity, implying stability and price predictability.

By monitoring these key indicators, investors and traders can gain a clearer understanding of market liquidity and make informed decisions about their trading strategies. Navigating the flow of the market effectively requires a comprehensive understanding of its liquidity dynamics.

Identifying Liquidity Trends and Patterns

Understanding liquidity trends and patterns is crucial for traders and investors seeking to navigate the market effectively. Liquidity, the ease with which an asset can be bought or sold at a fair price, is a fundamental driver of market behavior. Identifying liquidity trends allows participants to anticipate price movements, assess risk, and make informed trading decisions.

Several factors contribute to liquidity trends. Economic indicators like interest rates, inflation, and GDP growth can influence investor sentiment and impact trading activity. Market sentiment, driven by news events, geopolitical developments, and investor confidence, also plays a significant role. Technological advancements, such as the rise of algorithmic trading and high-frequency trading, have further shaped liquidity patterns.

Analyzing historical data provides valuable insights into liquidity trends. Tracking trading volume, the number of assets exchanged over a given period, reveals periods of high and low liquidity. Price volatility, the degree of price fluctuations, can also indicate liquidity levels. Order book analysis, examining the depth and breadth of buy and sell orders, offers a real-time view of liquidity.

By recognizing liquidity trends, traders and investors can gain a competitive edge. High-liquidity markets offer opportunities for rapid execution and tighter spreads, while low-liquidity markets may present challenges in entering and exiting positions. Understanding these dynamics enables investors to adjust their trading strategies and manage risk effectively.

Ultimately, identifying liquidity trends and patterns is an ongoing process. Staying informed about economic indicators, market sentiment, and technological changes is essential. By diligently analyzing data and adapting to evolving market conditions, investors can navigate the flow of liquidity and make informed decisions.

Impact of Liquidity on Trading Strategies

Market liquidity, the ease with which an asset can be bought or sold at a desired price, is a fundamental factor that influences trading strategies and outcomes. Understanding liquidity trends is crucial for navigating the market effectively and achieving profitable results.

High liquidity provides traders with several advantages:

- Faster execution: Orders are filled quickly with minimal slippage (the difference between the desired price and the actual price at which the trade is executed).

- Lower transaction costs: Reduced bid-ask spreads (the difference between the best buy and sell prices) translate into lower trading costs.

- Greater market depth: A large number of orders at various price levels allows for larger trade sizes without significantly impacting the market price.

Low liquidity, on the other hand, presents challenges for traders:

- Slower execution: Finding buyers or sellers can take time, leading to potential delays and missed opportunities.

- Higher transaction costs: Wider bid-ask spreads result in increased trading expenses, potentially impacting profitability.

- Price volatility: Larger orders can move the market price significantly, increasing the risk of adverse price movements.

Liquidity impacts trading strategies in various ways:

- Scalping, which relies on small price fluctuations, thrives in high-liquidity markets.

- Swing trading, focused on medium-term price swings, benefits from sufficient liquidity to enter and exit positions.

- Trend following strategies can be hampered by low liquidity, making it difficult to capitalize on emerging trends.

Monitoring liquidity trends is essential for informed decision-making. Traders should consider factors such as trading volume, bid-ask spreads, and order book depth to assess liquidity levels. By understanding the interplay between liquidity and trading strategies, traders can optimize their approach and enhance their chances of success in the market.

High Liquidity vs. Low Liquidity Markets

In the dynamic world of finance, understanding market liquidity is crucial for investors and traders alike. Liquidity refers to the ease with which an asset can be bought or sold in the market without significantly impacting its price. Markets can be broadly classified into two categories: high liquidity markets and low liquidity markets.

High Liquidity Markets

High liquidity markets are characterized by a large number of buyers and sellers, making it easy to trade assets quickly and efficiently. Here’s what distinguishes them:

- Rapid Execution: Orders are filled quickly, with minimal delay between the request and the transaction.

- Stable Prices: The volume of transactions prevents significant price swings, ensuring a relatively stable market.

- Easy Entry and Exit: Investors can enter and exit positions without causing substantial price movements.

Examples of high liquidity markets include major stock exchanges like the New York Stock Exchange (NYSE) and NASDAQ, as well as the foreign exchange (Forex) market.

