Navigating the stock market can feel like a wild ride, especially when volatility takes the wheel. But what if you could decode the ups and downs, turning unpredictable swings into opportunities? In this comprehensive guide, we’ll delve into the world of stock market volatility indicators, equipping you with the knowledge to make smarter investment decisions. We’ll break down the essential indicators, explaining how they work and how to interpret their signals to make informed choices in the face of market fluctuations.

Whether you’re a seasoned investor or just starting your journey, understanding volatility indicators can be a game-changer. These powerful tools provide insights into the market’s temperament, helping you identify potential risks and rewards. By mastering these indicators, you can enhance your risk management strategies, make more informed trading decisions, and potentially achieve greater returns on your investments. Let’s dive in and unlock the secrets of navigating market volatility.

What is Stock Market Volatility?

In the realm of finance, the stock market is often characterized by its inherent volatility. Volatility, in simple terms, refers to the rate and extent of price fluctuations in financial markets. It essentially measures how much a market’s value can change over a given period. When the market experiences significant price swings, it is considered volatile. Conversely, a market with relatively stable prices is deemed less volatile.

Volatility is a double-edged sword. While it presents opportunities for investors to profit from rapid price changes, it also carries substantial risks. High volatility can lead to substantial losses if an investor is not careful. Understanding the factors influencing stock market volatility is crucial for making informed investment decisions.

There are several factors that contribute to stock market volatility. Economic news, such as interest rate changes or inflation reports, can have a significant impact on market sentiment. Geopolitical events, like wars or political instability, can also create uncertainty and volatility. Furthermore, company-specific factors, such as earnings reports or product announcements, can cause individual stocks to fluctuate.

Volatility is a natural part of the stock market, and investors must be prepared for it. Understanding how volatility works can help you make more informed investment decisions and manage your portfolio more effectively. In the following sections, we will delve into specific indicators and strategies that can help you navigate the ups and downs of the market.

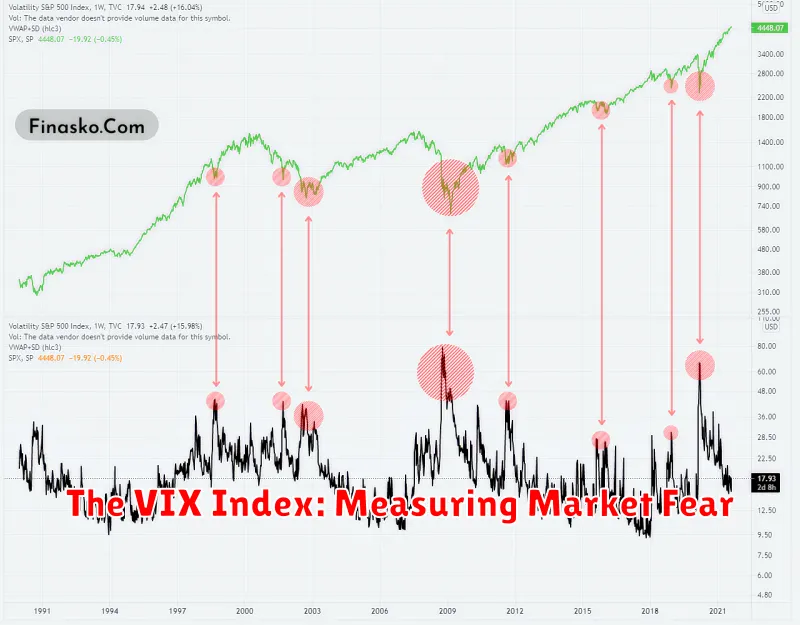

The VIX Index: Measuring Market Fear

The VIX Index, often referred to as the “fear gauge,” is a key indicator of market volatility. It measures the expected volatility of the S&P 500 index over the next 30 days. Higher VIX readings indicate a greater degree of fear and uncertainty among investors, suggesting a higher likelihood of market swings. Conversely, low VIX levels imply a more calm and stable market.

The VIX is calculated using options prices on the S&P 500. When investors anticipate a turbulent market, they buy options contracts, driving up their prices and ultimately increasing the VIX. Conversely, when investors are optimistic about the market, options prices fall, leading to a lower VIX.

