Are you tired of watching your savings erode due to inflation? Do you dream of building a secure financial future for yourself and your loved ones? If so, then investing in real estate may be the perfect solution for you. Real estate investing has consistently proven to be a powerful tool for wealth building, offering substantial returns and long-term stability. From purchasing rental properties to exploring REITs and even flipping houses, the possibilities are vast and adaptable to your individual financial goals and risk tolerance.

This comprehensive guide will equip you with the knowledge and strategies to confidently navigate the world of real estate investment. We’ll delve into the various investment options available, outlining their benefits and potential risks. You’ll gain valuable insights into essential considerations such as market analysis, property selection, financing, and effective property management. By understanding the fundamentals and adopting proven strategies, you can unlock the potential of real estate to build a solid financial foundation and achieve your wealth building aspirations.

Types of Real Estate Investments: Residential vs. Commercial

Real estate investing offers a path to building wealth and generating passive income. While the concept seems straightforward, the world of real estate investments can be complex. Two primary categories dominate the real estate landscape: residential real estate and commercial real estate. Each presents unique opportunities and challenges, making it crucial to understand their differences before diving in.

Residential real estate encompasses properties designed for living purposes. This category includes single-family homes, townhouses, condominiums, duplexes, and multi-family dwellings. The primary focus is on providing shelter and a comfortable living space. Commercial real estate, on the other hand, involves properties intended for business use. This category encompasses office buildings, retail stores, hotels, restaurants, warehouses, and industrial spaces. The primary goal is to generate income through rental or lease agreements.

Residential Real Estate: A Look Inside

Investing in residential real estate offers several benefits. Rental income is a significant attraction, providing a consistent stream of passive income. Additionally, property appreciation can generate substantial returns over time. However, residential real estate also involves maintenance responsibilities and potential tenant challenges. Managing tenants and ensuring property upkeep are crucial aspects of successful residential investing.

Commercial Real Estate: Unlocking Business Potential

Commercial real estate offers distinct advantages. Higher potential returns and longer lease terms are significant benefits. Moreover, commercial properties often involve less tenant turnover compared to residential investments. However, this category requires substantial capital and in-depth knowledge of market trends and commercial leases.

Ultimately, the choice between residential and commercial real estate depends on your individual investment goals, risk tolerance, and financial resources. Understanding the nuances of each category is crucial for making informed decisions and maximizing your investment potential.

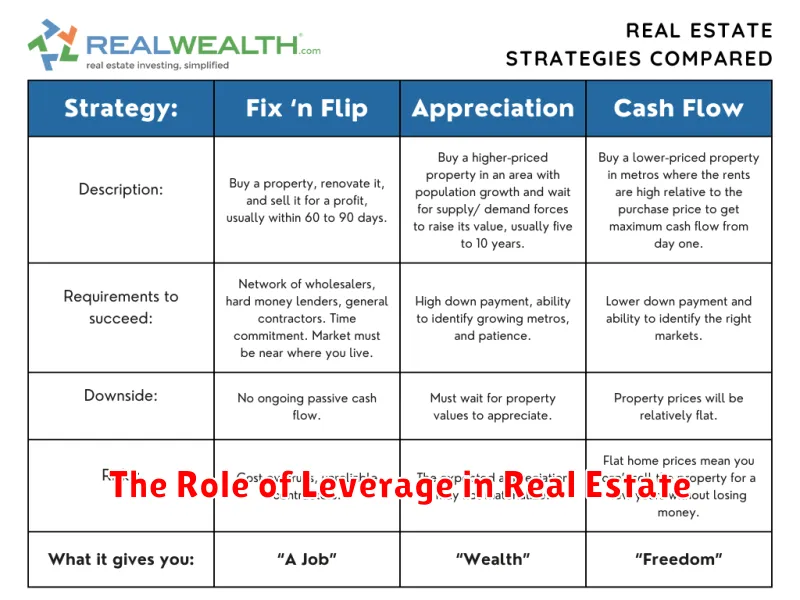

Buy and Hold: Long-Term Wealth Creation

The buy and hold strategy is a cornerstone of real estate investing, particularly for those seeking long-term wealth creation. This approach involves acquiring properties with the intention of holding them for an extended period, typically years or even decades, while reaping the benefits of appreciation and rental income. The buy and hold strategy is attractive due to its inherent simplicity and potential for passive income generation.

