Have you ever wondered how billionaires manage to amass such incredible wealth? While luck and inheritance play a role, the real secret lies in their investment strategies. Hedge funds, with their sophisticated strategies and access to exclusive information, are a key tool in the billionaire’s arsenal. But what exactly are these secret strategies, and how can you gain insights into the world of high-stakes finance?

This article dives into the world of billionaire hedge fund strategies, revealing the top tactics they use to generate massive returns. From long-short equity and merger arbitrage to quantitative trading and distressed debt investing, we’ll explore the most effective strategies and uncover the secrets behind their success. Get ready to unlock the secrets of high-finance and learn how to apply these strategies to your own portfolio, no matter your investment level.

Understanding Hedge Funds and Their Strategies

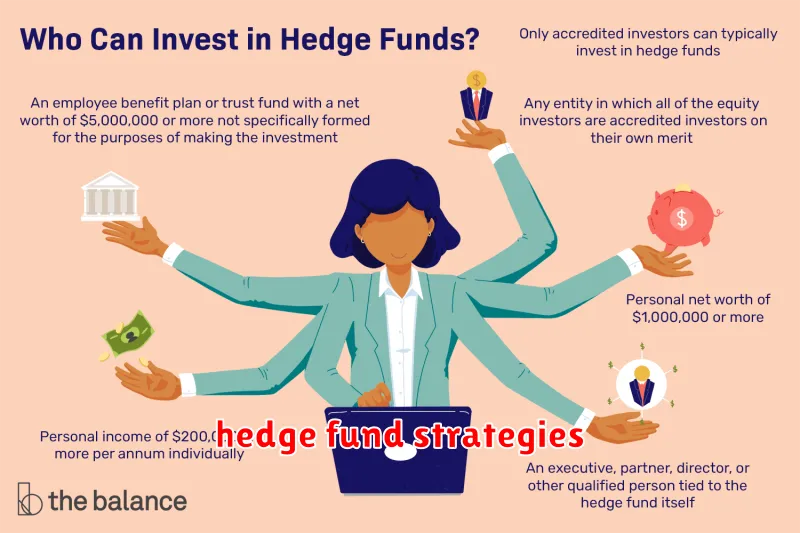

Hedge funds are investment funds that utilize a variety of strategies to generate returns for their investors. They are known for their sophisticated investment approaches and high-risk, high-reward nature. Hedge funds are typically accessible to wealthy individuals and institutional investors, as they often require substantial minimum investments.

Hedge fund strategies can be broadly categorized into several key approaches:

1. Long/Short Equity Strategies

Long/short equity strategies involve taking both long and short positions in stocks. A long position is a bet that a stock will increase in value, while a short position is a bet that a stock will decrease in value. Hedge funds employing this strategy aim to profit from both rising and falling markets.

2. Event-Driven Strategies

Event-driven strategies capitalize on specific events that impact the value of assets. These events can include mergers and acquisitions, corporate restructurings, and bankruptcies. Hedge funds seek to identify and exploit these events to generate returns.

3. Relative Value Strategies

Relative value strategies focus on exploiting price discrepancies between different assets. This can involve identifying undervalued securities within a particular sector or market, or finding mispricings between similar assets. Hedge funds utilizing this strategy aim to profit from the convergence of asset prices.

4. Macro Strategies

Macro strategies involve making bets on global economic trends. Hedge funds using this approach analyze economic data, geopolitical events, and other factors that could impact global markets. They then make investments based on their predictions of future market movements.

5. Quantitative Strategies

Quantitative strategies rely heavily on mathematical models and computer algorithms to identify investment opportunities. Hedge funds using this approach analyze large datasets of financial information to find patterns and make data-driven investment decisions.

It’s important to note that hedge fund strategies are complex and often involve significant risks. Their success depends on the skill and expertise of the fund managers, as well as their ability to predict market movements. While they have the potential to generate high returns, they also carry the risk of substantial losses.