Understanding the VIX can be valuable for investors. A high VIX reading can signal a heightened risk of market downturns, prompting investors to adjust their portfolios accordingly. For example, they may choose to reduce their exposure to stocks or seek out more conservative investments. On the other hand, a low VIX suggests a calmer market environment, potentially presenting opportunities for investors to take on more risk.

It’s important to remember that the VIX is just one indicator among many and shouldn’t be the sole basis for investment decisions. Nonetheless, it provides a valuable perspective on market sentiment and volatility, helping investors make more informed decisions.

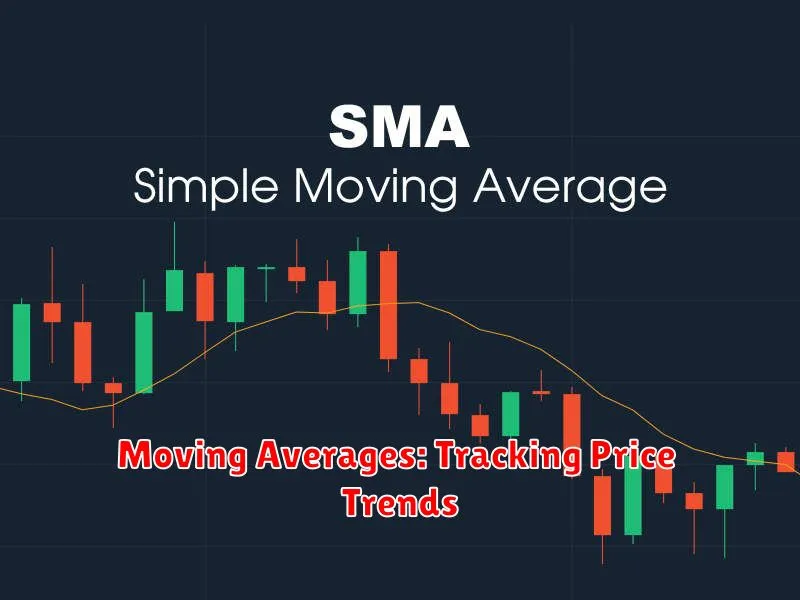

Moving Averages: Tracking Price Trends

Moving averages are a fundamental tool in technical analysis, providing valuable insights into price trends and potential reversals. They smooth out price fluctuations, highlighting the underlying direction of a stock’s movement. The concept is simple: a moving average calculates the average price of a stock over a specific period, such as 50 days or 200 days. The resulting line on a chart represents the average price over that timeframe.

There are two main types of moving averages: simple moving averages (SMA) and exponential moving averages (EMA). SMAs give equal weight to each data point within the period, while EMAs place more emphasis on recent data points. This makes EMAs more responsive to changes in price, while SMAs offer a smoother, less volatile representation.

Moving averages are used for a variety of purposes, including:

- Identifying trends: When a stock’s price crosses above a moving average, it often signals a potential uptrend. Conversely, a price crossing below a moving average can indicate a downtrend.

- Confirming trend strength: A strong trend is often accompanied by a price moving significantly above or below its moving average. A price near its moving average suggests weaker trend strength.

- Identifying potential support and resistance levels: Moving averages can act as support levels when a price rallies to meet them, or resistance levels when it encounters them on a decline.

- Generating trading signals: Some traders use moving average crossovers as signals to enter or exit trades.

While moving averages are a useful tool for understanding price trends, it’s important to remember they are lagging indicators. They reflect past price activity, not future movement. Furthermore, moving averages are not foolproof. It’s essential to use them in conjunction with other technical indicators and fundamental analysis for a more comprehensive view of the market.

Bollinger Bands: Identifying Volatility Squeezes

Bollinger Bands, created by John Bollinger, are a widely used technical analysis tool that helps traders and investors gauge volatility in financial markets. They are displayed as bands around a moving average, usually the 20-day simple moving average, and are calculated by adding and subtracting a certain standard deviation multiple from the moving average. The bands widen when volatility increases and narrow when volatility decreases.

Volatility squeezes occur when the price action of a security stays within a narrow range between the Bollinger Bands for an extended period. This indicates a period of low volatility, where prices are moving in a predictable manner. These periods of low volatility can sometimes precede periods of increased volatility, creating potential trading opportunities for investors.