One of the key advantages of the buy and hold strategy lies in its ability to leverage the power of compounding. As property values appreciate over time, the initial investment grows, leading to a snowball effect. Moreover, rental income provides a steady stream of cash flow, which can be reinvested to further accelerate wealth accumulation.

While the buy and hold strategy can be a powerful tool for wealth creation, it’s crucial to consider factors such as market conditions, property selection, and tenant management. Conducting thorough research, acquiring properties in growing areas, and maintaining good tenant relationships are essential for maximizing returns and minimizing risks. By carefully navigating these aspects, investors can harness the long-term benefits of the buy and hold strategy and pave the way for financial independence.

Fix and Flip: Profiting from Property Renovations

The “fix and flip” strategy is a popular real estate investment approach that involves purchasing properties, renovating them, and then quickly reselling them for a profit. It offers a fast-paced and potentially lucrative way to build wealth, but it requires careful planning, execution, and a keen understanding of the market.

Identifying the Right Property: The first step is finding undervalued properties with potential for improvement. This could include homes needing cosmetic updates, outdated kitchens, or structural repairs. Researching local market trends, comparable sales, and potential buyer demographics is crucial to determine the property’s estimated resale value after renovations.

Budgeting and Planning: Carefully budgeting for renovation costs is essential. Factor in the purchase price, permits, materials, labor, and unexpected expenses. Creating a detailed renovation plan, including timelines and milestones, helps ensure efficient progress and keeps the project on track.

Executing the Renovation: Once the renovation begins, efficient project management is key. Hiring reliable contractors, sourcing quality materials, and overseeing the work diligently contribute to a successful outcome. Understanding building codes and permits is also crucial to avoid delays and legal issues.

Marketing and Selling: When the renovation is complete, effectively marketing the property is essential for attracting buyers. Professional photography, attractive descriptions, and strategic online listings help showcase the property’s transformation. Negotiating a competitive selling price based on market analysis ensures a successful sale.

Potential Challenges: Fix and flip projects are not without risks. Unexpected repairs, material cost fluctuations, and fluctuating market conditions can affect profitability. Thorough research, realistic expectations, and a well-defined exit strategy are crucial for mitigating risks.

The Fix and Flip Advantage: Despite challenges, fix and flipping offers a relatively quick return on investment compared to long-term rentals. The profit potential is often substantial, making it an appealing strategy for investors seeking fast returns.

Rental Properties: Generating Passive Income

Investing in rental properties can be a powerful strategy for building wealth and generating passive income. By purchasing properties and renting them out, you can create a steady stream of income that can supplement your existing earnings and build long-term financial security.

Passive income from rental properties is earned with minimal effort on your part. Once you’ve found reliable tenants and managed the initial setup, the rental income largely flows in automatically. This frees you from the constant need to work for your income and allows you to focus on other endeavors.

Beyond the immediate income, rental properties also offer significant appreciation potential. As real estate values tend to rise over time, your investment can grow substantially. This appreciation can provide you with substantial returns when you eventually decide to sell the property.

While there are initial costs and ongoing responsibilities associated with rental properties, the long-term benefits can be substantial. Investing in rentals offers a path towards financial freedom and building a solid financial future.

REITs: Investing in Real Estate Through the Stock Market

Real estate has long been considered a cornerstone of wealth-building strategies, offering potential for capital appreciation and steady income streams. However, traditional real estate investments can be capital-intensive and require significant time and effort for management. Fortunately, there’s an avenue for accessing the benefits of real estate without the complexities of direct ownership: Real Estate Investment Trusts (REITs).

