In the dynamic world of finance, where market fluctuations can be both exhilarating and nerve-wracking, understanding market sentiment is a crucial skill for every savvy investor. Market sentiment, the collective mood and feeling of investors towards a particular security or market, can act as a powerful leading indicator, offering valuable insights into future price movements.

By deciphering the subtle cues and signals that reveal market sentiment, investors can gain a competitive edge, make more informed decisions, and potentially navigate the market with greater confidence. In this article, we’ll delve into the importance of market sentiment analysis and explore essential tools that can help you unlock this powerful market insight.

What is Market Sentiment?

Market sentiment refers to the overall feeling or attitude of investors towards the market. It’s essentially the collective mood of the market, reflecting the prevailing optimism or pessimism about future price movements. It’s a powerful force that can significantly influence market direction and asset prices.

Think of it as a barometer of investor confidence. When sentiment is bullish (positive), investors are generally optimistic and willing to buy, driving prices up. Conversely, bearish (negative) sentiment reflects fear and a reluctance to invest, leading to price declines.

The Importance of Gauging Sentiment

In the dynamic world of finance, market sentiment plays a pivotal role in shaping investment decisions. It encapsulates the collective attitude of investors towards a particular asset or market, acting as a powerful driver of price movements. While fundamental analysis focuses on the intrinsic value of an asset, gauging market sentiment offers a valuable window into the psychological forces at play. Understanding prevailing sentiment can help investors make more informed decisions, as it can provide early warning signals of potential shifts in market direction.

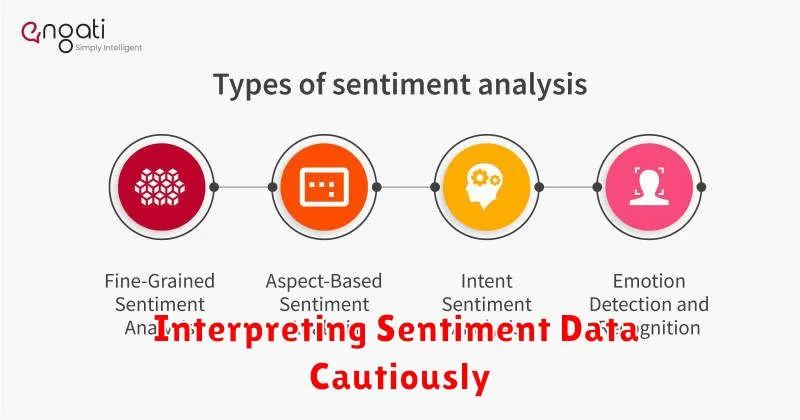

Sentiment analysis, a process of extracting and interpreting subjective information from data, offers a powerful tool for understanding market sentiment. By analyzing news articles, social media posts, and other data sources, investors can gain insights into the prevailing mood among investors. This information can be particularly valuable in volatile markets, where emotions can run high and influence trading patterns.

For instance, if there’s a surge in negative sentiment surrounding a particular company, investors may choose to sell their shares, leading to a decline in price. Conversely, positive sentiment can fuel buying pressure, driving prices higher. By understanding these dynamics, investors can potentially position themselves to profit from market shifts.

While sentiment analysis offers valuable insights, it’s crucial to remember that it’s just one piece of the investment puzzle. It should be used in conjunction with fundamental analysis and other tools to make informed decisions. Moreover, it’s essential to be aware of the limitations of sentiment analysis, such as the potential for bias in data sources and the difficulty in predicting future market movements with certainty.

Types of Market Sentiment Indicators

Market sentiment refers to the overall attitude and feeling of investors towards the financial markets. It’s essentially the collective mood of investors, which can be bullish (optimistic), bearish (pessimistic), or neutral. Understanding market sentiment is crucial for savvy investors because it can provide insights into potential market direction and help inform investment decisions. There are various types of market sentiment indicators that can help investors gauge the prevailing sentiment, and these indicators can be broadly categorized into the following:

1. Surveys and polls

Surveys and polls directly ask investors about their outlook on the market. Popular examples include the American Association of Individual Investors (AAII) Sentiment Survey and the Investor’s Intelligence Sentiment Survey. These surveys gauge the percentage of bullish, bearish, and neutral investors, providing a snapshot of the current market mood.

2. Social media and news sentiment analysis

With the rise of social media and online news, algorithms can analyze the sentiment expressed in articles, posts, and comments. These algorithms use natural language processing (NLP) to identify positive, negative, and neutral sentiment, offering insights into the public’s perception of the market. Platforms like Google Trends and Twitter Sentiment Analysis can be used to track sentiment trends.

