Navigating the real estate market can be a daunting task, especially in today’s ever-changing landscape. From rising interest rates to fluctuating property values, it’s crucial to have a comprehensive understanding of the market dynamics to make informed decisions. This guide is designed to equip you with the essential insights and tools needed to navigate this complex world, empowering you to make sound investments and achieve your real estate goals.

Whether you’re a seasoned investor or a first-time homebuyer, this market analysis guide will provide you with the knowledge you need to make strategic moves. We’ll delve into key market indicators, identify emerging trends, and explore strategies for success in various real estate segments. By understanding the current state of the market, you can position yourself for optimal returns and maximize your potential in this dynamic industry.

Key Economic Indicators Impacting Real Estate

The real estate market, like any other economic sector, is influenced by a multitude of factors. Understanding the interplay of these forces is crucial for investors, buyers, and sellers alike. Among the most significant are key economic indicators, which provide insights into the health and direction of the economy, ultimately impacting the real estate landscape.

Interest Rates

Interest rates play a pivotal role in determining affordability and demand for real estate. When interest rates rise, mortgage payments become more expensive, potentially dampening buyer enthusiasm and slowing down home sales. Conversely, falling interest rates make borrowing more attractive, stimulating demand and driving up prices.

Inflation

Inflation, the rate at which prices for goods and services increase, can have both direct and indirect effects on real estate. Rising inflation can lead to higher construction costs, making new homes more expensive. Additionally, it can erode the purchasing power of buyers, limiting their ability to afford homes.

Employment and Wages

The employment rate and wage growth are essential indicators of consumer confidence and spending power. Strong employment numbers and wage increases translate into greater demand for housing, as individuals have more disposable income to allocate towards homeownership.

Economic Growth

Economic growth, measured by factors such as GDP (Gross Domestic Product) and job creation, reflects the overall health of the economy. A thriving economy generally leads to increased demand for housing, as businesses expand and individuals experience greater financial stability.

Government Policies

Government policies, particularly those related to housing, can significantly impact the real estate market. Tax incentives, regulations, and zoning changes can influence the supply of homes, affordability, and overall investment opportunities.

By closely monitoring these key economic indicators, individuals and investors can gain a more comprehensive understanding of the real estate market’s dynamics and make informed decisions. Remember, understanding the interplay of economic forces is essential for navigating the ever-changing landscape of real estate.

Understanding Supply and Demand in Local Markets

The real estate market is a dynamic ecosystem driven by the fundamental forces of supply and demand. Understanding how these forces interact within your local market is crucial for making informed decisions, whether you’re a buyer, seller, or investor.

Supply refers to the number of properties available for sale at any given time. Factors influencing supply include:

- New construction activity

- Inventory of existing homes

- Economic conditions

- Government regulations

Demand represents the number of buyers actively searching for homes in a particular market. Key drivers of demand include:

- Population growth

- Economic indicators (e.g., employment, wages)

- Interest rates

- Consumer confidence

When supply exceeds demand, the market favors buyers. There’s greater competition among sellers, potentially leading to lower prices and longer selling times. Conversely, when demand exceeds supply, the market tilts in favor of sellers. Homes sell quickly, often for higher prices, as buyers face more competition.

Analyzing the interplay of supply and demand in your local market helps you:

- Identify market trends: Are prices rising or falling? Is inventory increasing or decreasing? This insight helps you predict future market movements.

- Negotiate effectively: Understanding the current balance of supply and demand gives you leverage when making offers or counteroffers.

- Maximize your investment: You can choose the right time to buy or sell, ensuring you get the best value for your property.

Keep in mind that local markets can vary significantly, even within the same city or region. Thorough research and consultation with real estate professionals are crucial for obtaining a comprehensive understanding of your local market dynamics.

Analyzing Property Value Trends and Historical Data

Understanding the dynamics of the real estate market is crucial for making informed decisions, whether you’re a buyer, seller, or investor. One of the most critical aspects to analyze is property value trends and historical data. This information can provide valuable insights into market fluctuations, potential growth areas, and the overall health of the real estate sector.

Historical data can be a powerful tool for identifying patterns and trends in property values. By examining past performance, you can gain a better understanding of how prices have fluctuated over time, influenced by factors such as economic conditions, interest rates, and local demographics. This data can help you anticipate future trends and make more informed predictions about the likely trajectory of property values.

Analyzing property value trends involves identifying the factors that have driven past price changes and assessing their potential impact on future valuations. This includes examining factors such as:

- Economic growth and employment: A strong economy with healthy employment levels typically translates into increased demand for housing and higher property values.