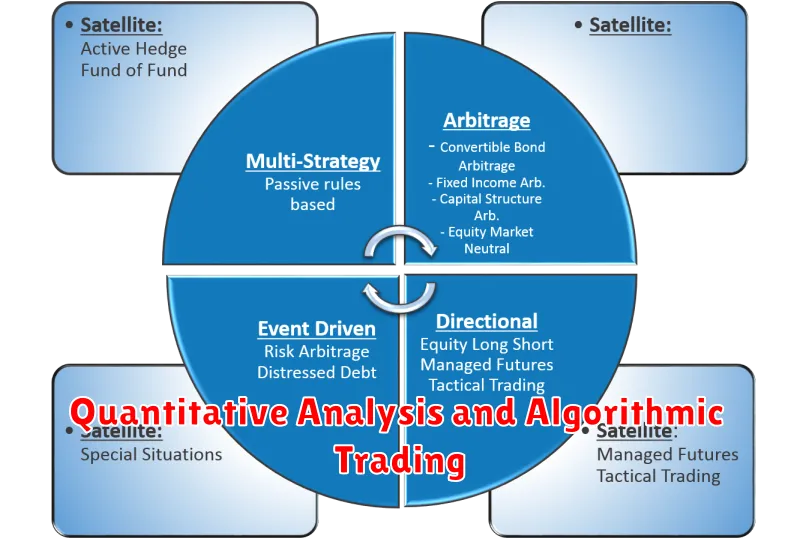

Quantitative Analysis and Algorithmic Trading

In the realm of high finance, where fortunes are made and lost in the blink of an eye, hedge funds stand as the ultimate playgrounds for sophisticated investors. At the heart of their success lie powerful strategies, often shrouded in secrecy, employed by billionaire fund managers. One such strategy, rapidly gaining prominence, is Quantitative Analysis (Quant) and Algorithmic Trading.

Quant strategies are rooted in rigorous mathematical models and statistical analysis. Hedge funds deploy these models to identify market inefficiencies, predict price movements, and execute trades with lightning speed and precision. Algorithmic Trading, a key component of this approach, automates trading decisions based on predefined rules and parameters. This eliminates human emotions and biases, allowing for more objective and efficient execution.

Here’s how Quant and Algorithmic Trading empower hedge funds:

- High-Frequency Trading (HFT): HFT algorithms exploit tiny price discrepancies in milliseconds, generating substantial profits through rapid execution.

- Statistical Arbitrage: These algorithms identify statistically mispriced securities across different markets, exploiting temporary price imbalances.

- Machine Learning and Artificial Intelligence (AI): Advanced algorithms analyze vast datasets, uncovering hidden patterns and trends, allowing for more accurate predictions and risk management.

While these strategies can generate impressive returns, they also come with inherent risks. The complexity of these models and the constant evolution of market dynamics necessitate ongoing monitoring and adjustments. Moreover, the sheer speed and volume of algorithmic trading can potentially exacerbate market volatility and contribute to flash crashes.

The use of Quantitative Analysis and Algorithmic Trading has revolutionized the landscape of hedge fund investing. While these strategies are not without risks, they offer a glimpse into the future of finance, where technology and data play a central role in driving investment decisions.

Long-Short Equity: Capitalizing on Market Discrepancies

One of the most popular and effective hedge fund strategies is long-short equity. This strategy involves taking long positions in stocks that are believed to be undervalued and short positions in stocks that are believed to be overvalued. The goal is to profit from the difference in performance between the two sets of stocks.

The key to success in long-short equity investing lies in identifying market discrepancies. This requires deep understanding of financial markets, company fundamentals, and market sentiment. The strategy can be employed across different sectors and market segments, offering flexibility and diversification opportunities.

Long-short equity strategy can be particularly attractive during periods of market volatility. When markets are experiencing significant fluctuations, opportunities for price divergence and arbitrage arise, creating potential profit streams for skilled investors. While this strategy is not without risks, it can be a powerful tool for generating alpha and mitigating downside risk.