3. Option market data

Options contracts allow investors to bet on the future direction of a security’s price. Put/Call ratio, which measures the ratio of put options (bets on price decline) to call options (bets on price increase), can be an indicator of market sentiment. A high put/call ratio suggests a bearish sentiment, while a low ratio indicates a bullish sentiment.

4. Short interest ratio

Short interest represents the number of shares that have been borrowed and sold in anticipation of a price decline. A high short interest ratio can indicate bearish sentiment, as investors are betting on a price drop. However, it’s important to note that short interest can also be a contrarian indicator, as covering short positions can drive prices up.

5. Volatility indices

Volatility indices, such as the VIX (Volatility Index), measure the expected volatility of the market. High volatility often signifies uncertainty and anxiety, which can indicate bearish sentiment. Conversely, low volatility can suggest a sense of calm and bullish sentiment.

It’s crucial to remember that market sentiment is just one piece of the investment puzzle. While sentiment indicators can provide valuable insights, they shouldn’t be solely relied upon for investment decisions. Investors should consider other fundamental and technical factors before making any investment choices.

Social Media Sentiment Analysis

In today’s digital age, social media has become an indispensable platform for gauging public opinion and understanding market sentiment. Social media sentiment analysis is a powerful tool that allows investors to glean valuable insights from the vast amount of data circulating online. By analyzing the sentiment expressed in social media posts, comments, and tweets, investors can identify emerging trends, anticipate market fluctuations, and make informed investment decisions.

One of the key benefits of social media sentiment analysis is its ability to provide real-time insights. Unlike traditional market research methods, which often involve time-consuming surveys and data collection, social media sentiment analysis can capture sentiment shifts in real-time, giving investors a significant edge in understanding the market’s direction.

Moreover, social media sentiment analysis can be used to identify market drivers and anticipate potential risks. By analyzing the conversations surrounding specific companies, industries, or economic events, investors can identify potential catalysts for price movements and assess the overall market sentiment towards them. This information can help them make more informed decisions about buying, selling, or holding their investments.

Here are some of the key applications of social media sentiment analysis in investment:

- Identifying market trends: Analyzing the sentiment expressed on social media platforms can reveal emerging trends and shifting consumer preferences, providing insights into potential investment opportunities.

- Gauging public perception of companies: By analyzing sentiment towards specific companies, investors can gain insights into their brand image, customer satisfaction, and potential risks.

- Predicting stock price movements: Studies have shown that sentiment analysis can be used to predict short-term stock price movements, giving investors an advantage in timing their trades.

- Identifying market risks: By monitoring negative sentiment surrounding specific industries or economic events, investors can anticipate potential risks and adjust their investment strategies accordingly.

While social media sentiment analysis is a powerful tool, it’s important to use it with caution. It’s essential to understand that not all sentiment expressed on social media is reliable or indicative of actual market movements. Investors should always use a combination of different data sources and analytical tools to make informed investment decisions.

In conclusion, social media sentiment analysis offers a valuable perspective on market sentiment, providing real-time insights that can be used to identify trends, anticipate risks, and make informed investment decisions. However, it’s crucial to use it responsibly and in conjunction with other analytical methods to ensure accuracy and avoid potential biases.

News Sentiment Analysis

In the dynamic world of finance, making informed decisions hinges on understanding the market’s pulse. News sentiment analysis emerges as a powerful tool for investors seeking to decipher the prevailing mood and anticipate potential market shifts. By analyzing the emotional tone expressed in news articles, social media posts, and other textual data, investors can gain valuable insights into the sentiment surrounding specific companies, industries, or even the overall market.

How does News Sentiment Analysis Work?

News sentiment analysis employs sophisticated algorithms and natural language processing (NLP) techniques to determine the sentiment expressed in textual data. These algorithms analyze words, phrases, and sentence structure to identify emotional cues. Sentiment is typically classified into three categories: positive, negative, and neutral. By aggregating the sentiment scores from various sources, analysts can gauge the overall sentiment surrounding a particular topic.

Benefits of News Sentiment Analysis for Investors:

News sentiment analysis offers several advantages for investors:

- Early Warning Signals: By tracking sentiment changes, investors can identify potential market shifts before they are reflected in price movements.

- Enhanced Risk Management: Sentiment analysis can help investors assess the risks associated with specific investments by identifying negative sentiment that might indicate potential downsides.

- Improved Investment Decisions: Understanding market sentiment can help investors make more informed investment decisions, aligning their portfolios with the prevailing market mood.

