Are you looking to level up your investing game? In today’s dynamic market, having the right tools is essential for success. Navigating the complexities of the stock market can be daunting, but with the help of powerful stock market software, you can gain valuable insights, make informed decisions, and maximize your returns. From real-time data analysis to portfolio tracking, these tools provide a comprehensive suite of features designed to empower investors of all levels.

Whether you’re a seasoned investor or just starting your financial journey, essential stock market software can significantly improve your investment experience. These tools offer a wealth of functionalities that can streamline your research, identify opportunities, and help you achieve your financial goals. So, if you’re ready to take your investing to the next level, join us as we explore the best software tools that can transform your approach to the market.

The Importance of Stock Market Software in Today’s Market

In today’s fast-paced market, having the right tools is crucial for successful investing. One of the most essential tools is stock market software. This software provides investors with valuable insights and capabilities that can significantly enhance their investment decisions.

Real-time data and analytics are crucial for making informed decisions. Stock market software provides access to real-time stock quotes, charts, and news, allowing investors to stay ahead of the curve. By analyzing data trends, investors can identify potential opportunities and avoid risks.

Automated trading is another significant advantage of stock market software. This feature allows investors to set up automated buy and sell orders, eliminating the need for manual intervention. Automated trading can save time, reduce emotional biases, and optimize trading strategies.

Portfolio management is simplified with the help of stock market software. It allows investors to track their portfolio performance, analyze asset allocation, and make adjustments as needed. This comprehensive overview helps investors make strategic decisions and manage their investments effectively.

Research and analysis tools are essential for uncovering valuable investment opportunities. Stock market software provides access to in-depth research reports, financial statements, and other data that can help investors understand the underlying fundamentals of companies.

In conclusion, stock market software is an indispensable tool for investors of all levels. By providing real-time data, automated trading, portfolio management capabilities, and research tools, it empowers investors to make informed decisions, optimize their trading strategies, and ultimately achieve their financial goals.

Types of Stock Market Software: A Comprehensive Overview

Navigating the stock market can be a daunting task, but the right tools can make the journey much smoother. Stock market software provides investors with real-time data, advanced analytics, and automated trading features, empowering them to make informed decisions. From charting and analysis to portfolio management and order execution, the software landscape is diverse, offering a range of options to meet individual needs. This guide provides a comprehensive overview of the different types of stock market software available.

Charting and Analysis Software

Charting and analysis software is essential for visualizing market trends and identifying potential trading opportunities. These tools provide a variety of technical indicators, drawing tools, and historical data, allowing users to create custom charts and study market patterns. Some popular charting software include:

- TradingView: A web-based platform known for its powerful charting capabilities and social features.

- MetaStock: A professional-grade software offering extensive charting, backtesting, and technical analysis tools.

- StockCharts.com: A web-based platform with a wide selection of chart types, indicators, and real-time data feeds.

Portfolio Management Software

Portfolio management software helps users track their investments, monitor performance, and analyze risk. These tools offer features such as asset allocation, performance reporting, and tax optimization. Some popular portfolio management software options include:

- Personal Capital: A free platform providing comprehensive portfolio management, budgeting, and financial planning tools.

- Mint: A free platform focused on budgeting and expense tracking, also offering basic portfolio management features.

- Betterment: A robo-advisor offering automated portfolio management and investment advice based on individual risk tolerance.

Order Execution Platforms

Order execution platforms facilitate the buying and selling of securities. These platforms connect investors to brokers and exchanges, allowing them to place orders and manage trades. Some popular order execution platforms include:

- TD Ameritrade: A brokerage firm with a user-friendly platform offering a variety of order types and research tools.

- E*TRADE: A brokerage firm known for its intuitive platform and extensive educational resources.

- Interactive Brokers: A brokerage firm catering to active traders with access to a wide range of markets and advanced trading tools.