Here’s how Bollinger Bands can help you identify volatility squeezes:

- Look for a narrowing of the bands: When the price action stays within a tight range, the bands start to converge, signifying a decrease in volatility.

- Observe price action: The price should be trading within the bands for an extended period, preferably a few days or weeks, to confirm the volatility squeeze.

- Consider the context: Take into account the overall market conditions, news events, and other technical indicators to confirm the validity of the squeeze.

Once you’ve identified a volatility squeeze, consider the following potential trading strategies:

- Breakouts: Volatility squeezes often precede strong price movements, either to the upside or the downside. Wait for a breakout above or below the bands to trigger a trade.

- Range trading: If the volatility squeeze persists, you can profit from trading the range between the bands, buying low and selling high.

Remember, volatility squeezes are not foolproof, and trading based solely on this indicator can lead to losses. Always use proper risk management techniques and consult other indicators before making any trading decisions.

Relative Strength Index (RSI): Spotting Overbought and Oversold Conditions

The Relative Strength Index (RSI) is a momentum indicator that measures the magnitude of recent price changes to evaluate overbought or oversold conditions in the price of a stock or other asset. It is calculated using a formula that compares the average gains to average losses over a specific period of time, typically 14 days. The RSI is displayed as an oscillator, ranging from 0 to 100.

An RSI reading above 70 is generally considered overbought, while an RSI reading below 30 is generally considered oversold. However, it’s important to note that these levels are not absolute and can vary depending on the market and the specific asset.

When the RSI is above 70, it suggests that the asset has been rising rapidly and may be due for a correction. Conversely, when the RSI is below 30, it suggests that the asset has been falling rapidly and may be due for a bounce.

It is important to note that the RSI is not a perfect indicator and should be used in conjunction with other indicators and analysis techniques. However, it can be a valuable tool for identifying potential overbought and oversold conditions, which can help investors make more informed decisions.

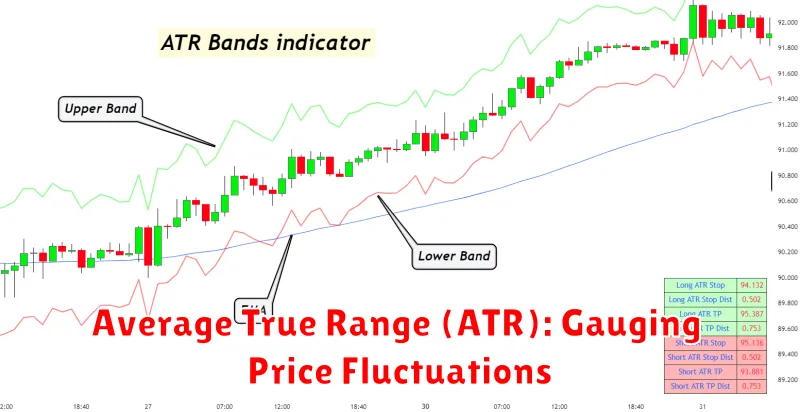

Average True Range (ATR): Gauging Price Fluctuations

The stock market is inherently volatile. Prices fluctuate constantly, driven by a multitude of factors like economic news, company performance, and investor sentiment. Understanding and quantifying this volatility is crucial for informed investment decisions. One powerful tool in a trader’s arsenal is the Average True Range (ATR), a technical indicator that measures the average price fluctuation over a specified period.

The ATR, developed by J. Welles Wilder Jr., calculates the average true range of price movement, encompassing the true range, which is the greatest of the following:

- Current High minus the current Low

- Absolute value of the current High minus the previous Close

- Absolute value of the current Low minus the previous Close

The ATR is then calculated as the average of these true range values over a specified number of periods, typically 14 days. This average provides a measure of the typical price fluctuation in the market.

How is ATR used in trading?

The ATR serves as a gauge of volatility, providing traders with insights into the magnitude of price movements. Here are some key applications:

- Identifying potential breakouts and breakdowns: High ATR values indicate significant price volatility, suggesting the potential for substantial price swings and potential breakouts or breakdowns.