- Interest rates: Lower interest rates make it more affordable to obtain mortgages, stimulating demand and potentially pushing up prices.

- Local demographics and amenities: Population growth, desirable amenities, and strong schools can enhance property values in specific areas.

- New construction and supply: An oversupply of new properties can exert downward pressure on prices, while limited supply can lead to higher valuations.

- Market conditions and seasonality: Real estate markets tend to fluctuate seasonally, with certain times of the year seeing more activity than others.

By carefully analyzing historical data and identifying key trends, you can gain a comprehensive understanding of the real estate landscape and make well-informed decisions about your property investments. Remember, this information is just a starting point. It’s essential to conduct thorough research, consult with real estate professionals, and stay informed about current market conditions to navigate the real estate landscape effectively.

The Impact of Interest Rates on Real Estate

Interest rates play a crucial role in shaping the real estate landscape. They directly influence the cost of borrowing money for mortgages, which in turn affects affordability and demand for homes. When interest rates rise, the cost of borrowing increases, making mortgages more expensive. This can lead to a decrease in demand for homes as buyers become less willing or able to afford the higher monthly payments.

Conversely, when interest rates fall, borrowing becomes more affordable, stimulating demand and potentially driving up home prices. This is because lower interest rates make it easier for buyers to qualify for larger loans and afford more expensive homes. However, it’s important to note that other factors besides interest rates also influence the real estate market, such as economic conditions, supply and demand, and government policies.

Understanding the impact of interest rates is vital for both buyers and sellers in the real estate market. Buyers need to be aware of how interest rates affect their borrowing power and the affordability of homes. Sellers need to consider how interest rates may impact demand and the potential selling price of their property.

In conclusion, interest rates play a significant role in shaping the real estate market. Rising interest rates can lead to decreased demand and potentially lower home prices, while falling interest rates can stimulate demand and drive up prices. By understanding the relationship between interest rates and the real estate market, buyers and sellers can make informed decisions and navigate the ever-changing landscape of the real estate world.

Evaluating Neighborhood Amenities and Growth Potential

Before you dive into the exciting world of real estate, it’s crucial to understand the intricacies of a neighborhood. A comprehensive market analysis isn’t just about numbers; it’s about the quality of life the neighborhood offers. This involves evaluating existing amenities and their potential for future growth. This is where your research skills come in handy.

Imagine yourself living in this neighborhood. What are the daily conveniences you need? Do schools, parks, grocery stores, and public transportation meet your standards? These essential amenities impact your everyday life.

But don’t stop at the present. Consider the future potential. Is there ongoing development, infrastructure projects, or community initiatives that could enhance the neighborhood’s appeal? Look for signs of growth and investment. These could be new businesses, construction projects, or even community-led initiatives.

By understanding the amenities and growth potential of a neighborhood, you gain a valuable insight into its desirability and long-term value. This knowledge helps you make informed decisions when navigating the real estate landscape.

Assessing the Strength of Rental Markets

Understanding the strength of a rental market is crucial for both landlords and tenants. A strong rental market means higher demand for units, potentially leading to higher rental rates and lower vacancy rates for landlords. For tenants, a strong market can mean more competition for available units and potentially higher rental costs.

Here are some key factors to consider when assessing the strength of a rental market:

Supply and Demand:

The fundamental principle of supply and demand applies to rental markets. When demand for rentals exceeds supply, rents tend to rise. Conversely, when supply exceeds demand, rents may decline.

Population Growth and Demographics:

A growing population, especially with a high concentration of young professionals and families, can boost demand for rental units. Understanding the age demographics and their housing preferences within a market is essential.

Local Economy:

A thriving local economy with robust job growth typically leads to increased demand for housing, including rentals. Look for industries that are driving economic activity in the area.

Interest Rates and Mortgage Rates:

When interest rates and mortgage rates are high, it can become more expensive for people to purchase homes. This can push more people towards renting, influencing the strength of the rental market.

Rental Rates and Vacancy Rates:

Track the average rental rates in the area and compare them to historical data. A rising trend in rental rates can indicate a strong market. Vacancy rates provide insight into the availability of rental units and can signal the strength of the market. Lower vacancy rates suggest higher demand.

Local Amenities and Lifestyle:

Desirable neighborhoods with amenities like parks, schools, transportation, and cultural attractions are more likely to attract renters, potentially leading to higher demand and stronger rental markets.