Tools and Resources for News Sentiment Analysis:

Several tools and resources are available to assist investors in conducting news sentiment analysis. These include:

- Sentiment Analysis APIs: APIs from providers like Google Cloud Natural Language API and Amazon Comprehend offer sentiment analysis capabilities.

- Sentiment Analysis Software: Specialized software packages such as MonkeyLearn and Lexalytics provide comprehensive sentiment analysis functionalities.

- Financial News Aggregators: Platforms like Bloomberg and Reuters offer news feeds with sentiment scores.

Conclusion:

News sentiment analysis is a valuable tool for investors seeking to gain a deeper understanding of the market’s pulse. By leveraging this technology, investors can identify emerging trends, mitigate risks, and make more informed investment decisions. As sentiment analysis continues to evolve, its importance in the financial world is likely to grow even further, empowering investors to navigate the complex market landscape with greater confidence.

Technical Analysis Indicators for Sentiment

While fundamental analysis focuses on a company’s financial health, technical analysis delves into market behavior and investor sentiment. This approach uses price action and trading volume to identify patterns and trends, providing insights into the market’s overall sentiment.

Several technical indicators are specifically designed to gauge market sentiment. These indicators help traders understand the prevailing market mood, whether it’s bullish, bearish, or neutral. By analyzing these indicators, traders can make more informed decisions about their trades. Here are a few of the most common indicators used for sentiment analysis:

1. On-Balance Volume (OBV)

The OBV indicator measures the cumulative volume of buying and selling pressure. It accumulates volume on up days and subtracts volume on down days. A rising OBV indicates bullish sentiment, while a falling OBV suggests bearish sentiment. Divergences between price and OBV can also be significant signals.

2. Chaikin Money Flow (CMF)

Similar to OBV, Chaikin Money Flow considers both price and volume. It measures the flow of money into and out of a security over a specific period. Values above zero suggest bullish sentiment, while values below zero indicate bearish sentiment.

3. Relative Strength Index (RSI)

While not solely a sentiment indicator, the RSI is often used to gauge market sentiment. This momentum indicator measures the magnitude of recent price changes to evaluate overbought or oversold conditions. Readings above 70 suggest overbought conditions, while readings below 30 indicate oversold conditions. These extremes can be interpreted as potential signals of changing sentiment.

4. Moving Average Convergence Divergence (MACD)

The MACD is another momentum indicator that can be used to assess sentiment. It compares two moving averages (usually 12-period and 26-period) to create a signal line. Crossovers between the MACD and the signal line can indicate shifts in sentiment. A bullish crossover suggests increasing buying pressure, while a bearish crossover suggests increasing selling pressure.

5. Put/Call Ratio

The Put/Call Ratio compares the number of put options traded to the number of call options traded. A higher ratio indicates more pessimism and suggests a bearish sentiment, while a lower ratio suggests optimism and a bullish sentiment.

By incorporating these technical analysis indicators into their strategies, traders can gain valuable insights into market sentiment. This information, combined with other market data and their own risk tolerance, allows traders to make more informed trading decisions. Remember, no indicator is perfect, and it’s essential to use them in conjunction with other analysis techniques for a comprehensive view of the market.

Using Sentiment Analysis Tools Effectively

Sentiment analysis tools can be incredibly valuable for investors, offering insights into the public’s opinion and potential market trends. However, effectively utilizing these tools requires understanding their strengths and limitations. Here’s a guide to maximize your use of sentiment analysis tools:

Choose the right tool: A vast array of sentiment analysis tools exists, each with its own strengths. Consider factors like data sources, accuracy, ease of use, and pricing when making your selection. Some tools specialize in specific sectors, while others offer broader coverage.

Define your focus: Before using any tool, clearly define your objectives. Are you interested in analyzing consumer sentiment toward a particular product, gauging investor sentiment towards a specific company, or understanding broader market trends? Specifying your focus ensures you collect relevant data and generate meaningful insights.

Understand the limitations: Sentiment analysis tools are not infallible. They can be influenced by factors like sarcasm, slang, and cultural nuances. Be cautious in interpreting results and supplement them with other forms of market research.

Contextualize the data: Sentiment analysis should be considered in the context of broader market trends and company-specific news. Consider factors like recent events, economic conditions, and industry developments. This approach will help you avoid drawing misleading conclusions.

Combine with other tools: Sentiment analysis tools are most effective when used in conjunction with other data sources and analytical techniques. Integrating sentiment data with financial data, news articles, and social media trends can provide a comprehensive view of market sentiment.