Other Types of Stock Market Software

In addition to charting, portfolio management, and order execution, other types of software enhance the trading experience. These include:

- Screeners: Help investors identify potential investment opportunities by filtering stocks based on specific criteria.

- News and Research Platforms: Provide access to real-time news, financial reports, and analyst recommendations.

- Automated Trading Robots: Use algorithms to automatically execute trades based on predefined rules.

Choosing the right stock market software depends on individual investment goals, experience level, and budget. It is essential to compare different options, evaluate features, and consider customer reviews before making a decision.

Key Features to Look for in Stock Market Software

Navigating the stock market can be overwhelming, especially for beginners. To make informed decisions and maximize your returns, you need the right tools at your disposal. Stock market software is essential for investors of all levels, offering a range of features to simplify and enhance the investment process.

Here are some key features to look for in stock market software:

Real-Time Data & Quotes

Access to real-time data is crucial for making informed investment decisions. Look for software that provides up-to-the-minute stock quotes, news updates, and market analysis. This ensures you’re working with the most current information available.

Charting & Technical Analysis Tools

Visualizing market trends is essential for identifying potential investment opportunities. Stock market software should offer advanced charting tools, including various technical indicators and drawing tools. These features allow you to analyze price patterns, volume, and other indicators to support your trading strategies.

Screening & Research

Don’t spend hours sifting through countless stocks manually. Good stock market software includes powerful screening tools that allow you to filter stocks based on specific criteria, such as industry, sector, price-to-earnings ratio, or dividend yield. It also provides comprehensive research reports and fundamental data on companies, helping you to evaluate investment potential.

Portfolio Management

Efficient portfolio management is key to success. Stock market software should allow you to track your investments, monitor performance, and analyze your portfolio’s overall health. Features like automated rebalancing and performance reporting can help you stay on top of your investments and make adjustments as needed.

Order Execution & Trading

The ability to execute trades directly from the platform is a must-have. Look for software that integrates with reputable brokerage firms and offers a user-friendly trading interface. Consider features like stop-loss orders, limit orders, and market orders for managing risk and maximizing returns.

Alerts & Notifications

Stay informed about market movements and potential opportunities with real-time alerts and notifications. Set up personalized alerts for price changes, news events, or technical indicators. This ensures you never miss important developments that could impact your investments.

User-Friendly Interface

The user interface should be intuitive and easy to navigate. Look for software with a clean layout, customizable dashboards, and straightforward navigation. A user-friendly interface ensures a smooth and efficient trading experience.

Customer Support

Finally, consider the level of customer support provided. A reliable customer support team can assist you with technical issues, answer questions, and provide guidance when needed.

By choosing stock market software with these key features, you’ll be well-equipped to navigate the market confidently and make informed investment decisions.

Top Stock Market Software for Technical Analysis

Technical analysis is a powerful tool for investors who want to make data-driven decisions. By studying historical price patterns and other technical indicators, traders can identify potential trends and predict future price movements. To help you get started, we’ve compiled a list of some of the top stock market software tools for technical analysis.

TradingView

TradingView is a popular platform for technical analysis that offers a wide range of features. It includes a robust charting engine, a variety of indicators and drawing tools, and real-time data feeds. TradingView also provides access to a large community of traders who share ideas and strategies.

MetaStock

MetaStock is another popular platform that’s designed for technical analysis. It offers advanced charting capabilities, a comprehensive library of indicators, and real-time data feeds. MetaStock also has backtesting and strategy optimization tools.

NinjaTrader

NinjaTrader is a powerful platform for day traders and scalpers. It features a real-time charting engine, a variety of indicators, and order management tools. NinjaTrader also offers backtesting and strategy optimization features.

StockCharts.com

StockCharts.com is a website that offers a wide range of tools for technical analysis. Its charting engine is easy to use, and it offers a large library of indicators and drawing tools. StockCharts.com also provides market research and educational resources.

