Are you looking for a way to potentially boost your portfolio with high-risk, high-reward opportunities? If so, then you might want to consider investing in penny stocks. Penny stocks are shares of companies that trade for less than $5 per share, making them a popular choice for investors looking for a chance to make a quick profit. However, it’s important to remember that penny stocks are also very risky, and there’s a good chance you could lose all of your investment. But if you’re willing to take on the risk, penny stocks could be a good way to potentially earn a significant return on your investment.

In this article, we’ll be exploring the world of penny stocks, diving into the potential rewards and risks associated with this type of investment. We’ll also provide some tips on how to identify promising penny stocks and discuss some of the top penny stocks to watch right now. Whether you’re a seasoned investor or just starting out, this guide will equip you with the knowledge you need to navigate the exciting (and sometimes volatile) world of penny stocks.

What are Penny Stocks?

Penny stocks are shares of publicly traded companies that trade at a very low price, typically under $5 per share. These stocks are often associated with small, emerging companies that may be in the early stages of development or experiencing financial difficulties.

While the low price point can be attractive to investors looking for potential high returns, it’s crucial to understand that penny stocks are generally considered to be high-risk investments. Due to their low price and often limited liquidity, penny stock prices can fluctuate wildly, making them susceptible to large gains and losses.

The term “penny stocks” is a bit of a misnomer, as the actual price can vary significantly. While some penny stocks may trade for just a few cents, others can reach several dollars. However, the defining characteristic remains their low market capitalization, which typically reflects a relatively small company with a limited track record.

Understanding the Risks of Penny Stock Investing

Before diving into the potential of penny stocks, it’s crucial to understand the inherent risks associated with this volatile market. Penny stocks, typically priced under $5 per share, often represent companies in nascent industries or facing financial challenges. Their low price can be alluring, but it also signifies a higher risk profile.

Volatility is a hallmark of penny stocks. Their prices can fluctuate wildly, often driven by speculative trading and market sentiment rather than fundamental company performance. This volatility can lead to rapid losses, especially for inexperienced investors.

Lack of Liquidity is another major concern. Penny stocks often have limited trading volume, making it difficult to buy or sell shares quickly. This lack of liquidity can result in significant price swings and hinder your ability to exit a position when desired.

Financial Instability is a prevalent characteristic of companies issuing penny stocks. Many are struggling financially, facing potential bankruptcy or dilution of existing shares. Their future is uncertain, making it challenging to predict their long-term viability.

Scams and Fraud are unfortunately common in the penny stock market. Unscrupulous operators may manipulate prices or disseminate misleading information to lure unsuspecting investors. It’s essential to exercise extreme caution and conduct thorough due diligence before investing.

Regulation surrounding penny stocks is often less stringent than that governing traditional stocks. This can create opportunities for unethical practices and further increase investor risk.

Investing in penny stocks can be tempting, but it’s crucial to approach it with a clear understanding of the associated risks. Before making any decisions, conduct thorough research, evaluate your risk tolerance, and consider diversifying your portfolio with less volatile investments.

Identifying Potential Winners: Due Diligence Tips

Penny stocks, often defined as shares trading below $5, can offer enticing high-risk, high-reward opportunities. However, wading into this volatile market requires rigorous due diligence. Before investing, it’s crucial to conduct thorough research and assess the potential for success.

Here are some key steps to help you identify potential winners:

Analyze the Company’s Fundamentals

- Financial Statements: Scrutinize the company’s balance sheet, income statement, and cash flow statement. Look for strong revenue growth, profitability, and a healthy cash position.

- Debt Levels: High debt can indicate financial distress, making the company more susceptible to downturns. Assess the company’s debt-to-equity ratio and interest coverage ratio.

- Management Team: Evaluate the experience and track record of the company’s leadership. A strong management team with a proven history of success can instill confidence.

Research the Industry

- Market Trends: Is the industry experiencing growth or decline? Are there emerging trends that could benefit the company?

- Competition: Analyze the competitive landscape. Are there established players in the industry, and how does the company differentiate itself?

- Regulatory Environment: Understand the regulatory environment in which the company operates. Any upcoming regulations or changes could impact the industry’s future.