- Setting stop-loss orders: ATR can help traders determine appropriate stop-loss levels to manage risk. Multiplying the ATR by a factor (e.g., 2 or 3) and placing stop-loss orders at that distance from the entry price can help mitigate losses during volatile periods.

- Confirming trend strength: Rising ATR values typically accompany strong trends, while declining ATR values suggest weakening trends or consolidation.

- Evaluating risk: ATR provides a quantitative measure of market risk, allowing traders to assess the potential for significant price fluctuations and make informed decisions based on their risk tolerance.

It’s important to remember that the ATR is just one indicator among many, and it shouldn’t be used in isolation. Combining it with other technical and fundamental analyses can provide a more comprehensive picture of market dynamics. Additionally, the ATR’s effectiveness can vary depending on the asset class, timeframe, and market conditions.

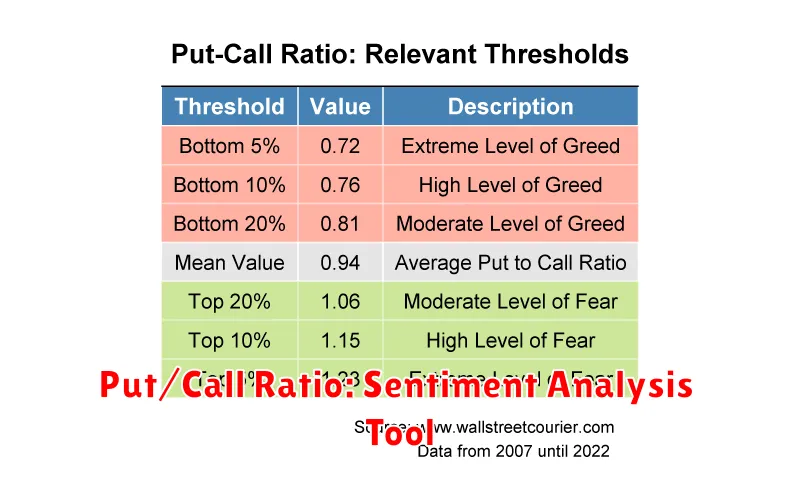

Put/Call Ratio: Sentiment Analysis Tool

The put/call ratio is a popular sentiment indicator used by traders to gauge the market’s overall optimism or pessimism. It measures the ratio of put options to call options traded on a particular underlying asset, such as a stock or index.

Put options give the holder the right, but not the obligation, to sell an asset at a specific price (the strike price) on or before a certain date. Conversely, call options give the holder the right, but not the obligation, to buy an asset at a specific price on or before a certain date.

When the put/call ratio is high, it suggests that investors are more likely to be bearish and are buying put options to protect themselves against potential losses. A low put/call ratio indicates a bullish sentiment, with investors buying call options to capitalize on potential gains.

It’s important to note that the put/call ratio is just one indicator, and it’s best to consider it in conjunction with other market data. Additionally, the ratio can be influenced by factors beyond sentiment, such as hedging strategies and arbitrage opportunities.

Here are some key takeaways about the put/call ratio:

- A high ratio suggests pessimism, while a low ratio suggests optimism.

- It can be used as a sentiment indicator, but it’s not a foolproof predictor of market direction.

- It should be used in conjunction with other indicators and market analysis.

By understanding the put/call ratio and its potential implications, traders can gain valuable insights into market sentiment and make more informed trading decisions.