Government Policies and Regulations:

Local government policies, such as rent control laws or regulations on new construction, can influence the rental market. Policies that encourage rental housing development can strengthen the market.

Identifying Undervalued Properties

In the dynamic realm of real estate, identifying undervalued properties is a coveted skill that can unlock lucrative opportunities. By mastering the art of market analysis, you can gain an edge and secure properties that offer substantial upside potential.

One key strategy is to leverage data-driven insights. Comparative Market Analysis (CMA) plays a pivotal role in pinpointing undervalued gems. By meticulously analyzing recent sales, active listings, and expired properties in the target area, you can establish a clear understanding of current market values. Pay close attention to factors such as location, size, condition, and amenities to determine if a property is priced below its fair market value.

Moreover, conducting thorough research on neighborhood trends is crucial. Look for areas experiencing revitalization or positive economic growth. These factors often indicate an upward trajectory in property values, making undervalued properties in such neighborhoods particularly attractive.

Another potent technique involves identifying properties with potential for renovation or improvement. Properties that require some TLC may be priced lower due to perceived inconvenience or perceived lack of marketability. However, by assessing the scope of necessary improvements and factoring in potential appreciation after renovation, you can uncover hidden value and unlock substantial returns.

Finally, remember to consider the long-term investment potential. Focus on properties that align with your investment goals and timeframe. While short-term opportunities may present themselves, consider factors such as market stability, future development plans, and overall desirability of the area when evaluating long-term prospects. By combining a discerning eye, market intelligence, and a strategic approach, you can effectively identify undervalued properties and position yourself for success in the competitive real estate market.

The Role of Real Estate Agents and Brokers

In the intricate world of real estate, real estate agents and brokers play crucial roles as navigators, guiding buyers and sellers through the complex process of property transactions. While often used interchangeably, there’s a subtle distinction between the two.

A real estate agent is a licensed professional who represents either a buyer or a seller in a real estate transaction. They act as intermediaries, negotiating deals, handling paperwork, and ensuring a smooth closing process. Agents are typically employed by a brokerage firm.

A real estate broker, on the other hand, holds a higher level of licensure and can oversee a team of agents. They often act as the principal of a brokerage firm, managing the business and supervising agents. While brokers can also represent clients directly, their primary role is often to manage and train a team of agents.

The expertise of real estate agents and brokers is invaluable in navigating the complexities of the real estate market. They possess extensive knowledge of local market trends, property values, and legal requirements. Their ability to network and connect with other professionals, such as lenders and inspectors, further streamlines the transaction process.

By leveraging their skills and experience, real estate agents and brokers can help buyers find their dream homes, secure the best possible prices, and avoid costly mistakes. For sellers, they can maximize property value, attract qualified buyers, and expedite the sales process.

Utilizing Online Real Estate Platforms and Data

In today’s digital age, the real estate landscape has been transformed by the emergence of powerful online platforms and data-driven insights. These resources provide invaluable tools for both buyers and sellers, empowering them with comprehensive market analysis and informed decision-making.

Real estate portals such as Zillow, Redfin, and Trulia offer vast databases of properties, allowing users to search by location, price range, and specific features. These platforms also provide valuable data points, including historical sales records, property valuations, and market trends, enabling users to gain a comprehensive understanding of the local real estate market.

Data analytics platforms like CoreLogic and Realtor.com go a step further by offering advanced insights and predictive models. These platforms utilize a vast array of data sources, including public records, mortgage data, and economic indicators, to generate detailed market reports, neighborhood profiles, and property value estimations. This data can help buyers and sellers identify undervalued properties, predict future market trends, and make strategic decisions.

Social media platforms like Facebook and Instagram have also become significant players in the real estate market. Real estate agents and property investors leverage these platforms to connect with potential clients, showcase listings, and share market insights. Social media analytics tools can provide valuable data on audience demographics, engagement levels, and campaign performance, helping real estate professionals target their marketing efforts effectively.

By effectively utilizing online real estate platforms and data, buyers and sellers can gain a competitive edge in the market. Access to real-time information, market trends, and property valuations empowers them to make well-informed decisions, negotiate favorable terms, and maximize their returns on their real estate investments.

Making Informed Decisions in Real Estate

The real estate market is a dynamic and constantly evolving landscape. To make informed decisions, it’s crucial to have a comprehensive understanding of current market trends, economic factors, and local conditions. This guide provides a framework for analyzing the market and making strategic decisions.