REITs are companies that own and operate income-producing real estate, such as office buildings, shopping malls, apartments, and data centers. They function similarly to mutual funds, pooling capital from numerous investors to acquire and manage properties. REITs trade on major stock exchanges, allowing investors to buy and sell shares just like any other stock.

Investing in REITs offers several advantages:

- Diversification: REITs provide diversification by investing in a portfolio of properties across different sectors and geographic locations, reducing the risk associated with owning a single property.

- Liquidity: REIT shares are highly liquid, enabling investors to easily buy and sell them on the stock market, unlike traditional real estate investments.

- Professional Management: REITs are managed by experienced professionals who handle all aspects of property management, including leasing, maintenance, and financing.

- Regular Income: REITs typically distribute a significant portion of their earnings to shareholders in the form of dividends, providing a steady income stream.

There are various types of REITs, including:

- Equity REITs: These REITs directly own and operate properties.

- Mortgage REITs: These REITs invest in real estate debt, such as mortgages.

- Hybrid REITs: These REITs combine both equity and mortgage investments.

REITs are an effective way to diversify your investment portfolio and gain exposure to the real estate market. They offer liquidity, professional management, and the potential for both capital appreciation and income generation. As with any investment, it’s crucial to conduct thorough research, understand the risks involved, and seek professional advice before investing in REITs.

Analyzing Investment Property Cash Flow

When investing in real estate, understanding cash flow is paramount. It’s the lifeblood of your investment, determining your profitability and the overall success of your strategy. Analyzing cash flow involves meticulously evaluating the income generated by your property and the expenses associated with its operation.

The key to successful cash flow analysis lies in accurate forecasting. It’s crucial to project both income and expenses realistically, factoring in variables like vacancy rates, maintenance costs, and property taxes.

Here’s a simple breakdown of cash flow components:

- Income: This includes rental income, parking fees, laundry income, and any other revenue streams from your property.

- Expenses: This encompasses mortgage payments, property taxes, insurance, utilities, maintenance, and management fees.

Positive cash flow occurs when your rental income exceeds your expenses. This is the ultimate goal of any real estate investment.

Negative cash flow, on the other hand, signifies that your expenses surpass your income, leading to financial losses. While this might be acceptable during the initial phases of a renovation or property improvement, it’s crucial to address it proactively to ensure long-term profitability.

Tools and techniques to analyze cash flow:

- Pro Forma Statements: These financial statements project future income and expenses, providing a clear picture of potential cash flow.

- Spreadsheet Analysis: A simple spreadsheet can help you meticulously track income and expenses, allowing you to identify potential areas for improvement.

- Cash Flow Calculators: Numerous online tools and software can streamline your cash flow analysis, offering comprehensive reports and insights.

By diligently analyzing your investment property’s cash flow, you can:

- Maximize profitability: Identify areas for cost reduction and revenue enhancement.

- Minimize risk: Understand the potential risks associated with your investment and develop strategies to mitigate them.

- Make informed decisions: Data-driven analysis helps you make sound decisions about your property, ensuring long-term success.

In conclusion, analyzing cash flow is a crucial step in building wealth through real estate. By diligently evaluating your property’s income and expenses, you gain valuable insights that can help you maximize profits, minimize risks, and achieve your investment goals.

Financing Options for Real Estate Investors

Securing financing is a crucial step in any real estate investment journey. Fortunately, real estate investors have a variety of financing options available to them. Understanding these options and choosing the right one for your specific needs is essential for maximizing your returns and achieving your investment goals.

Traditional Mortgages: These are the most common financing options for real estate investors. They involve obtaining a loan from a bank or other financial institution, with the property serving as collateral. While traditional mortgages offer stability and predictability, they often require a significant down payment and may have strict eligibility criteria.

Hard Money Loans: Hard money loans are short-term loans typically offered by private lenders. They can be particularly useful for investors who need fast funding for fix-and-flip projects or for properties that may not qualify for traditional financing. However, hard money loans come with higher interest rates and fees.

Private Lending: This option involves borrowing money from individuals or groups of investors. Private lending can offer more flexible terms and faster approval times, but it’s essential to thoroughly vet potential lenders and understand the associated risks.