Investigate the Stock Itself

- Trading Volume: High trading volume can indicate strong investor interest, but it could also be a sign of speculation. A moderate volume suggests a balance between buyers and sellers.

- Price History: Analyze the stock’s price history. Look for patterns or trends that may indicate potential future price movements.

- Short Interest: A high short interest ratio (the percentage of shares sold short) can signal a bearish sentiment among investors.

Seek Additional Information

- Analyst Reports: Read reports from independent analysts who provide insights into the company’s prospects.

- Investor Forums: Engage in online forums to gain insights from other investors.

- Company Investor Relations: Contact the company’s investor relations department for additional information.

Penny stocks can provide opportunities for substantial returns, but they also carry significant risks. Thorough due diligence, coupled with a deep understanding of the company, industry, and stock, can significantly improve your chances of identifying potential winners in the penny stock market.

Sectors to Watch for Penny Stock Opportunities

Penny stocks are known for their potential for high returns, but they also come with high risk. Before you invest, it’s essential to understand the factors that can drive penny stock prices and the sectors that are likely to offer the most opportunities. Here are some sectors to keep your eye on.

Energy: The energy sector is always volatile, but it’s particularly exciting right now with the increasing demand for oil and gas and the transition towards renewable energy sources. Look for penny stocks in companies developing innovative technologies or exploring new oil and gas reserves.

Technology: The tech sector is constantly evolving, and it’s full of opportunities for penny stocks. Focus on companies that are developing disruptive technologies or those operating in growing sub-sectors like artificial intelligence, cybersecurity, and cloud computing.

Healthcare: The healthcare sector is another area with high potential for growth, driven by factors like an aging population and advances in medical technology. Look for penny stocks in companies developing innovative treatments, diagnostic tools, or medical devices.

Cannabis: The legalization of cannabis in several countries has created a new and rapidly growing market. Look for penny stocks in companies that are involved in cultivation, processing, or retail sales of cannabis products.

Remember that these are just a few sectors to consider. It’s crucial to conduct thorough research before investing in any penny stock. Evaluate the company’s financial health, management team, and market opportunity. Be prepared for volatility and be willing to accept the risk of losing some or all of your investment.

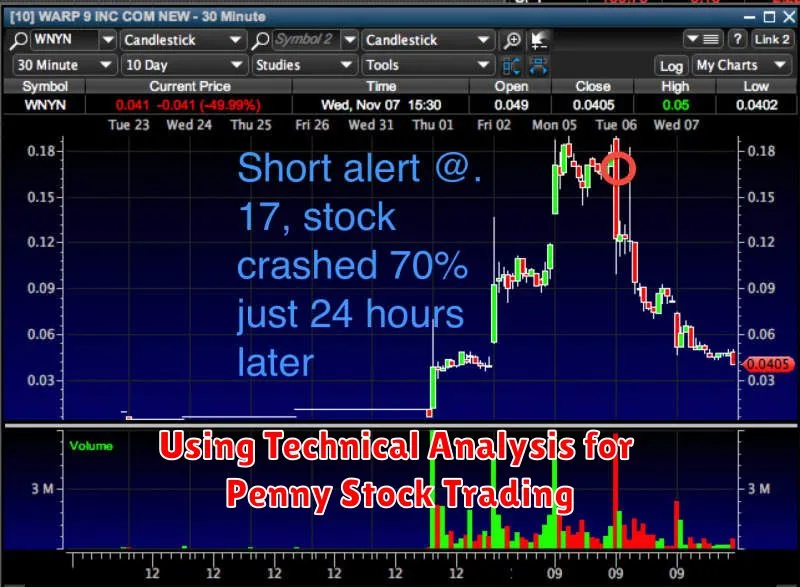

Using Technical Analysis for Penny Stock Trading

Penny stocks are often seen as high-risk, high-reward investments, and while they can offer significant potential for gains, they also carry a high risk of loss. One strategy that traders use to navigate these volatile markets is technical analysis, which focuses on price action and trading volume to identify potential trading opportunities.