Thinkorswim

Thinkorswim is a powerful platform for options traders and technical analysts. It offers advanced charting capabilities, a comprehensive library of indicators, and real-time data feeds. Thinkorswim also has backtesting and strategy optimization tools.

These are just a few of the top stock market software tools for technical analysis. You can find a more comprehensive list of tools on the Investopedia website.

No matter which software tool you choose, the important thing is to practice and develop your technical analysis skills. The more you use these tools, the better you’ll be able to identify potential trends and make profitable trading decisions.

Best Stock Screeners for Finding Investment Opportunities

Finding great investment opportunities can feel like searching for a needle in a haystack. With so many stocks to choose from, it’s easy to get overwhelmed. That’s where stock screeners come in handy. These powerful tools help you filter through thousands of stocks based on your specific criteria, allowing you to identify potentially profitable investments.

Here are some of the best stock screeners to level up your investing game:

1. Finviz

Finviz is a popular choice among investors due to its user-friendly interface and comprehensive data. It offers a wide range of screening criteria, including financial metrics, technical indicators, industry sectors, and more. Finviz also provides real-time stock quotes, charting tools, and news feeds, making it a one-stop shop for stock research.

2. TradingView

TradingView is known for its advanced charting capabilities and social trading features. While it’s a favorite among day traders, it’s also a great tool for long-term investors. Its screener lets you filter stocks based on technical indicators, fundamental data, and even sentiment analysis.

3. Stock Rover

Stock Rover stands out with its robust fundamental analysis capabilities. It provides detailed financial statements, valuation ratios, and even risk scores for each stock. Its screener allows you to filter stocks based on a wide range of metrics, making it ideal for value investors.

4. Seeking Alpha

Seeking Alpha is a popular platform for investment research and analysis. Its screener lets you filter stocks based on a variety of factors, including analyst ratings, dividend yield, and growth potential. Seeking Alpha also provides in-depth articles and analysis from expert contributors.

5. Yahoo Finance

While not as feature-rich as some of the others, Yahoo Finance offers a free and easy-to-use screener. It lets you filter stocks based on basic criteria, such as industry, market cap, and price-to-earnings ratio. Its integration with other Yahoo Finance features makes it a convenient option for casual investors.

No matter your investing style, these stock screeners can significantly enhance your research process. Remember to always do your own due diligence before making any investment decisions.

Portfolio Management Software: Tracking Performance and Risk

Navigating the stock market can be daunting, especially for beginners. But with the right tools, you can gain insights and make informed decisions. Portfolio management software plays a crucial role in helping you track your investments, analyze performance, and manage risk effectively. This powerful software offers a comprehensive solution to empower your investment journey.

One of the primary benefits of portfolio management software is its ability to track your performance. It provides a clear view of your investment holdings, their current values, and their historical performance. This data allows you to see the overall health of your portfolio, identify potential areas for improvement, and make informed decisions based on your individual investment goals.

Furthermore, portfolio management software helps you manage risk by providing valuable insights into your portfolio’s diversification and potential vulnerabilities. It can identify areas of concentration and highlight any risky investments, allowing you to adjust your holdings accordingly. The software also provides risk analysis tools to assess your portfolio’s exposure to different market factors, helping you make informed decisions to mitigate potential losses.

In addition to performance tracking and risk management, portfolio management software often offers other valuable features, such as:

- Real-time data and market updates

- Automated portfolio rebalancing

- Investment research and analysis tools

- Tax optimization strategies

- Personalized financial planning features

By leveraging the power of portfolio management software, you can gain a significant advantage in the stock market. It empowers you with the knowledge, tools, and insights needed to make informed investment decisions, track your progress, and manage risk effectively. Whether you are a seasoned investor or just starting, these software solutions are essential for maximizing your investment potential and achieving your financial goals.

Real-Time Data and News Feeds for Informed Decisions

In the fast-paced world of stock market investing, having access to real-time data and news feeds is crucial for making informed decisions. This information allows investors to stay ahead of the curve, identify potential opportunities, and mitigate risks. Real-time data provides insights into market movements, including stock prices, trading volume, and economic indicators, giving investors a clear picture of the current market landscape.