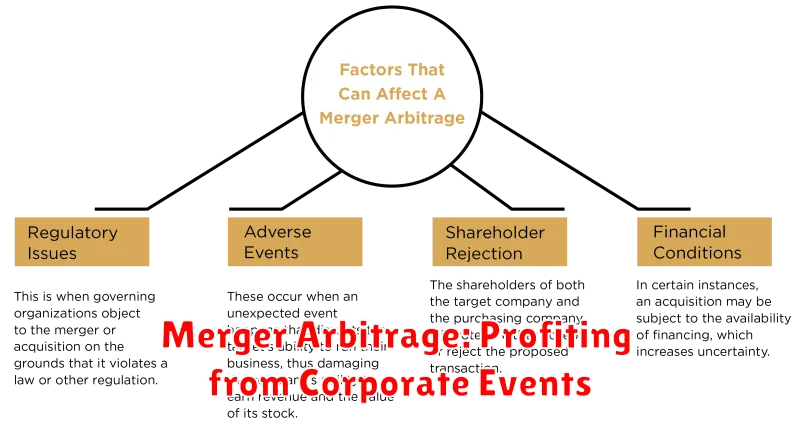

Merger Arbitrage: Profiting from Corporate Events

Merger arbitrage is a strategy employed by hedge funds to profit from the discrepancies in price that arise during a corporate event like a merger or acquisition. The core principle is to capitalize on the potential price difference between the acquiring company’s shares and the target company’s shares, exploiting the market’s anticipation and uncertainty during the deal’s lifecycle.

Here’s how it works: When a merger announcement is made, the target company’s stock price typically jumps, reflecting the value of the deal. Meanwhile, the acquiring company’s stock price might experience a dip due to factors like dilution or the potential risks associated with the integration process. This disparity presents an opportunity for merger arbitrageurs. They simultaneously buy the target company’s stock (hoping it will rise further towards the deal price) and sell the acquirer’s stock (expecting its price to rebound). If the merger successfully completes, the arbitrageur profits from the price convergence between the two stocks.

However, merger arbitrage is not without its risks. Deals can fall through due to regulatory hurdles, shareholder opposition, or other unforeseen circumstances. If the deal is canceled, the arbitrageur faces a potential loss. Therefore, meticulous risk management is essential for successful merger arbitrage. Hedge funds carefully analyze the deal’s terms, the market environment, and the companies involved to assess the likelihood of deal completion and potential risks.

In addition to the core arbitrage strategy, hedge funds can employ other techniques related to merger arbitrage. These include buying the target company’s debt, which typically rallies in anticipation of the merger, and exploiting short-term price fluctuations during the deal’s progress. Despite the complexities and risks involved, merger arbitrage remains a popular strategy for hedge funds seeking to generate consistent returns through opportunistic trading in the market.

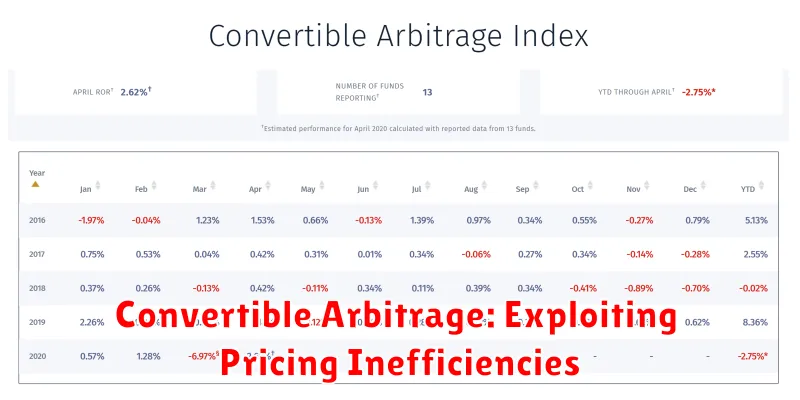

Convertible Arbitrage: Exploiting Pricing Inefficiencies

Convertible arbitrage is a sophisticated hedge fund strategy that capitalizes on pricing inefficiencies between convertible bonds and their underlying stocks. These inefficiencies arise due to market factors such as volatility, investor sentiment, and limited liquidity.

Convertible bonds are a type of debt security that can be converted into shares of the issuing company’s stock. Hedge funds employing convertible arbitrage strategies exploit these bonds’ dual nature, buying them when they believe the bond’s price is undervalued relative to the underlying stock and selling them when the price disparity narrows. This strategy aims to profit from the convergence of the bond and stock prices, driven by factors like dividends, interest rate changes, and volatility.

Here’s a simplified example: Imagine a convertible bond trading at $90 and the underlying stock at $100. The arbitrageur believes the bond is undervalued, expecting the stock price to rise or the bond price to appreciate. They buy the bond and simultaneously short the stock, hoping to profit from the price difference as the bond price rises closer to the stock price or the stock price falls closer to the bond price. This strategy involves careful analysis of the company’s financial performance, market conditions, and potential risks associated with the convertible bond.

Convertible arbitrage is a complex strategy requiring significant expertise, resources, and risk management capabilities. It involves intricate calculations, understanding of financial instruments, and ability to anticipate market movements. This strategy is typically employed by highly experienced hedge funds with deep pockets and sophisticated risk management frameworks.