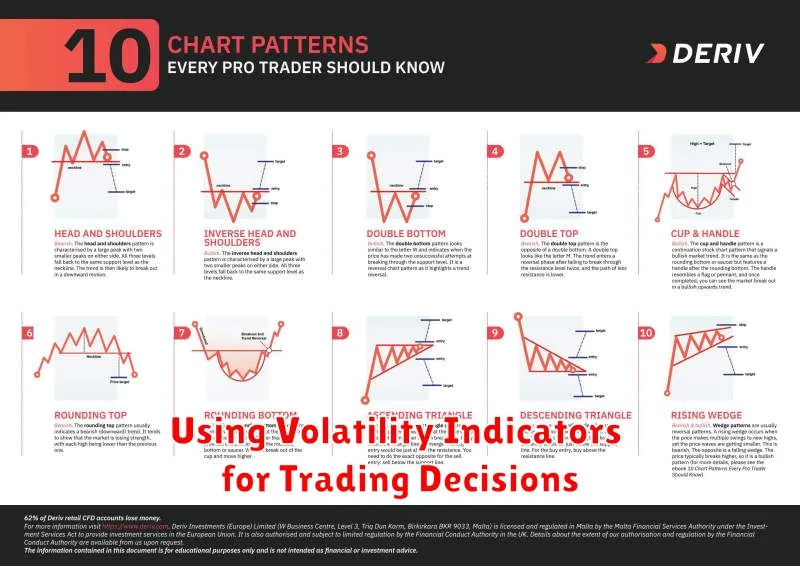

Using Volatility Indicators for Trading Decisions

Volatility indicators are essential tools for traders seeking to navigate the dynamic landscape of the stock market. These indicators provide valuable insights into the magnitude and frequency of price fluctuations, empowering traders to make informed decisions and potentially enhance their trading strategies.

Understanding Volatility: Volatility, in simple terms, refers to the degree of price fluctuations in a particular asset over a given period. High volatility signifies significant price swings, while low volatility suggests relatively stable price movements. By analyzing volatility, traders can identify periods of heightened market activity and potential opportunities for profit or risk mitigation.

Key Volatility Indicators: Several widely used indicators provide valuable insights into market volatility. These include:

- Average True Range (ATR): ATR measures the average price range over a specific period, helping to determine the typical daily price fluctuation.

- Bollinger Bands: Bollinger Bands are a popular technical indicator that represents a band of standard deviations above and below a moving average. They provide a visual representation of price volatility and potential buy/sell signals.

- Volatility Index (VIX): The VIX, also known as the “fear index,” measures the market’s expectation of future volatility in the S&P 500 index. It reflects the level of uncertainty and risk perceived by investors.

Utilizing Volatility Indicators for Trading Decisions: Volatility indicators play a crucial role in informed trading decisions. Here’s how they can be leveraged:

- Identifying Trends: Volatility indicators can help identify periods of high volatility, indicating potential trend reversals or breakouts.

- Entry and Exit Points: Traders can use volatility indicators to determine ideal entry and exit points based on the level of price fluctuation. For example, low volatility periods might suggest opportunities to enter trades while high volatility periods might indicate a need for caution or potential exit strategies.

- Risk Management: Volatility indicators are valuable tools for managing risk. By understanding the expected range of price fluctuations, traders can adjust their position size and stop-loss orders to mitigate potential losses.

Conclusion: Volatility indicators are indispensable tools for traders seeking to navigate the complexities of the stock market. By understanding and effectively utilizing these indicators, traders can gain valuable insights into market volatility, enhance their trading strategies, and potentially improve their investment outcomes.

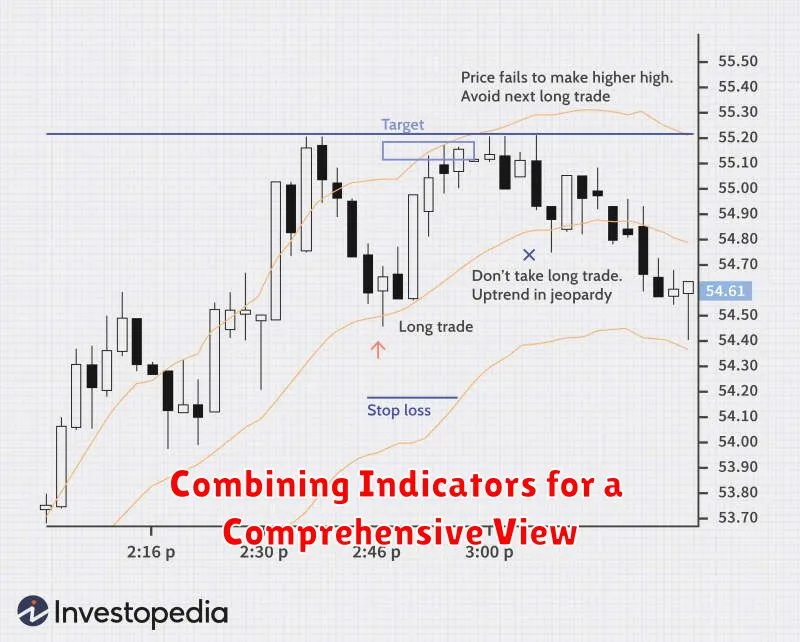

Combining Indicators for a Comprehensive View

While individual volatility indicators can provide valuable insights, combining them can offer a more comprehensive and nuanced understanding of market dynamics. This involves looking for confirmations, divergences, and overall patterns across different indicators.