Seller Financing: In some cases, sellers may be willing to provide financing to buyers. This can be a beneficial option for investors who have limited cash or need to secure financing quickly. Seller financing often involves a lower down payment and flexible terms.

Home Equity Loans and Lines of Credit (HELOCs): These options allow homeowners to borrow against the equity they have built in their primary residence. While they can provide access to funds for investment purposes, they can also increase your overall debt burden and potentially put your home at risk.

Crowdfunding: Crowdfunding platforms allow investors to pool their resources together to fund real estate projects. This can be a viable option for projects that require a significant amount of capital. However, it’s important to carefully research crowdfunding platforms and understand the associated risks.

Ultimately, the best financing option for real estate investors depends on individual circumstances, investment goals, and risk tolerance. Careful consideration and research are essential for choosing the right financing strategy that aligns with your overall investment plan.

Working with Property Managers and Contractors

Investing in real estate can be a lucrative venture, but it also comes with its own set of challenges. One of the most crucial aspects of success in real estate investing is knowing how to effectively manage your properties. This often involves working with two key players: property managers and contractors.

Property managers are essential for landlords who can’t be physically present at their rental properties. They handle day-to-day operations, including tenant screening, rent collection, maintenance requests, and legal compliance. A good property manager can save you time, headaches, and potentially a lot of money by preventing costly issues from escalating.

Contractors, on the other hand, are crucial for handling repairs, renovations, and improvements to your properties. Finding reliable and skilled contractors is vital. You want someone who is experienced, trustworthy, and can provide competitive pricing. It’s recommended to get multiple quotes and check references before hiring any contractor.

Building a strong network of both property managers and contractors is an integral part of building wealth through real estate. Here are some tips for maximizing your success when working with these professionals:

- Clearly define your expectations. Communicate your needs and goals upfront to avoid misunderstandings.

- Establish contracts. Formal agreements will protect both you and the professionals you work with.

- Stay organized. Keep detailed records of all communication, work done, and payments made.

- Maintain open communication. Regular communication helps ensure everyone is on the same page and prevents issues from snowballing.

- Be proactive. Address potential problems before they become major issues.

By effectively partnering with property managers and contractors, you can streamline your real estate investments, maximize your returns, and build a solid foundation for long-term wealth.

Tax Benefits of Real Estate Investing

Real estate investing offers a compelling pathway to wealth accumulation, and among its many benefits are significant tax advantages. These tax benefits can translate into substantial savings, enhancing your overall return on investment. Let’s delve into the key tax perks that make real estate investing so attractive.

Depreciation Deduction: One of the most valuable tax benefits for real estate investors is the ability to deduct depreciation on rental properties. Depreciation reflects the gradual wear and tear on your property over time. While not an actual cash expense, you can deduct a portion of your property’s value annually, reducing your taxable income and tax liability. This deduction can be substantial, especially for newer properties.

Mortgage Interest Deduction: If you’re financing your investment property with a mortgage, you can deduct the interest you pay on the loan. This can significantly lower your tax bill, especially in the early years of the mortgage when the interest portion is larger. This benefit can be especially attractive for investors who are utilizing leverage to acquire properties.

Property Taxes: Property taxes are another deductible expense for real estate investors. This can provide significant savings, particularly in areas with high property tax rates. By deducting these taxes, you further reduce your taxable income and potentially your overall tax liability.

Capital Gains Exclusion: If you’re selling a property that you’ve owned for more than a year, you might be eligible for a capital gains exclusion. This allows you to exclude a certain amount of profit from your taxable income. The specific amounts vary depending on your filing status and the length of ownership, but this can be a substantial tax benefit when you sell your property.

1031 Exchange: The 1031 exchange, also known as a like-kind exchange, enables you to defer capital gains taxes when you sell one investment property and reinvest the proceeds into a similar property. This can be a powerful tool for investors looking to grow their real estate portfolio without incurring immediate tax obligations.

Understanding and utilizing these tax benefits can significantly enhance your real estate investment strategy. By carefully planning and leveraging the tax advantages available, you can maximize your returns and accelerate your path to financial success.