Distressed Securities: Finding Value in Troubled Companies

Distressed securities investing is a high-risk, high-reward strategy employed by hedge funds and savvy investors seeking to capitalize on the misfortune of companies facing financial difficulties. These securities, encompassing bonds, stocks, and other debt instruments, are often trading at deep discounts to their intrinsic value due to market panic or perceived insolvency.

The key to success in distressed investing lies in identifying viable turnaround opportunities. Investors meticulously analyze a company’s financial health, its competitive landscape, and the potential for restructuring or asset sales to unlock hidden value. The goal is to buy distressed securities at a significantly discounted price, hoping for a dramatic rebound in the company’s fortunes.

A successful distressed securities investor possesses a unique skillset. They must be adept at navigating complex financial statements, understanding the intricacies of corporate restructuring, and possessing strong negotiation abilities. They also need to be comfortable with the inherent risks associated with investing in troubled companies, including potential losses or delays in realizing returns.

While distressed securities investing can be highly profitable, it is not for the faint of heart. It requires a deep understanding of the market, rigorous due diligence, and a willingness to take on substantial risk. For seasoned investors with the right expertise, distressed securities can present a compelling opportunity to unlock hidden value and generate substantial returns.

Global Macro: Navigating Global Economic Trends

In the high-stakes world of finance, hedge funds, with their formidable resources and sophisticated strategies, have consistently attracted attention, particularly from those seeking to emulate their success. Among the diverse approaches employed by these institutions, one strategy stands out for its focus on understanding and exploiting global economic trends: global macro.

Global macro investing essentially involves identifying and capitalizing on macroeconomic events that influence global markets. This strategy, often characterized by its long-term perspective, aims to profit from movements in currencies, interest rates, commodities, and equity markets, driven by factors like economic growth, inflation, political instability, and global trade dynamics.

To navigate the complexities of the global economic landscape, hedge funds employ a range of techniques within the global macro framework. These include:

- Fundamental analysis: This involves scrutinizing economic data, government policies, and geopolitical events to forecast future market trends.

- Technical analysis: By analyzing historical price patterns and trading volumes, technical analysts identify potential trends and entry and exit points for trades.

- Quantitative analysis: Employing statistical models and algorithms, hedge funds can uncover hidden patterns and identify market inefficiencies.

- Arbitrage strategies: Identifying price discrepancies across different markets, global macro funds can profit from exploiting these arbitrage opportunities.

The success of global macro strategies hinges on a deep understanding of interconnected global markets, astute risk management, and the ability to adapt to rapidly changing economic conditions. As the world becomes increasingly interconnected, the importance of global macro investing is likely to continue to grow.

Emerging Markets: Tapping into Growth Opportunities

Emerging markets are often seen as a risky investment, but they can also be a great source of growth. Hedge funds, which are known for their sophisticated strategies and ability to take on higher risk, have long been investing in emerging markets. In recent years, the popularity of emerging market investing has exploded, with many hedge funds focusing on this sector. But what are the top strategies that these funds are using to generate returns?

One common strategy is to invest in value stocks, which are companies that are trading at a discount to their intrinsic value. Hedge funds believe that these companies are undervalued and that their stock prices will rise in the future. Another popular strategy is to invest in growth stocks, which are companies that are expected to grow rapidly in the future. Hedge funds often seek out companies that are disrupting industries or expanding into new markets.

Hedge funds also use a variety of other strategies, such as arbitrage, which involves profiting from price discrepancies in different markets, and event-driven investing, which involves taking advantage of specific events, such as mergers and acquisitions.

With careful research and due diligence, it’s possible for investors to tap into the growth potential of emerging markets. By understanding the strategies used by successful hedge funds, you can potentially identify opportunities and position yourself for success.