For instance, combining moving average convergence divergence (MACD) with the Bollinger Bands can be insightful. When the MACD crosses above its signal line within a narrowing Bollinger Band, it can suggest a potential breakout, whereas a crossover below the signal line with widening bands might indicate increased volatility and a possible reversal.

Similarly, comparing the relative strength index (RSI) with the average true range (ATR) can provide a more comprehensive view of momentum and volatility. A high RSI coupled with a low ATR might signal overbought conditions, while a low RSI with a high ATR could indicate increased risk and potential downside.

Combining indicators allows investors to develop a more holistic perspective on the market’s direction, strength, and volatility. It helps to identify potential opportunities and mitigate risks by considering multiple perspectives and avoiding relying solely on a single indicator.

Remember, no single indicator is perfect. By integrating multiple indicators, investors can build a more robust and informed trading strategy, ultimately making smarter investing decisions.

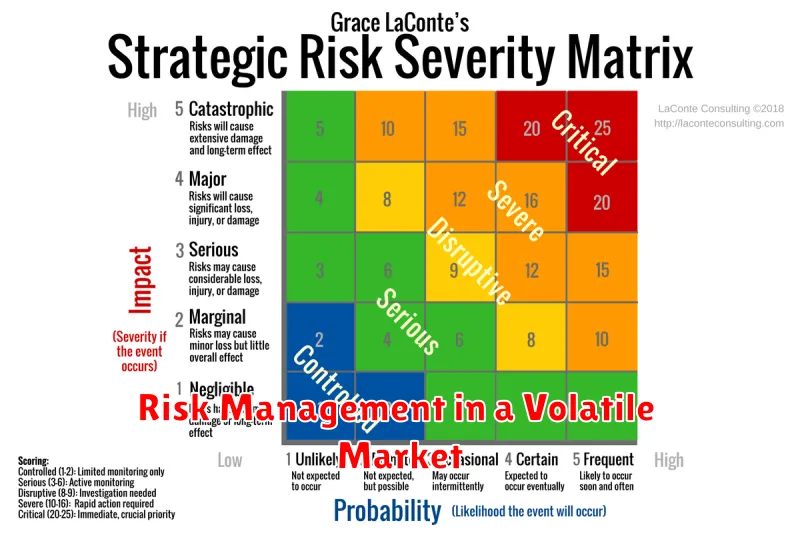

Risk Management in a Volatile Market

Navigating the stock market, especially during times of volatility, requires a strategic approach to risk management. Volatility refers to the degree of price fluctuations in a market, and while it presents both opportunities and threats, understanding how to manage risk is crucial. Here are some key strategies:

Diversification: Spreading your investments across different asset classes like stocks, bonds, and real estate helps mitigate the impact of any single asset’s performance. A diversified portfolio reduces overall risk by ensuring that losses in one area are offset by gains in another.

Rebalancing: As your portfolio shifts due to market movements, rebalancing ensures that you maintain your desired asset allocation. This involves periodically buying and selling assets to bring your portfolio back to its target proportions.

Stop-Loss Orders: These orders automatically sell your stock when it reaches a predetermined price, limiting potential losses. While they can be helpful, it’s essential to set realistic stop-loss levels and understand their limitations.

Emotional Discipline: Market volatility can trigger fear and greed, leading to impulsive decisions. Staying disciplined and avoiding emotional reactions is essential for making rational investment choices.

Long-Term Perspective: Remember that market fluctuations are a natural part of investing. Holding a long-term perspective and focusing on your overall investment goals can help you ride out short-term volatility.

Risk management is an ongoing process that requires vigilance and adaptation. By implementing these strategies, you can navigate market volatility more effectively and protect your investments.