News feeds are equally important, as they deliver breaking news, company announcements, and analyst reports that can significantly impact stock prices. By staying informed about these events, investors can adjust their investment strategies accordingly and capitalize on emerging trends.

By combining real-time data and news feeds, investors can gain a comprehensive understanding of the market and make more informed decisions. This allows for quicker responses to market fluctuations, better risk management, and ultimately, more successful investment outcomes.

Stock Market Simulators: Practice Your Trading Strategies

Before you dive into the real stock market with your hard-earned cash, it’s wise to practice and hone your skills in a risk-free environment. This is where stock market simulators come into play. These valuable tools allow you to experience the ups and downs of the market without the financial consequences of real-world trading.

Think of them as virtual trading playgrounds where you can experiment with different investment strategies, test your trading psychology, and learn from your mistakes without risking your own money. These simulators typically provide you with a virtual portfolio and a realistic market environment, allowing you to buy and sell stocks, track your performance, and analyze your trading decisions.

Here are some key benefits of using stock market simulators:

- Learn without Risk: The biggest advantage is the ability to practice without risking your capital. Make mistakes, experiment with different strategies, and learn from your experience in a safe space.

- Develop Trading Skills: Simulators help you develop essential trading skills like market analysis, risk management, and portfolio management. You can test your ability to identify opportunities, manage your emotions during market volatility, and execute trades effectively.

- Test Different Strategies: Explore various investment strategies without the pressure of real-world consequences. You can try different trading styles, such as day trading, swing trading, or long-term investing, to see which suits your risk tolerance and goals.

- Improve Decision-Making: Simulators provide you with valuable insights into your trading decisions. You can analyze your trades, identify patterns, and learn from both successes and failures. This process helps you become a more disciplined and informed investor.

- Build Confidence: As you gain experience and achieve positive results in a simulator, your confidence in your trading abilities will grow. This confidence can be invaluable when you eventually transition to live trading.

Choosing the Right Simulator:

With numerous stock market simulators available, it’s essential to choose one that suits your needs. Consider factors like:

- Market Data: Ensure the simulator offers realistic and up-to-date market data to provide an accurate simulation experience.

- Trading Features: Look for simulators with a comprehensive range of trading features, such as order types, chart analysis tools, and historical data.

- Educational Resources: Some simulators offer educational content, courses, or tutorials to further enhance your learning experience.

- User Interface: Choose a simulator with a user-friendly interface that is easy to navigate and understand.

Stock market simulators are invaluable tools for aspiring and experienced investors alike. They provide a risk-free platform to hone your skills, experiment with different strategies, and build confidence before entering the real market. Take advantage of these simulators to level up your investing game and become a more informed and successful trader.

Choosing the Right Stock Market Software for Your Needs

In the world of investing, having the right tools can make all the difference. Stock market software plays a crucial role in helping investors make informed decisions and manage their portfolios effectively. But with so many options available, choosing the right software for your needs can feel overwhelming.

To make the selection process easier, consider these key factors:

Your Investment Goals and Experience

First, define your investment goals and experience level. Are you a beginner or an experienced trader? Do you primarily invest in stocks, ETFs, or options? Your investment strategy will guide you toward software that aligns with your needs.

Features and Functionality

Consider the features and functionality that are essential for you. Some software offers real-time quotes, charting tools, news and analysis, portfolio tracking, and order execution. Look for software that provides the features you need to make informed trading decisions.

User Interface and Ease of Use

The software should be user-friendly and intuitive. A clear and organized interface will help you navigate the platform easily and quickly access the information you need.

Mobile App Availability

If you need to monitor your investments and manage your portfolio on the go, look for software with a mobile app. This will allow you to stay connected to the market and make adjustments as needed.