Low Liquidity Markets

Low liquidity markets, conversely, have limited buyers and sellers, leading to challenges in executing trades.

- Delayed Execution: Finding a counterparty for a trade can be time-consuming, leading to delays in execution.

- Price Volatility: Small trades can cause significant price swings due to the limited trading volume.

- Difficulty in Entering and Exiting: Investors may struggle to find buyers or sellers for their desired asset, impacting their ability to enter or exit positions quickly.

Low liquidity markets often include smaller companies, emerging markets, or less frequently traded assets, such as real estate or certain types of bonds.

Implications for Investors

Understanding the liquidity characteristics of a market is vital for investors. Here’s why:

- Risk Management: In low liquidity markets, price fluctuations can be unpredictable, making risk management more challenging.

- Trading Costs: Higher liquidity generally translates to lower transaction costs, while low liquidity often comes with higher trading fees and commissions.

- Market Entry and Exit: Investors need to consider their ability to enter and exit positions quickly based on the market’s liquidity.

Conclusion

Navigating the flow of financial markets requires a clear understanding of liquidity. High liquidity markets offer greater ease of execution, price stability, and accessibility for investors. Low liquidity markets, while potentially offering attractive opportunities, present challenges related to execution, volatility, and market entry/exit. By carefully analyzing the liquidity dynamics of different markets, investors can make informed decisions that align with their risk tolerance and investment goals.

Volatility and its Relationship with Liquidity

In the dynamic world of finance, understanding the intricate relationship between volatility and liquidity is crucial for navigating the market effectively. Volatility refers to the degree of price fluctuations in a market, while liquidity signifies the ease with which an asset can be bought or sold without affecting its price. These two concepts are intrinsically linked, shaping market dynamics and influencing investment decisions.

High volatility often leads to decreased liquidity. When prices are fluctuating wildly, investors tend to hesitate, fearing potential losses. This reluctance to trade results in lower trading volumes, making it more challenging to find buyers or sellers quickly. Conversely, low volatility typically indicates higher liquidity. With stable prices, investors are more confident in their decisions, leading to increased trading activity and easier execution of orders.

The relationship between volatility and liquidity is a double-edged sword. On the one hand, high volatility can create opportunities for short-term traders seeking to profit from price swings. However, it can also expose long-term investors to significant risk. Conversely, low volatility provides a stable environment for long-term investing but may limit short-term profit potential. Understanding this dynamic allows investors to tailor their strategies to their individual risk tolerance and investment goals.

The interplay of volatility and liquidity is a key factor in determining market sentiment and influencing investor behavior. By closely monitoring these trends, investors can gain valuable insights into the market’s health and make informed decisions. Whether riding the wave of volatility or seeking a haven of stability, understanding the relationship between these two concepts is essential for navigating the complex and ever-evolving financial landscape.

The Role of Market Makers and Participants

In the bustling world of financial markets, liquidity is the lifeblood that enables smooth trading and price discovery. At the heart of this process lie two crucial players: market makers and market participants. Their roles are interconnected and vital for maintaining a vibrant and efficient marketplace.

Market makers, often referred to as “liquidity providers,” are financial institutions or individuals who constantly quote bid and ask prices for financial instruments. They act as intermediaries, ready to buy and sell securities at those prices, ensuring continuous trading even with fluctuating demand. This crucial role promotes market depth and stability by offering buyers and sellers a readily accessible counterparty.

Market participants, on the other hand, are the diverse group of individuals and entities who engage in trading activities. They include:

- Institutional Investors: Large-scale players like pension funds, hedge funds, and mutual funds.

- Retail Investors: Individuals who invest their own money in financial markets.

- Brokers: Intermediaries who facilitate trades between buyers and sellers on behalf of their clients.

- Corporations: Companies that issue securities and raise capital in the market.

The dynamic interplay between market makers and participants drives market liquidity. Market makers provide the initial liquidity, while market participants create the demand and supply that shape prices. When market participants are actively buying and selling, it enhances trading volume and incentivizes market makers to provide more liquidity, creating a virtuous cycle.

Understanding the roles of market makers and participants is crucial for navigating market liquidity trends. By recognizing their influence on price movements and trading activity, investors can make informed decisions about their trading strategies and investment choices.