Technical analysis uses charts, indicators, and patterns to study the historical movement of a stock’s price. By understanding these patterns, traders can attempt to predict future price movements and make informed trading decisions. However, it’s crucial to remember that technical analysis isn’t a guarantee of success, and its effectiveness can vary significantly, especially in the highly volatile penny stock market.

Some common technical indicators used in penny stock trading include:

- Moving Averages: These indicators smooth out price fluctuations and provide insights into the overall trend of the stock.

- Relative Strength Index (RSI): This indicator measures the magnitude of recent price changes to evaluate whether a stock is overbought or oversold.

- MACD (Moving Average Convergence Divergence): This indicator identifies potential trend changes by comparing two moving averages.

- Volume Indicators: These indicators can provide insights into the buying and selling pressure on a stock, which can be particularly useful in the penny stock market where volume can play a significant role.

While technical analysis can be a valuable tool for penny stock trading, it’s essential to understand its limitations. Penny stocks are often influenced by factors beyond price action, including news events, corporate actions, and market sentiment. Therefore, traders should always conduct thorough due diligence and consider other factors before making any investment decisions.

Ultimately, using technical analysis for penny stock trading requires a combination of skill, discipline, and risk management. It’s crucial to develop a sound trading strategy, manage risk effectively, and be prepared for the inherent volatility of this market. Remember, penny stocks are a speculative investment, and it’s always important to invest only what you can afford to lose.

Setting Realistic Expectations and Managing Risk

Penny stocks are often associated with high risk and high reward. While it’s true that they offer the potential for substantial gains, it’s crucial to understand the risks involved and set realistic expectations. Penny stocks are typically traded over-the-counter (OTC) and are considered highly speculative due to their low price and often limited liquidity.

Before investing in penny stocks, it’s essential to conduct thorough research and understand the company’s fundamentals. Look for signs of financial stability, experienced management, and a viable business plan. Consider factors such as revenue, profitability, and debt levels. Remember that past performance is not indicative of future results.

Managing risk is paramount when dealing with penny stocks. Diversification is essential to mitigate potential losses. Allocate only a small portion of your investment portfolio to penny stocks, and never invest more than you can afford to lose. Additionally, it’s crucial to stay informed about market trends, company news, and regulatory developments that could impact the stock’s price.

While penny stocks can offer the potential for significant returns, they also come with substantial risks. Setting realistic expectations and implementing a sound risk management strategy are crucial for navigating these high-volatility investments. Remember that due diligence, diversification, and careful consideration of your financial situation are paramount when exploring penny stock opportunities.

Avoiding Common Penny Stock Scams

Penny stocks, also known as micro-cap stocks, are shares of companies with a market capitalization of less than $1 billion. They can be highly volatile and offer the potential for significant gains. But, it is important to be aware of the risks involved. Penny stocks are often targeted by scammers, who prey on investors looking for quick riches.

There are many red flags to watch out for when considering penny stocks. Be sure to be skeptical of any investment advice received, especially if it is unsolicited. If you come across any of these scams, do not invest.

Common Penny Stock Scams

Here are some of the most common penny stock scams:

- Pump-and-dump schemes: In these scams, scammers artificially inflate the price of a stock by spreading false or misleading information. They then sell their shares at a profit, leaving investors holding worthless stock.

- Boiler rooms: These are operations that use high-pressure sales tactics to convince investors to buy penny stocks. They often use misleading or fraudulent information to entice investors.

- Fake news: Scammers often use fake news websites or social media accounts to spread false information about penny stocks. They may create fake press releases or news stories that make a stock look more valuable than it actually is.

- Celebrity endorsements: Be wary of penny stocks that are promoted by celebrities, as they may be part of a scam. Celebrities are often paid to endorse these stocks, and they may not have any real knowledge of the company or its prospects.

Protecting Yourself from Penny Stock Scams

Here are some tips for protecting yourself from penny stock scams:

- Do your own research: Don’t rely on the advice of strangers or those who may be attempting to profit from your investment. Look into the company’s financials, management team, and business model before investing.

- Be wary of high-pressure sales tactics: If someone is pressuring you to invest quickly, it is a red flag. You should never feel pressured to invest in anything.