Cost and Pricing

Stock market software comes with varying pricing structures. Some offer free versions with limited features, while others require a monthly or annual subscription. Consider your budget and choose a software that fits your financial constraints.

Ultimately, choosing the right stock market software is a personal decision. By carefully considering your needs, you can find a platform that empowers you to make sound investment choices and level up your investing game.

Free vs. Paid Stock Market Software: Weighing the Options

In the dynamic world of stock market investing, having the right tools can significantly enhance your performance and decision-making. Stock market software plays a crucial role in providing you with the necessary data, analysis, and insights to make informed investment choices. But when faced with the abundance of options, a common question arises: should you opt for free or paid software?

Free stock market software offers a compelling entry point for beginners and those seeking basic functionalities. It often provides access to real-time quotes, charting tools, and basic screening features. However, it may have limitations in terms of data depth, advanced analytics, and customization options. Free software might also display advertisements and impose restrictions on certain features.

On the other hand, paid stock market software typically comes with a premium price tag but unlocks a suite of advanced features that can greatly benefit experienced investors. This includes in-depth market data, real-time news feeds, advanced technical analysis tools, customizable watchlists, portfolio tracking, and even personalized alerts. Paid software often provides a more user-friendly interface and comprehensive support.

Ultimately, the decision between free and paid software depends on your individual needs, investment style, and budget. If you’re just starting out and seeking a basic introduction to the market, free software can be a good starting point. However, as your investment journey progresses and your requirements become more sophisticated, paid software may offer the necessary tools to elevate your investment game.

Here’s a quick breakdown of factors to consider:

- Your investment experience: Beginners may find free software sufficient, while experienced traders may benefit from the advanced features of paid software.

- Your budget: Free software comes at no cost, while paid software requires a subscription fee.

- Your investment goals: If you aim for active trading and advanced analysis, paid software may be more suitable. Basic investing can be managed with free software.

- Features and functionalities: Compare the features offered by different platforms, both free and paid, to find the best fit for your needs.

No matter your choice, choosing the right stock market software is crucial for maximizing your investment potential. By carefully weighing your options and aligning your software selection with your investment strategy, you can empower yourself to make informed decisions and achieve your financial goals.

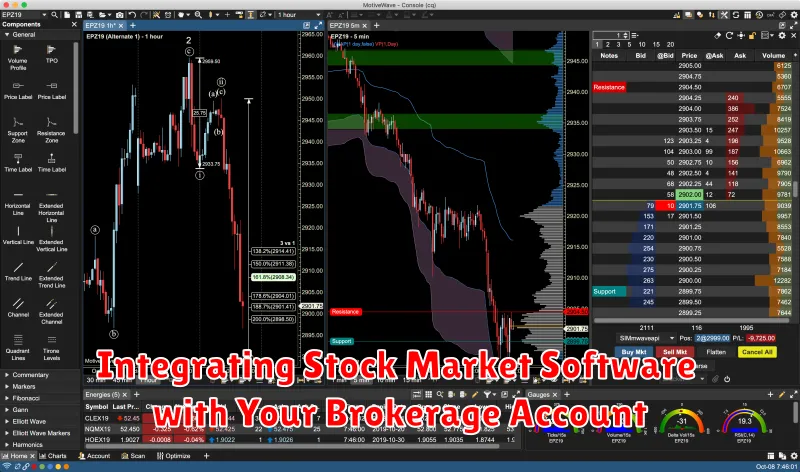

Integrating Stock Market Software with Your Brokerage Account

Integrating stock market software with your brokerage account is a powerful way to enhance your investing experience. This integration allows you to streamline your workflow, gain access to advanced features, and make more informed investment decisions. Here’s a breakdown of the benefits and steps involved in this process.

Benefits of Integration:

- Real-time Data and Analytics: Stock market software provides real-time data feeds, giving you up-to-the-minute insights into market movements, company performance, and other crucial metrics.