1. Research and Data Analysis: Start by gathering data on local real estate trends. Websites like Zillow, Realtor.com, and Redfin offer valuable insights into home values, sales activity, and market inventory. Analyze recent sales data, compare properties, and identify areas with strong growth potential.

2. Economic Indicators: Monitor key economic indicators that impact the real estate market. Interest rates, inflation, employment figures, and consumer confidence all influence demand and pricing. Understanding these factors provides context for your decisions.

3. Neighborhood Analysis: Delve deeper into specific neighborhoods. Consider factors like school quality, crime rates, proximity to amenities, and community involvement. Research local plans for development or infrastructure projects, as these can impact property values.

4. Market Conditions: Assess the current market conditions. Is it a buyer’s or seller’s market? Understanding the balance between supply and demand is crucial. If there’s a high demand and low inventory, expect competitive bidding and potential price increases.

5. Expert Consultation: Seek guidance from a qualified real estate professional. A realtor can provide expert advice based on their market knowledge, local expertise, and understanding of current trends. They can help you navigate the complexities of the buying or selling process.

6. Financial Planning: Determine your financial capacity and budget. Consider your down payment, mortgage affordability, and long-term financial goals. Secure pre-approval for a mortgage to demonstrate your financial readiness.

7. Due Diligence: Thoroughly evaluate properties. Inspect the condition of the property, review disclosures, and consider potential maintenance costs. It’s wise to seek professional inspections, such as home inspections and appraisal reports.

By diligently researching and analyzing the real estate market, you equip yourself with the knowledge necessary to make informed decisions. This comprehensive approach helps you identify opportunities, mitigate risks, and navigate the ever-changing landscape of real estate.

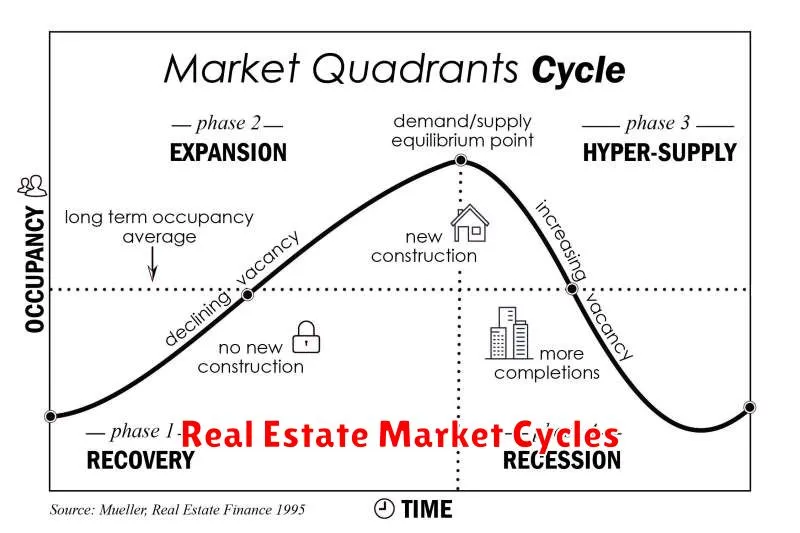

Real Estate Market Cycles

The real estate market is cyclical, meaning it experiences periods of growth and decline over time. Understanding these cycles is crucial for investors, buyers, and sellers alike. These cycles are driven by a multitude of factors, including economic conditions, interest rates, demographics, and government policies.

Typically, real estate market cycles consist of four phases:

- Expansion: This is a period of strong economic growth, low interest rates, and rising home prices. Demand exceeds supply, leading to increased competition and bidding wars.

- Peak: The market reaches its highest point, with prices at their peak and limited inventory. This phase marks the end of the expansion cycle and the beginning of the downturn.

- Contraction: Economic growth slows, interest rates rise, and home prices begin to decline. This phase is characterized by reduced demand and an increasing supply of homes for sale.

- Trough: The market reaches its lowest point, with home prices at their lowest and inventory at its highest. This phase presents opportunities for bargain hunters but can be challenging for sellers.

Identifying the current stage of the market cycle is essential for informed decision-making. During periods of expansion, investors may seek to capitalize on rising prices and strong demand. Conversely, during contractions, they may adopt a more conservative approach, waiting for the market to stabilize.

It’s important to note that real estate market cycles vary in length and intensity. Factors like technological advancements, government interventions, and global events can significantly impact these cycles. Staying informed about the current market conditions, economic indicators, and historical trends can help navigate the dynamic real estate landscape.