Mitigating Risks in Real Estate

Real estate investing, while a potential path to wealth creation, inherently involves risks. Understanding and mitigating these risks is crucial for successful and profitable ventures. Here are some key strategies to minimize exposure to potential downsides:

Thorough Due Diligence: This involves meticulous research, including property inspections, market analysis, and financial audits. Understanding the property’s condition, its potential rental income, and the surrounding area’s growth prospects is vital for informed decision-making.

Diversification: Spreading your investments across different property types, locations, and price ranges reduces the impact of market fluctuations or individual property issues. This can include diversifying geographically, investing in both residential and commercial properties, or exploring different rental strategies.

Financial Prudence: Careful financial planning is paramount. Secure financing from reputable lenders, maintain a healthy debt-to-equity ratio, and set aside a sufficient cash reserve for unexpected repairs or market downturns.

Professional Guidance: Seeking advice from experienced real estate professionals, including real estate agents, property managers, and legal counsel, can provide valuable insights and help navigate complex transactions and market trends.

Market Research: Staying informed about market trends, local regulations, and economic indicators helps make better investment decisions. Understanding supply and demand, potential appreciation rates, and the impact of interest rate fluctuations is crucial.

Insurance Coverage: Comprehensive insurance policies protect your investments against unexpected events like fire, natural disasters, or liability claims. Ensure adequate coverage for both the property and any associated rentals.

Exit Strategy: Develop a clear exit plan, including potential holding periods and strategies for selling or refinancing. This provides a framework for navigating future market conditions and maximizing returns.

By implementing these risk mitigation strategies, real estate investors can position themselves for greater success and build a robust portfolio that stands the test of time.

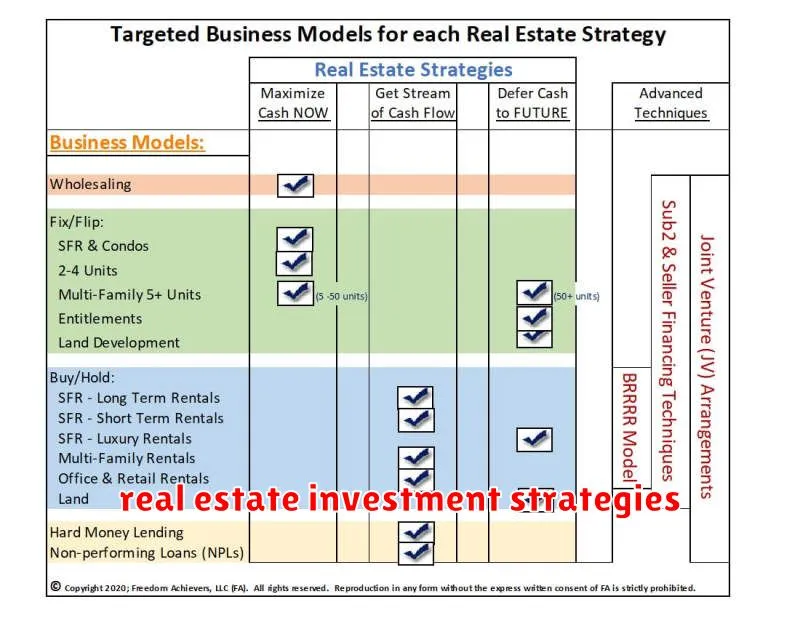

Real Estate Investment Strategies for Beginners

Investing in real estate can be a smart way to build wealth, but it can also be intimidating for beginners. There are many different strategies you can use, and it’s important to choose one that’s right for your goals and risk tolerance.

Here are some effective real estate investment strategies for beginners:

Buy and hold: This is a classic strategy that involves buying properties and holding them for the long term, hoping to benefit from appreciation in value and rental income.

Fix and flip: This strategy involves buying distressed properties, fixing them up, and then selling them for a profit. It can be a high-risk, high-reward strategy, but it can also be very lucrative.