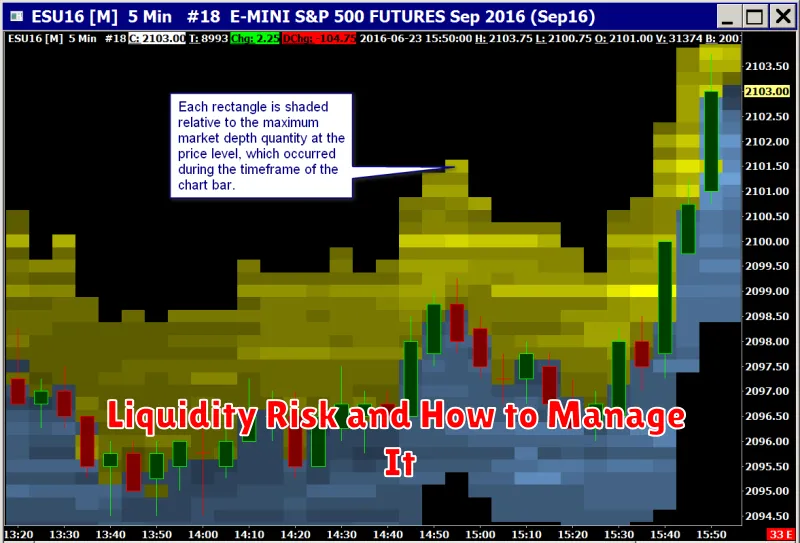

Liquidity Risk and How to Manage It

Liquidity risk is the risk that an asset cannot be bought or sold quickly enough at a fair price, meaning that an investor may have to sell at a loss to obtain cash quickly. This is a significant concern for investors and companies, as it can have a major impact on their ability to meet financial obligations and achieve their investment goals.

There are a number of factors that can contribute to liquidity risk, including:

- Market volatility: When markets are volatile, it can be difficult to find buyers or sellers for assets, leading to price fluctuations and making it harder to sell at a desired price.

- Lack of market depth: In markets with low trading volume, it can be difficult to find buyers or sellers for large quantities of assets, making it difficult to sell quickly or at a fair price.

- Lack of transparency: In opaque markets with limited information, it can be difficult to determine the fair value of an asset, leading to uncertainty and making it harder to sell quickly.

To manage liquidity risk, investors and companies can take a number of steps, including:

- Diversify investments: Spreading investments across different asset classes, industries, and geographies can help reduce the risk of being stuck with illiquid assets.

- Maintain adequate cash reserves: Having sufficient cash on hand can provide a buffer in times of market volatility and help meet short-term obligations.

- Monitor liquidity positions: Regularly tracking liquidity positions can help identify potential problems early on and allow for timely adjustments to investment strategies.

- Develop contingency plans: Having contingency plans in place for dealing with illiquid assets can help mitigate losses and ensure a smooth transition.

By understanding the risks and implementing effective management strategies, investors and companies can enhance their financial resilience and navigate market fluctuations with greater confidence.

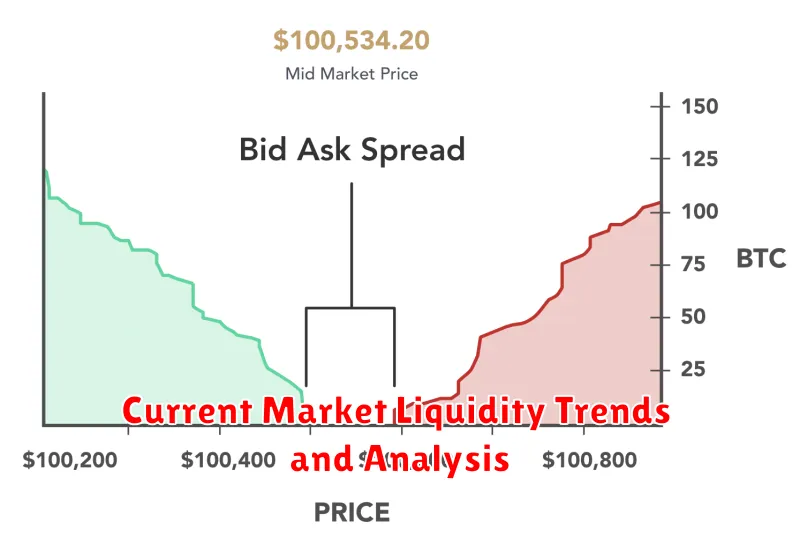

Current Market Liquidity Trends and Analysis

Market liquidity, the ease with which assets can be bought and sold at fair prices, is a cornerstone of efficient market function. It enables investors to enter and exit positions readily, fostering price discovery and market stability. However, market liquidity dynamics are constantly evolving, influenced by a complex interplay of factors.