- Beware of guarantees: No one can guarantee a return on your investment. Anyone who promises a guaranteed return is likely a scammer.

- Don’t invest more than you can afford to lose: Penny stocks are risky investments. If you invest more than you can afford to lose, you could be putting your financial security at risk.

Resources for Penny Stock Research

While penny stocks offer potential for significant gains, they are also known for their high risk. To make informed decisions, comprehensive research is crucial. Fortunately, several resources can help you analyze penny stocks effectively.

Financial News Websites: Websites like Yahoo Finance, Google Finance, and Seeking Alpha provide up-to-date information on penny stock prices, news, and analysis. You can track price movements, read company press releases, and access expert opinions.

Brokerage Platforms: Most online brokerage platforms offer detailed information on penny stocks, including company financials, analyst ratings, and research reports. Some platforms even provide tools for technical analysis and charting.

SEC Filings: The Securities and Exchange Commission (SEC) requires companies to file periodic reports, such as 10-Ks and 10-Qs. These filings provide valuable insights into a company’s financial performance, management, and operations.

Industry-Specific Publications: Many industries have dedicated publications that provide in-depth coverage of penny stocks. For example, if you’re interested in the mining industry, you could look for resources specializing in mining news and analysis.

Discussion Forums: Online forums and communities dedicated to penny stocks can be a valuable source of information. However, it’s essential to be cautious about the information shared on these platforms, as opinions may be biased or speculative.

Financial Analysts: Consider consulting with a financial advisor or analyst specializing in penny stocks. They can provide personalized guidance and help you navigate the complexities of the market.

Remember, conducting thorough research is paramount when investing in penny stocks. Utilize these resources wisely to make informed decisions and mitigate risks. Remember, past performance is not indicative of future results.

Case Studies of Successful Penny Stock Investments

While penny stocks are known for their high risk, they also offer the potential for significant rewards. A successful penny stock investment can transform a small investment into a substantial fortune. Here are some real-life examples of successful penny stock investments that demonstrate the possibility of high returns:

1. Tesla (TSLA): In 2010, Tesla was a struggling electric car company trading for less than $4 per share. Today, Tesla is a global automotive giant valued at hundreds of billions of dollars. Investors who bought Tesla shares early on have seen their investments multiply by hundreds or even thousands of times.

2. Amazon (AMZN): Amazon, now one of the largest companies in the world, was a struggling online bookstore in the 1990s. In 1997, it traded for less than $2 per share. Those who invested in Amazon early on witnessed incredible growth, with the stock price rising to over $3,000 per share at its peak.

3. Apple (AAPL): Apple’s journey from struggling computer company to technological powerhouse is another classic example of penny stock success. In the early 1990s, Apple’s stock price was below $1 per share. However, with the launch of innovative products like the iMac and iPod, the company witnessed a dramatic turnaround, and its stock price soared to become one of the most valuable companies in the world.

These examples highlight the potential for significant returns from penny stock investments. However, it is crucial to remember that these are rare success stories. The majority of penny stocks fail to achieve such success. Thorough research, a solid investment strategy, and risk management are essential for navigating the unpredictable world of penny stocks.

The Importance of a Sound Investment Strategy

While the allure of high-risk, high-reward investments like penny stocks can be tempting, it’s crucial to remember that a sound investment strategy is paramount. A well-defined strategy serves as your roadmap, guiding you through the volatile world of investing and mitigating potential losses.

Before diving into any investment, especially high-risk ones, it’s essential to conduct thorough research, define your investment goals, and understand your risk tolerance. A sound strategy will help you:

- Diversify your portfolio: Spreading your investments across different asset classes can help reduce overall risk.

- Set clear goals: Knowing your objectives, whether it’s long-term wealth building or short-term gains, will help you choose appropriate investments.

- Manage risk effectively: A good strategy will help you identify and manage potential risks, minimizing potential losses.

- Make informed decisions: Research, analysis, and a structured approach will empower you to make educated investment choices.

Remember, investing is a marathon, not a sprint. A sound investment strategy provides a framework for navigating the market’s ups and downs, ensuring you stay on track towards your financial goals.