By following these tips, investors can harness the power of sentiment analysis tools to gain valuable insights, make more informed decisions, and stay ahead of the curve in a constantly evolving market.

Combining Sentiment with Other Data Points

While market sentiment can provide valuable insights, it’s crucial to remember that it’s just one piece of the puzzle. Combining sentiment data with other data points can offer a more comprehensive and nuanced understanding of market trends.

For instance, fundamental analysis can be integrated with sentiment data to identify discrepancies between investor expectations and underlying company performance. If a company’s financial statements are strong but sentiment is negative, it could signal an opportunity to buy. Conversely, if a company’s fundamentals are weak but sentiment is positive, it might indicate a potential bubble.

Technical analysis can also be combined with sentiment to identify support and resistance levels, momentum, and potential trend reversals. Sentiment data can help confirm or contradict technical signals, adding another layer of confidence to trading decisions.

Moreover, macroeconomic indicators can provide context for sentiment data. For example, if sentiment is positive but economic indicators are pointing to a slowdown, it might suggest that the market is overoptimistic and prone to a correction.

By combining sentiment with other data points, investors can develop a more robust and informed investment strategy. This approach allows for a comprehensive view of market dynamics, reducing reliance on any single data source and mitigating potential biases.

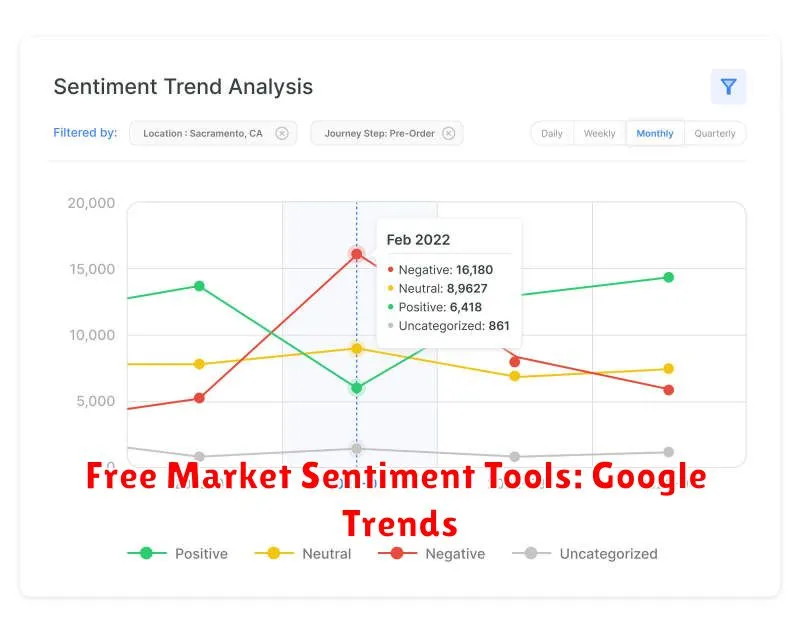

Free Market Sentiment Tools: Google Trends

Market sentiment is a powerful force in financial markets. It can influence asset prices, trading volumes, and even the direction of the overall market. For savvy investors, understanding market sentiment is crucial for making informed decisions. While there are many paid tools available, there are also several free options that can provide valuable insights. One such option is Google Trends.

Google Trends is a free tool that allows users to track the popularity of search terms over time. By analyzing search data, you can gain insights into what people are searching for, which can be a proxy for market sentiment. For example, if there is a surge in searches for “Bitcoin price prediction,” it could indicate that investors are becoming more interested in the cryptocurrency market.

Here’s how you can use Google Trends to gauge market sentiment:

- Track search trends for specific assets: Look for searches related to individual stocks, commodities, currencies, or other assets. A spike in searches could indicate increased interest and potential price volatility.

- Monitor industry-related searches: Analyze search terms related to specific industries or sectors. This can help you identify emerging trends and potential investment opportunities.

- Compare search trends over time: Use the “compare” feature in Google Trends to compare search interest for different assets or terms. This can help you understand relative sentiment and identify potential shifts in investor preferences.

While Google Trends is a valuable free tool, it’s essential to remember that it’s not a perfect indicator of market sentiment. Search data can be influenced by various factors, including news events, social media trends, and seasonal effects.

However, when used in conjunction with other technical and fundamental analysis tools, Google Trends can offer a valuable perspective on market sentiment and help you make more informed investment decisions.