Current Market Liquidity Trends are characterized by a mix of influences. Central bank policies, particularly interest rate adjustments and quantitative easing programs, have a significant impact. Rising interest rates tend to reduce liquidity as investors seek higher returns elsewhere, while easing policies can inject liquidity into markets.

Global economic conditions also play a critical role. Economic uncertainty, geopolitical tensions, and potential recessions can dampen investor sentiment, leading to reduced trading activity and lower liquidity.

Technological advancements, including algorithmic trading and high-frequency trading, have contributed to increased market liquidity in certain segments. However, these same advancements can also exacerbate market volatility and exacerbate liquidity risks in times of stress.

Analysis of Current Trends reveals a complex picture. While some markets, particularly in developed economies, continue to enjoy relatively high liquidity, others, particularly emerging markets, face greater challenges.

Assessing Market Liquidity involves examining several key indicators:

- Trading volume: High trading volume suggests ample liquidity.

- Bid-ask spread: Narrow spreads indicate greater liquidity.

- Price impact: The extent to which trades influence prices is a measure of liquidity.

Understanding current market liquidity trends is crucial for investors, traders, and market participants alike. By staying informed about these dynamics, participants can make more informed decisions, navigate market fluctuations effectively, and manage risk appropriately.

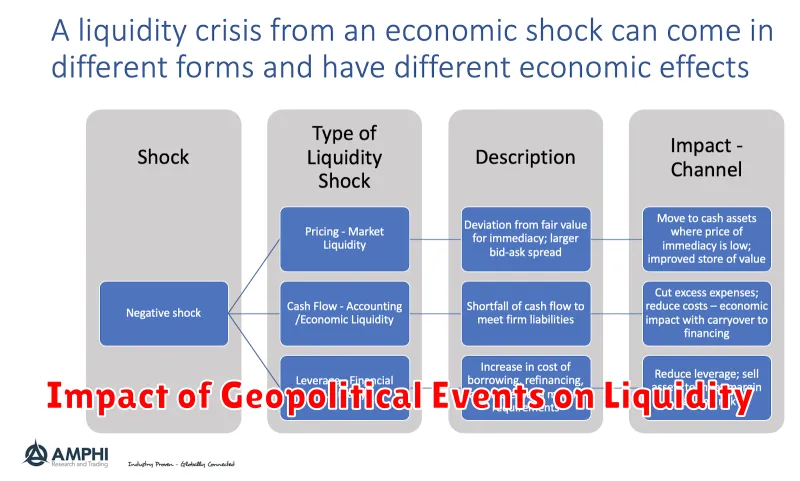

Impact of Geopolitical Events on Liquidity

Geopolitical events, from trade wars to global conflicts, can profoundly impact market liquidity. These events introduce uncertainty, leading investors to seek safe haven assets and potentially pull back from risky investments. This can lead to a reduction in trading activity, resulting in thinner order books and wider bid-ask spreads, making it more difficult to execute trades efficiently.

The impact can be particularly pronounced in emerging markets, which are often more sensitive to global events. For example, during periods of heightened geopolitical tension, investors might pull funds out of emerging markets, leading to currency depreciations and increased volatility. This can make it challenging for local businesses to access funding and can even hinder economic growth.

Furthermore, geopolitical events can impact central bank policies and their ability to manage liquidity. For example, a trade war might force central banks to intervene in the currency market to stabilize exchange rates, which could have unintended consequences for liquidity.

While the impact of geopolitical events on liquidity can be significant, it’s important to note that the effect can vary depending on the specific event and its duration. However, it is crucial for market participants to understand these potential impacts and to develop strategies to navigate periods of heightened geopolitical risk.