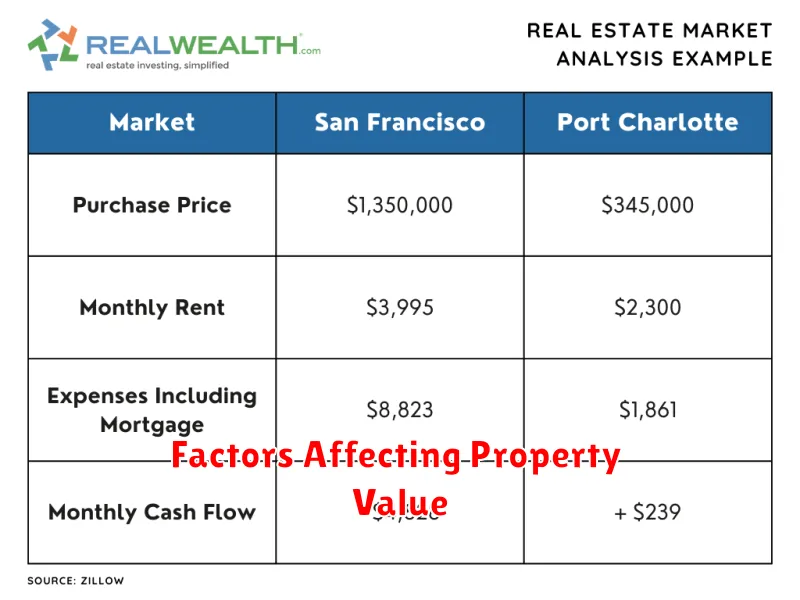

Factors Affecting Property Value

Navigating the real estate market can be a daunting task, especially for those unfamiliar with the intricacies of property values. Understanding the factors that influence a property’s worth is crucial for both buyers and sellers, ensuring informed decisions and maximizing returns. This guide will delve into the key drivers of property value, providing a comprehensive analysis of the real estate landscape.

Location, Location, Location

The age-old adage holds true – location is paramount. The desirability of a neighborhood, proximity to amenities, schools, transportation, and employment centers all play a significant role. A property situated in a high-demand area with desirable features will naturally command a higher price than one in a less sought-after location.

Property Condition and Features

The condition and features of a property are directly correlated to its value. A well-maintained, updated home with modern amenities will be more appealing to buyers and fetch a premium price. Factors such as square footage, number of bedrooms and bathrooms, kitchen and bathroom upgrades, landscaping, and overall curb appeal significantly impact valuation.

Market Conditions

The broader economic climate and local real estate market trends heavily influence property value. Interest rates, supply and demand, economic growth, and employment rates are all interconnected and directly affect the pricing of properties. A thriving economy with low interest rates and high demand typically results in increased property values.

Comparable Properties

A crucial element in determining a property’s value is comparing it to similar properties in the area that have recently sold. This process, known as a comparative market analysis (CMA), provides a benchmark for pricing and helps identify any unique features or drawbacks that may influence the value.

Other Factors

Beyond the major factors outlined above, other considerations can also affect property value. These include:

- School Districts: Schools with strong academic reputations can significantly enhance property values in a neighborhood.

- Property Taxes: High property taxes can reduce the attractiveness of a property and impact its value.

- Neighborhood Amenities: The presence of parks, recreation facilities, and other desirable neighborhood amenities can increase property value.

- Zoning Regulations: Strict zoning laws can limit development potential and impact property value.

By understanding these factors and their interrelationships, both buyers and sellers can navigate the real estate market with confidence and make informed decisions that align with their financial goals.

Analyzing Neighborhood Demographics

Understanding the demographics of a neighborhood is crucial for making informed real estate decisions. This analysis can shed light on a neighborhood’s character, potential growth, and overall desirability. By examining key demographic factors, you can gain insights into the local population and anticipate future trends.

One essential aspect to consider is the age distribution of the neighborhood. A community with a large proportion of young families might indicate strong demand for family-friendly amenities like schools and parks. Conversely, a neighborhood with a high concentration of retirees might suggest a more relaxed pace of life and a focus on healthcare facilities.

Another vital element is household income. Higher median income levels often translate to higher property values and a more affluent community. It’s essential to assess if the neighborhood’s income aligns with your financial goals and the affordability of properties in the area.

Furthermore, exploring the educational attainment of residents can provide valuable insights. A neighborhood with a high concentration of well-educated individuals may indicate a strong job market and access to quality schools. This can be particularly important if you have children or plan to start a family.