- Automated Trading: Some software enables automated trading, allowing you to set up pre-defined orders and execute trades based on specific parameters. This can be particularly useful for active traders or those who want to capitalize on market opportunities quickly.

- Portfolio Management: You can track your portfolio’s performance, analyze asset allocation, and monitor risk levels more effectively. This comprehensive view empowers you to make informed adjustments to your investment strategy.

- Paper Trading: Many software platforms offer a paper trading feature, letting you practice trading strategies without risking real money. This can be a valuable learning tool for new investors.

How to Integrate:

- Choose Your Software: Select stock market software that aligns with your investment goals and trading style. Consider features, pricing, and compatibility with your brokerage account.

- Connect Your Brokerage Account: Most software providers offer direct integration with popular brokerage platforms. Follow the platform’s instructions to connect your account securely.

- Review and Customize Settings: Once integrated, review and adjust the software’s settings to reflect your investment preferences, risk tolerance, and trading goals.

Remember: While integration can be beneficial, it’s important to choose reputable software providers and prioritize security. Always review the terms of service and privacy policies before connecting your brokerage account.

By integrating stock market software with your brokerage account, you can unlock a range of features and tools that can significantly enhance your investing journey. Embrace the power of technology to make smarter, more informed decisions in the dynamic world of stock trading.

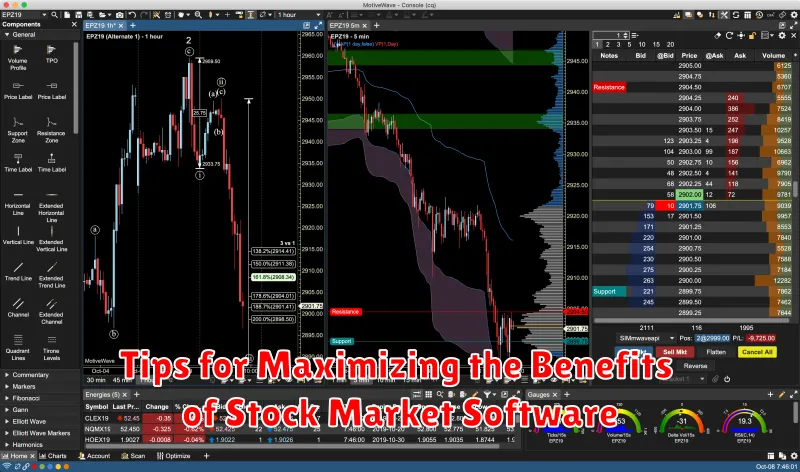

Tips for Maximizing the Benefits of Stock Market Software

Stock market software can be a powerful tool for investors of all levels, but getting the most out of it requires more than just signing up and clicking around. Here are a few key tips to help you maximize the benefits of your chosen software:

1. Understand Your Needs: Before diving in, clearly define your goals and investment style. What are you looking for? Research and analysis tools? Real-time data? Portfolio tracking? Choosing software that aligns with your specific needs is crucial.

2. Explore Features: Most software offers a range of features. Experiment with different functionalities, such as charting, screening, backtesting, and portfolio management, to understand what works best for your investment approach.

3. Personalize Your Experience: Utilize the software’s customization options. Set alerts for price changes, create watchlists, and personalize your dashboards to focus on the data that matters most to you.

4. Don’t Overwhelm Yourself: Start small and gradually add complexity. Focus on a few key features at a time to avoid information overload. As you gain confidence, explore more advanced functionalities.

5. Continuously Learn and Adapt: Stock market software is constantly evolving. Stay updated on new features and updates. Attend webinars, read tutorials, and leverage the software’s support resources to maximize your knowledge and utilization.

6. Take Advantage of Resources: Most software providers offer tutorials, webinars, and support forums. Don’t hesitate to tap into these resources to enhance your understanding and get the most out of the software.

By following these tips, you can effectively leverage stock market software to improve your investment decision-making, stay informed, and enhance your overall trading experience.