Free Market Sentiment Tools: Social Media Monitoring

In today’s digital age, social media has become a powerful tool for gauging market sentiment. By analyzing public conversations and opinions, investors can gain valuable insights into the overall mood of the market, identify emerging trends, and make more informed investment decisions. Fortunately, numerous free tools allow you to monitor social media for market sentiment.

Google Trends is a valuable resource for tracking the popularity of search terms related to specific companies or industries. By analyzing search volume trends, you can get a sense of public interest and potential market shifts.

Twitter is a real-time platform where users express their opinions on various topics, including financial markets. Twitter Advanced Search allows you to filter tweets based on keywords, hashtags, and other criteria. You can use this feature to track sentiment towards specific companies, industries, or macroeconomic events.

Reddit is another popular online forum where users engage in discussions and share their views. By monitoring relevant subreddits, such as r/stocks, r/investing, or r/wallstreetbets, you can gain insights into the sentiment of retail investors and potential market movements.

Social Mention is a free tool that aggregates data from various social media platforms, including Facebook, Twitter, and LinkedIn. It allows you to track mentions of specific companies, brands, or products, along with the associated sentiment, reach, and influence.

Brand24 offers a free trial for its social media monitoring platform. It allows you to monitor brand mentions across multiple channels and gain insights into customer sentiment, brand reputation, and market trends. It can help you identify potential issues before they escalate and respond proactively.

Remember that social media sentiment is just one piece of the puzzle. It’s crucial to consider other factors, such as fundamental analysis and technical indicators, to make informed investment decisions. By combining social media monitoring with other data sources, investors can gain a more comprehensive understanding of market sentiment and make smarter decisions.

Paid Market Sentiment Platforms: Advantages and Features

Market sentiment is a powerful indicator that can provide valuable insights into the direction of asset prices. While free resources offer some information, paid market sentiment platforms often provide a more comprehensive and detailed view of market sentiment, equipping investors with the edge they need to make informed decisions.

One of the key advantages of using paid market sentiment platforms is access to real-time data. These platforms continuously monitor various sources, including social media, news articles, and financial forums, to gauge investor sentiment. This allows investors to stay ahead of the curve and react quickly to emerging trends.

Another advantage is the sophisticated analytics that these platforms offer. They employ advanced algorithms to analyze large volumes of data, identifying patterns and trends that might be missed by manual analysis. This provides investors with a deeper understanding of the market and helps them make more accurate predictions.

Paid platforms also provide customized reports and alerts, tailoring information to specific investment goals and preferences. This personalized approach ensures that investors receive only the most relevant and actionable data, saving them time and effort. Furthermore, many platforms offer professional support and guidance, answering questions and helping investors interpret the data effectively.

Some of the key features commonly found in paid market sentiment platforms include:

- Sentiment scores and indicators: These platforms often provide numerical scores representing the overall bullish or bearish sentiment for specific assets or markets.

- Social media analysis: They monitor social media platforms for mentions of specific companies, industries, or assets, gauging public opinion and potential market impact.

- News sentiment analysis: These platforms analyze news articles and financial reports to identify bullish or bearish sentiment expressed by experts and analysts.

- Historical data: Access to historical sentiment data allows investors to track long-term trends and compare current sentiment to past levels.

- Real-time charting and visualization: Visual representations of sentiment data help investors quickly grasp trends and identify potential turning points in the market.

By providing access to real-time data, advanced analytics, and personalized insights, paid market sentiment platforms empower investors to make more informed decisions and potentially improve their investment performance.

Interpreting Sentiment Data Cautiously

In the realm of investing, understanding market sentiment is crucial. Sentiment data, derived from news articles, social media posts, and other sources, can offer valuable insights into investor psychology and potential market trends. However, interpreting sentiment data cautiously is paramount, as it’s often subjective and prone to biases.

One key challenge is the inherent ambiguity of language. Sentiment analysis algorithms struggle to accurately discern the nuanced meaning behind words and phrases. For example, a statement like “The stock is finally showing signs of life” could be interpreted as bullish or bearish depending on the context.

Moreover, sentiment data can be easily manipulated. Fake news, propaganda, and coordinated campaigns can distort the true sentiment picture. It’s essential to consider the source of the data and its potential biases before drawing conclusions.

Finally, sentiment data is often lagging. By the time sentiment analysis reveals a shift in market mood, the opportunity to capitalize on it may have already passed. It’s crucial to use sentiment data as a supplementary tool, not a primary driver of investment decisions.

In conclusion, while sentiment data can offer valuable insights, it’s crucial to interpret it cautiously. Consider the ambiguity of language, potential biases, and the lagging nature of the data before making investment decisions based on sentiment alone.