Finally, diversity and cultural influences play a significant role in shaping a neighborhood’s character. Understanding the cultural mix can help you identify unique attributes that might resonate with your personal preferences.

By analyzing these demographic factors, you can gain a comprehensive understanding of a neighborhood’s current state and potential future trends. This knowledge empowers you to make informed decisions and navigate the real estate landscape with confidence.

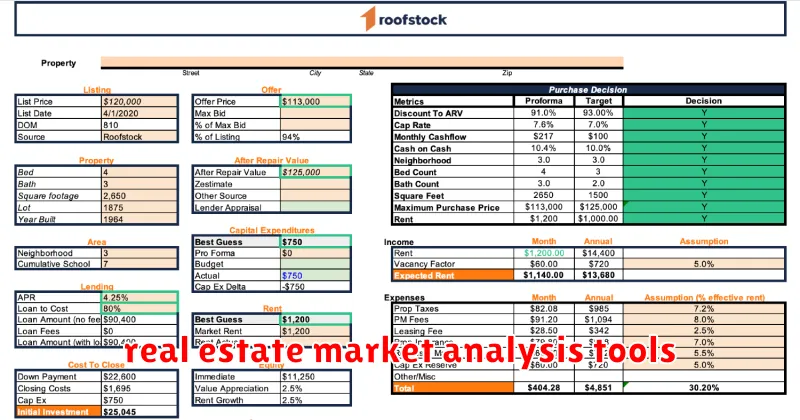

Tools for Real Estate Market Research

Real estate is a dynamic and ever-evolving market, and staying ahead of the curve requires comprehensive market research. This guide provides insights into essential tools that can empower you to make informed decisions and gain a competitive edge.

1. Real Estate Multiple Listing Service (MLS): The MLS is a database maintained by local real estate associations, offering comprehensive listings for properties currently on the market. This valuable resource provides crucial information such as property details, asking prices, and sales history.

2. Property Valuation Websites: Websites like Zillow, Redfin, and Trulia provide estimated property values, recent sales data, and market trends. These tools offer a quick overview of market conditions in specific neighborhoods.

3. Local Government Data: Accessing local government websites grants insights into building permits, property taxes, and zoning regulations. This data can help assess market activity and potential development opportunities.

4. Demographic and Economic Data: Resources like the U.S. Census Bureau and the Bureau of Labor Statistics provide insights into population growth, household income, and employment rates. This data helps understand the demographics and economic forces driving real estate demand.

5. Real Estate Market Reports: Professional real estate research firms publish comprehensive market reports analyzing local and regional trends. These reports provide in-depth insights into market conditions, including pricing, inventory, and absorption rates.

6. Social Media and Online Forums: Platforms like Facebook and Reddit offer valuable insights into local community sentiment and real estate trends. Engaging with online forums can provide real-time feedback from residents and potential buyers.

7. Data Analytics Tools: Specialized data analytics tools like Tableau and Power BI enable visualizing and analyzing large datasets. This allows for identifying patterns and trends, providing a comprehensive picture of market dynamics.

By leveraging these tools, you can conduct thorough real estate market research, make data-driven decisions, and gain a competitive advantage in this ever-changing landscape.

Importance of Professional Property Inspections

Navigating the real estate market can be a daunting task, especially for first-time buyers or those unfamiliar with the intricacies of property transactions. Amidst the excitement of finding your dream home, it’s crucial to remember that a thorough inspection is an essential step in safeguarding your investment.

A professional property inspection provides a comprehensive evaluation of the property’s condition, identifying potential issues that might not be immediately apparent. This impartial assessment offers valuable insights into the property’s structural integrity, systems, and overall safety, empowering you to make informed decisions.

Here are some compelling reasons why professional property inspections are indispensable:

- Uncover Hidden Defects: Inspections can reveal underlying problems like foundation cracks, plumbing leaks, electrical hazards, or roof damage, which can be costly to repair later.

- Negotiation Power: The inspection report gives you leverage during negotiations with the seller. You can use the findings to request repairs or adjustments to the purchase price.

- Peace of Mind: Knowing the true condition of the property provides reassurance and reduces the risk of unexpected expenses after closing.

- Preventive Maintenance: An inspection can identify potential issues that can be addressed proactively, minimizing the likelihood of future breakdowns or repairs.

- Avoid Costly Repairs: Early detection of problems allows you to prioritize repairs and avoid costly replacements later.

Remember, a professional inspection is an investment in your future. By engaging a qualified inspector, you gain a comprehensive understanding of the property’s condition, enabling you to make informed and confident decisions.