House hacking: This strategy involves buying a multi-family property and living in one unit while renting out the others. This can help you build equity faster and offset your mortgage payments.

Wholesale: This strategy involves finding undervalued properties and then selling them to other investors for a profit. It can be a good way to get started in real estate with less capital, but it does require some negotiation and marketing skills.

Real estate investment trusts (REITs): These are companies that own and operate income-producing real estate. Investing in REITs can be a more diversified way to invest in real estate and provide consistent income.

No matter which strategy you choose, it’s important to do your research and understand the risks involved. It’s also important to have a solid financial plan and budget before making any real estate investments. Consulting with a financial advisor can be helpful in determining the best course of action for your individual situation.

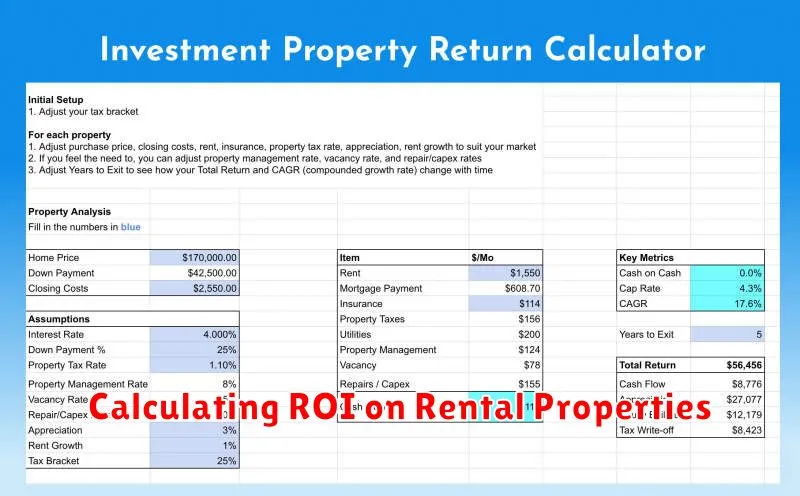

Calculating ROI on Rental Properties

Real estate investing can be a lucrative way to build wealth, but it’s important to approach it strategically. One crucial aspect is understanding your return on investment (ROI). Calculating ROI on rental properties helps you assess the profitability of your investment and compare different opportunities.

To calculate ROI, you need to consider two key factors: annual rental income and total investment costs.

Annual Rental Income

This is the total amount of rent you expect to collect over a year, factoring in vacancy rates and potential rent increases.

Total Investment Costs

This includes all expenses associated with the property, including:

- Purchase price

- Closing costs

- Repairs and maintenance

- Property taxes

- Insurance

- Mortgage payments (if applicable)

Calculating ROI

Once you have your annual rental income and total investment costs, you can calculate ROI using the following formula:

ROI = (Annual Rental Income – Total Investment Costs) / Total Investment Costs * 100

For example, if your annual rental income is $24,000 and your total investment costs are $200,000, your ROI would be:

ROI = ($24,000 – $200,000) / $200,000 * 100 = -88%

A negative ROI indicates that you’re losing money on the investment. A positive ROI means you’re making a profit. The higher the ROI, the more profitable the investment.

Important Considerations

Remember that ROI is just one metric to consider. It’s essential to factor in other aspects such as:

- Market conditions: Real estate markets can fluctuate, impacting property values and rental rates.

- Property management: Managing a rental property requires time, effort, and potentially additional costs.

- Tax benefits: Rental property ownership comes with various tax benefits that can affect your overall profitability.

By calculating ROI and considering these factors, you can make informed decisions about your real estate investments and maximize your chances of building wealth through property.

Finding Off-Market Real Estate Deals

In the world of real estate investment, securing off-market deals can be a game-changer. These deals, often referred to as “pocket listings,” are properties not actively listed on the Multiple Listing Service (MLS). This means you have the opportunity to acquire them at potentially discounted prices, often before they hit the public market. Finding off-market deals requires a strategic approach, but the rewards can be significant.