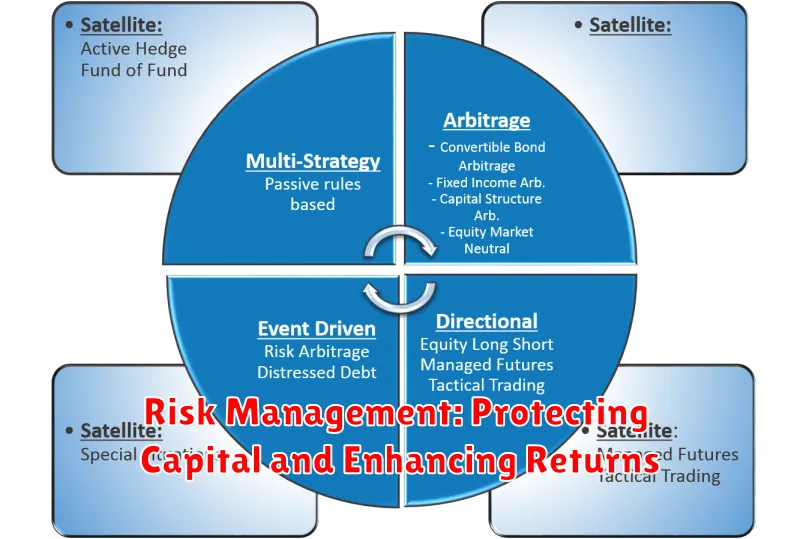

Risk Management: Protecting Capital and Enhancing Returns

Hedge funds, often associated with high-net-worth individuals and institutional investors, are known for their aggressive strategies aimed at maximizing returns. However, behind the pursuit of substantial profits lies a critical element – risk management. Hedge funds prioritize protecting capital while seeking exceptional returns, and their sophisticated strategies are built around this principle. This article delves into the core risk management techniques employed by these financial giants, providing valuable insights into the secrets behind their success.

Diversification: Spreading Risk Across Multiple Assets

Diversification is the cornerstone of risk management in hedge funds. By allocating investments across a wide range of assets, including stocks, bonds, currencies, commodities, and real estate, hedge funds aim to reduce the impact of any single asset’s underperformance. This strategy helps mitigate losses and enhances the overall portfolio resilience.

Hedging: Mitigating Downside Risk

Hedge funds actively employ hedging strategies to protect against potential losses. This involves taking offsetting positions in different assets, effectively creating a safety net. For example, if a fund is long on a particular stock, they might short a similar stock or buy put options to limit potential losses in case the stock price declines. This helps neutralize adverse market movements and preserves capital.

Risk Modeling and Analysis: Predicting and Managing Potential Threats

Hedge funds rely heavily on sophisticated risk modeling and analysis techniques. By leveraging advanced algorithms and historical data, they can identify potential risks, assess their impact, and implement appropriate mitigation measures. This proactive approach enables them to anticipate and manage potential threats before they materialize.

Strict Risk Parameters and Stop-Loss Orders

Hedge funds establish strict risk parameters and implement stop-loss orders to limit losses on individual investments. These measures automatically trigger the sale of an asset if its price falls below a predetermined threshold, preventing further erosion of capital. This disciplined approach helps protect the portfolio from significant drawdowns.

Stress Testing and Scenario Analysis

Hedge funds regularly conduct stress testing and scenario analysis to assess the portfolio’s resilience under extreme market conditions. These exercises simulate various adverse scenarios, such as economic downturns, market crashes, or geopolitical events, to understand the portfolio’s vulnerability and develop contingency plans. This proactive approach helps prepare for unexpected challenges and ensure portfolio stability.

In conclusion, risk management is an integral part of hedge fund strategies. These sophisticated techniques, encompassing diversification, hedging, risk modeling, strict risk parameters, and stress testing, are crucial for protecting capital and maximizing returns. By understanding these principles, investors can gain valuable insights into the methods employed by billionaires to navigate the complexities of the financial markets and achieve their investment objectives.

The Importance of Due Diligence and Fund Selection

Before diving into the world of hedge fund strategies employed by billionaires, it’s crucial to understand the foundation of smart investing: due diligence and fund selection. These are not just buzzwords; they are the cornerstones of responsible investment.

Due diligence involves meticulously scrutinizing a hedge fund’s track record, investment philosophy, management team, fees, and risk management practices. This deep dive helps investors assess the fund’s capabilities, transparency, and alignment with their own investment goals.

Fund selection is equally critical. It involves carefully evaluating a range of hedge funds based on their strategies, performance, and suitability to an investor’s portfolio. Understanding the fund’s target market, investment approach, and risk appetite is paramount in choosing the right fit.

Both due diligence and fund selection are essential in mitigating potential risks and maximizing returns. Neglecting these crucial steps can lead to significant financial losses, undermining the overall effectiveness of any hedge fund strategy.