Here’s how you can unlock the potential of off-market real estate deals:

- Build Relationships: Network with real estate agents, investors, and property owners. Cultivate a strong reputation and let them know you’re actively seeking off-market opportunities.

- Utilize Your Network: Inform your existing network, including friends, family, and colleagues, that you’re on the hunt for off-market deals. They might know of properties that haven’t yet been listed.

- Target Specific Neighborhoods: Identify areas with potential for appreciation and focus your search on properties within those zones.

- Attend Real Estate Events: Participate in local real estate events, networking gatherings, and auctions to connect with potential sellers and learn about upcoming deals.

- Be Proactive: Reach out to property owners directly, even if a property isn’t listed. This can involve sending personalized letters, making phone calls, or arranging property visits.

- Utilize Online Resources: Leverage websites and platforms dedicated to connecting buyers and sellers of off-market properties. These resources often provide a database of properties that are not yet publicly advertised.

Remember, finding off-market deals is about building relationships, being proactive, and utilizing every resource available. By implementing these strategies, you can increase your chances of securing lucrative off-market deals and maximizing your real estate investment returns.

The Role of Leverage in Real Estate

Leverage is a powerful tool in real estate investing, allowing you to control a larger asset with a smaller initial investment. It essentially amplifies your returns, but also amplifies your risk. Understanding how leverage works is crucial for any investor aiming to build wealth through property.

The most common form of leverage in real estate is through mortgages. By taking out a loan, you can purchase a property with a significant down payment, allowing you to invest in a more valuable asset than you could with cash alone. This leverage can lead to significant returns, especially in a rising market.

Here’s an example: You purchase a property worth $100,000 with a 20% down payment ($20,000) and a mortgage for the remaining $80,000. If the property value increases by 10%, you’ll see a profit of $10,000, representing a 50% return on your initial investment. If you had paid cash, your return would only be 10%.

However, leverage also carries risks. If the property value decreases, you could face a negative equity situation, owing more on the mortgage than the property is worth. Moreover, interest rates and loan terms can significantly impact your return on investment.

Understanding the pros and cons of leverage is essential. It’s not a magic bullet but a powerful tool when used wisely. Proper research, market analysis, and careful budgeting are vital to leveraging real estate effectively and building sustainable wealth.

Legal Considerations for Real Estate Investors

Investing in real estate can be a rewarding endeavor, offering potential for substantial financial growth. However, it’s crucial to navigate the legal landscape effectively to protect your interests and ensure a smooth investment journey. This article outlines key legal considerations for real estate investors.

Title and Ownership: Before investing, thoroughly examine the title to the property. A clear and unencumbered title ensures that you have full ownership rights. Consult with a real estate attorney to review the title, identify any potential liens or encumbrances, and ensure proper transfer of ownership.

Zoning and Land Use Regulations: Familiarize yourself with local zoning laws and land use restrictions. These regulations dictate how a property can be used and may impact your investment plans. Ensure your intended use complies with zoning requirements to avoid legal complications.

Environmental Issues: Conduct environmental due diligence, particularly for older properties. Inspect for potential contamination or environmental hazards that could impact the property’s value and potentially incur remediation costs. Engage with qualified environmental professionals to assess risks.

Leases and Tenant Agreements: If you plan to lease out your property, carefully draft lease agreements that protect your rights as a landlord. Consult with a legal expert to ensure the lease complies with local laws and provides clear terms for rent, maintenance responsibilities, and tenant obligations.

Property Taxes and Assessments: Research local property tax rates and any potential special assessments that might impact your investment. Understand the tax implications of ownership and seek professional advice to optimize your tax strategies.

Insurance: Secure adequate insurance coverage for your property, including liability insurance, property damage insurance, and title insurance. These policies provide protection against unforeseen events and financial risks.

Disputes and Litigation: Be prepared for potential disputes with tenants, contractors, or neighboring property owners. Consult with a legal professional to understand your rights and obligations, and consider strategies for resolving conflicts through negotiation or litigation.

By carefully navigating these legal considerations, real estate investors can mitigate risks, protect their investments, and enjoy the benefits of successful property ownership.